This version of the form is not currently in use and is provided for reference only. Download this version of

Form E668

for the current year.

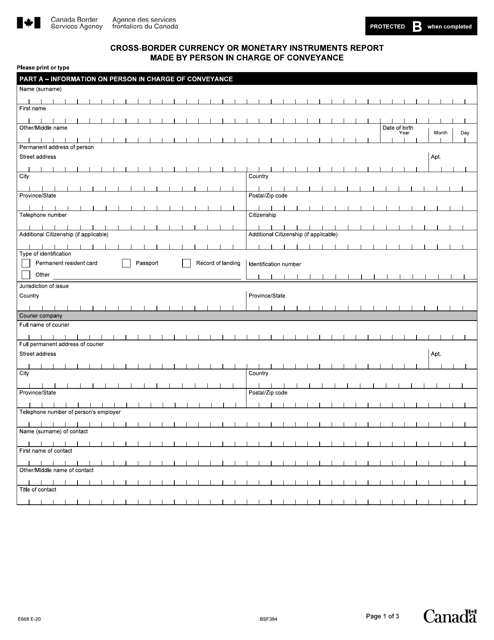

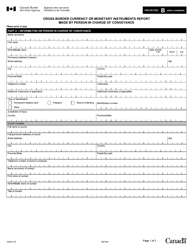

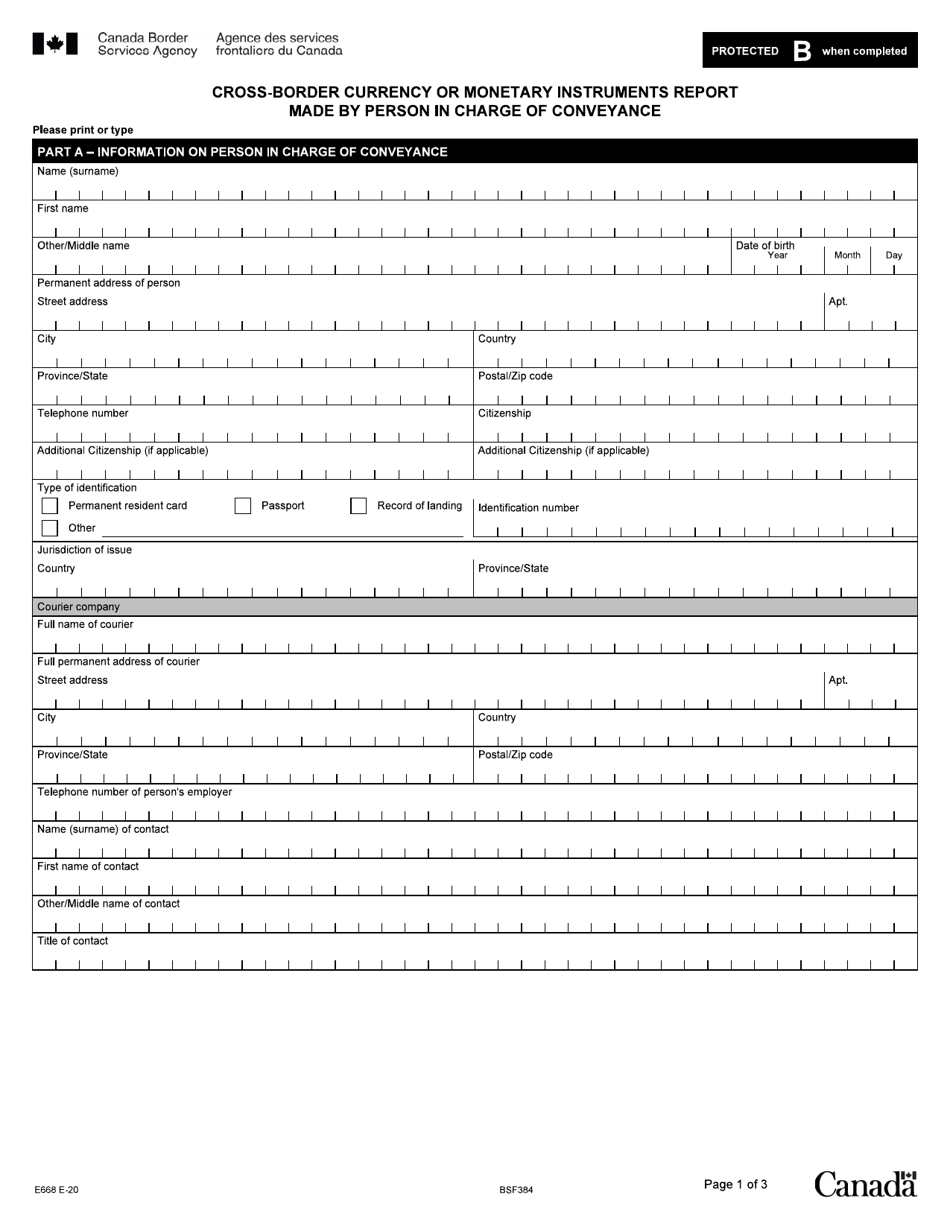

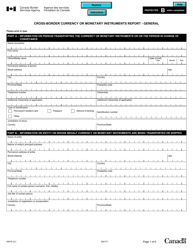

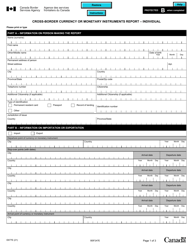

Form E668 Cross-border Currency or Monetary Instruments Report Made by Person in Charge of Conveyance - Canada

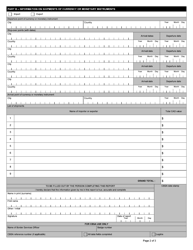

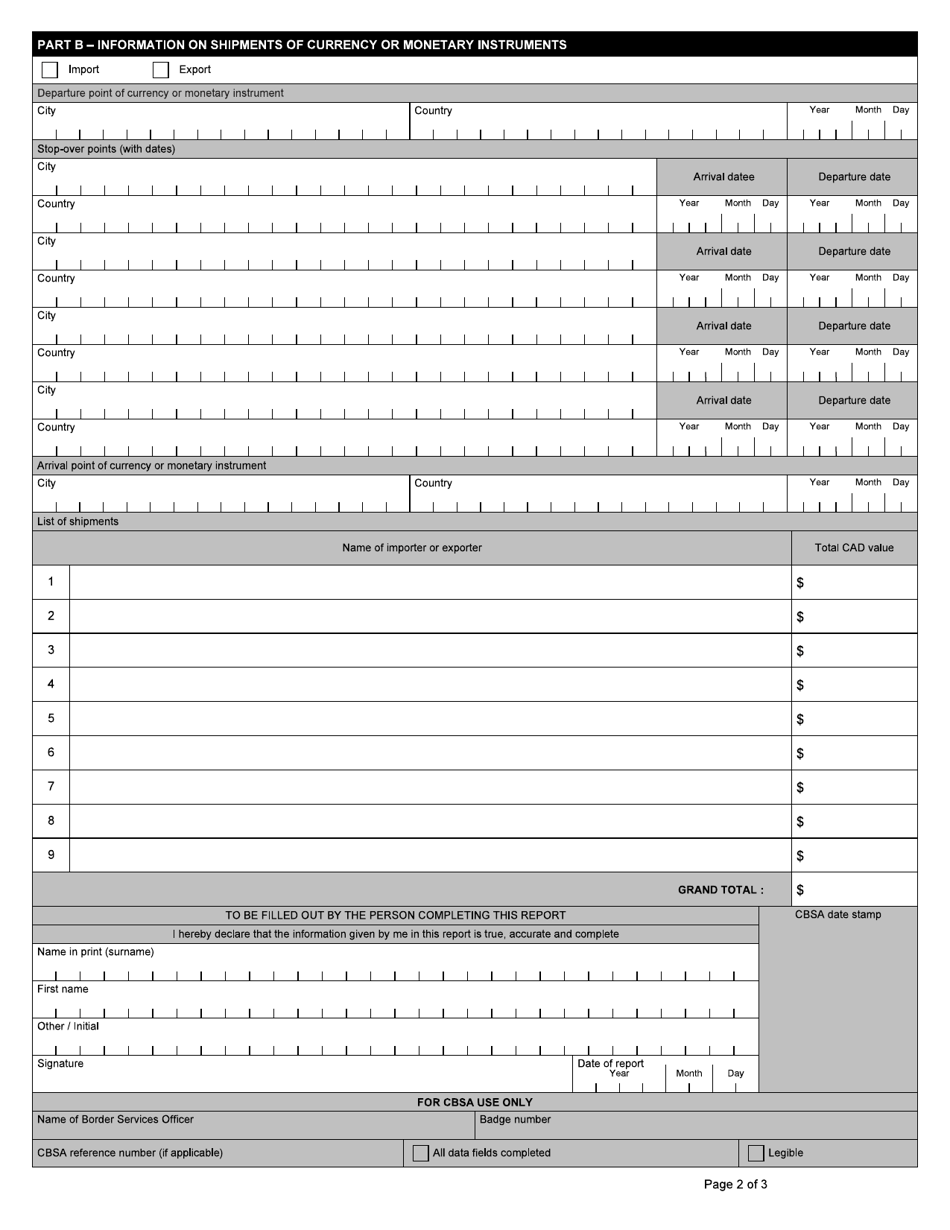

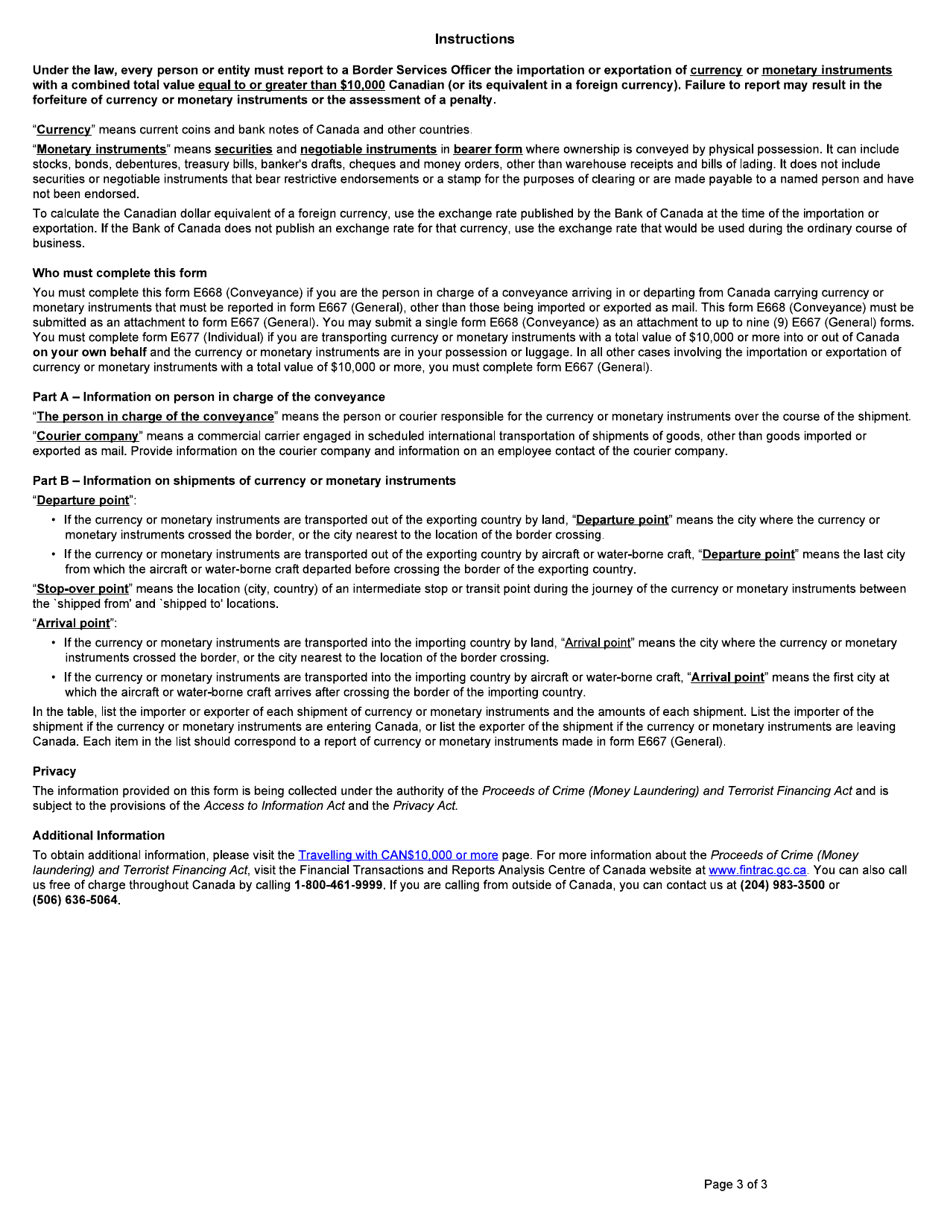

Form E668, also known as the Cross-border Currency or Monetary Instruments Report Made by Person in Charge of Conveyance, is used in Canada to report the movement of currency or monetary instruments worth CAD 10,000 or more entering or leaving the country by air, land, or water. It is a requirement under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act to help prevent money laundering and other illegal activities.

The person in charge of the conveyance, such as an airline or shipping company, files the Form E668 Cross-border Currency or Monetary Instruments Report in Canada.

FAQ

Q: What is Form E668?

A: Form E668 is a Cross-border Currency or Monetary Instruments Report made by the person in charge of conveyance when traveling to or from Canada with currency or monetary instruments.

Q: Who is required to fill out Form E668?

A: The person in charge of conveyance, such as the captain or pilot of the aircraft, vessel, or vehicle, is required to fill out Form E668.

Q: What is considered currency or monetary instruments?

A: Currency or monetary instruments include cash, securities, traveler's cheques, and negotiable instruments, with a total value of CAD 10,000 or more.

Q: Do I need to report if I have less than CAD 10,000 in currency or monetary instruments?

A: No, you only need to report if the total value of your currency or monetary instruments is CAD 10,000 or more.

Q: How do I submit Form E668?

A: Form E668 should be submitted to the Canada Border Services Agency (CBSA) when entering or leaving Canada.

Q: Are there any penalties for not reporting currency or monetary instruments?

A: Yes, failing to report currency or monetary instruments of CAD 10,000 or more can result in fines, seizure of the funds, or criminal charges.