This version of the form is not currently in use and is provided for reference only. Download this version of

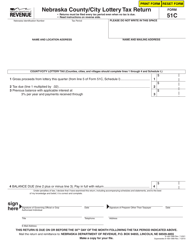

Form 51

for the current year.

Form 51 Nebraska Lottery / Raffle Tax Return - Nebraska

What Is Form 51?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

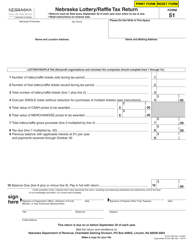

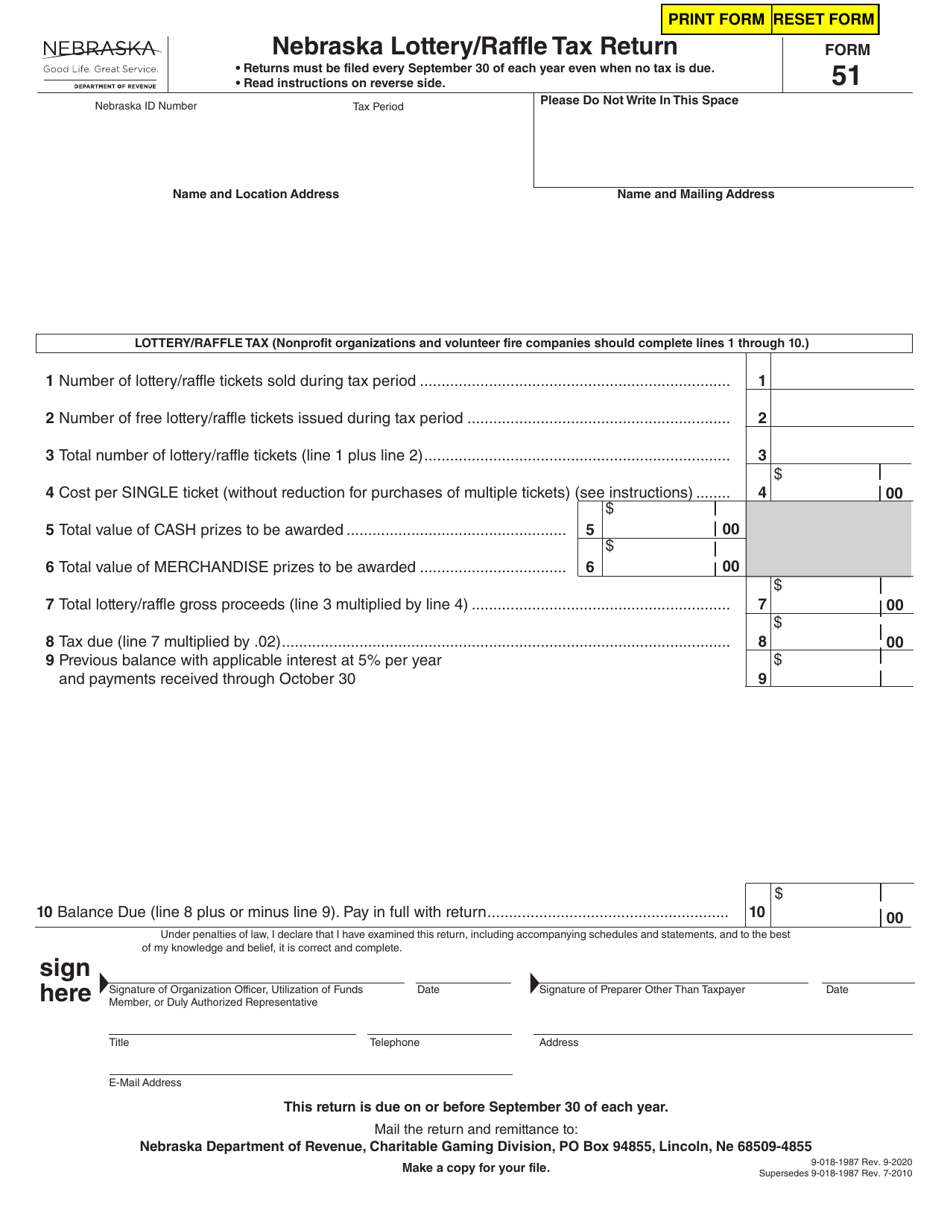

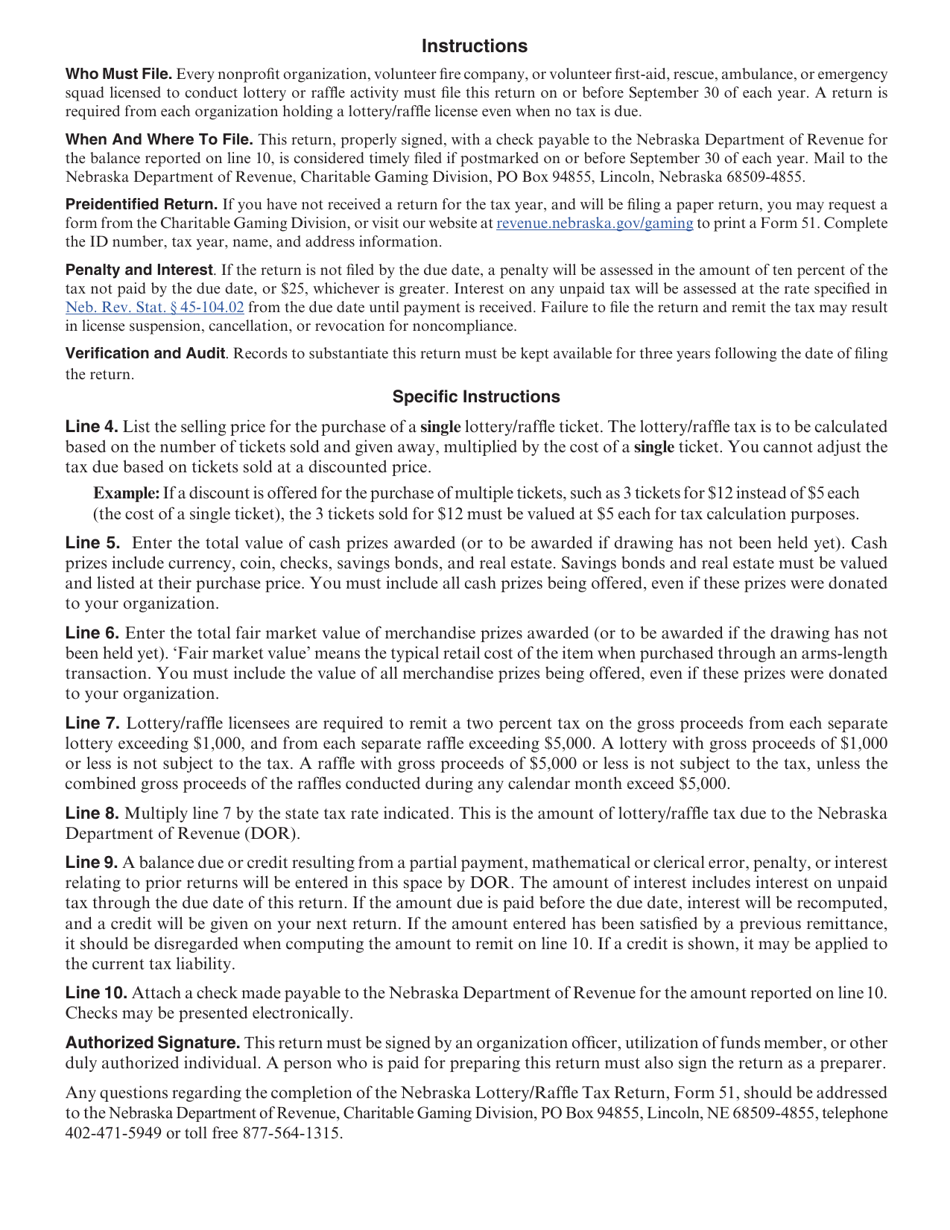

Q: What is Form 51 Nebraska Lottery/Raffle Tax Return?

A: Form 51 Nebraska Lottery/Raffle Tax Return is a tax form used in Nebraska to report income from lottery winnings and raffle prizes.

Q: Who needs to file Form 51 Nebraska Lottery/Raffle Tax Return?

A: Individuals who have received lottery winnings or raffle prizes in Nebraska are required to file Form 51.

Q: What information is required to complete Form 51 Nebraska Lottery/Raffle Tax Return?

A: The form requires information about the amount of lottery winnings or raffle prizes received, as well as personal information such as name, address, and Social Security number.

Q: When is the deadline to file Form 51 Nebraska Lottery/Raffle Tax Return?

A: The form must be filed by April 15th of the following year.

Q: Is there a penalty for late filing of Form 51 Nebraska Lottery/Raffle Tax Return?

A: Yes, there may be penalties for late filing or failure to file the form.

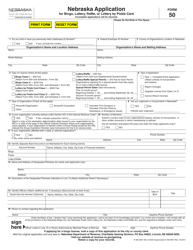

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 51 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.