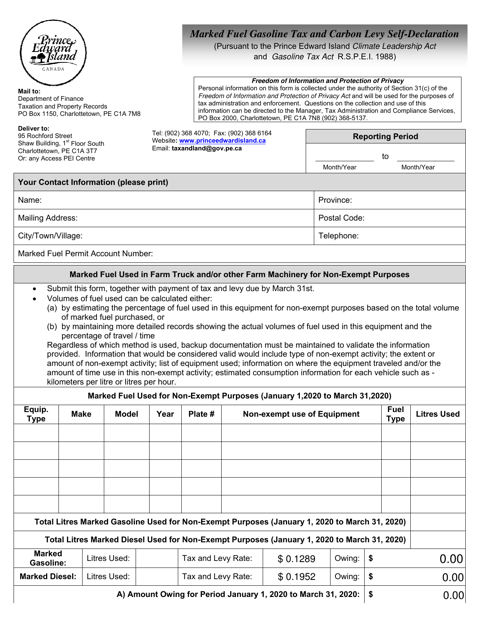

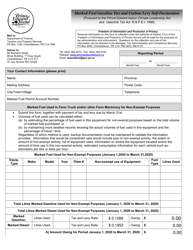

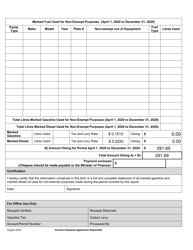

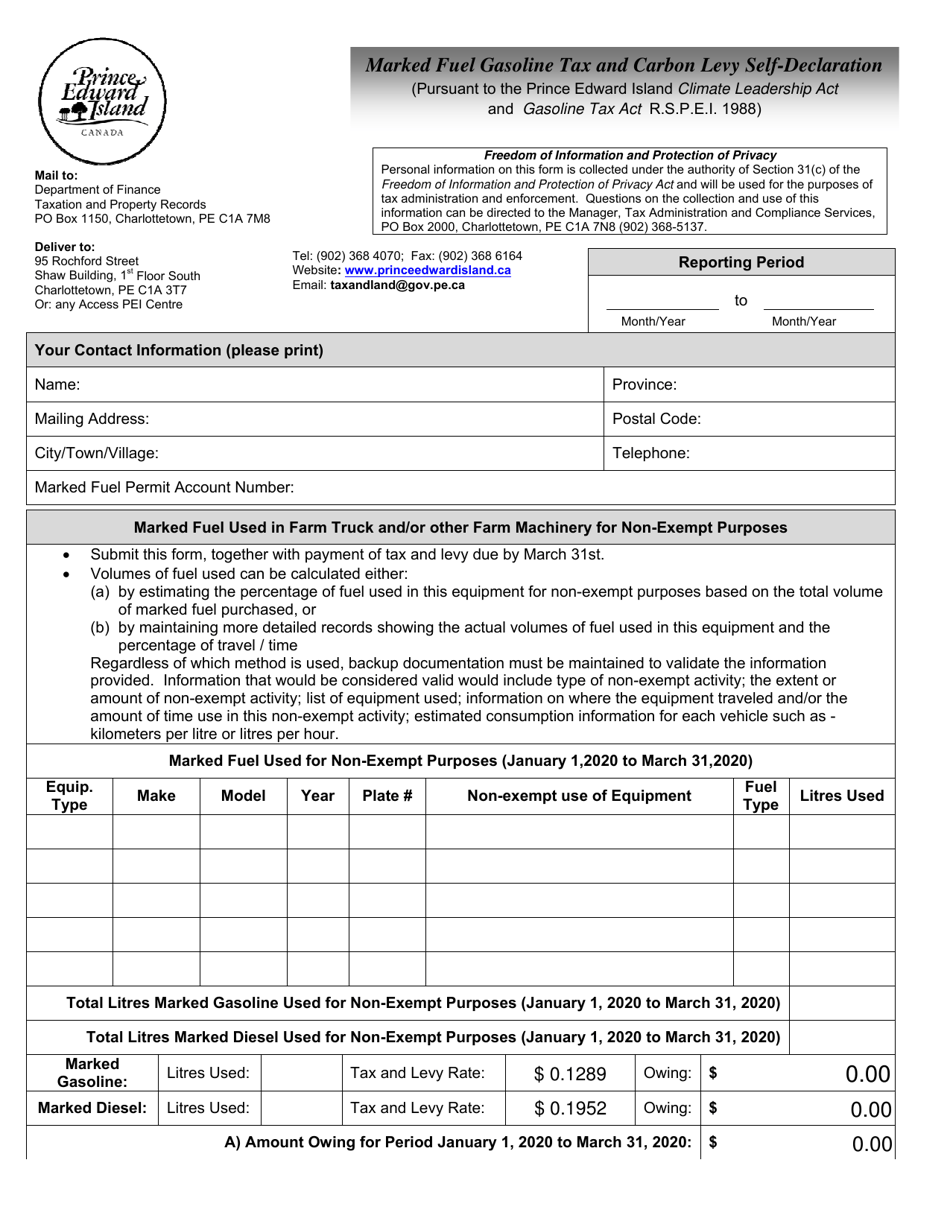

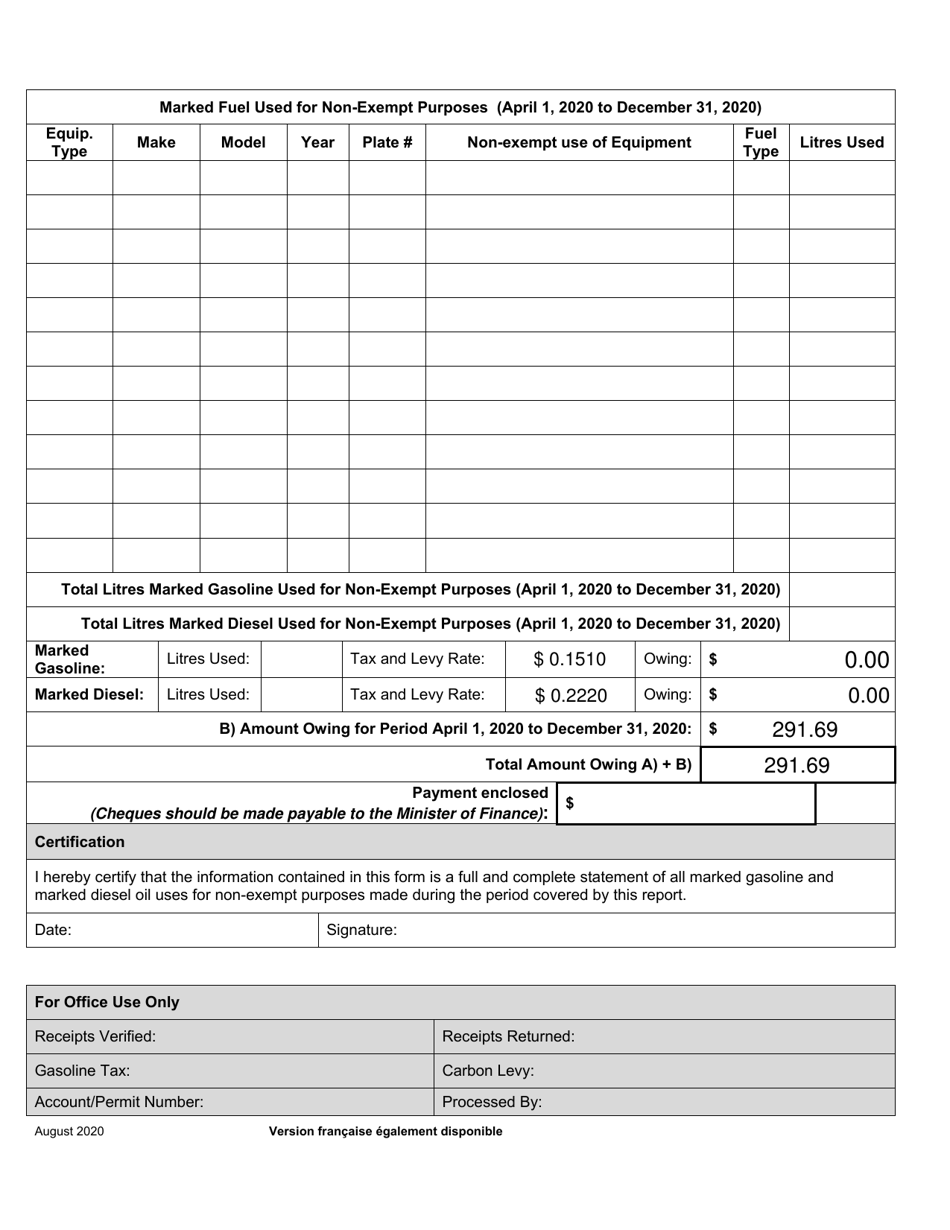

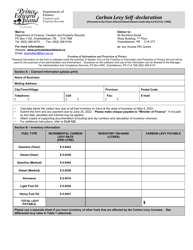

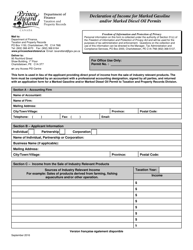

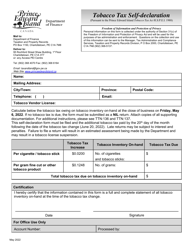

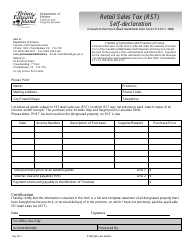

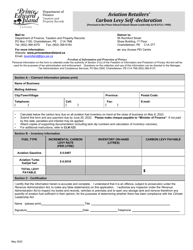

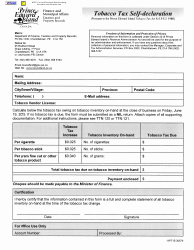

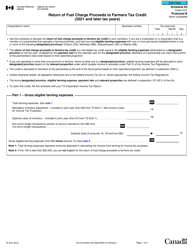

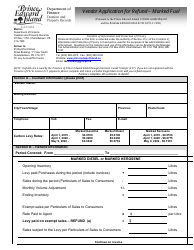

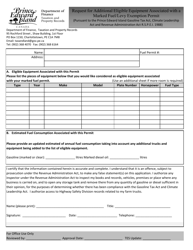

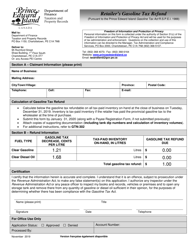

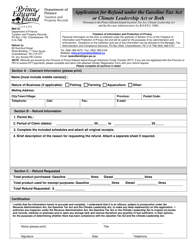

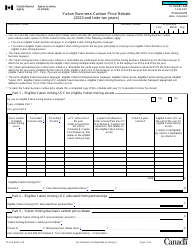

Marked Fuel Gasoline Tax and Carbon Levy Self-declaration - Prince Edward Island, Canada

The Marked Fuel Gasoline Tax and Carbon Levy Self-declaration in Prince Edward Island, Canada is a form that individuals or businesses must complete to report and pay taxes on the purchase of marked fuel gasoline and carbon levy. It helps the government keep track of these taxes and ensures compliance with the regulations in place.

The marked fuel gasoline tax and carbon levy self-declaration in Prince Edward Island, Canada is filed by the fuel distributor.

FAQ

Q: What is the Marked Fuel Gasoline Tax and Carbon Levy Self-declaration?

A: It is a declaration made by individuals or businesses in Prince Edward Island regarding the use of marked fuel gasoline and the corresponding tax and carbon levy.

Q: Who needs to make the Self-declaration?

A: Individuals or businesses in Prince Edward Island who use marked fuel gasoline.

Q: What is marked fuel gasoline?

A: Marked fuel gasoline is fuel that is used for non-highway purposes, such as farming, fishing, or heating.

Q: What is the purpose of the tax and carbon levy?

A: The tax and carbon levy help fund programs and initiatives related to transportation and environmental conservation.

Q: What happens if I don't make the Self-declaration?

A: Failure to make the Self-declaration may result in penalties or fines.

Q: Is the Self-declaration required every year?

A: Yes, the Self-declaration needs to be made annually.

Q: Are there any exemptions to the tax and carbon levy?

A: Yes, there are certain exemptions for specific uses of marked fuel gasoline, such as farming or fishing.