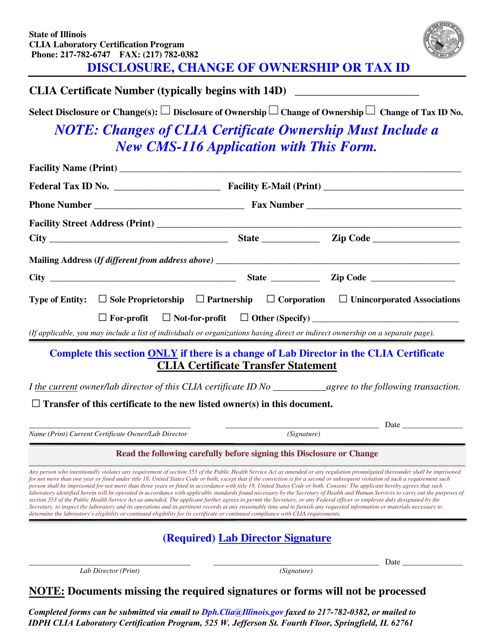

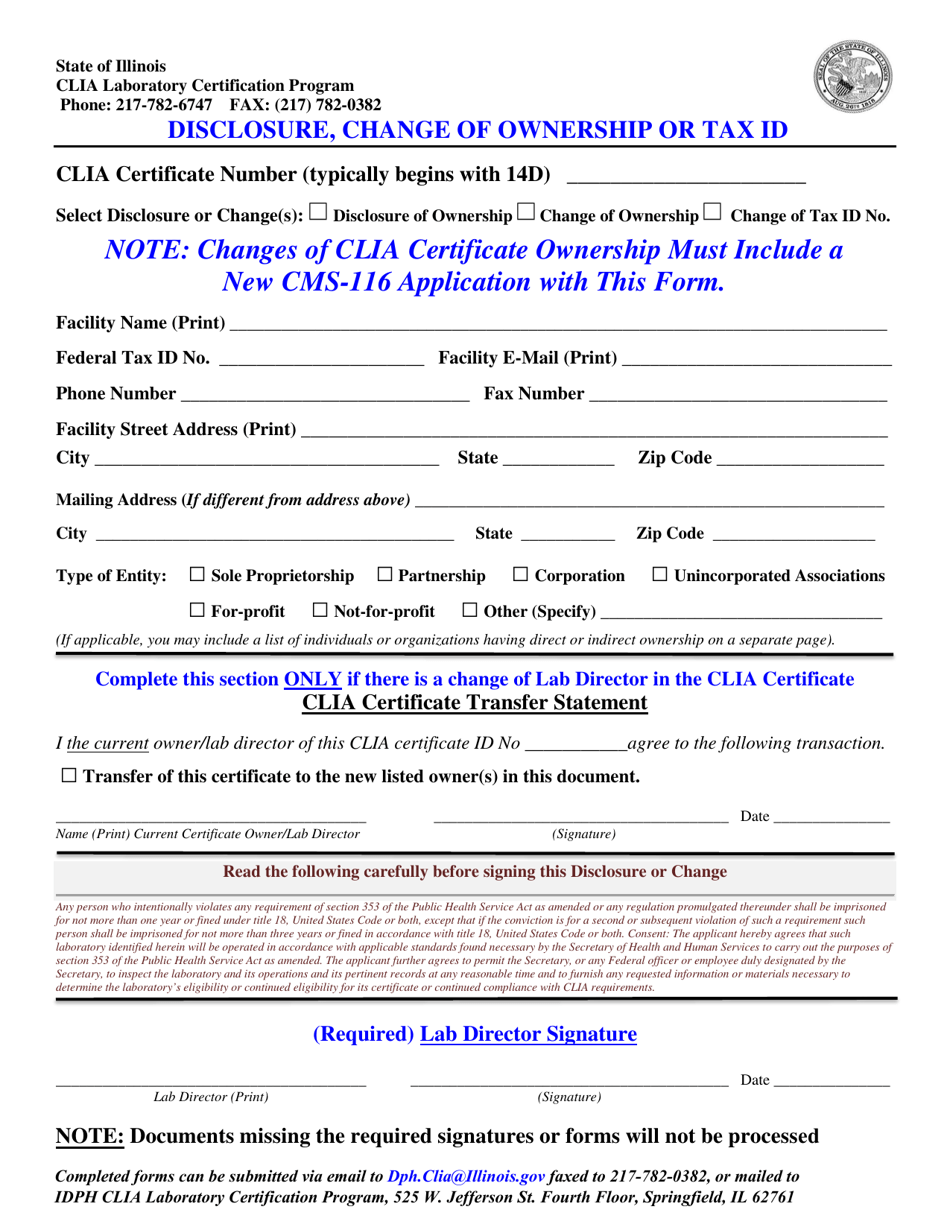

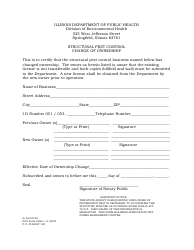

Disclosure, Change of Ownership or Tax Id - Illinois

Disclosure, Change of Ownership or Tax Id is a legal document that was released by the Illinois Department of Public Health - a government authority operating within Illinois.

FAQ

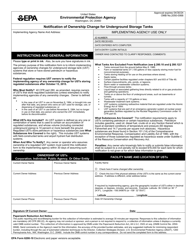

Q: How do I disclose a change of ownership in Illinois?

A: Disclosure of a change of ownership in Illinois can be done by filing the necessary forms with the Illinois Department of Revenue.

Q: What forms do I need to file for a change of ownership in Illinois?

A: The specific forms required for a change of ownership in Illinois may vary depending on the type of business you have. You may need to file forms like the Sales and Use Tax Return or the Business Registration Application.

Q: How do I update my tax ID information in Illinois?

A: To update your tax ID information in Illinois, you will need to contact the Illinois Department of Revenue and provide them with the necessary documentation and information.

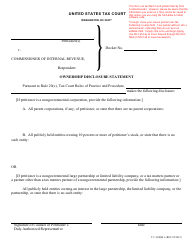

Q: What is a tax ID?

A: A tax ID, also known as an Employer Identification Number (EIN), is a unique identification number assigned to businesses by the Internal Revenue Service (IRS) for tax purposes.

Q: Do I need to notify the Illinois Department of Revenue if I change the ownership of my business?

A: Yes, it is important to notify the Illinois Department of Revenue if there is a change in the ownership of your business. This ensures that the department has updated and accurate information for tax purposes.

Q: Are there any fees associated with disclosing a change of ownership in Illinois?

A: The fees associated with disclosing a change of ownership in Illinois may vary depending on the specific forms and requirements of your business. It is recommended to check with the Illinois Department of Revenue for the applicable fees.

Form Details:

- The latest edition currently provided by the Illinois Department of Public Health;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Illinois Department of Public Health.