This version of the form is not currently in use and is provided for reference only. Download this version of

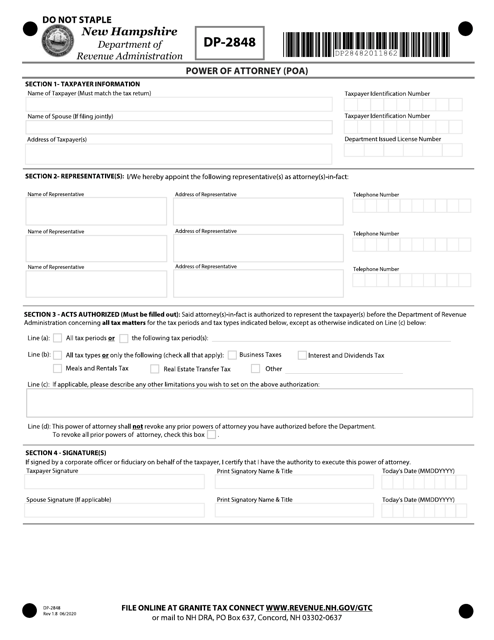

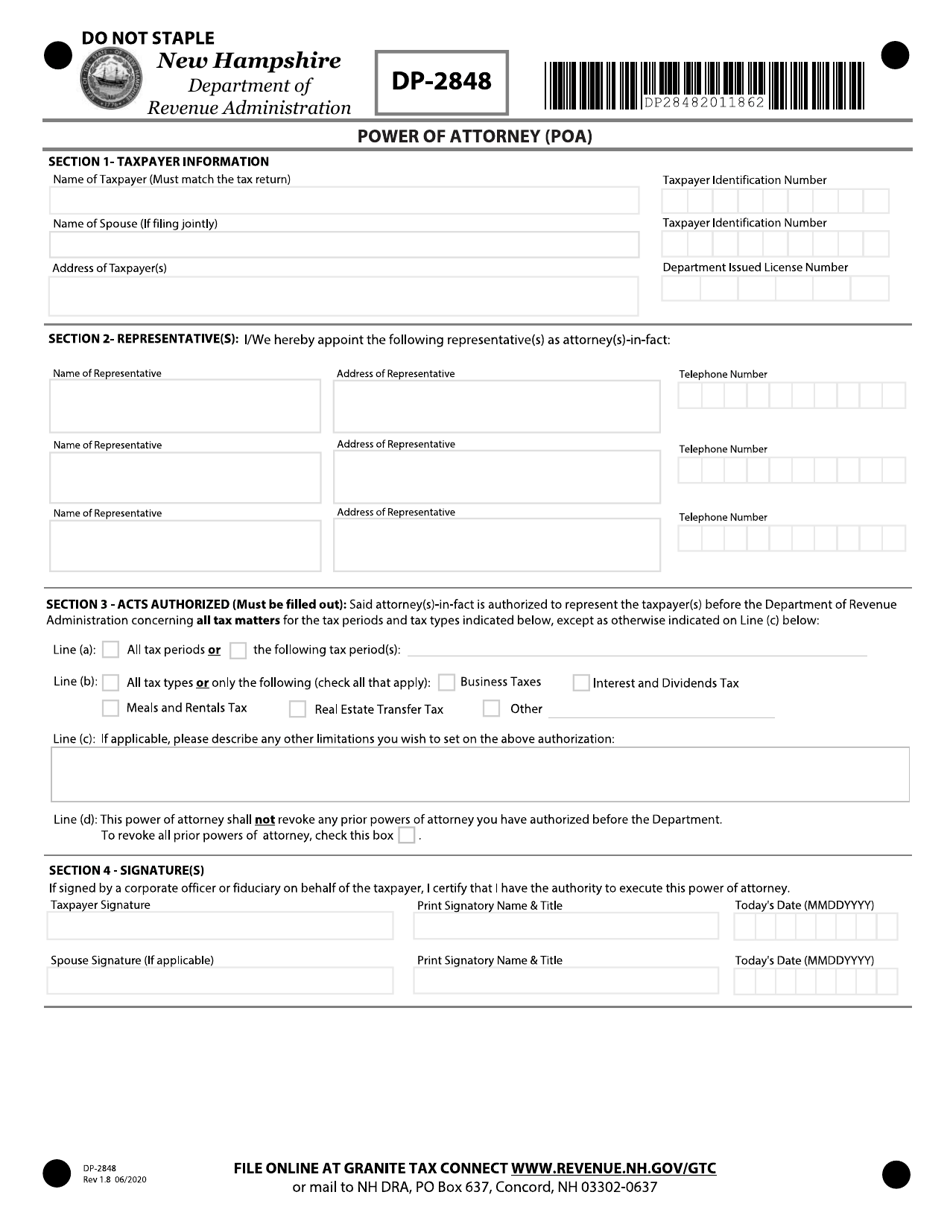

Form DP-2848

for the current year.

Form DP-2848 Power of Attorney (Poa) - New Hampshire

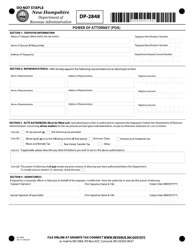

What Is Form DP-2848?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

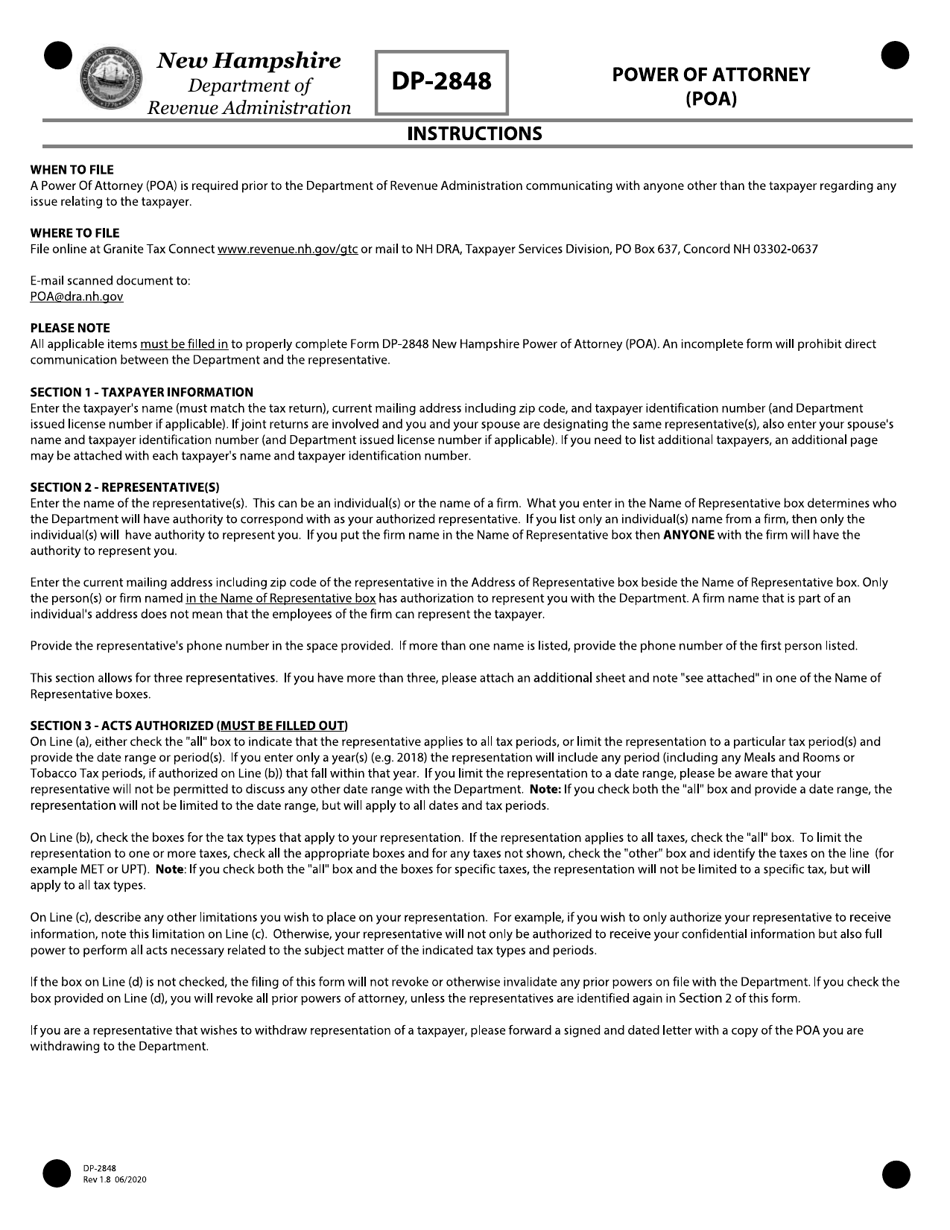

Q: What is Form DP-2848?

A: Form DP-2848 is a Power of Attorney (POA) form used in New Hampshire.

Q: What is a Power of Attorney (POA)?

A: A Power of Attorney (POA) is a legal document that allows someone else to make decisions and act on your behalf.

Q: What is the purpose of Form DP-2848?

A: Form DP-2848 is used to designate an individual or organization, known as the attorney-in-fact, to handle your legal and financial matters in New Hampshire.

Q: Who can use Form DP-2848?

A: Form DP-2848 can be used by individuals who want to appoint someone to represent them in legal and financial matters in New Hampshire.

Q: Is Form DP-2848 specific to New Hampshire?

A: Yes, Form DP-2848 is specific to New Hampshire and should only be used for legal matters within the state.

Q: Is Form DP-2848 legally binding?

A: Yes, once properly executed, Form DP-2848 becomes a legally binding document in New Hampshire.

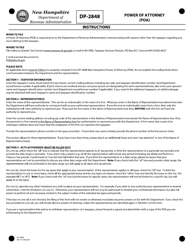

Q: Do I need a lawyer to fill out Form DP-2848?

A: While it is not required to have a lawyer, it is recommended to seek legal advice when filling out Form DP-2848 to ensure it meets your specific needs.

Q: What should I consider before using Form DP-2848?

A: Before using Form DP-2848, you should carefully consider who you trust to act as your attorney-in-fact and make sure they understand your wishes and responsibilities.

Q: What happens after I complete Form DP-2848?

A: After completing Form DP-2848, you should provide a copy to your attorney-in-fact and keep a copy for your records.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-2848 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.