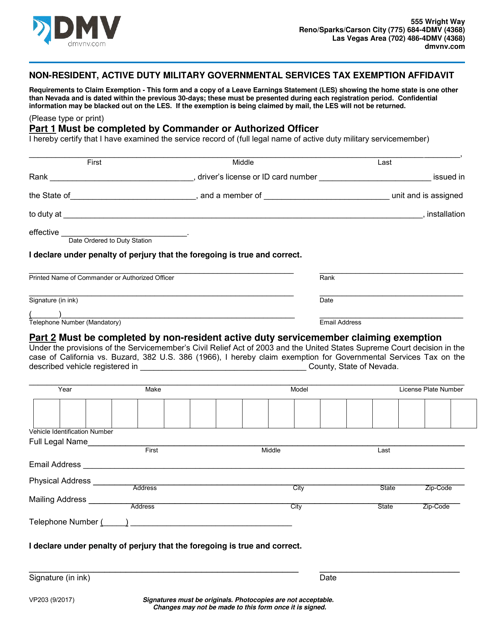

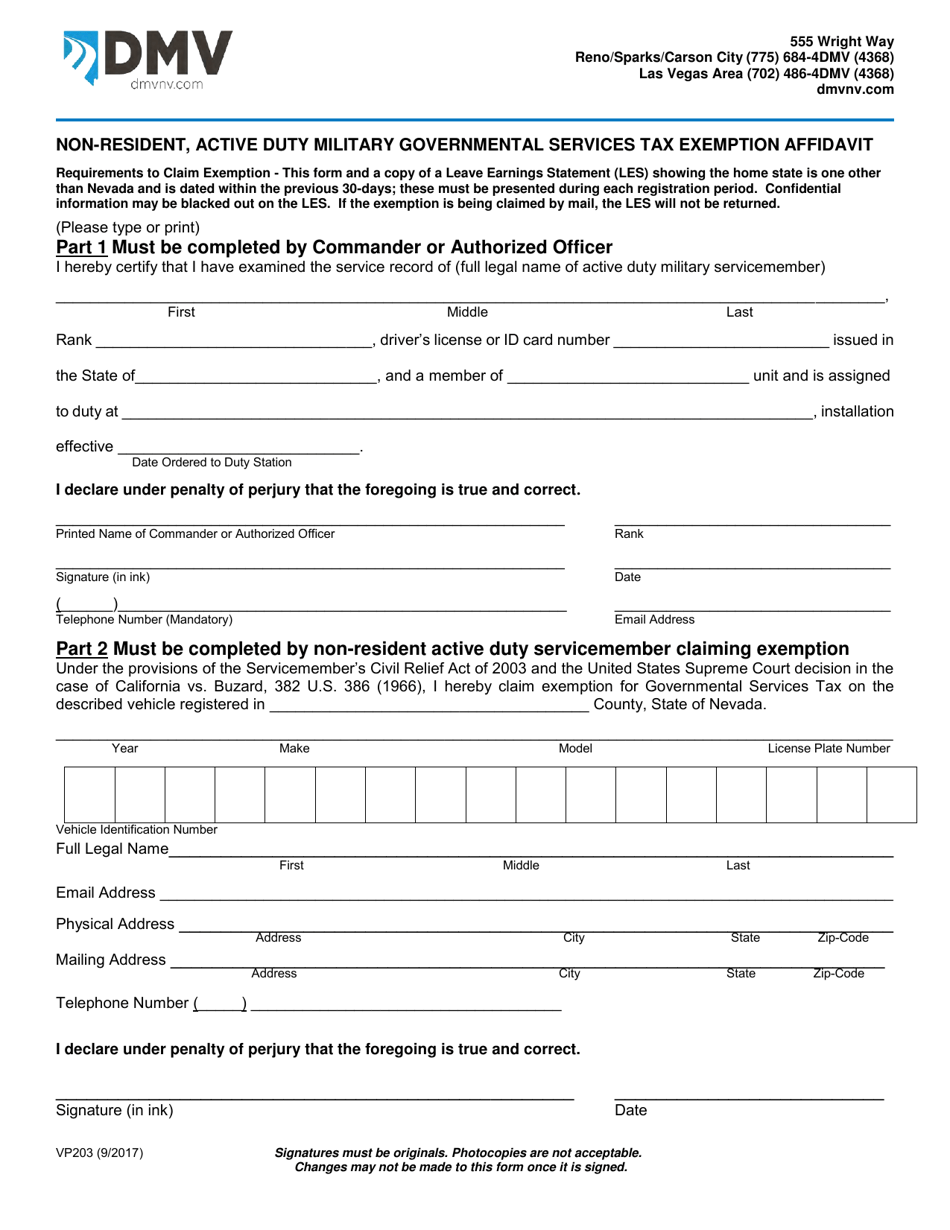

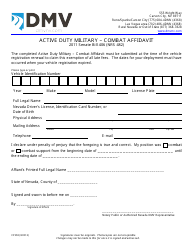

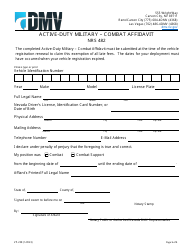

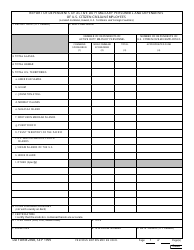

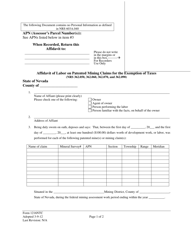

Form VP203 Non-resident, Active Duty Military Governmental Services Tax Exemption Affidavit - Nevada

What Is Form VP203?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VP203?

A: Form VP203 is the Non-resident, Active Duty Military Governmental Services Tax Exemption Affidavit in Nevada.

Q: Who is eligible to use Form VP203?

A: Active duty military personnel who are non-residents of Nevada and are stationed in the state.

Q: What is the purpose of Form VP203?

A: The form is used to claim an exemption from Nevada state governmental services tax for non-resident active duty military personnel.

Q: Is Form VP203 specific to Nevada?

A: Yes, Form VP203 is specific to Nevada and is not applicable in other states.

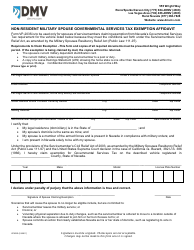

Q: Do I need to submit any supporting documents along with Form VP203?

A: Yes, supporting documents such as a copy of military identification and military orders may be required to accompany the form.

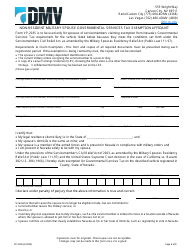

Q: Are there any filing fees associated with Form VP203?

A: No, there are no filing fees associated with Form VP203.

Q: How often do I need to submit Form VP203?

A: Form VP203 needs to be submitted annually or whenever there is a change in military assignment or residency status.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Nevada Department of Motor Vehicles;

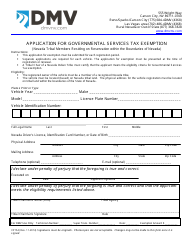

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP203 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.