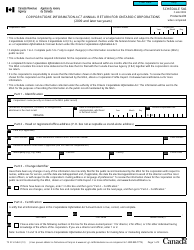

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T5003

for the current year.

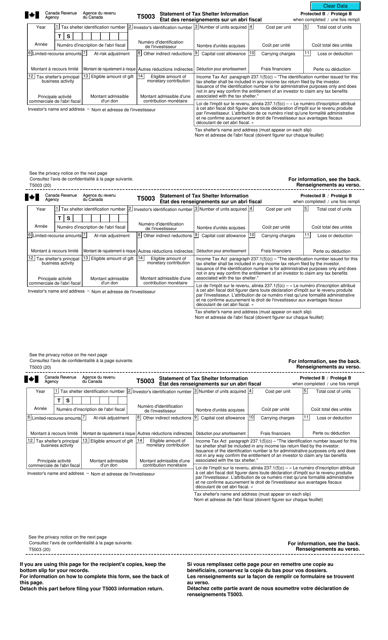

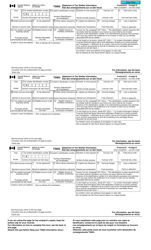

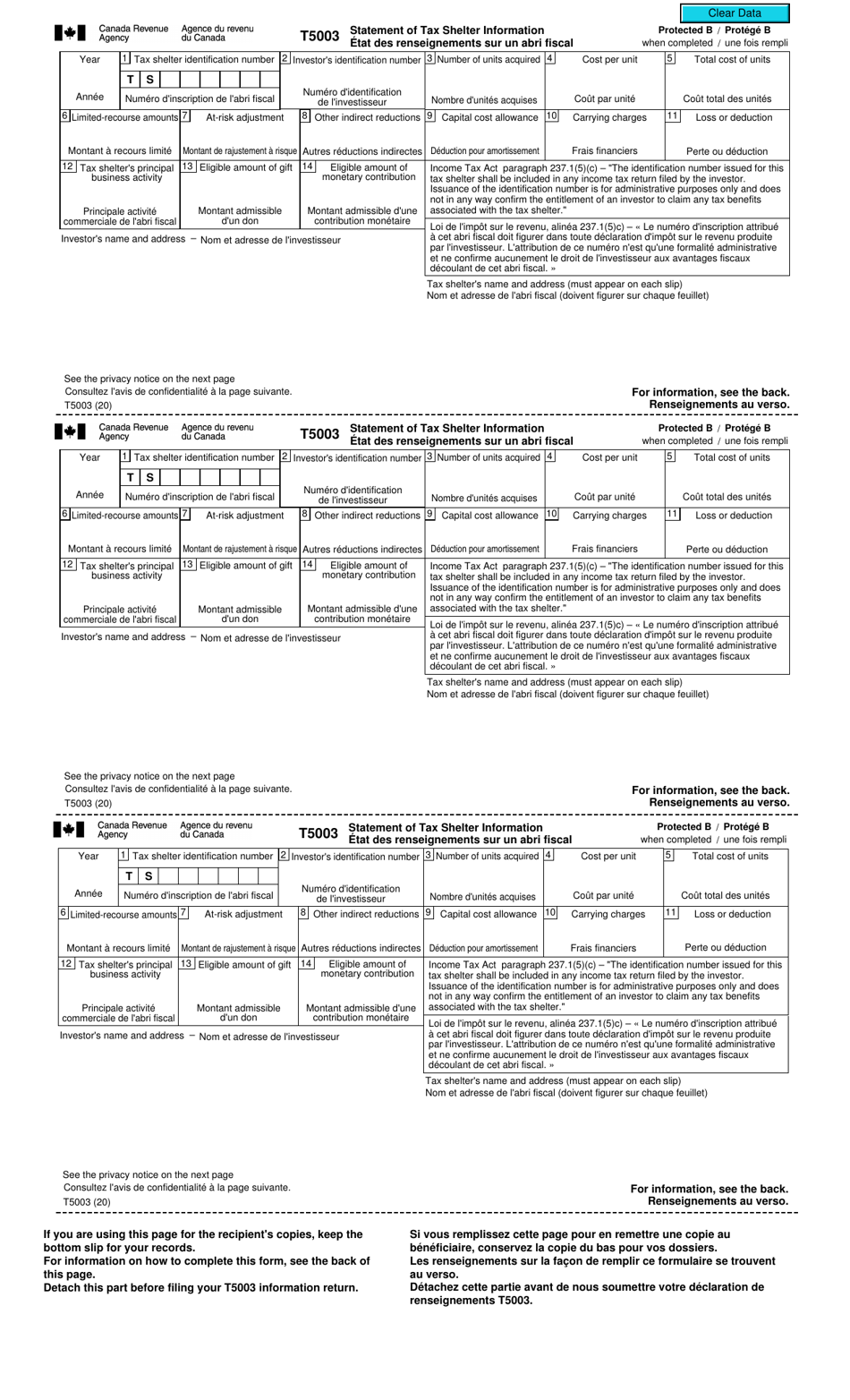

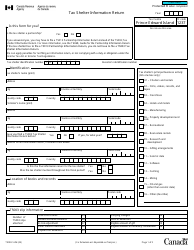

Form T5003 Statement of Tax Shelter Information - Canada (English / French)

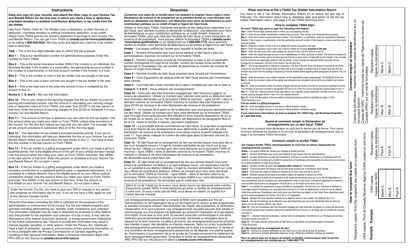

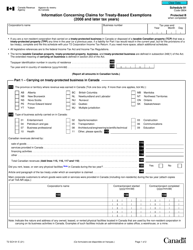

Form T5003 Statement of Tax Shelter Information is used in Canada to report information about tax shelter investments. It provides details about the tax shelter's identification, promoters, investors, and the tax benefits being claimed. This form helps the Canada Revenue Agency (CRA) track and monitor tax shelter investments to ensure compliance with tax laws. It is filed by promoters of tax shelters and is used by the CRA to assess and audit these investments.

The tax shelter promoter files the Form T5003 Statement of Tax Shelter Information in Canada.

FAQ

Q: What is Form T5003?

A: Form T5003 is a statement of tax shelter information.

Q: Who needs to fill out Form T5003?

A: Anyone who is involved in a tax shelter must fill out Form T5003.

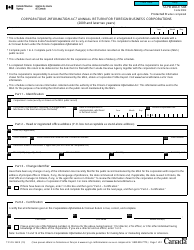

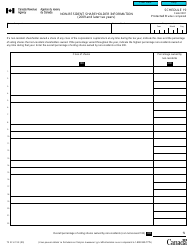

Q: What information is required on Form T5003?

A: Form T5003 requires information about the tax shelter, including the identification number, promoter information, and details about the tax benefits.

Q: Can Form T5003 be filed electronically?

A: No, Form T5003 cannot be filed electronically. It must be submitted in paper format.

Q: Is Form T5003 available in both English and French?

A: Yes, Form T5003 is available in both English and French.

Q: What is the purpose of Form T5003?

A: The purpose of Form T5003 is to provide the Canada Revenue Agency with information about tax shelters, which helps them identify and monitor potentially abusive tax schemes.

Q: When is Form T5003 due?

A: Form T5003 is due on or before the day the tax return for the tax year is due.

Q: What happens if I don't fill out Form T5003?

A: If you don't fill out Form T5003 when required, you may be subject to penalties and interest charges.

Q: Can I amend Form T5003 once it has been filed?

A: Yes, you can amend Form T5003 if you discover errors or omissions after it has been filed. You must submit an amended form as soon as possible.