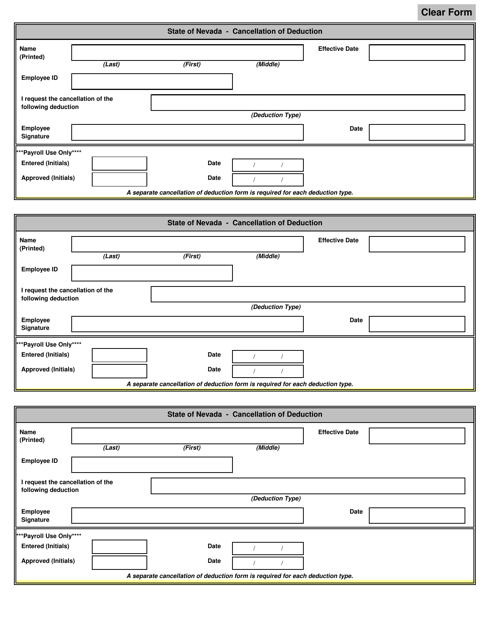

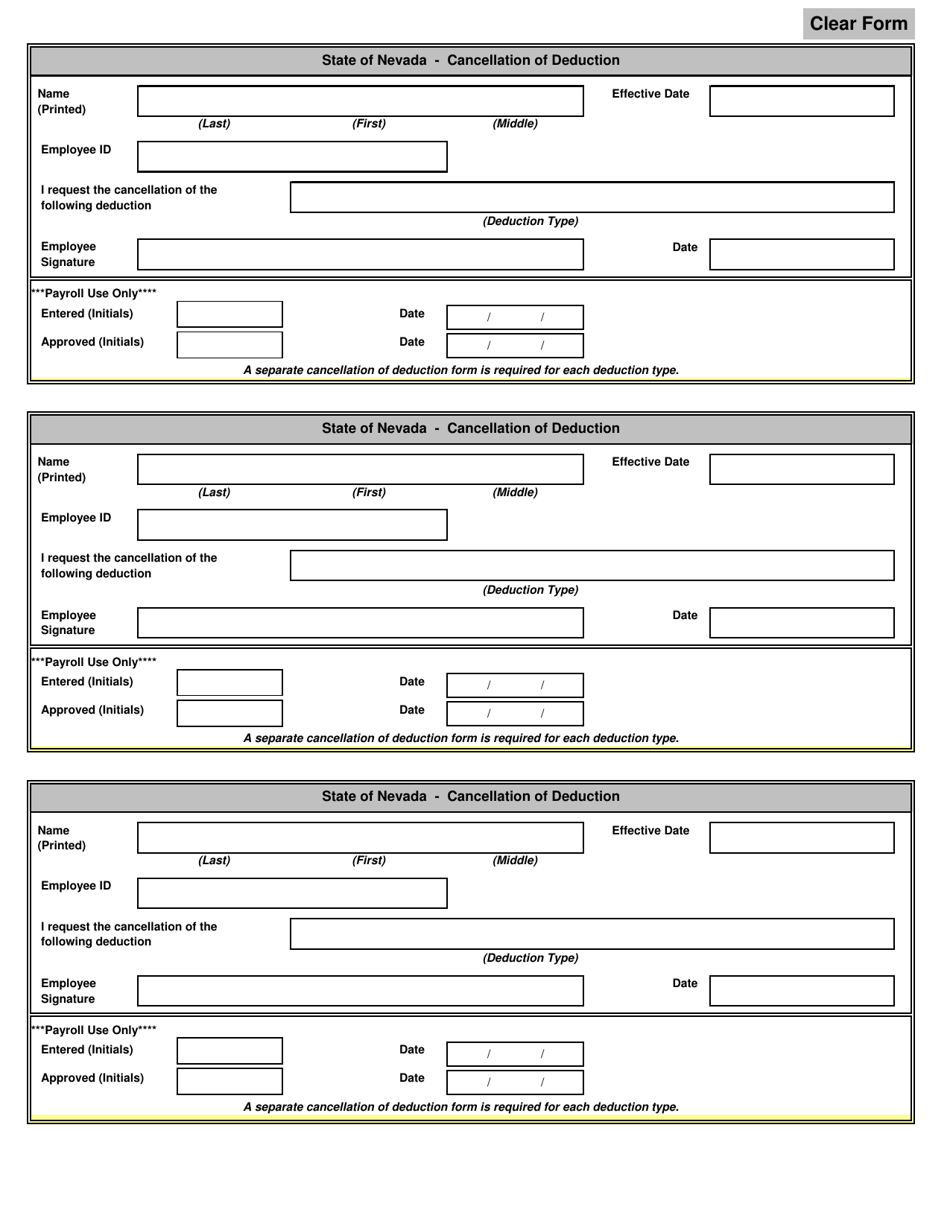

Cancellation of Deduction - Nevada

Cancellation of Deduction is a legal document that was released by the Nevada Department of Administration - a government authority operating within Nevada.

FAQ

Q: What is the cancellation of deduction in Nevada?

A: The cancellation of deduction in Nevada refers to the process of removing a deduction from a tax return.

Q: What are some common reasons for cancellation of deduction in Nevada?

A: Some common reasons for cancellation of deduction in Nevada include errors or inaccuracies in the deduction claimed, failure to meet the eligibility requirements for the deduction, or changes in tax laws affecting the availability of the deduction.

Q: How can I cancel a deduction in Nevada?

A: To cancel a deduction in Nevada, you should contact the Nevada Department of Taxation or consult with a tax professional for guidance on the specific steps to take.

Q: Are there any fees or penalties for cancellation of deduction in Nevada?

A: There may be fees or penalties associated with the cancellation of deduction in Nevada, depending on the circumstances. It is advisable to review the applicable tax laws or consult with a tax professional for accurate information.

Q: Can I cancel a deduction after filing my tax return in Nevada?

A: In Nevada, you may be able to cancel a deduction after filing your tax return under certain circumstances, such as if you discover an error or omission in the deduction claimed. However, it is recommended to consult with a tax professional or the Nevada Department of Taxation for guidance on the specific procedures and deadlines.

Form Details:

- The latest edition currently provided by the Nevada Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Administration.