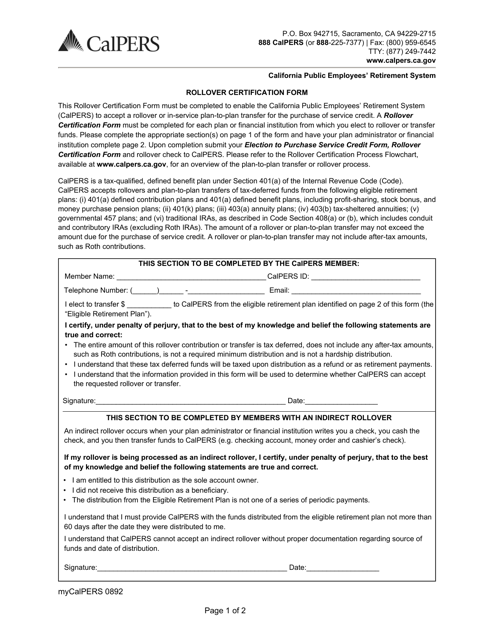

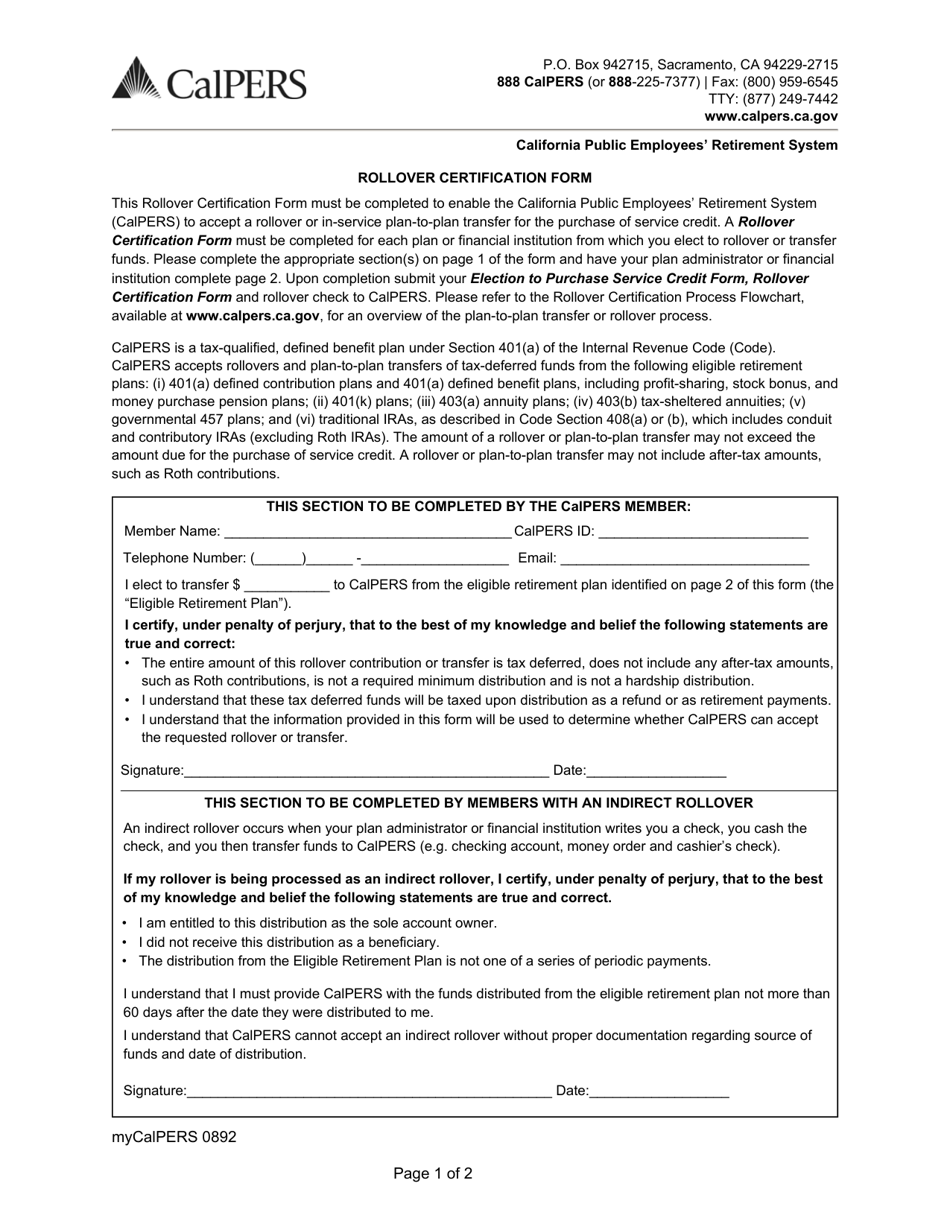

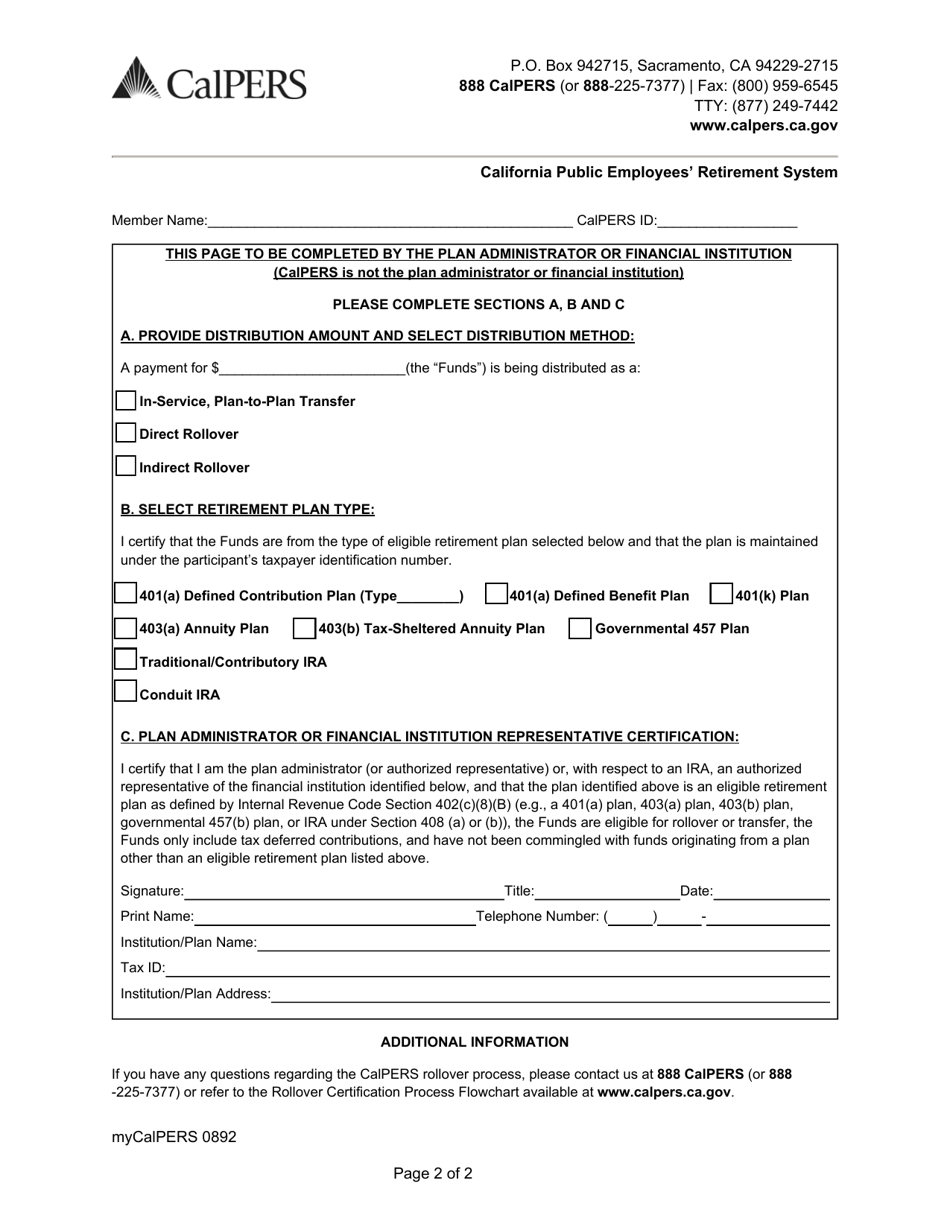

Form my|CalPERS0892 Rollover Certification Form - California

What Is Form my|CalPERS0892?

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of the CalPERS0892 Rollover Certification Form?

A: The form is used to certify rollover contributions made to a retirement account.

Q: Who needs to complete the CalPERS0892 Rollover Certification Form?

A: Employees of CalPERS-covered agencies who have made rollover contributions.

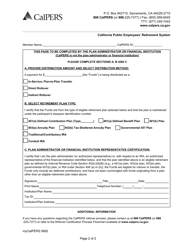

Q: What information is required on the form?

A: The form requires details about the rollover contributions, such as the amount, source, and relevant account information.

Q: Is the CalPERS0892 Rollover Certification Form mandatory?

A: Yes, it is mandatory for individuals who have made rollover contributions to a retirement account under CalPERS.

Q: Are there any deadlines for submitting the form?

A: The form should be submitted within 30 days of making the rollover contribution.

Q: What happens after submitting the CalPERS0892 Rollover Certification Form?

A: CalPERS will review the form and process the rollover contributions accordingly.

Q: Can I make changes to the form after submission?

A: No, any changes or corrections should be communicated to CalPERS through a separate amendment form.

Q: Who should I contact for assistance with the form?

A: For assistance, you can contact the CalPERS Member Services or your employer's benefits office.

Form Details:

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form my|CalPERS0892 by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.