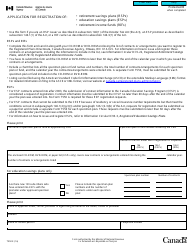

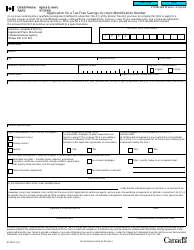

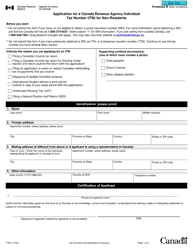

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T5001

for the current year.

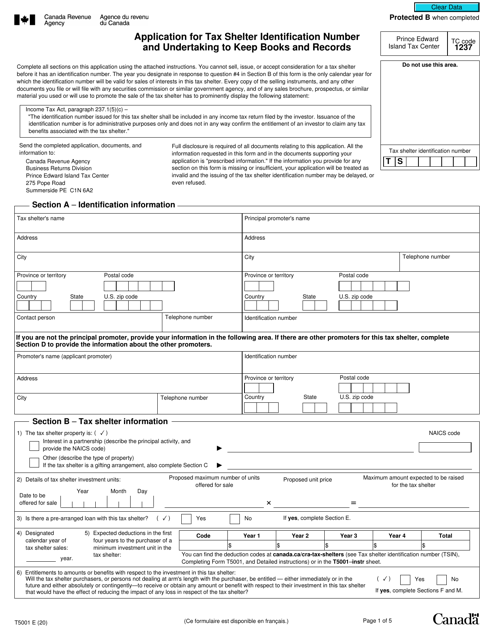

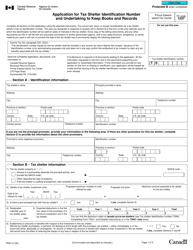

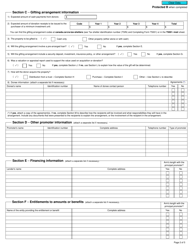

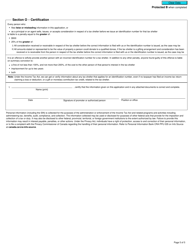

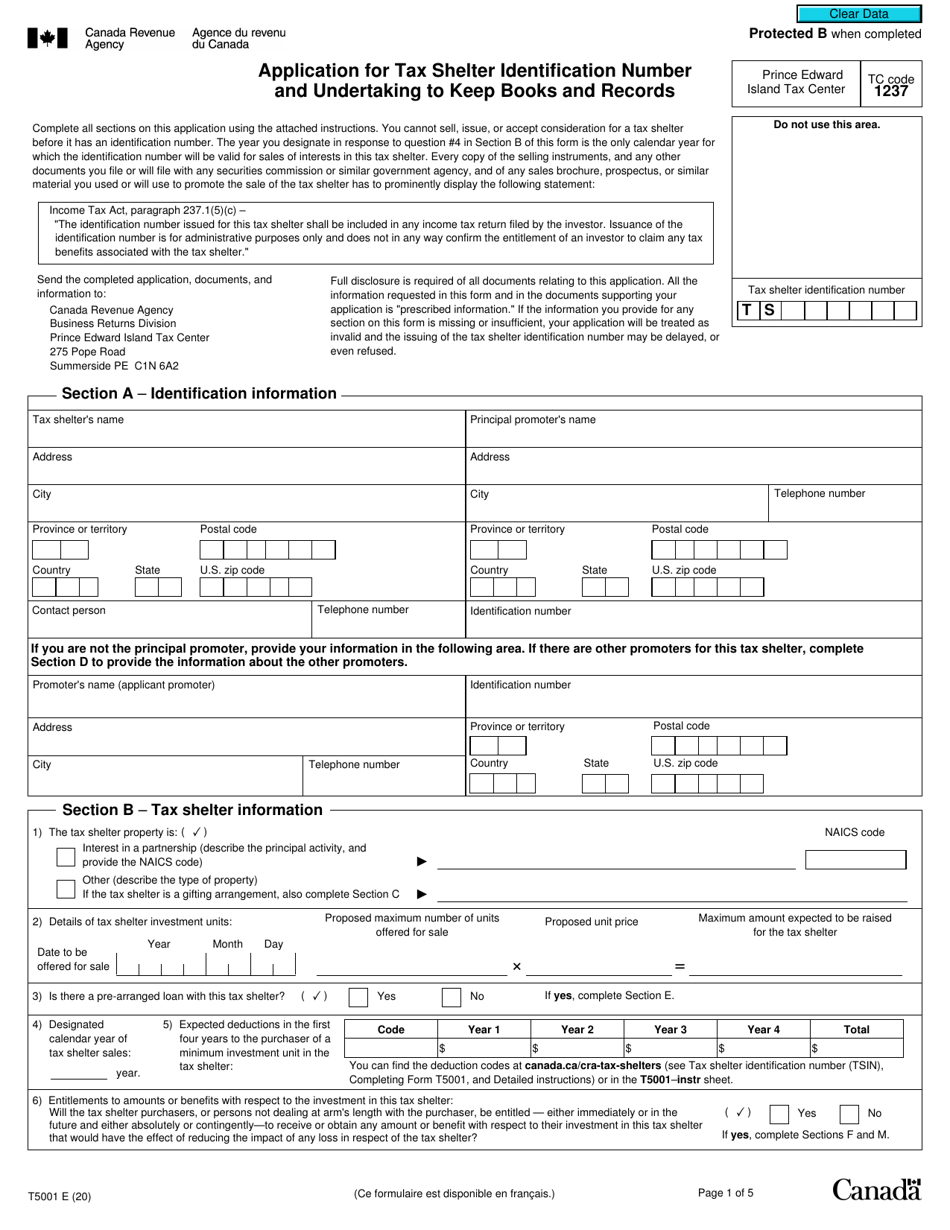

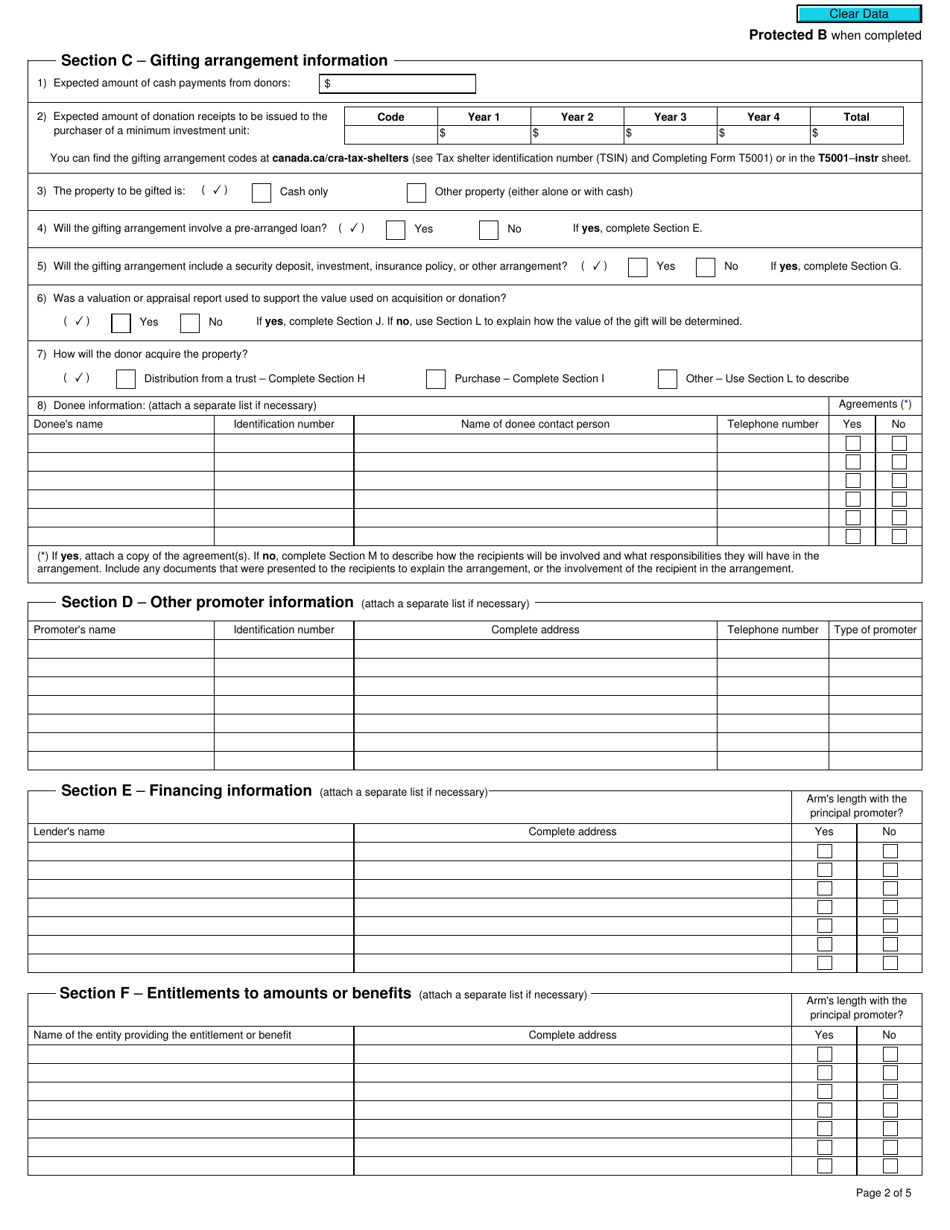

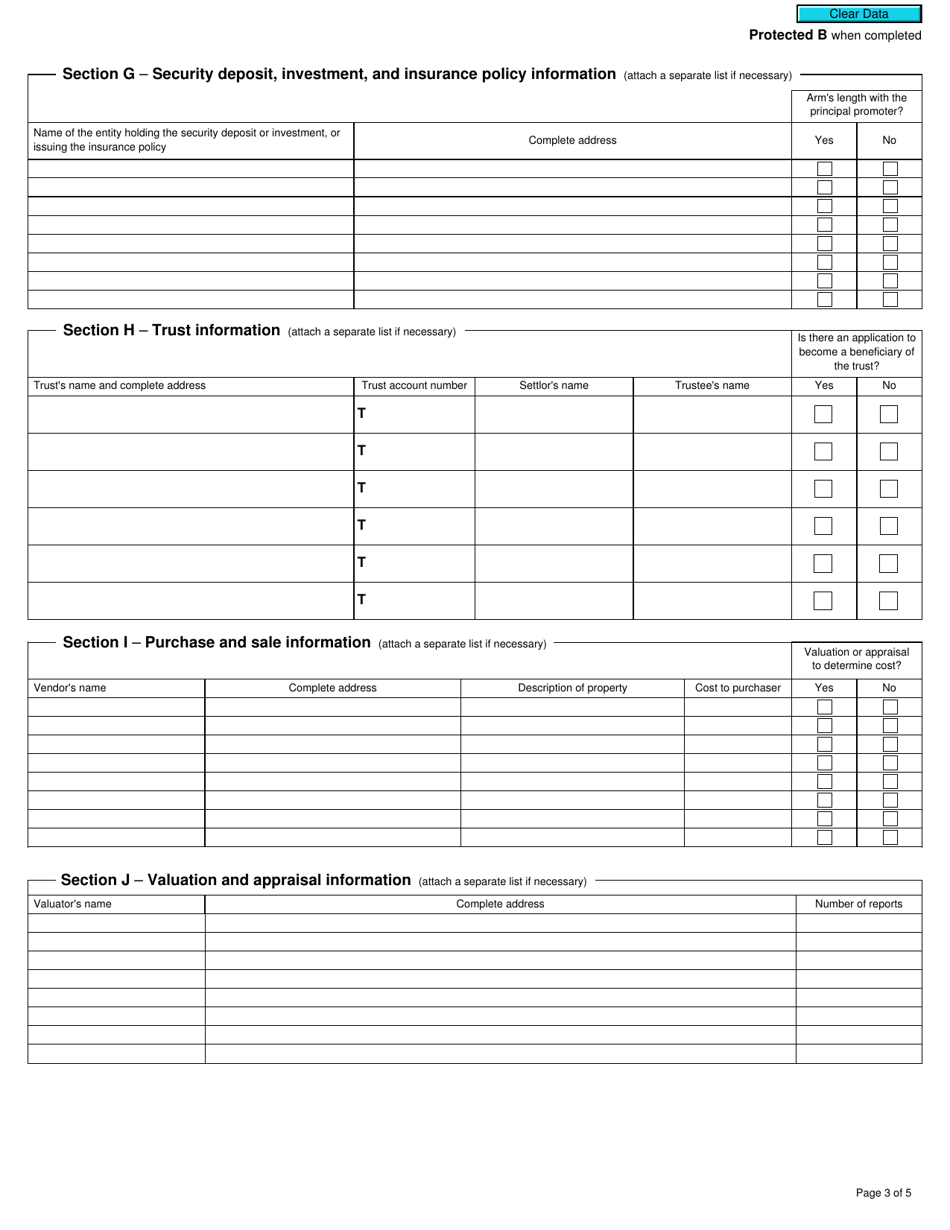

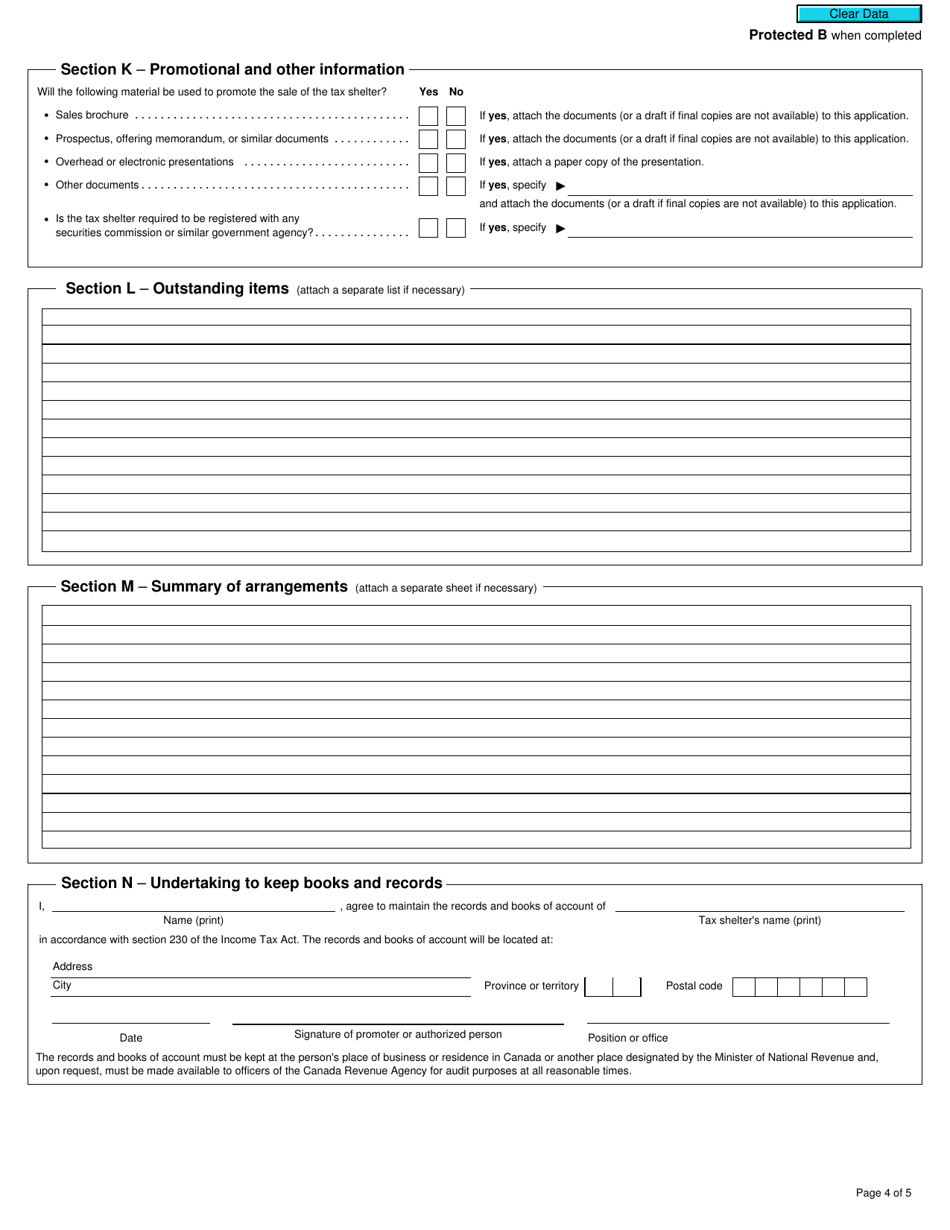

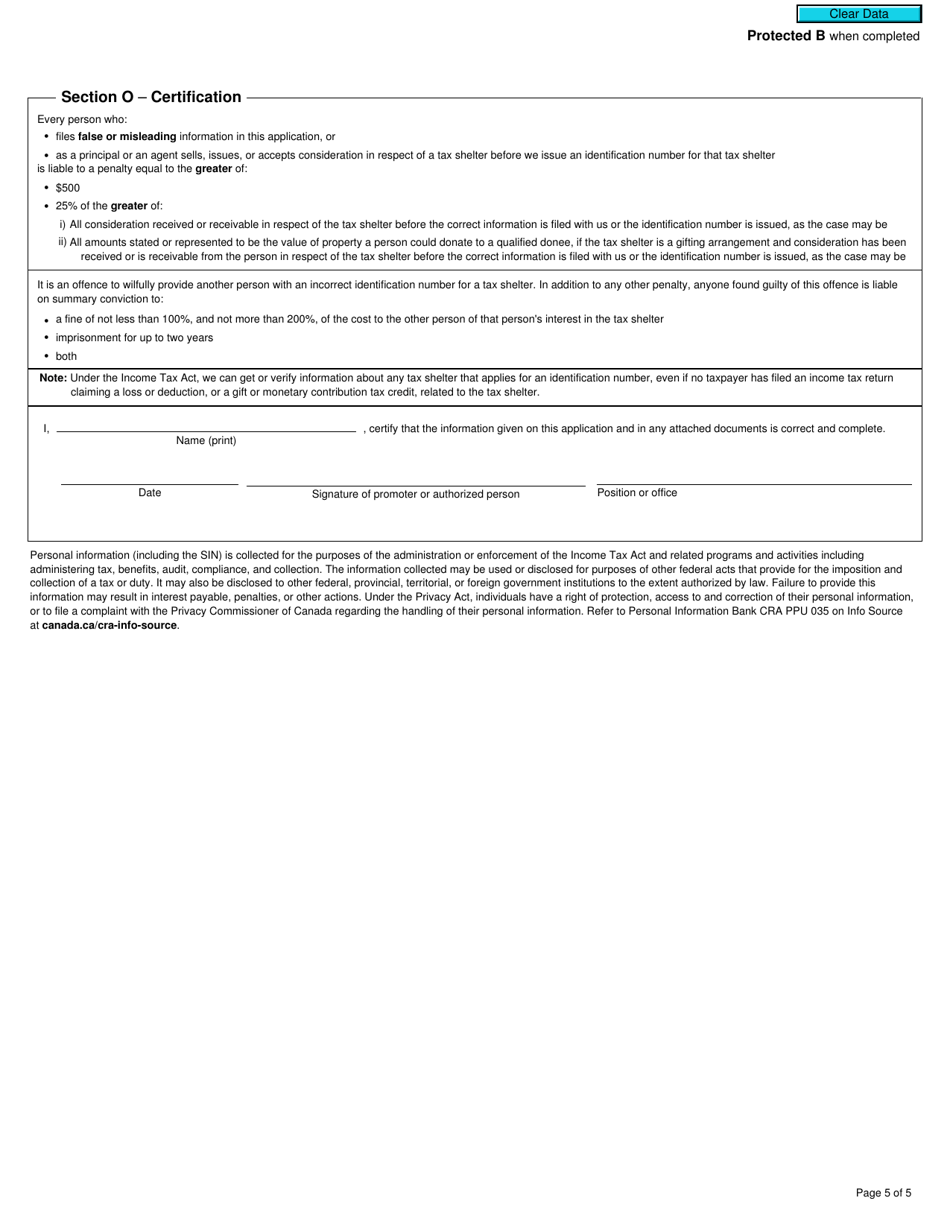

Form T5001 Application for Tax Shelter Identification Number and Undertaking to Keep Books and Records - Canada

Form T5001 Application for Tax Shelter Identification Number and Undertaking to Keep Books and Records is used in Canada for the purpose of applying for a tax shelter identification number and committing to keep proper books and records in support of the tax shelter.

The form T5001 is filed by a promoter or an investor participating in a tax shelter in Canada.

FAQ

Q: What is Form T5001?

A: Form T5001 is an application for Tax Shelter Identification Number and an undertaking to keep books and records in Canada.

Q: Who needs to fill out Form T5001?

A: Individuals or organizations that operate or promote tax shelters in Canada must fill out Form T5001.

Q: What is a Tax Shelter Identification Number?

A: A Tax Shelter Identification Number is a unique identifier that is issued by the Canada Revenue Agency to tax shelters.

Q: Why is it important to keep books and records for tax shelters?

A: Keeping books and records is important for tax shelters to ensure compliance with tax laws and to provide accurate information to the Canada Revenue Agency.

Q: Is there a deadline for submitting Form T5001?

A: There is no specific deadline for submitting Form T5001, but it must be filed before the first tax shelter investment is made.

Q: What happens if I don't file Form T5001?

A: Failure to file Form T5001 can result in penalties, fines, or the disallowance of tax benefits associated with the tax shelter.

Q: Is there a fee for obtaining a Tax Shelter Identification Number?

A: There is no fee for obtaining a Tax Shelter Identification Number.

Q: Can I use Form T5001 for tax shelters outside of Canada?

A: Form T5001 is specifically for tax shelters in Canada. Different countries may have their own forms and requirements for tax shelters.