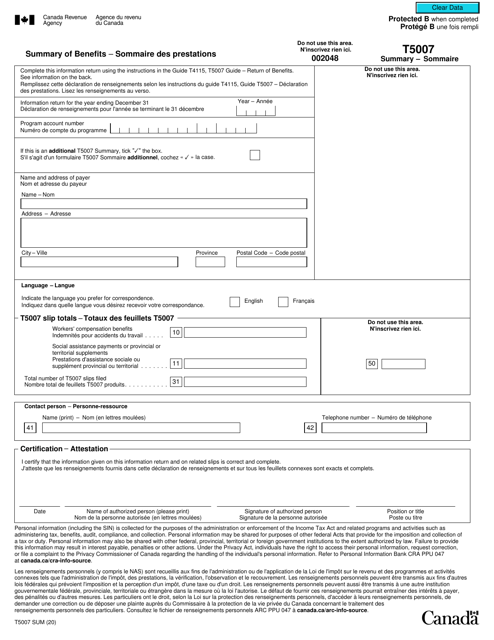

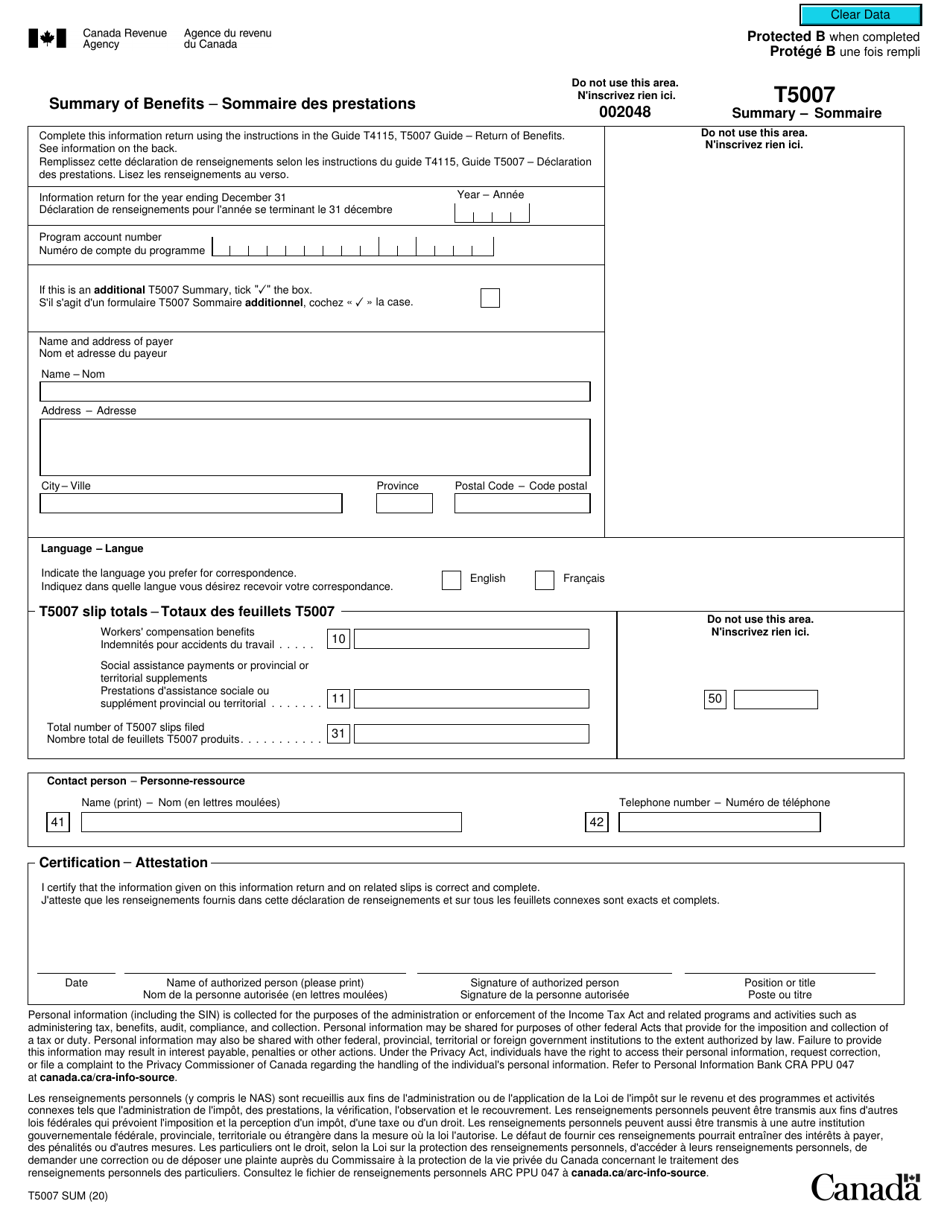

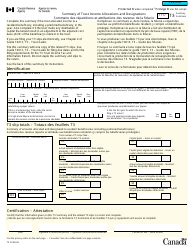

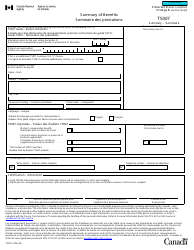

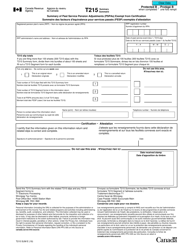

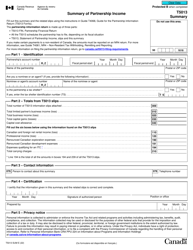

Form T5007 SUM Summary of Benefits - Canada (English / French)

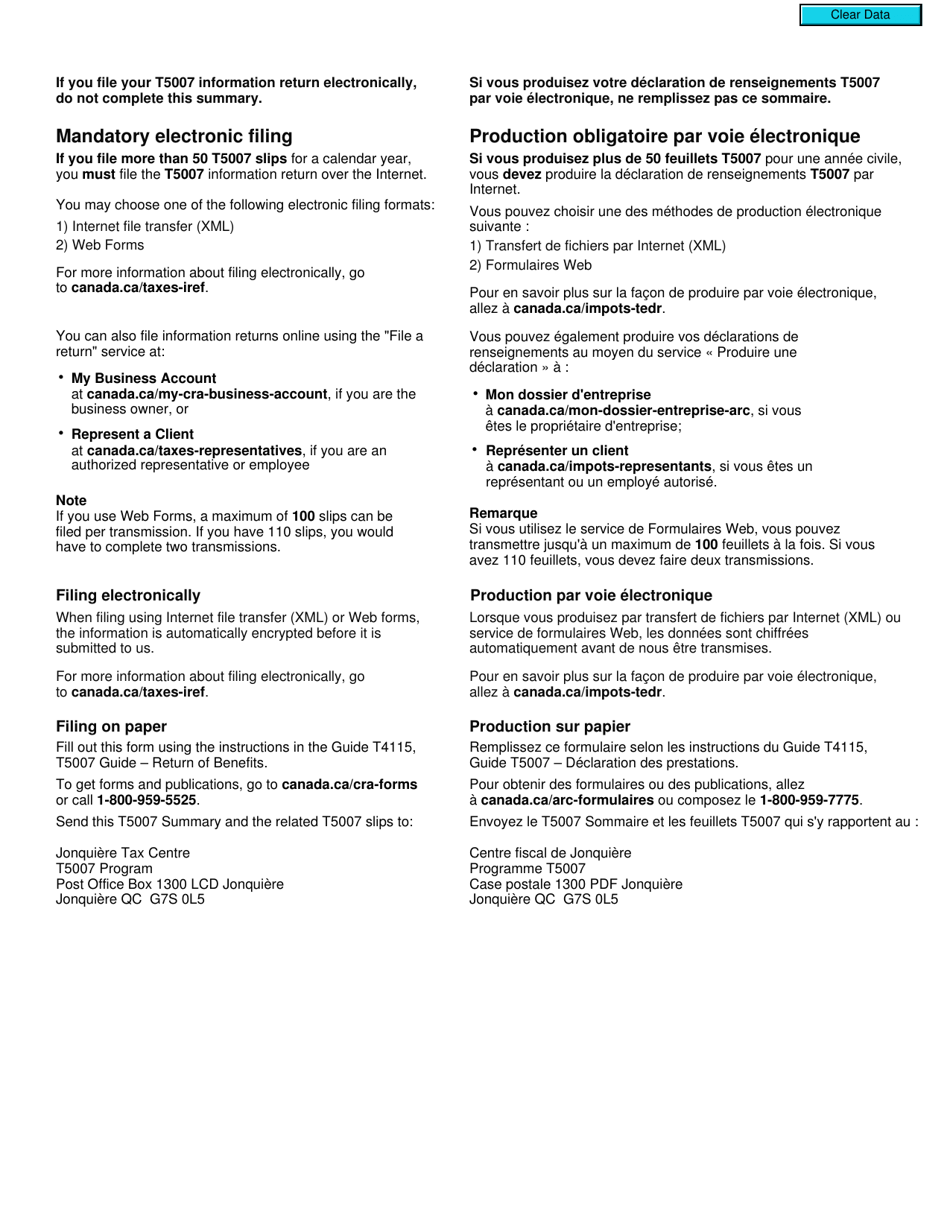

Form T5007 SUM Summary of Benefits in Canada is used to report the social assistance benefits received by individuals from various government programs. It provides a summary of the benefits received and is used for tax purposes, specifically to determine the taxable amount of the benefits. The form is available in both English and French.

The Form T5007 SUM Summary of Benefits in Canada is typically filed by the recipient of the benefits.

FAQ

Q: What is Form T5007 SUM?

A: Form T5007 SUM is a summary of benefits provided by the Canadian government.

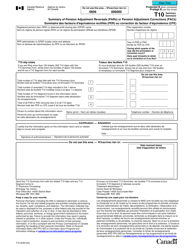

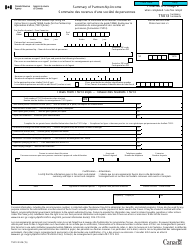

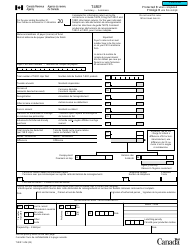

Q: What does the form summarize?

A: The form summarizes the various benefits received by an individual during a calendar year.

Q: Who receives Form T5007 SUM?

A: Form T5007 SUM is typically sent to individuals who have received certain types of government benefits in Canada.

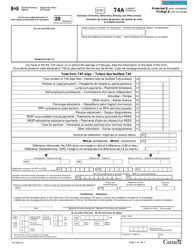

Q: Which benefits are included in Form T5007 SUM?

A: Some of the benefits included in Form T5007 SUM are employment insurance benefits, workers' compensation benefits, social assistance benefits, and other similar benefits.

Q: Why is Form T5007 SUM important?

A: Form T5007 SUM is important as it helps individuals keep track of the benefits they have received and may be required for filing taxes or accessing other government programs.

Q: Can I request a copy of Form T5007 SUM if I have not received one?

A: Yes, you can contact the relevant government department to request a copy of Form T5007 SUM if you have not received one.

Q: Do I need to keep a copy of Form T5007 SUM?

A: Yes, it is recommended to keep a copy of Form T5007 SUM for your records and for future reference, especially when filing taxes.

Q: Is Form T5007 SUM available in both English and French?

A: Yes, Form T5007 SUM is available in both English and French versions to accommodate both official languages of Canada.