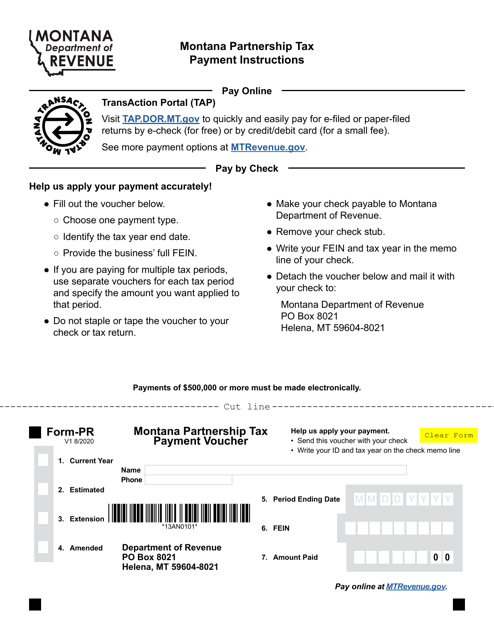

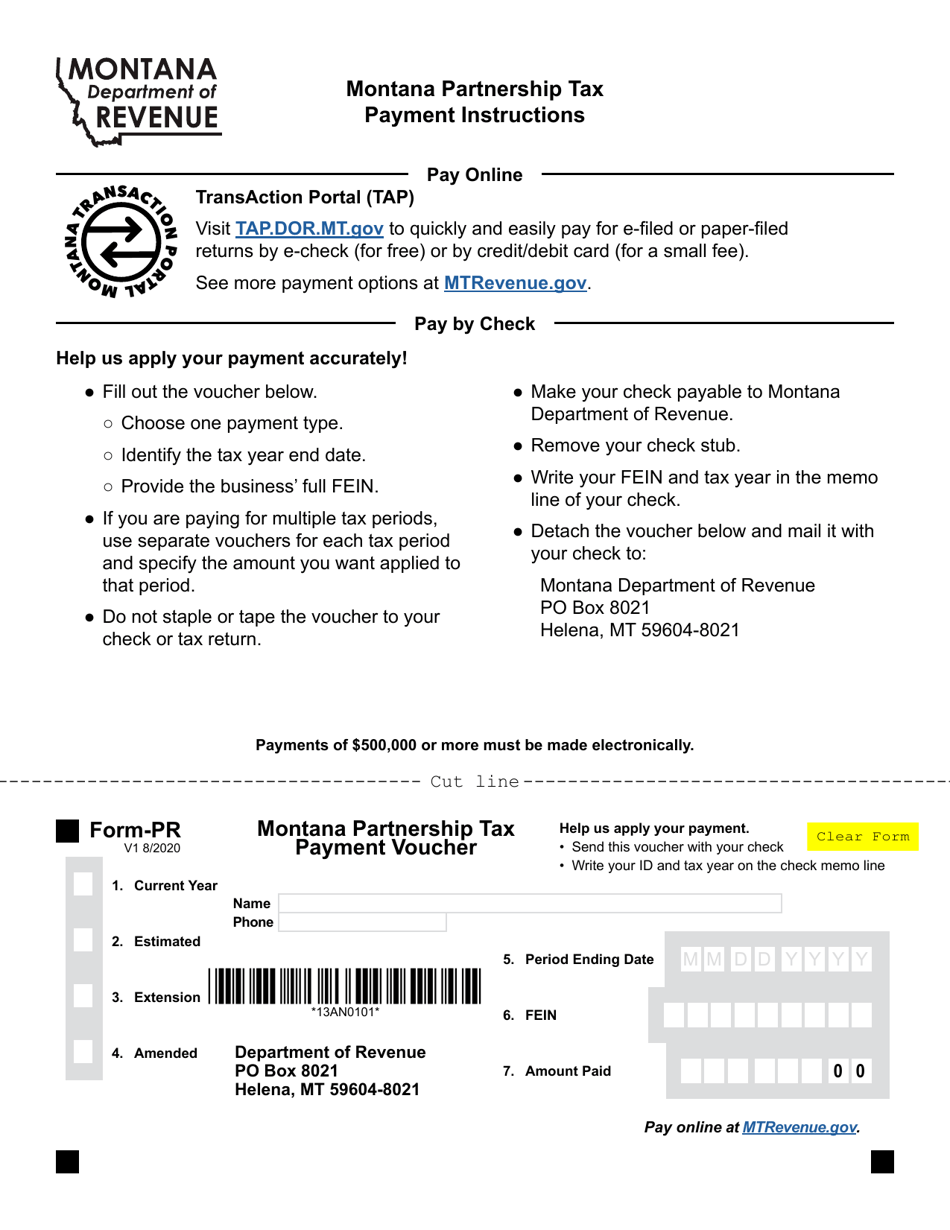

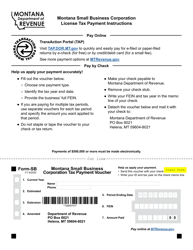

Form PR Montana Partnership Tax Payment Voucher - Montana

What Is Form PR?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PR?

A: Form PR is the Montana Partnership Tax Payment Voucher.

Q: Who needs to file Form PR?

A: Partnerships in Montana need to file Form PR.

Q: What is the purpose of Form PR?

A: The purpose of Form PR is to submit tax payments for partnership income in Montana.

Q: When is Form PR due?

A: Form PR is due on or before the 15th day of the 4th month following the close of the tax year.

Q: What should I include with Form PR?

A: You should include your payment for partnership taxes with Form PR.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PR by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.