This version of the form is not currently in use and is provided for reference only. Download this version of

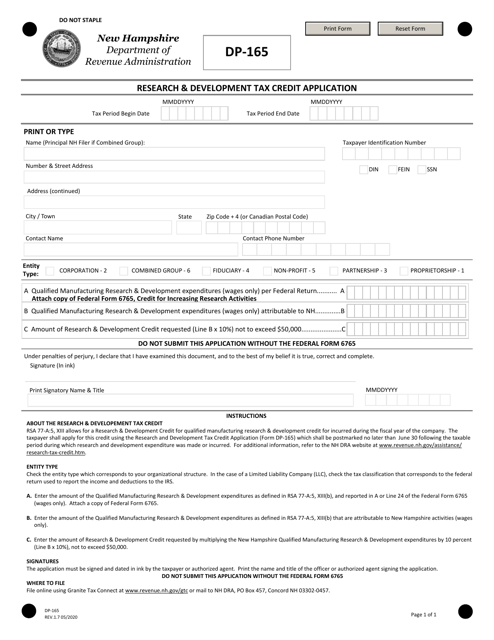

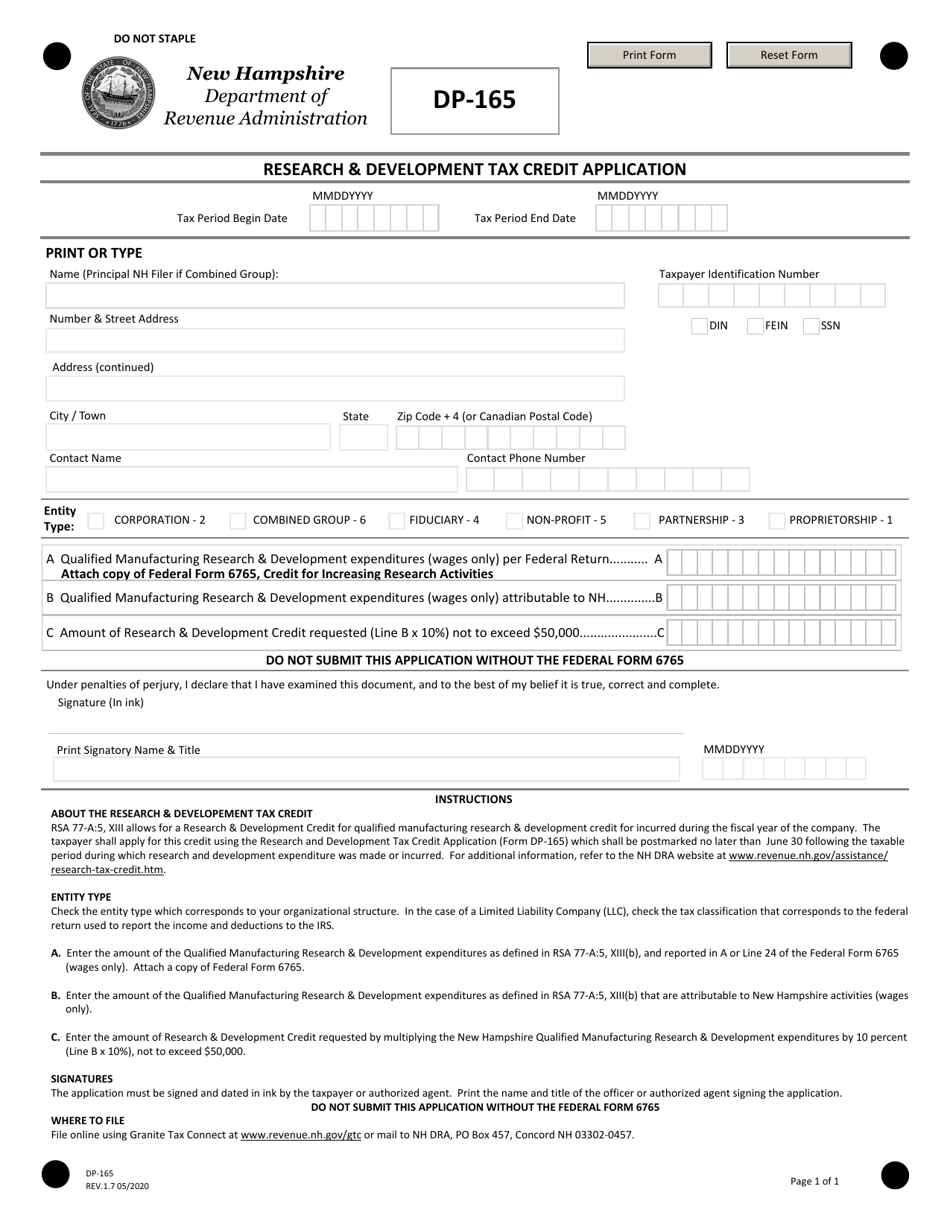

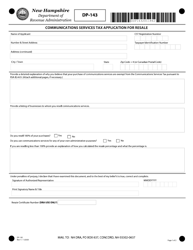

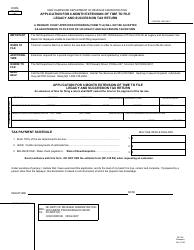

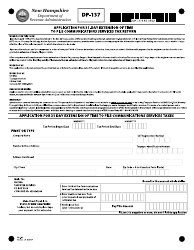

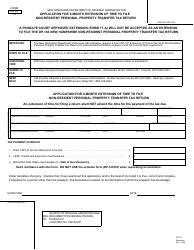

Form DP-165

for the current year.

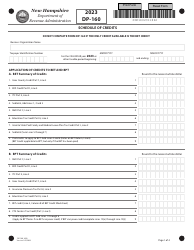

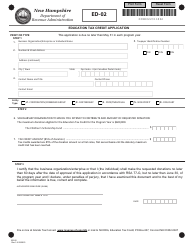

Form DP-165 Research & Development Tax Credit Application - New Hampshire

What Is Form DP-165?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DP-165?

A: The Form DP-165 is the Research & Development Tax Credit Application in New Hampshire.

Q: What is the purpose of the Form DP-165?

A: The purpose of the Form DP-165 is to apply for the Research & Development Tax Credit in New Hampshire.

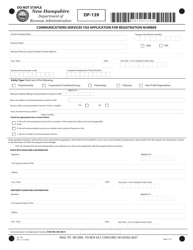

Q: Who can use Form DP-165?

A: Any eligible taxpayer in New Hampshire who has incurred qualified research expenses can use Form DP-165.

Q: How do I fill out Form DP-165?

A: You need to provide your taxpayer information, the amount of qualified research expenses incurred, and any other required details as specified in the form instructions.

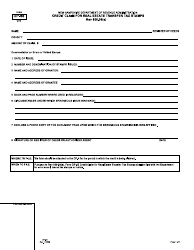

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-165 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.