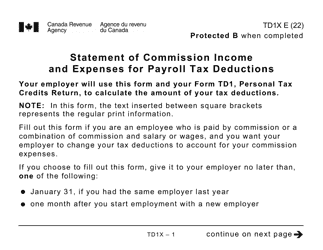

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1X

for the current year.

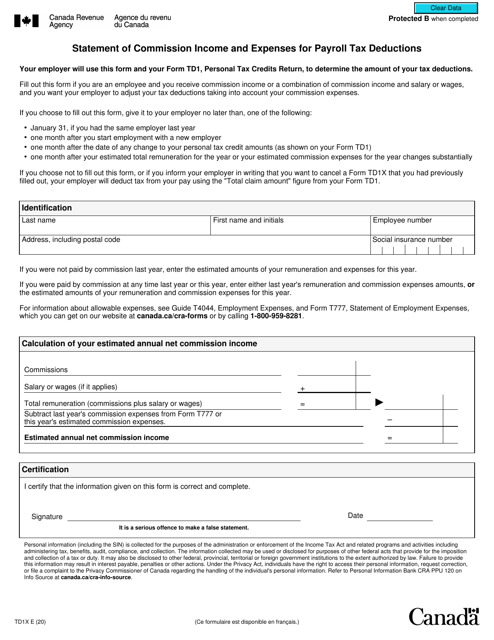

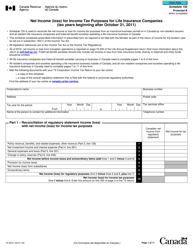

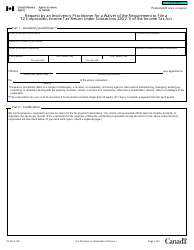

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions - Canada

Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions, is used in Canada by individuals who earn commission income and want to have additional tax deductions withheld from their paychecks. This form allows them to provide the necessary information about their commission income and expenses in order to calculate the appropriate amount of tax that should be deducted from their earnings.

In Canada, Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions is filed by individuals who earn commission income and want to claim certain deductions for tax purposes.

FAQ

Q: What is Form TD1X?

A: Form TD1X is a statement of commission income and expenses for payroll tax deductions in Canada.

Q: Who needs to complete Form TD1X?

A: Individuals who earn commission income and want to claim expenses for payroll tax deductions in Canada need to complete Form TD1X.

Q: What is the purpose of Form TD1X?

A: The purpose of Form TD1X is to calculate the appropriate amount of tax to be deducted from an individual's commission income, taking into account any eligible expenses.

Q: What information is required to complete Form TD1X?

A: To complete Form TD1X, you will need to provide details about your commission income, eligible expenses related to your commission income, and any other relevant information.

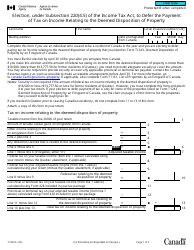

Q: When should I submit Form TD1X?

A: You should submit Form TD1X to your employer as soon as possible, preferably before you start earning commission income.

Q: What happens after I submit Form TD1X?

A: After you submit Form TD1X to your employer, they will use the information provided to calculate the appropriate amount of tax to be deducted from your commission income.

Q: Can I claim expenses on Form TD1X for income other than commission?

A: No, Form TD1X is specifically for claiming commission income and related expenses for payroll tax deductions.

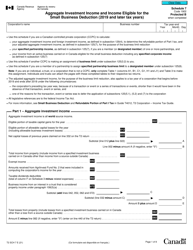

Q: What types of expenses can I claim on Form TD1X?

A: You can claim eligible expenses on Form TD1X that are directly related to earning your commission income, such as advertising fees, meal and entertainment expenses, and transportation costs.

Q: Do I need to keep receipts for my claimed expenses on Form TD1X?

A: Yes, it is recommended to keep all relevant receipts and supporting documents for your claimed expenses on Form TD1X in case of an audit by the CRA.