This version of the form is not currently in use and is provided for reference only. Download this version of

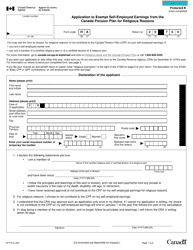

Form CPT124

for the current year.

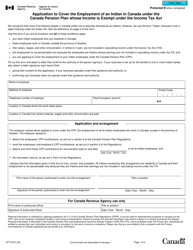

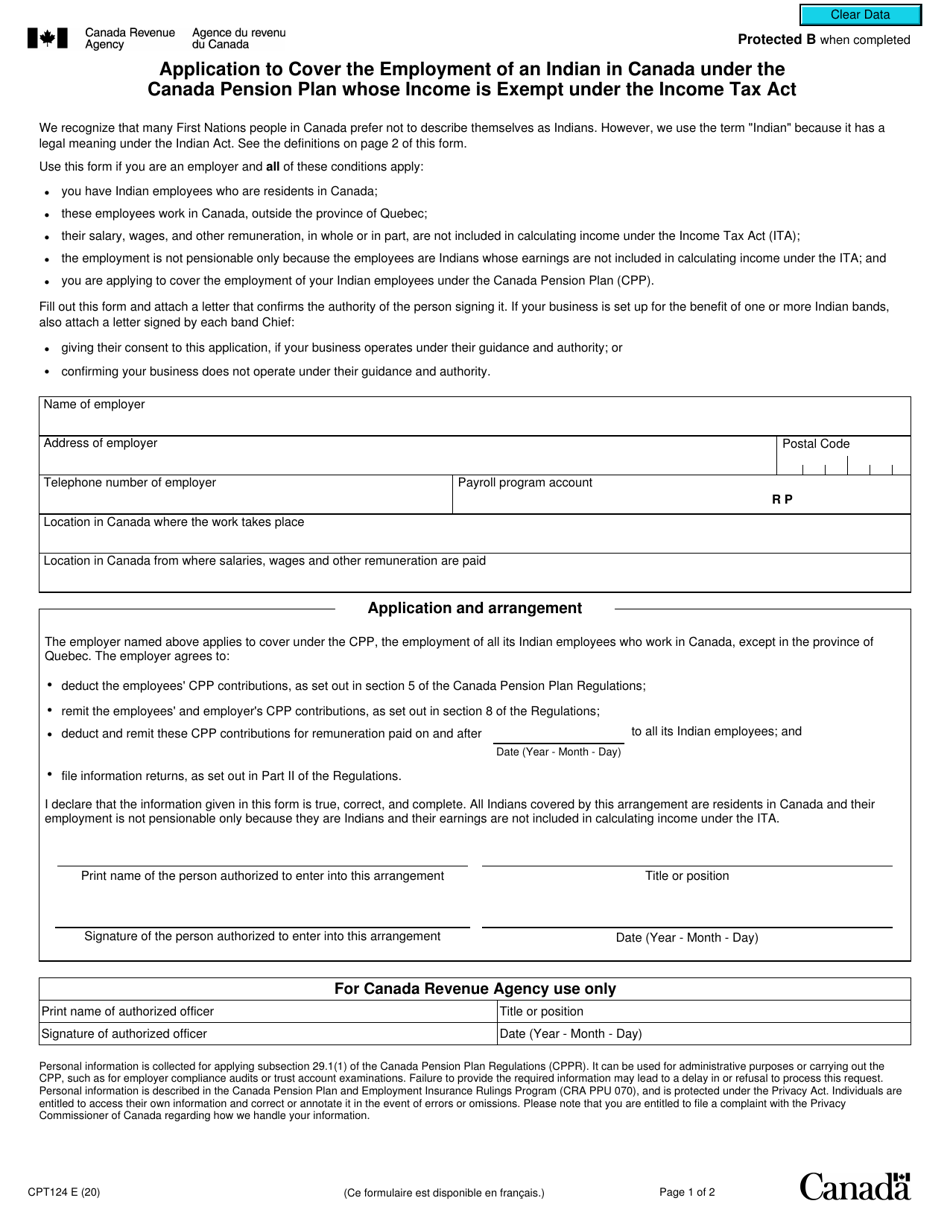

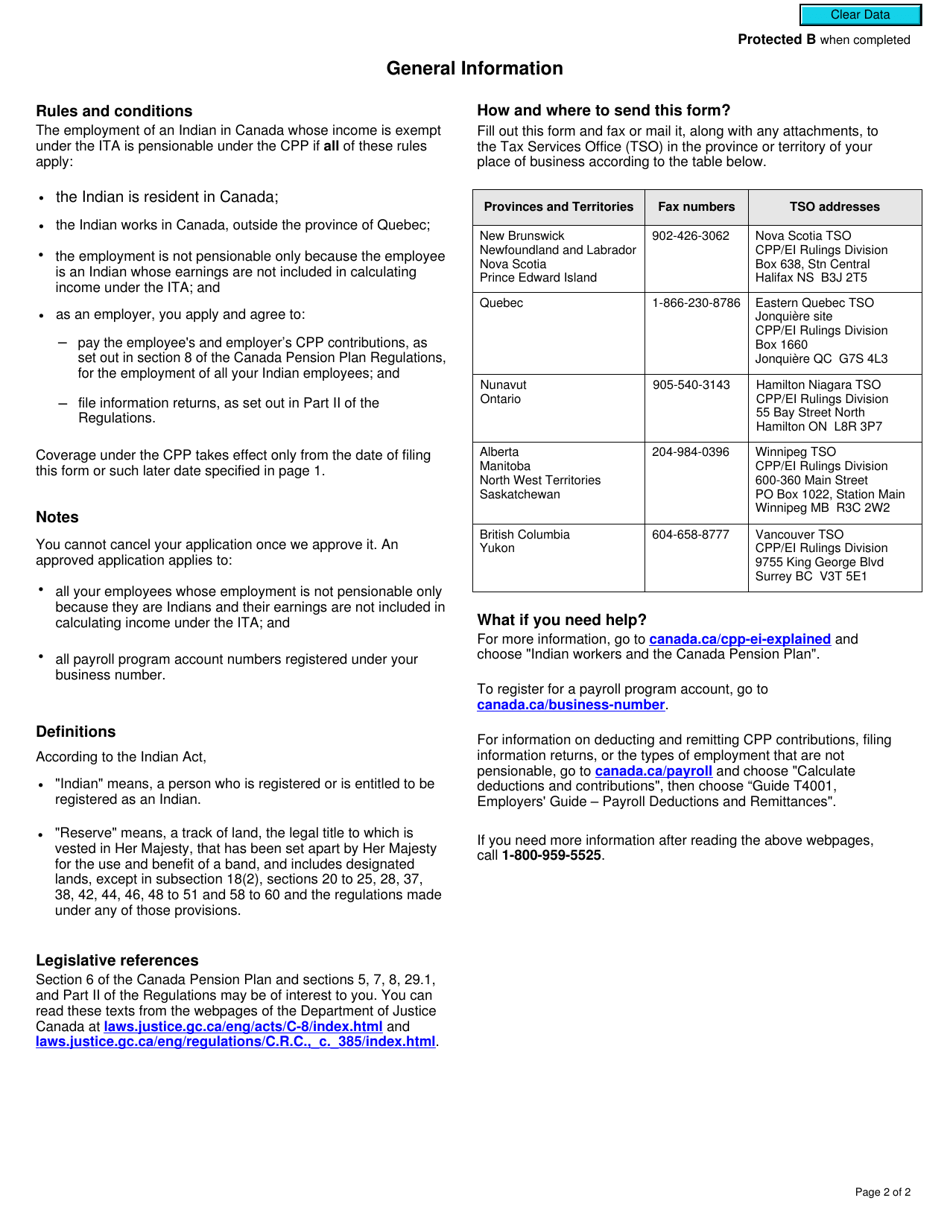

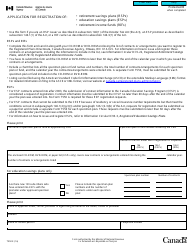

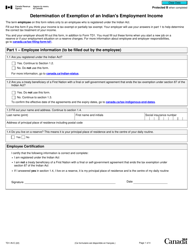

Form CPT124 Application to Cover the Employment of an Indian in Canada Under the Canada Pension Plan Whose Income Is Exempt Under the Income Tax Act - Canada

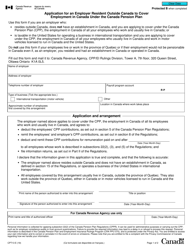

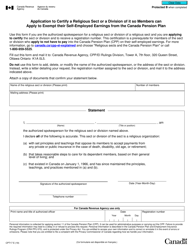

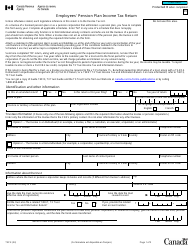

Form CPT124 is used for applying to cover the employment of an Indian in Canada under the Canada Pension Plan, whose income is exempt under the Income Tax Act - Canada. It allows Indians in Canada to have their employment covered under the pension plan, even if their income is exempt from income tax.

The employer files the Form CPT124 application.

FAQ

Q: What is Form CPT124?

A: Form CPT124 is an application to cover the employment of an Indian in Canada under the Canada Pension Plan whose income is exempt under the Income Tax Act.

Q: What is the Canada Pension Plan?

A: The Canada Pension Plan is a social insurance program that provides financial benefits to eligible individuals in Canada.

Q: Who is eligible for the Canada Pension Plan?

A: Most individuals who work in Canada and contribute to the plan are eligible for the Canada Pension Plan.

Q: What is the Income Tax Act?

A: The Income Tax Act is a federal law in Canada that governs the taxation of individuals and businesses.

Q: Why is the income of an Indian exempt under the Income Tax Act?

A: The income of an Indian may be exempt under the Income Tax Act due to certain provisions for the taxation of First Nations individuals.

Q: What is the purpose of Form CPT124?

A: The purpose of Form CPT124 is to apply for coverage under the Canada Pension Plan for an Indian employee whose income is exempt under the Income Tax Act.

Q: Are there any fees associated with Form CPT124?

A: There are no fees associated with submitting Form CPT124.

Q: What information do I need to provide in Form CPT124?

A: You will need to provide personal information about the Indian employee, details of employment, and information about the exemption under the Income Tax Act.

Q: Who should I contact for assistance with Form CPT124?

A: You can contact the Canada Revenue Agency for assistance with Form CPT124.