This version of the form is not currently in use and is provided for reference only. Download this version of

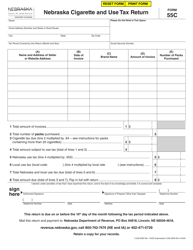

Form 59

for the current year.

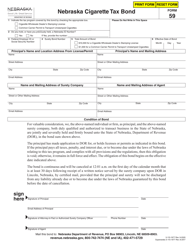

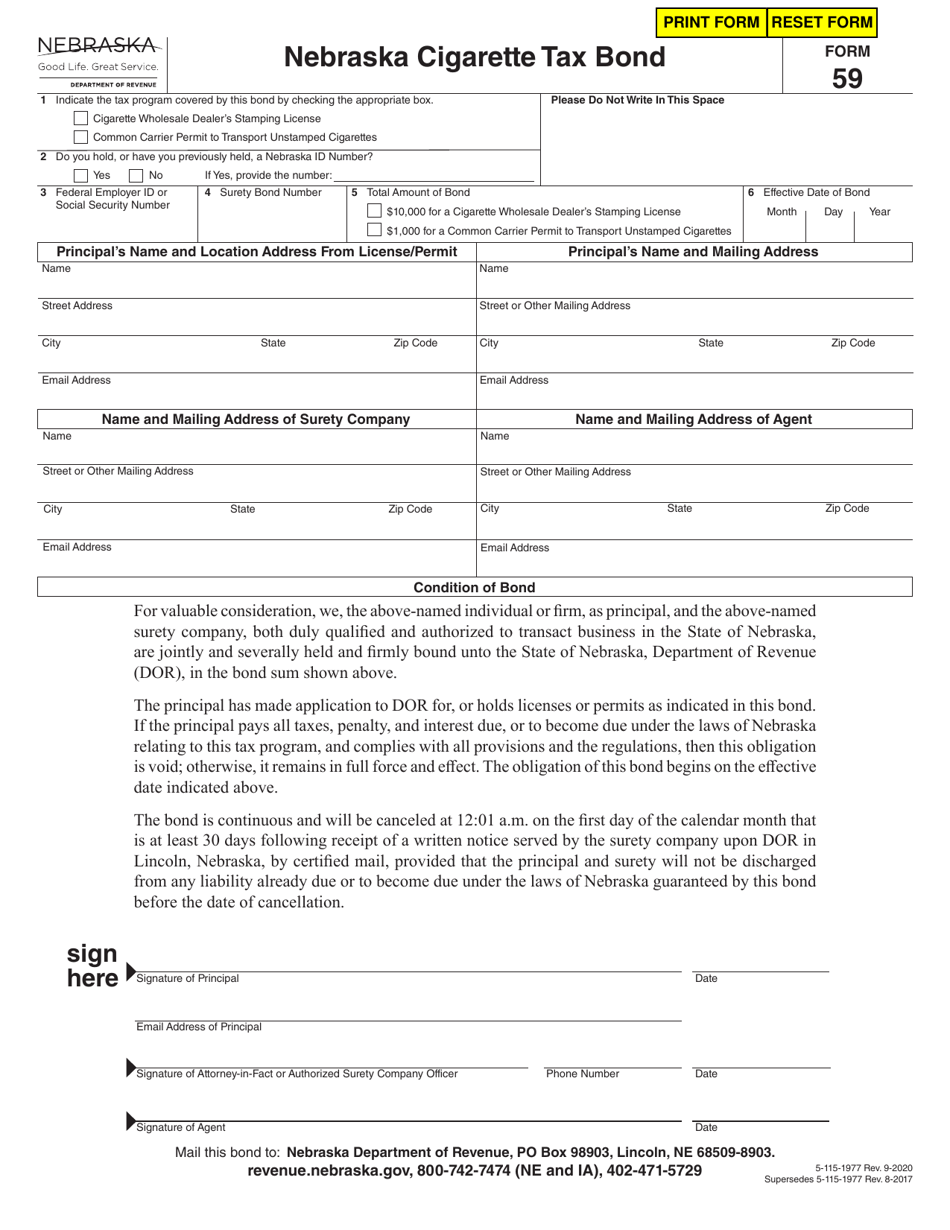

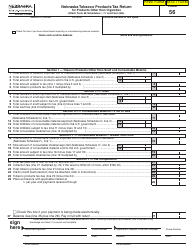

Form 59 Nebraska Cigarette Tax Bond - Nebraska

What Is Form 59?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

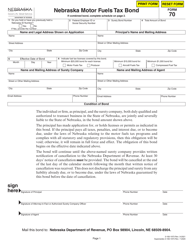

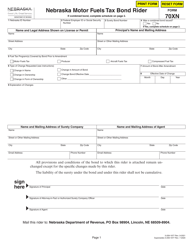

Q: What is a Form 59 Nebraska Cigarette Tax Bond?

A: Form 59 Nebraska Cigarette Tax Bond is a type of surety bond required by the Nebraska Department of Revenue for businesses involved in the sale, distribution, or storage of cigarettes in Nebraska.

Q: Why is a Form 59 Nebraska Cigarette Tax Bond required?

A: The bond is required to ensure that the business complies with the state's tax laws and regulations regarding cigarette sales and distribution, and to provide financial protection to the state in case of non-payment of taxes or other violations.

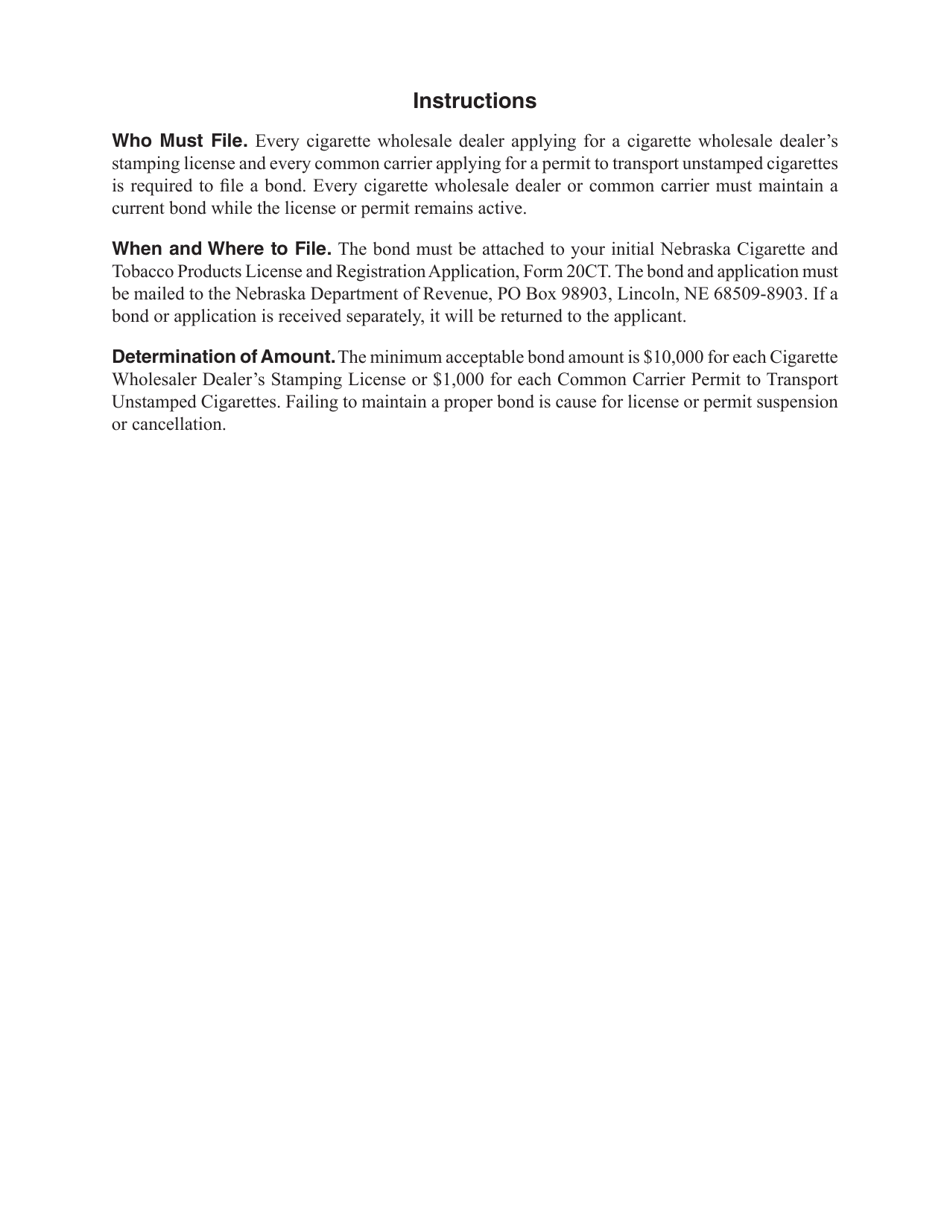

Q: Who needs to obtain a Form 59 Nebraska Cigarette Tax Bond?

A: Any business that sells, distributes, or stores cigarettes in Nebraska is required to obtain this bond.

Q: How much does a Form 59 Nebraska Cigarette Tax Bond cost?

A: The cost of the bond varies depending on factors like the bond amount, the applicant's credit history, and the bonding company chosen.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 59 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.