This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2152 Schedule 2

for the current year.

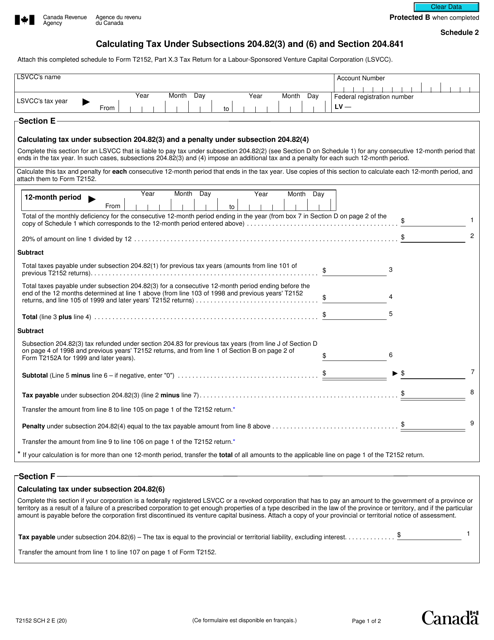

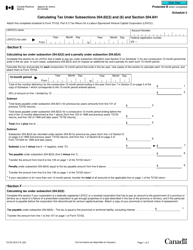

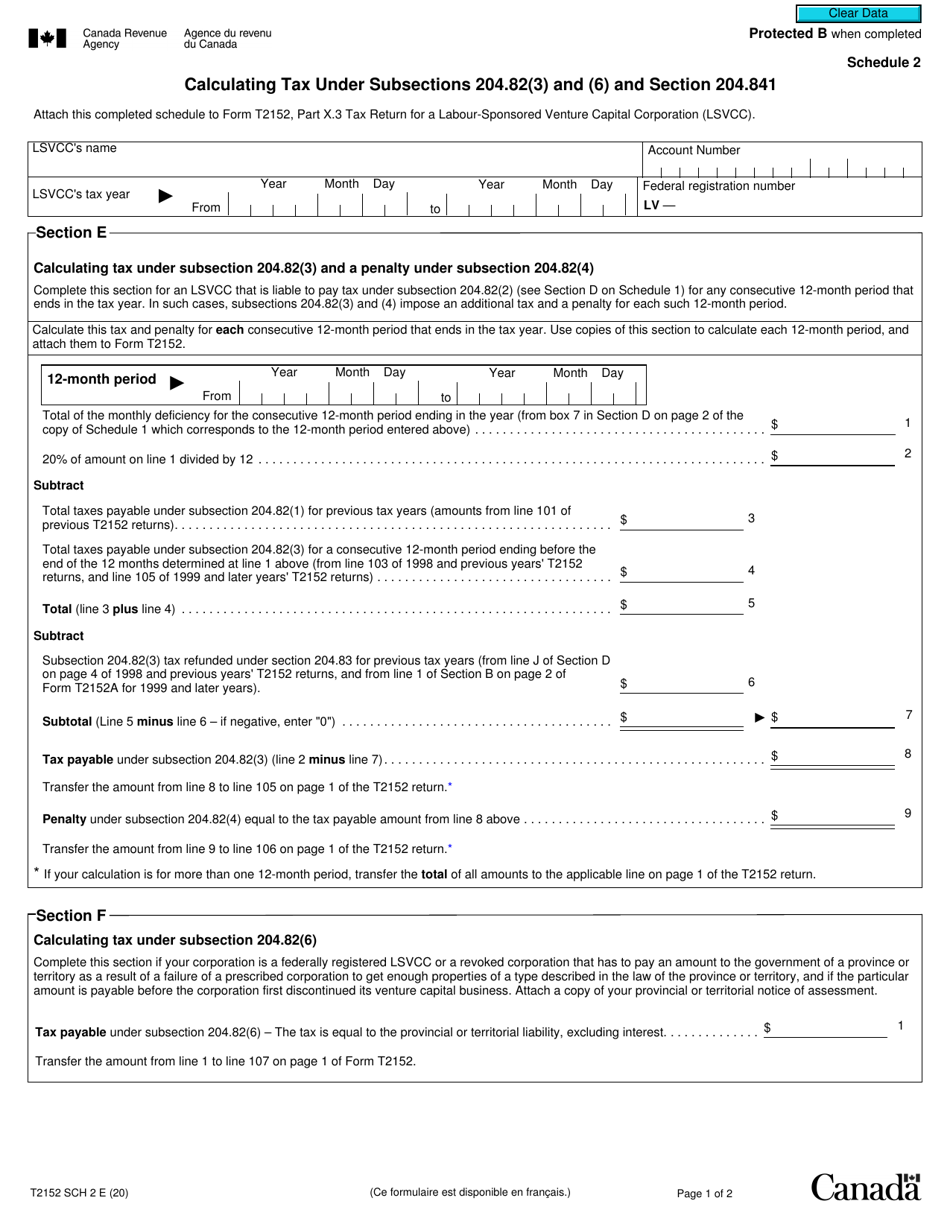

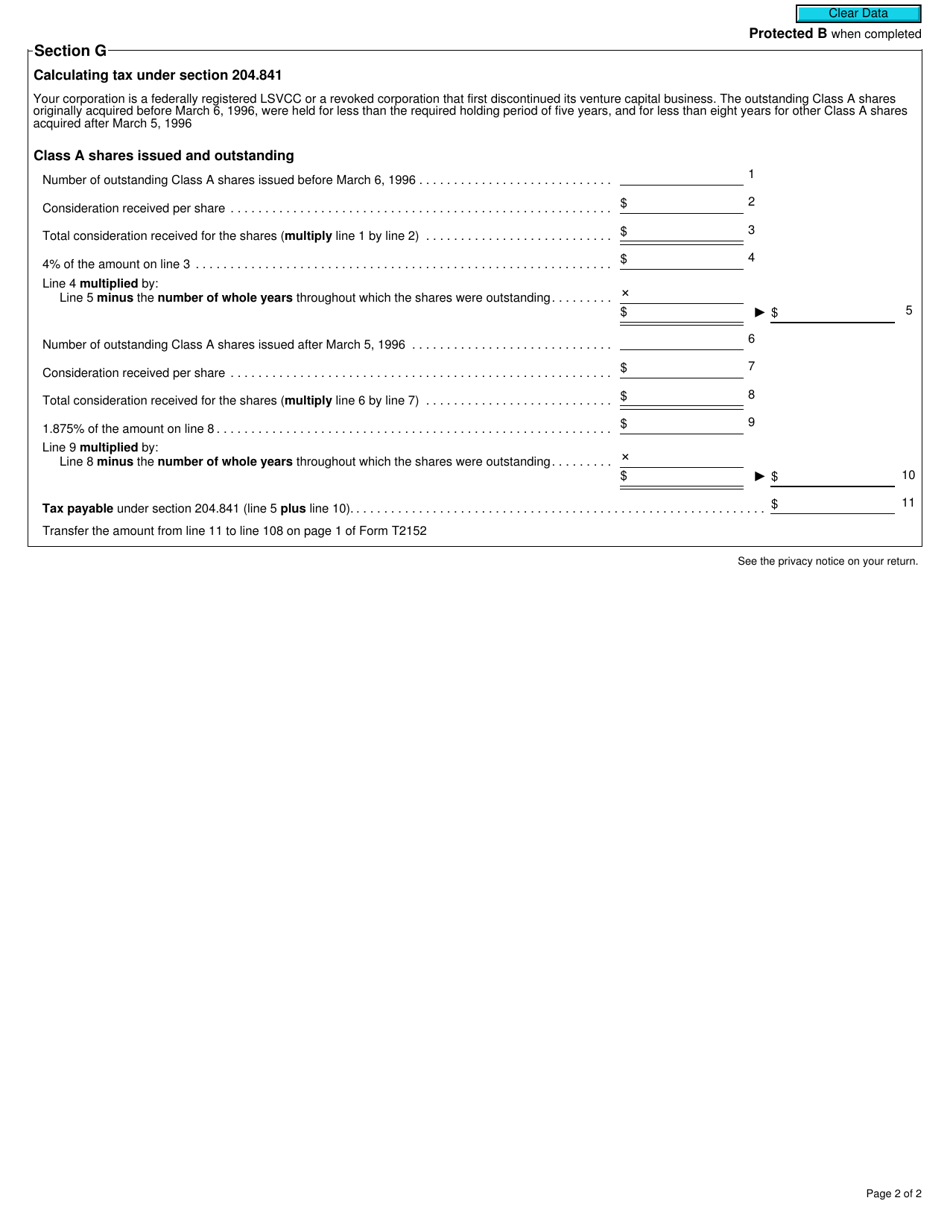

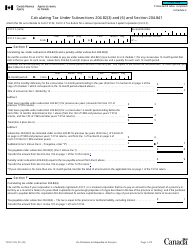

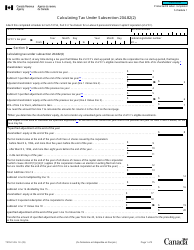

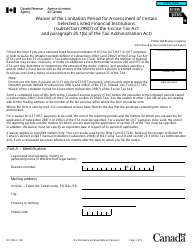

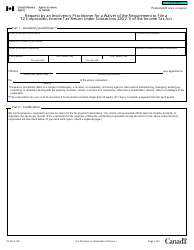

Form T2152 Schedule 2 Calculating Tax Under Subsections 204.82(3) and (6) and Section 204.841 - Canada

Form T2152 Schedule 2, "Calculating Tax Under Subsections 204.82(3) and (6) and Section 204.841," is a document used in Canada for calculating tax. It is specifically designed to help taxpayers determine the amount of tax owed or refundable under the mentioned sections of the Canadian Income Tax Act. This form provides a step-by-step calculation of the tax liability, taking into account the applicable provisions and guidelines outlined in the sections referenced. It is typically used by individuals or businesses to ensure accurate tax calculations and compliance with Canadian tax laws.

The Form T2152 Schedule 2, which is used for calculating tax under subsections 204.82(3) and (6) and section 204.841 in Canada, is typically filed by individuals or businesses who are subject to these specific tax provisions. It is important to consult with a tax professional or refer to the Canada Revenue Agency (CRA) guidelines for specific details regarding the filing of this form.

FAQ

Q: What is Form T2152?

A: Form T2152 is a schedule used in Canada to calculate tax under Subsections 204.82(3) and (6) and Section 204.841.

Q: What does Form T2152 calculate?

A: Form T2152 calculates tax under specific subsections and sections of the Canadian tax law.

Q: What are Subsections 204.82(3) and (6) and Section 204.841?

A: Subsections 204.82(3) and (6) and Section 204.841 are specific sections of the Canadian tax law that determine how tax should be calculated.

Q: Who needs to fill out Form T2152?

A: Individuals or businesses who are required to calculate tax under Subsections 204.82(3) and (6) and Section 204.841 need to fill out Form T2152.

Q: Is Form T2152 mandatory?

A: Yes, if you are required to calculate tax under Subsections 204.82(3) and (6) and Section 204.841, you must fill out Form T2152.

Q: What happens after I submit Form T2152?

A: After you submit Form T2152, the Canada Revenue Agency will review your information and use it to calculate your tax liability based on Subsections 204.82(3) and (6) and Section 204.841.

Q: Do I need to keep a copy of Form T2152 for my records?

A: Yes, it is recommended to keep a copy of Form T2152 for your records in case you need to reference it in the future or if the Canada Revenue Agency requires additional information.