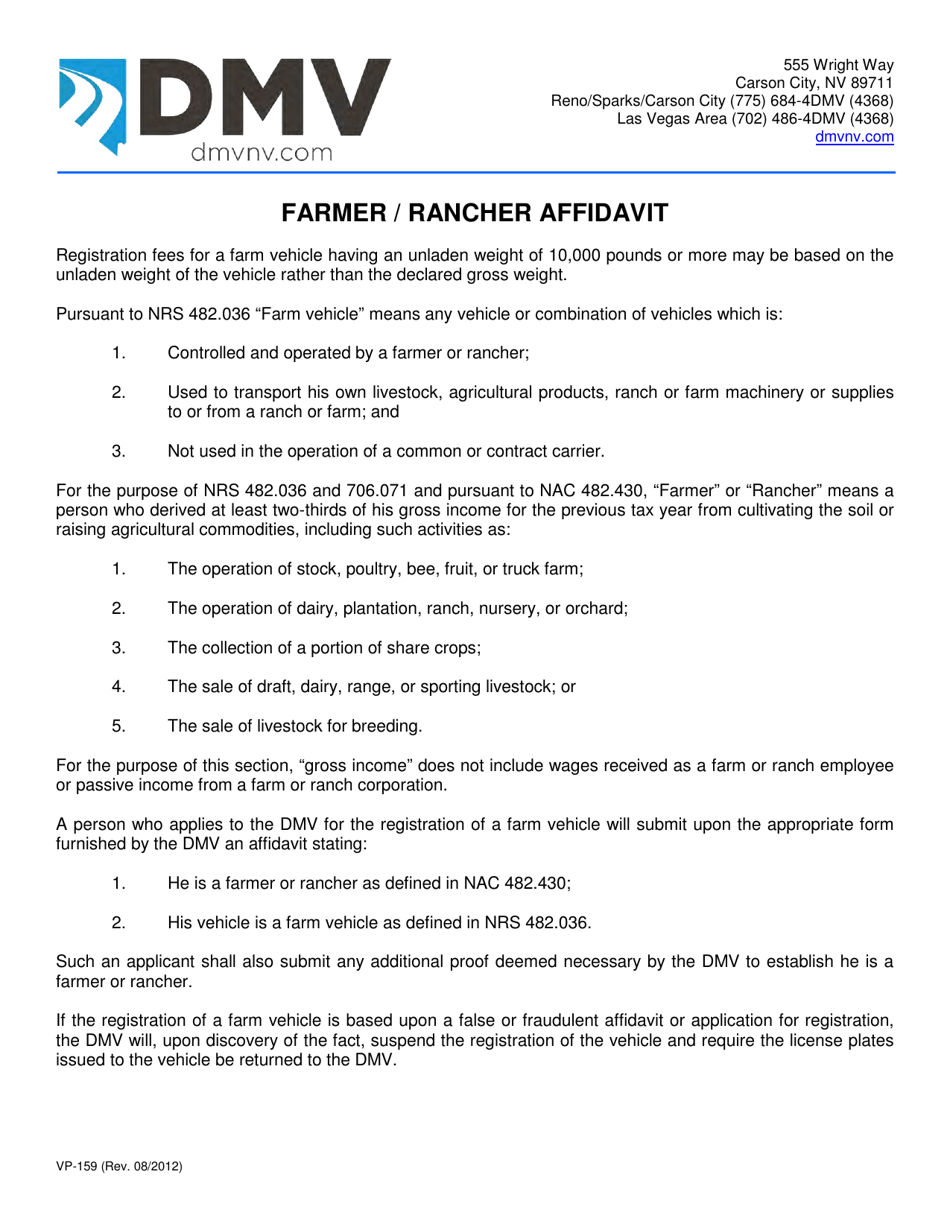

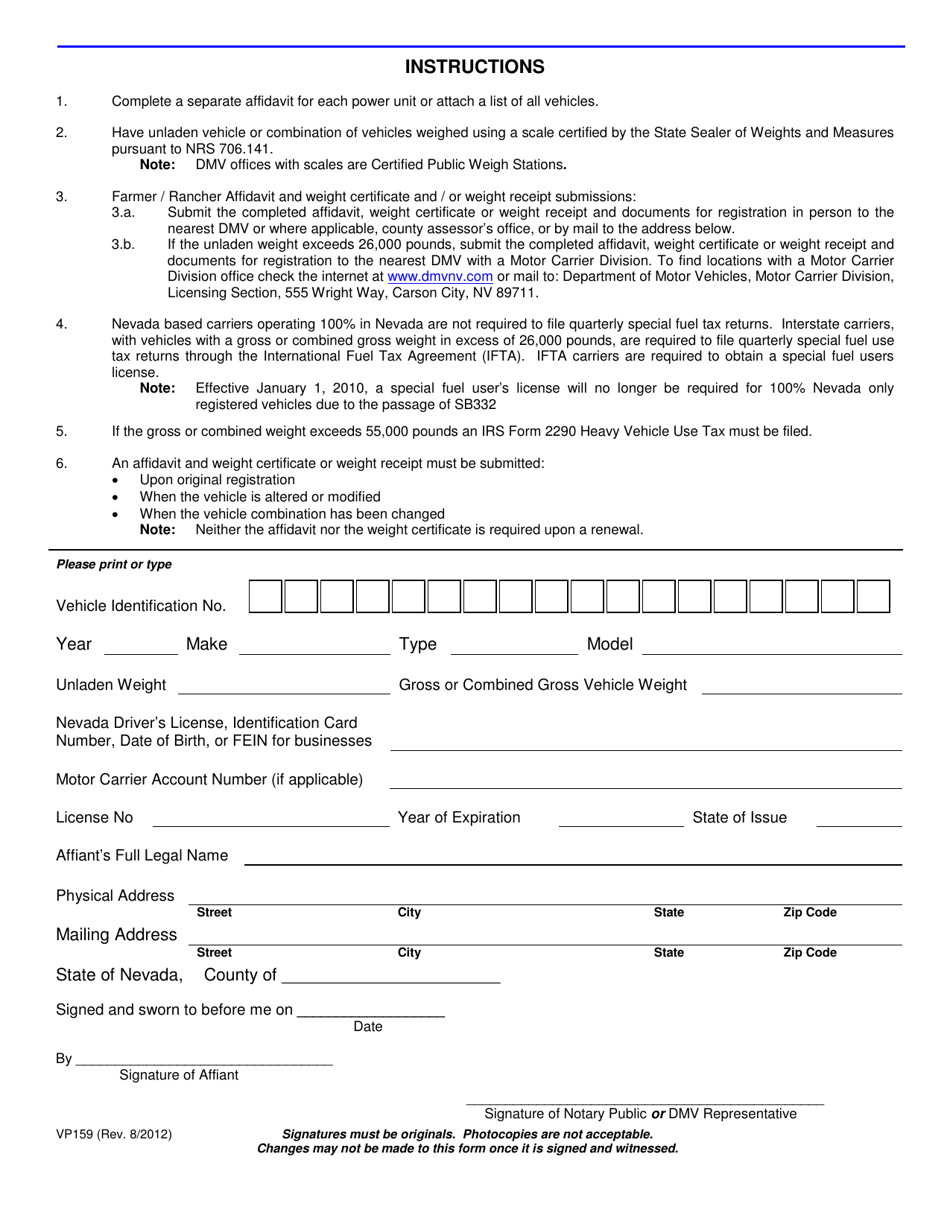

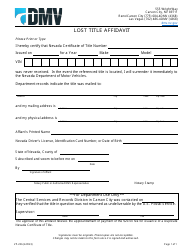

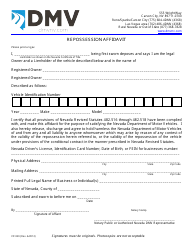

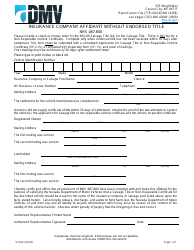

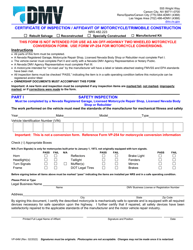

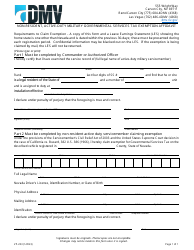

Form VP-159 Farmer / Rancher Affidavit - Nevada

What Is Form VP-159?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

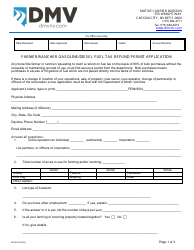

Q: What is Form VP-159?

A: Form VP-159 is a Farmer / Rancher Affidavit in Nevada.

Q: Who needs to use Form VP-159?

A: Farmers or ranchers in Nevada who qualify for certain property tax benefits need to use Form VP-159.

Q: What are the property tax benefits for farmers or ranchers in Nevada?

A: Farmers or ranchers in Nevada may be eligible for property tax deductions or exemptions based on their agricultural activities.

Q: What information is required on Form VP-159?

A: Form VP-159 requires information about the applicant's agricultural activities, such as the number of acres of land used for farming or ranching, livestock numbers, and income from agricultural operations.

Q: How often do I need to file Form VP-159?

A: Form VP-159 needs to be filed annually with the county assessor's office to maintain the property tax benefits.

Q: Are there any deadlines for filing Form VP-159?

A: Yes, the deadline for filing Form VP-159 in Nevada is usually on or before the third Monday in March of each year.

Q: What happens if I don't file Form VP-159?

A: Failure to file Form VP-159 may result in the loss of property tax benefits for farmers or ranchers in Nevada.

Q: Can I get assistance with filling out Form VP-159?

A: Yes, you can seek assistance from the Nevada Department of Taxation or your local county assessor's office.

Q: Is there a fee for filing Form VP-159?

A: There is no fee for filing Form VP-159 in Nevada.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP-159 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.