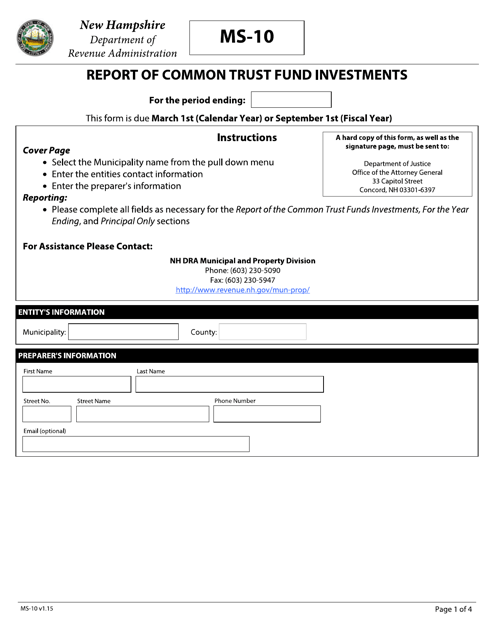

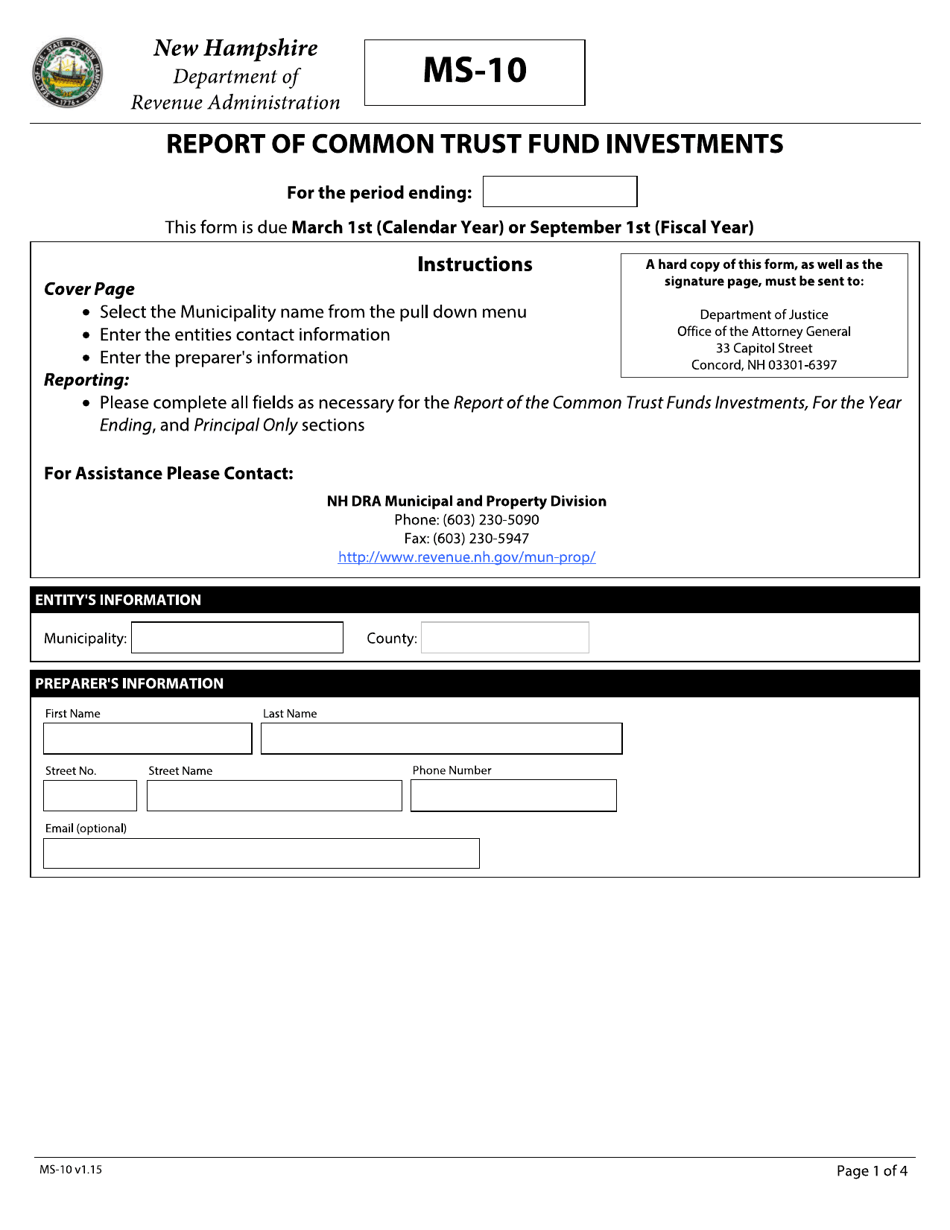

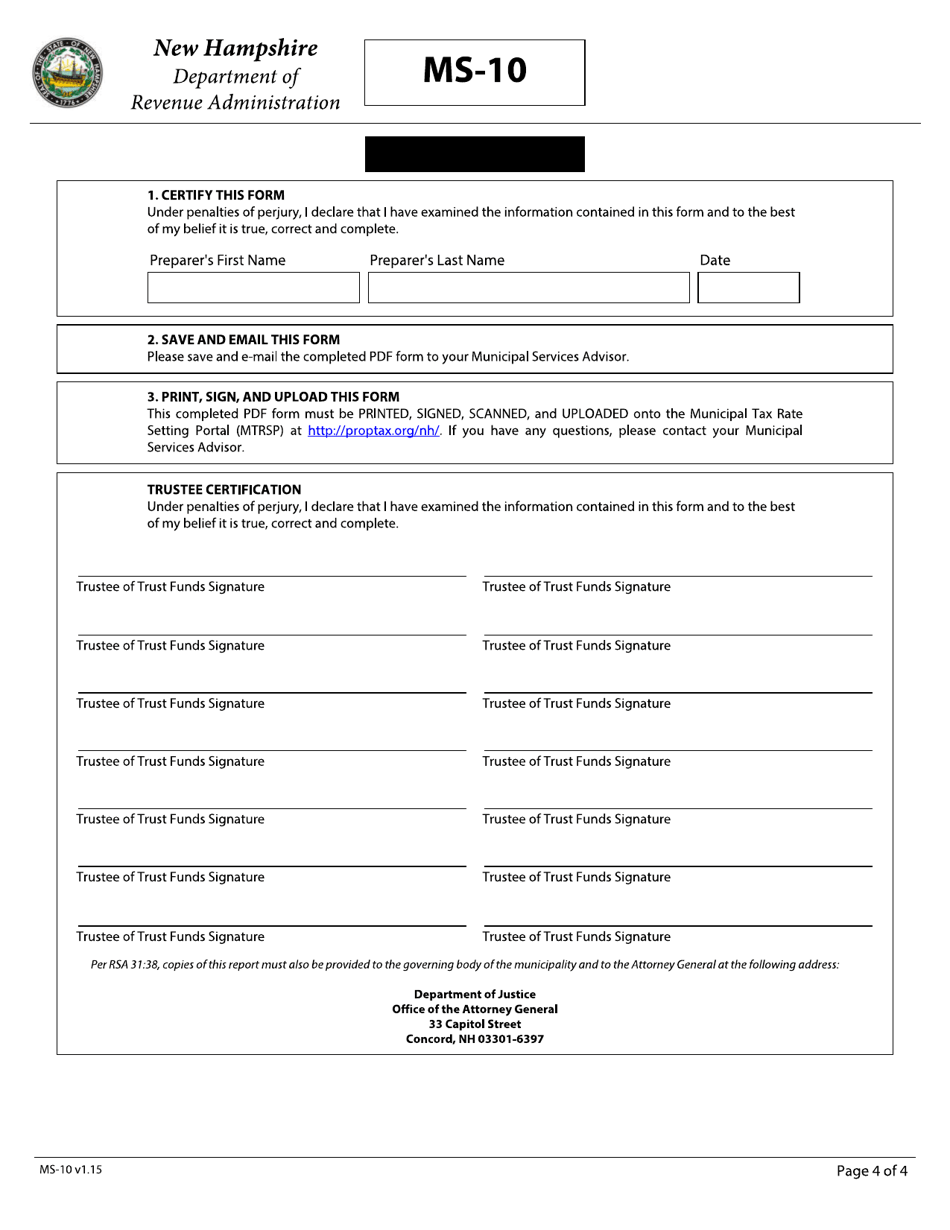

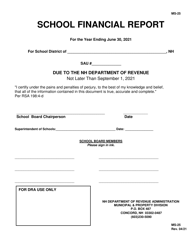

Form MS-10 Report of Common Trust Fund Investments - New Hampshire

What Is Form MS-10?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MS-10?

A: Form MS-10 is the Report of Common Trust Fund Investments.

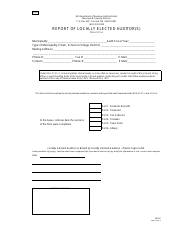

Q: Who needs to file Form MS-10?

A: Trust companies, state-chartered banks, and other financial institutions in New Hampshire are required to file Form MS-10.

Q: What is a Common Trust Fund?

A: A Common Trust Fund is a collective investment fund managed by a financial institution that pools the assets of multiple trusts for investment purposes.

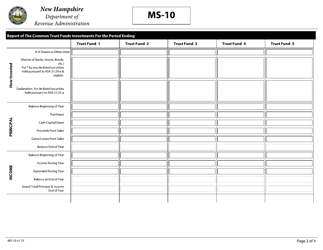

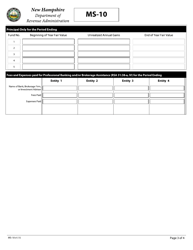

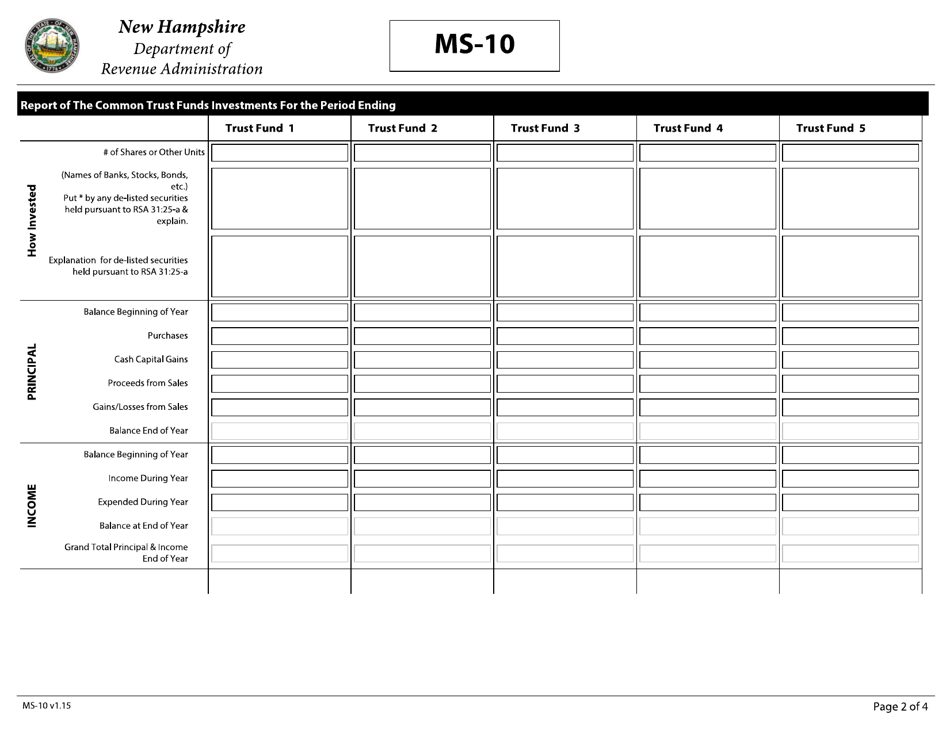

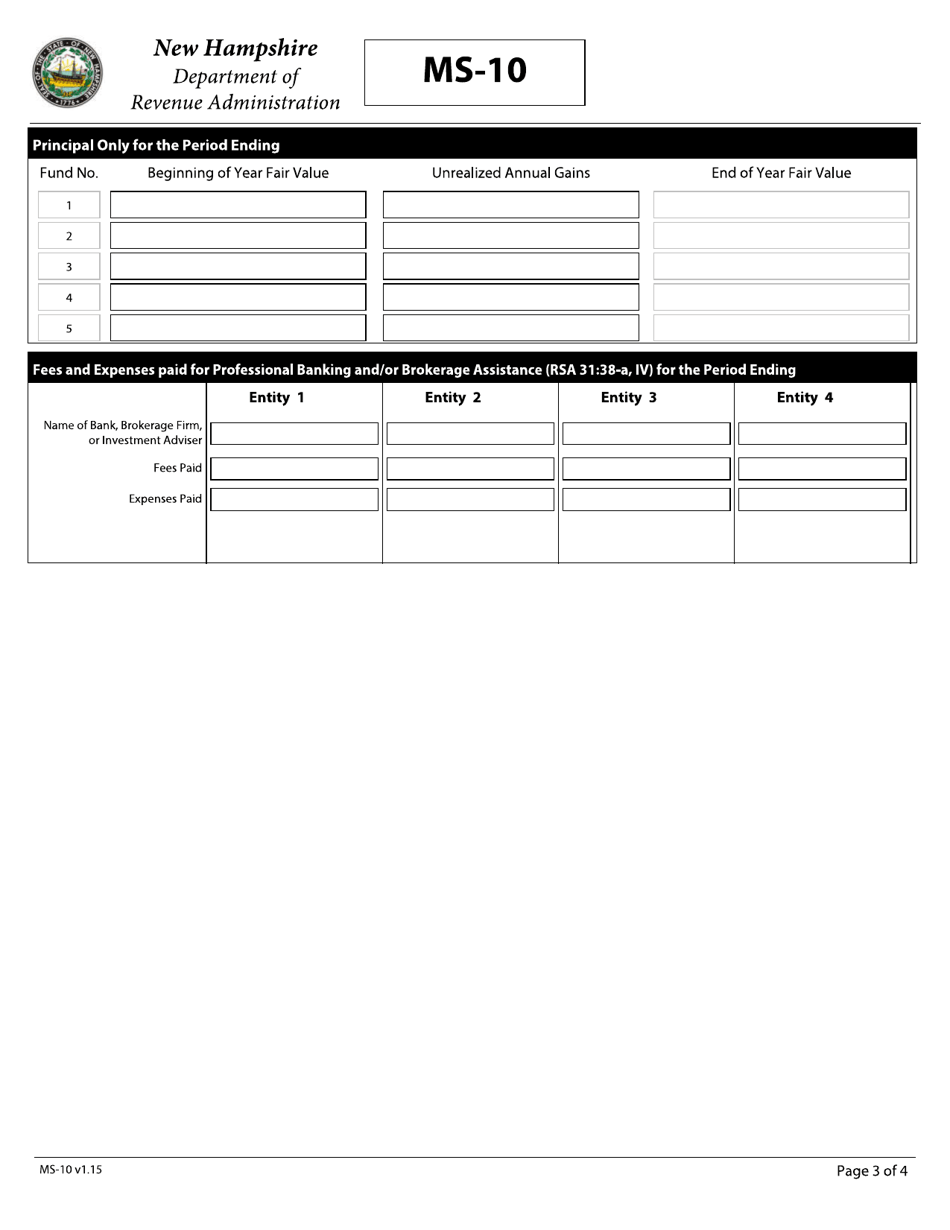

Q: What information is required on Form MS-10?

A: Form MS-10 requires the reporting of the market values and other details of the investments held in Common Trust Funds.

Q: When is Form MS-10 due?

A: Form MS-10 is due annually on or before March 31st.

Q: Are there any penalties for not filing Form MS-10?

A: Failure to file Form MS-10 or filing false or incomplete information may result in penalties and potential legal consequences.

Q: Is there a fee for filing Form MS-10?

A: There is no fee for filing Form MS-10.

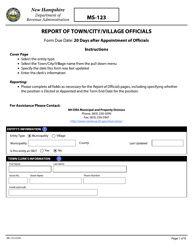

Form Details:

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MS-10 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.