This version of the form is not currently in use and is provided for reference only. Download this version of

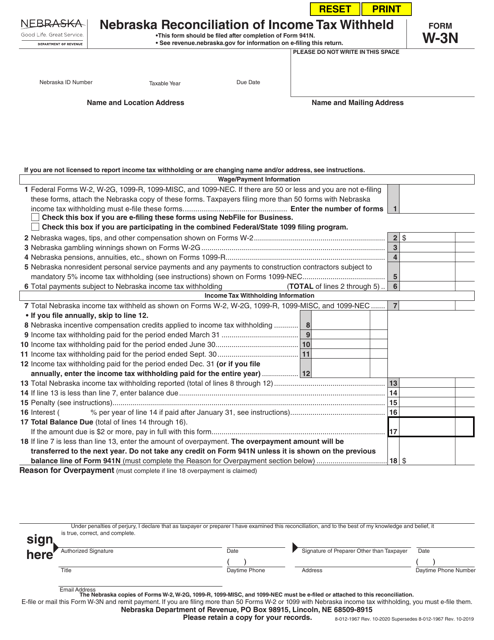

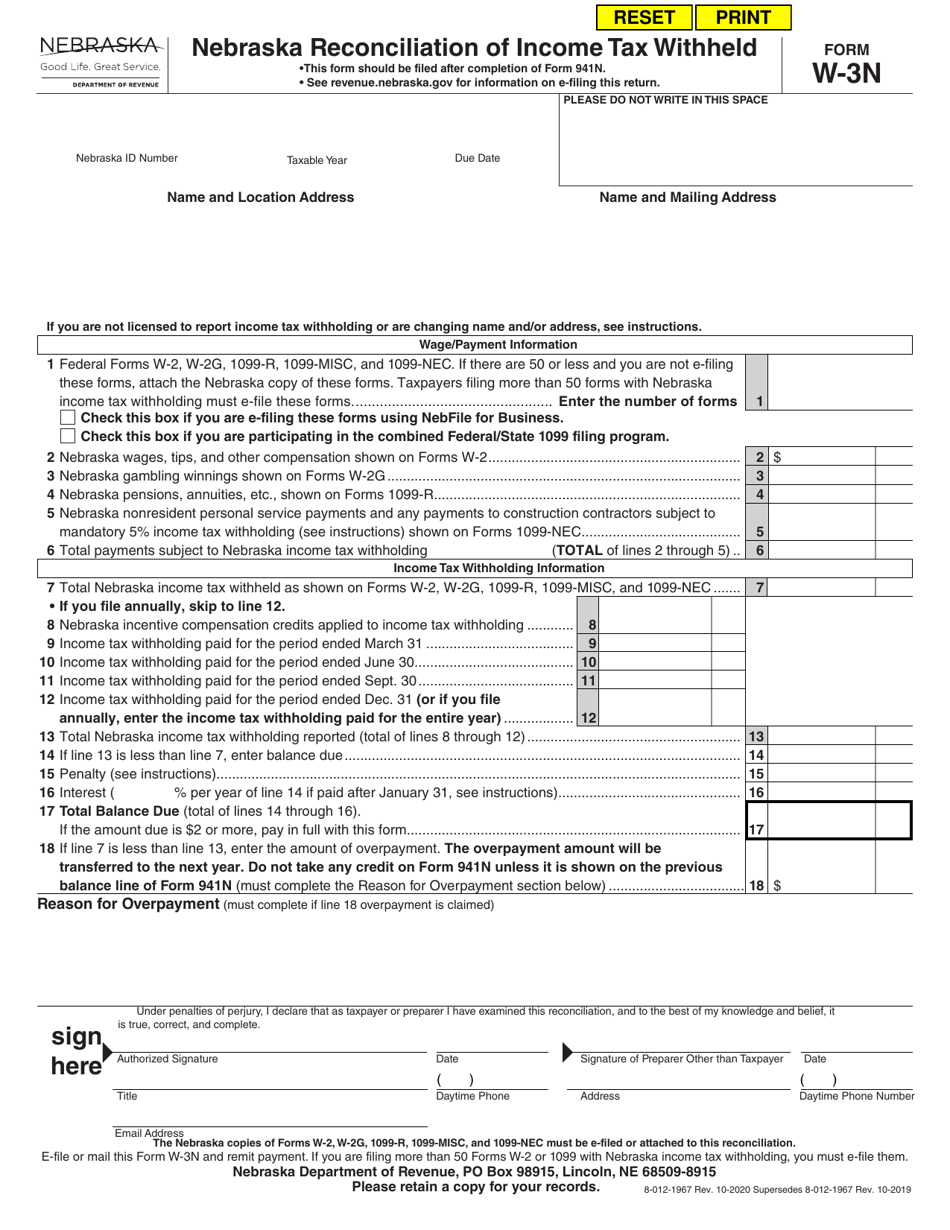

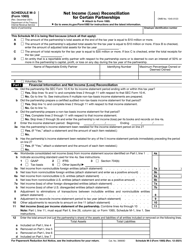

Form W-3N

for the current year.

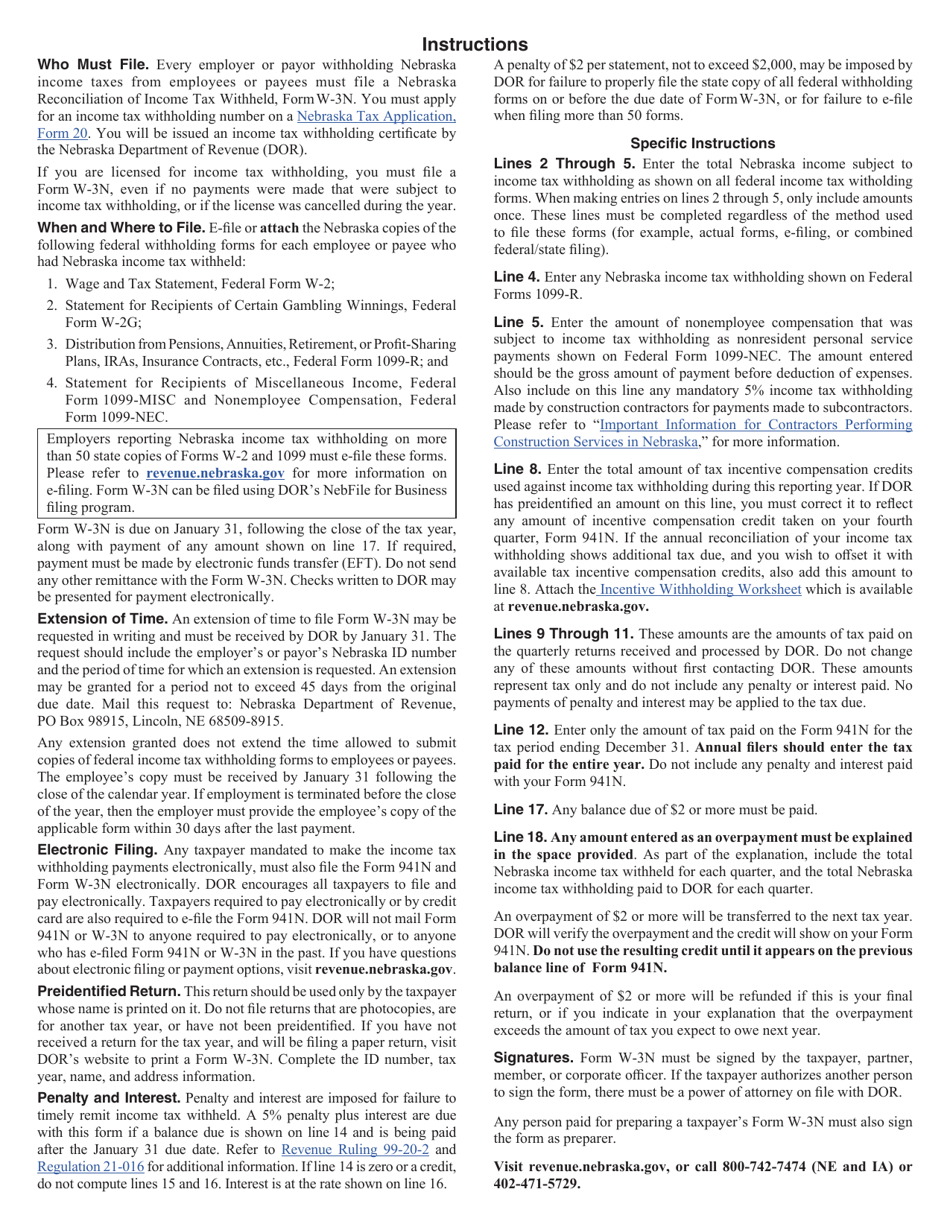

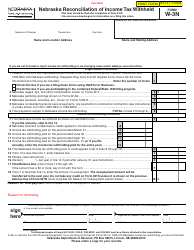

Form W-3N Nebraska Reconciliation of Income Tax Withheld - Nebraska

What Is Form W-3N?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-3N?

A: Form W-3N is the Nebraska Reconciliation of Income Tax Withheld form for reporting and reconciling income tax withheld from employees in Nebraska.

Q: Who needs to file Form W-3N?

A: Employers who withhold income tax from their employees' wages in Nebraska need to file Form W-3N.

Q: What information is required on Form W-3N?

A: Form W-3N requires information about the employer, the employees, and the income tax withheld.

Q: When is Form W-3N due?

A: Form W-3N is due on or before February 28th of the year following the tax year.

Q: Is Form W-3N the same as Form W-3?

A: No, Form W-3N is specific to Nebraska and is used for reconciling income tax withheld in Nebraska, while Form W-3 is a federal form used for transmitting wage and tax statements to the Social Security Administration.

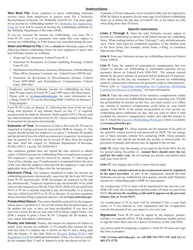

Q: Can Form W-3N be filed electronically?

A: Yes, Nebraska allows employers to file Form W-3N electronically.

Q: What are the penalties for not filing Form W-3N?

A: Failure to file Form W-3N or filing it late can result in penalties and interest charges.

Q: Are there any additional requirements for Form W-3N?

A: Employers also need to provide copies of Form W-2 to their employees and file them with the Social Security Administration.

Q: Is Form W-3N used for federal income tax withholding?

A: No, Form W-3N is specific to Nebraska and is used for reconciling state income tax withholding.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-3N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.