This version of the form is not currently in use and is provided for reference only. Download this version of

Form NR602

for the current year.

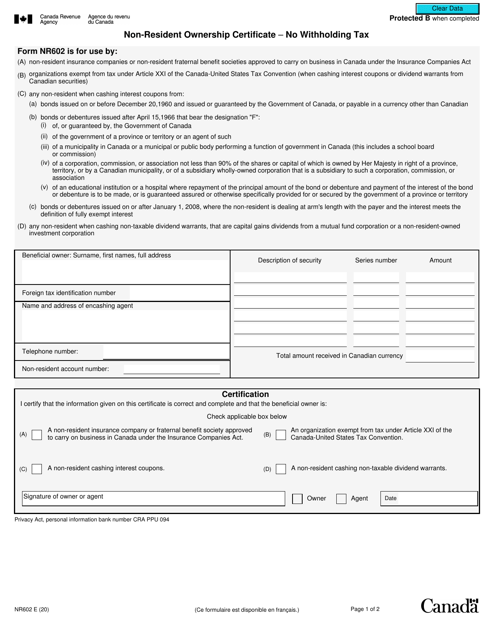

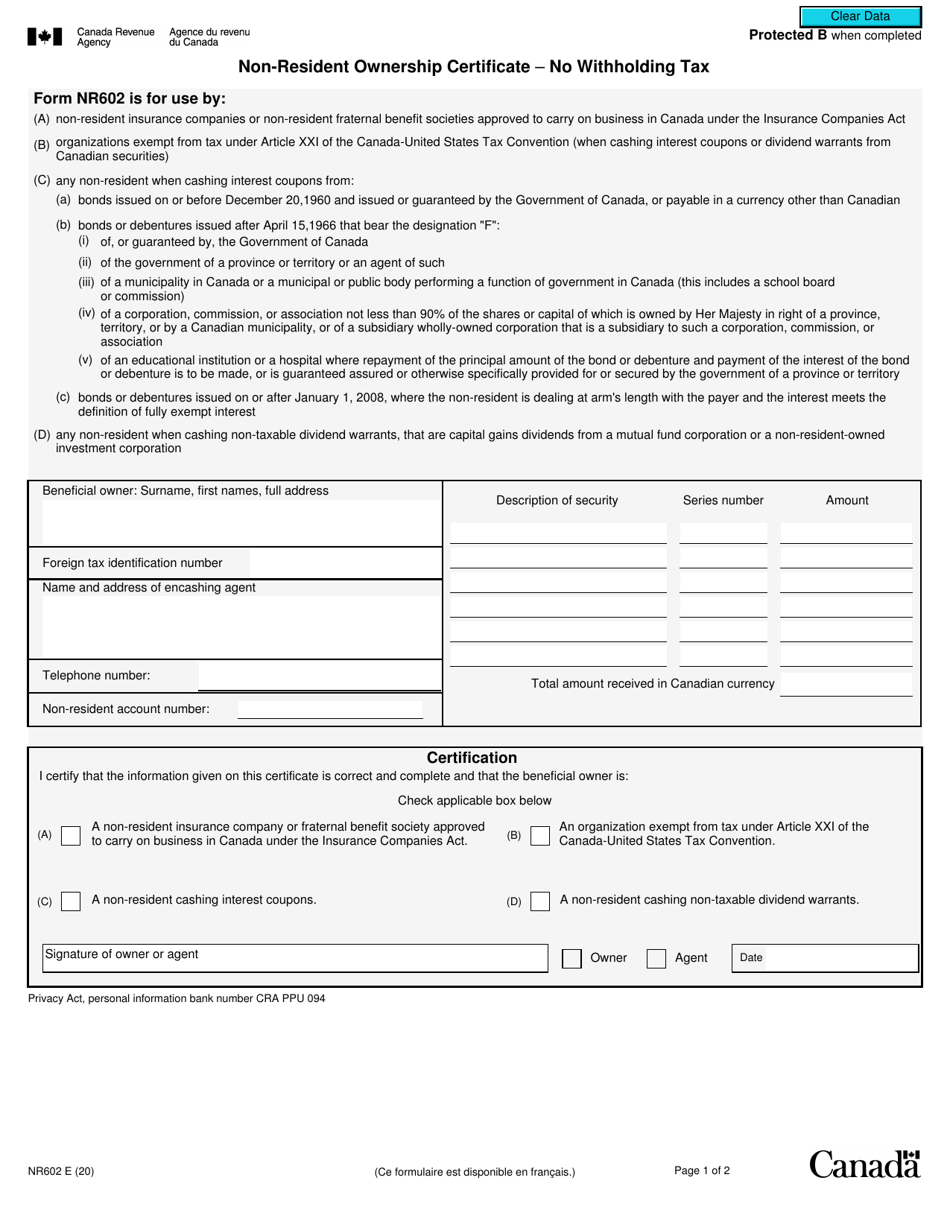

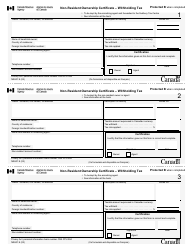

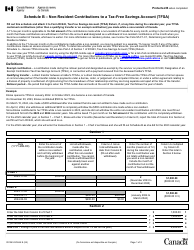

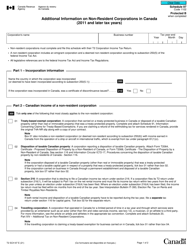

Form NR602 Non-resident Ownership Certificate - No Withholding Tax - Canada

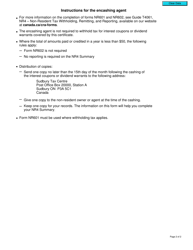

Form NR602 Non-resident Ownership Certificate - No Withholding Tax is a document used in Canada to certify that a non-resident owner of rental property meets the eligibility criteria for a reduced or zero withholding tax rate on their rental income. It allows non-resident owners to avoid excessive withholding tax deductions on their rental income in Canada.

The Form NR602 Non-resident Ownership Certificate - No Withholding Tax in Canada is typically filed by non-resident individuals or corporations who own Canadian property and qualify for an exemption from withholding tax.

FAQ

Q: What is Form NR602?

A: Form NR602 is the Non-resident Ownership Certificate.

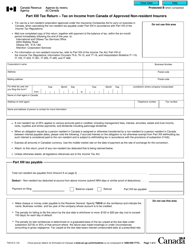

Q: What is the purpose of Form NR602?

A: The purpose of Form NR602 is to certify that a non-resident of Canada is exempt from withholding tax on certain Canadian income.

Q: Who can use Form NR602?

A: Non-residents of Canada who want to claim an exemption from withholding tax on Canadian income can use Form NR602.

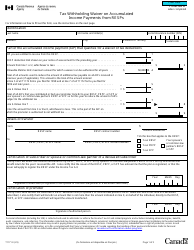

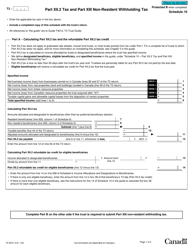

Q: What information is required on Form NR602?

A: Form NR602 requires information such as the non-resident's name, address, tax identification number, description of income, and the applicable tax treaty.

Q: Is there a deadline for filing Form NR602?

A: There is no specific deadline for filing Form NR602, but it is recommended to submit it well in advance of the payment date to ensure exemption from withholding tax.

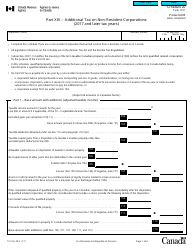

Q: What happens after submitting Form NR602?

A: Once Form NR602 is submitted, the CRA will review the information and determine if the non-resident qualifies for an exemption from withholding tax.

Q: Are there any fees associated with filing Form NR602?

A: There are no fees associated with filing Form NR602.

Q: Can I use Form NR602 for all types of Canadian income?

A: Form NR602 can be used for various types of Canadian income, such as rental income, dividends, and pension income, depending on the specific tax treaty provisions.