Form MC076 Registrant / Taxpayer Responsibilities - Nevada

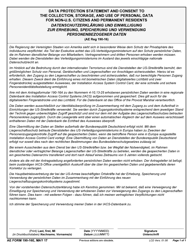

What Is Form MC076?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form MC076?

A: Form MC076 is used for registering as a taxpayer in Nevada.

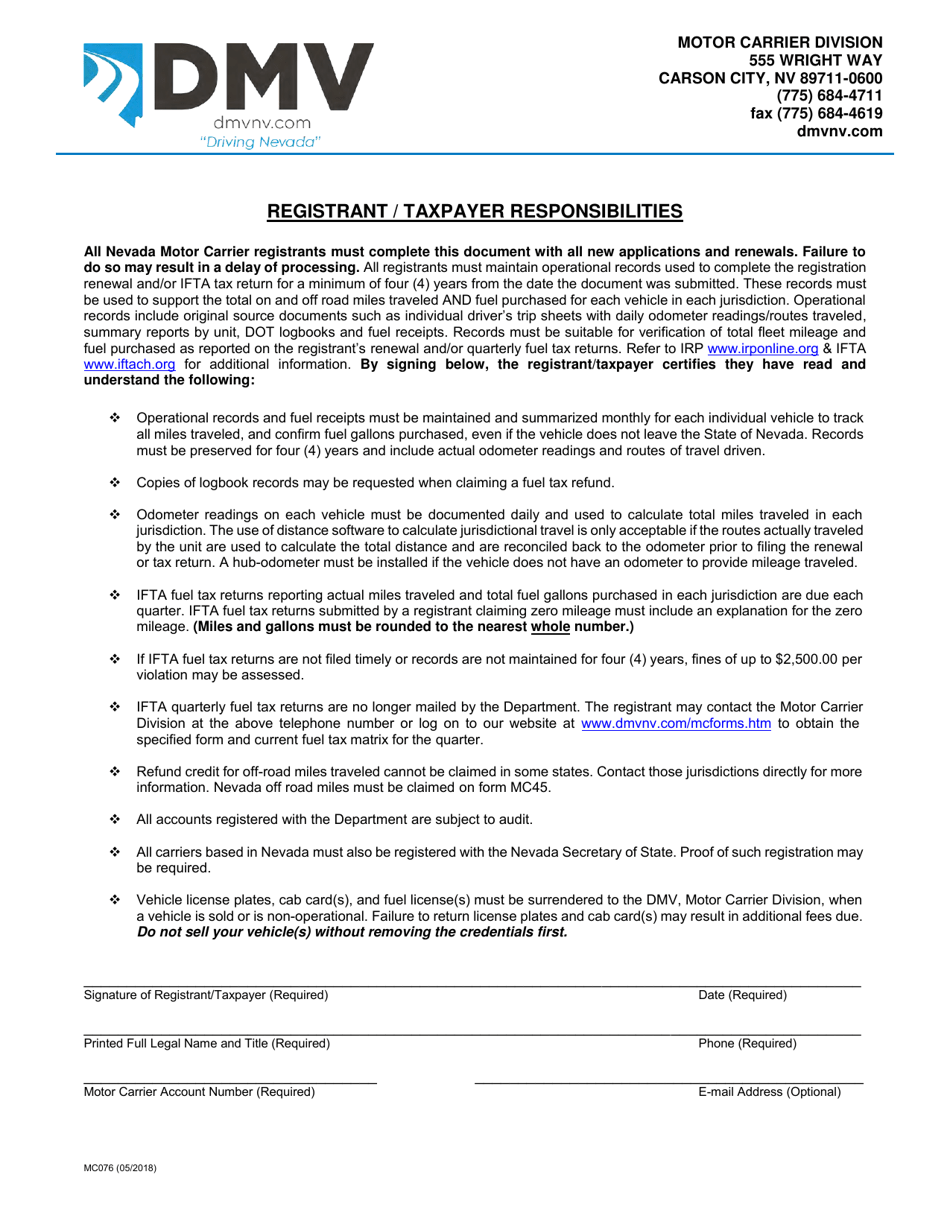

Q: What are the responsibilities of a registrant/taxpayer in Nevada?

A: The responsibilities include maintaining accurate records, complying with tax laws, filing tax returns, and paying taxes.

Q: Who needs to fill out form MC076?

A: Anyone who wants to register as a taxpayer in Nevada needs to fill out form MC076.

Q: Is there a deadline for submitting form MC076?

A: There is no specific deadline for submitting form MC076. It should be submitted as soon as you decide to register as a taxpayer in Nevada.

Q: Is there a fee for submitting form MC076?

A: There is no fee for submitting form MC076.

Q: What should I do after filling out form MC076?

A: After filling out form MC076, you should submit it to the Nevada Department of Taxation.

Q: What if I have more questions about registering as a taxpayer in Nevada?

A: If you have more questions, you can contact the Nevada Department of Taxation for assistance.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC076 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.