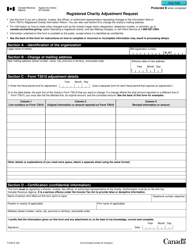

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1-ADJ

for the current year.

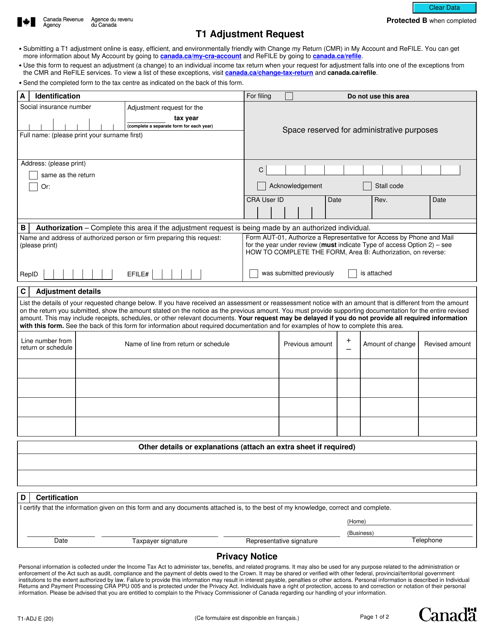

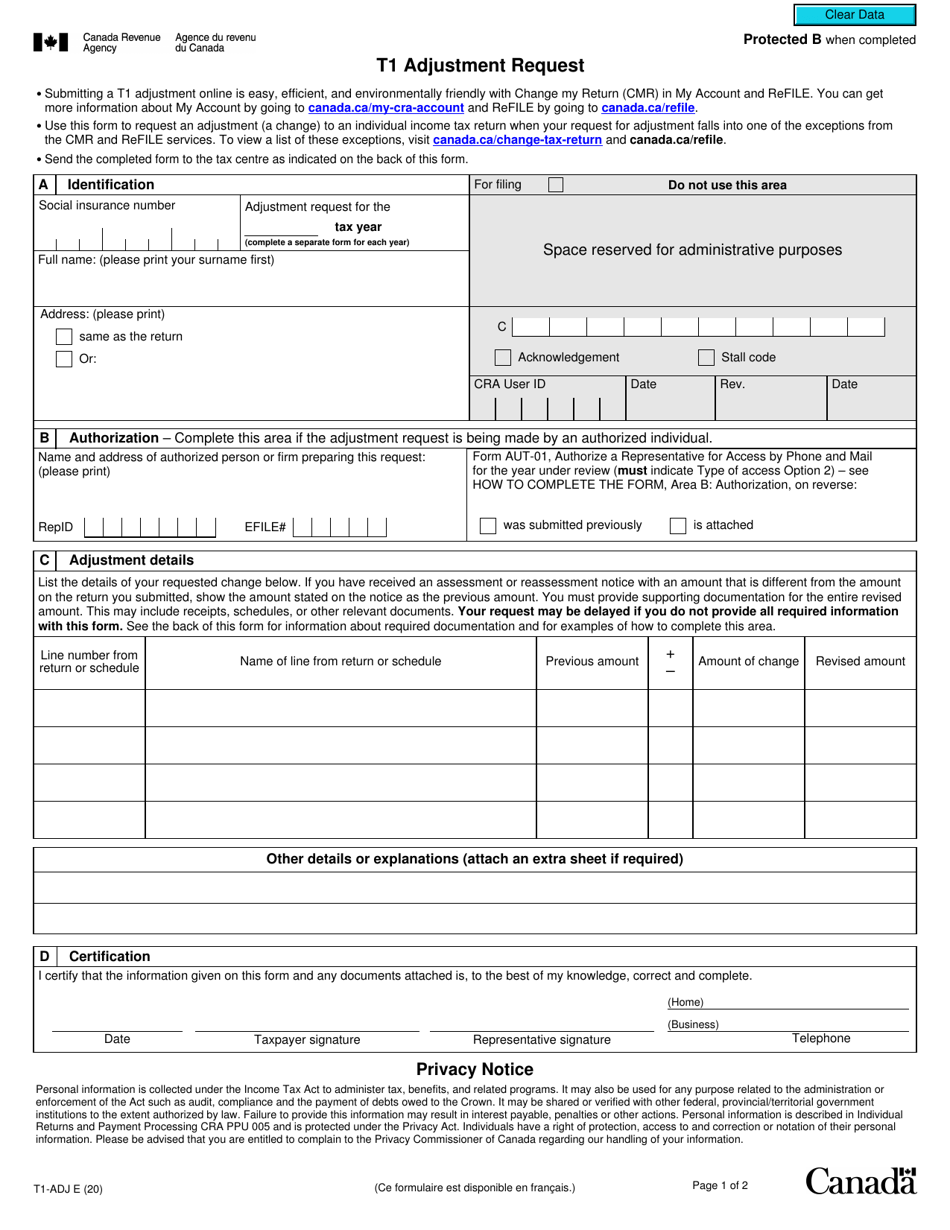

Form T1-ADJ T1 Adjustment Request - Canada

The Form T1-ADJ is used in Canada to request adjustments or changes to a previously filed individual tax return, known as the T1 return. It allows taxpayers to correct errors or provide additional information to the Canada Revenue Agency (CRA).

The Form T1-ADJ T1 Adjustment Request in Canada is filed by individual taxpayers to make changes or corrections to their previously filed personal income tax returns.

FAQ

Q: What is Form T1-ADJ?

A: Form T1-ADJ is a form used in Canada to request an adjustment to your individual income tax return.

Q: When should I use Form T1-ADJ?

A: You should use Form T1-ADJ when you want to make changes or corrections to your previously filed T1 income tax return.

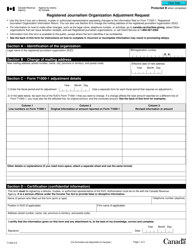

Q: What types of changes can I request using Form T1-ADJ?

A: You can use Form T1-ADJ to request changes to your income, deductions, credits, and taxes on your previously filed tax return.

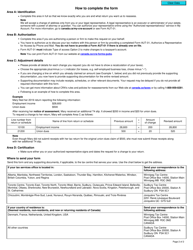

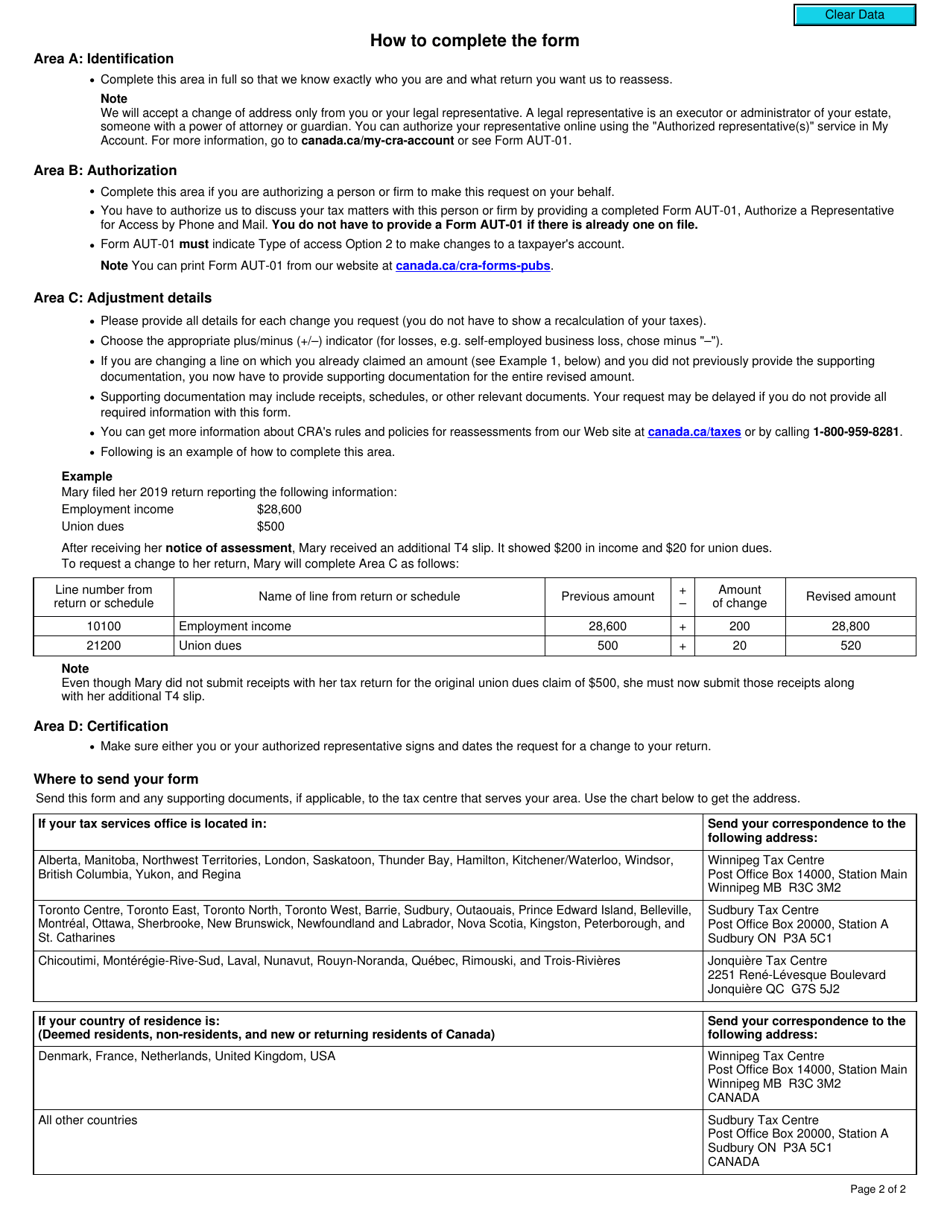

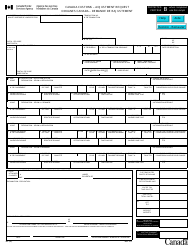

Q: How do I complete Form T1-ADJ?

A: To complete Form T1-ADJ, you will need to provide your personal information, explain the changes you are requesting, and provide supporting documents.

Q: Is there a deadline for submitting Form T1-ADJ?

A: Yes, you must submit Form T1-ADJ within 10 years from the end of the tax year in which the adjustments are being requested.

Q: What is the processing time for Form T1-ADJ?

A: The processing time for Form T1-ADJ varies, but it can take several weeks or months for the CRA to review and process your request.

Q: Will I receive a refund or have to pay additional taxes if my adjustment request is approved?

A: Depending on the nature of your adjustment request, you may receive a refund or have to pay additional taxes if the CRA approves your request.

Q: Can I appeal if my adjustment request is denied?

A: Yes, if your adjustment request is denied, you have the right to appeal the decision by contacting the CRA's Appeals Branch.