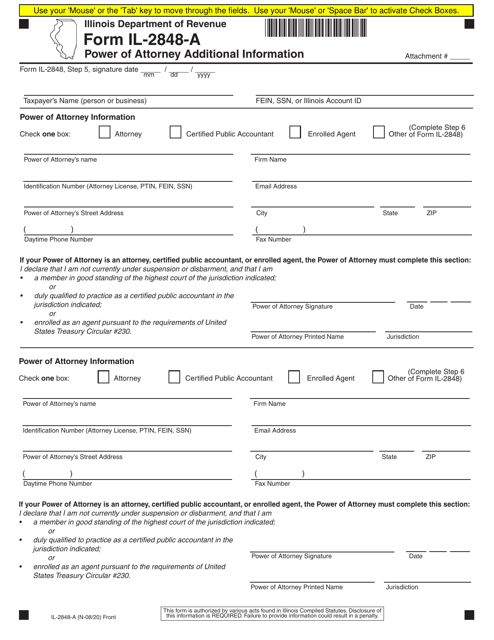

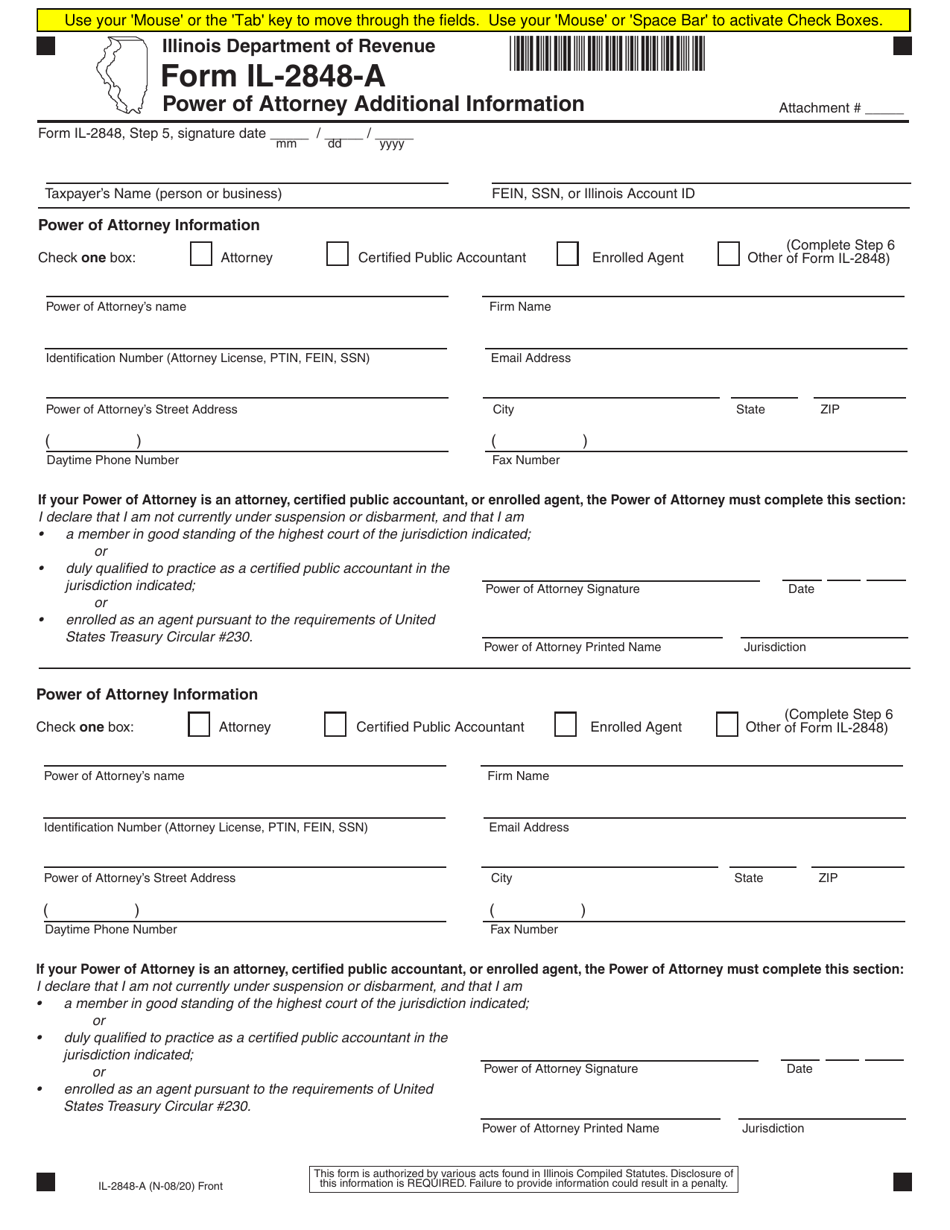

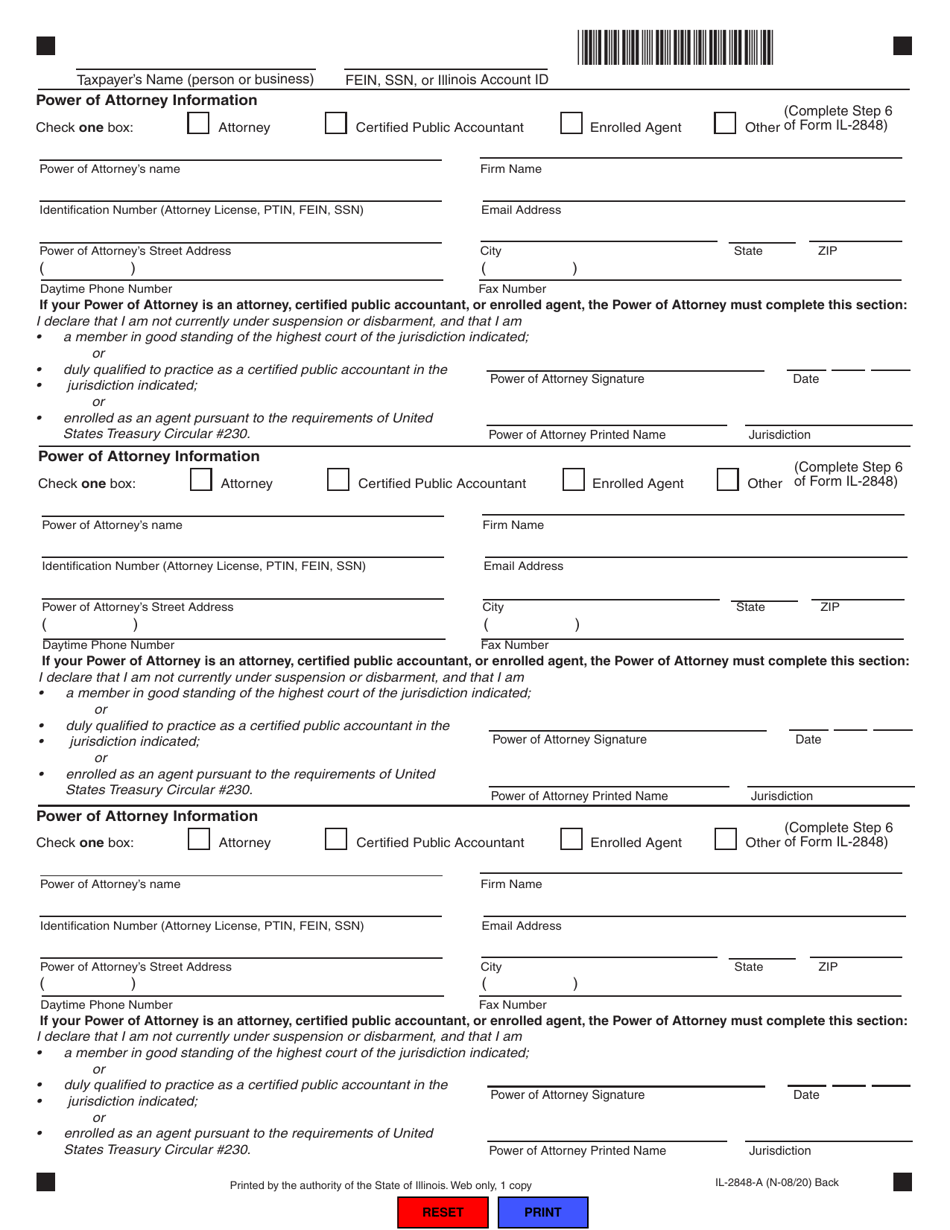

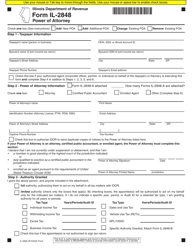

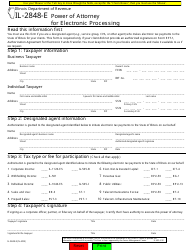

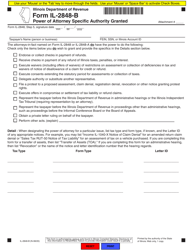

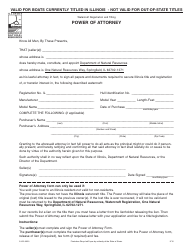

Form IL-2848-A Power of Attorney Additional Information - Illinois

What Is Form IL-2848-A?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-2848-A?

A: Form IL-2848-A is a power of attorney form used in the state of Illinois.

Q: What is the purpose of Form IL-2848-A?

A: The purpose of Form IL-2848-A is to authorize someone else to act on your behalf in tax matters with the Illinois Department of Revenue.

Q: Who should use Form IL-2848-A?

A: Form IL-2848-A should be used by individuals or businesses who want to grant someone else the authority to handle their tax matters with the Illinois Department of Revenue.

Q: What information is required on Form IL-2848-A?

A: Form IL-2848-A requires basic information about the taxpayer (such as name, address, and taxpayer identification number) as well as information about the appointed representative.

Q: Do I need to sign Form IL-2848-A?

A: Yes, both the taxpayer and the appointed representative must sign Form IL-2848-A.

Q: Is Form IL-2848-A specific to individual or business taxes?

A: Form IL-2848-A can be used for both individual and business tax matters with the Illinois Department of Revenue.

Q: Can I revoke a power of attorney granted through Form IL-2848-A?

A: Yes, you can revoke a power of attorney granted through Form IL-2848-A by submitting a written statement to the Illinois Department of Revenue.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-2848-A by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.