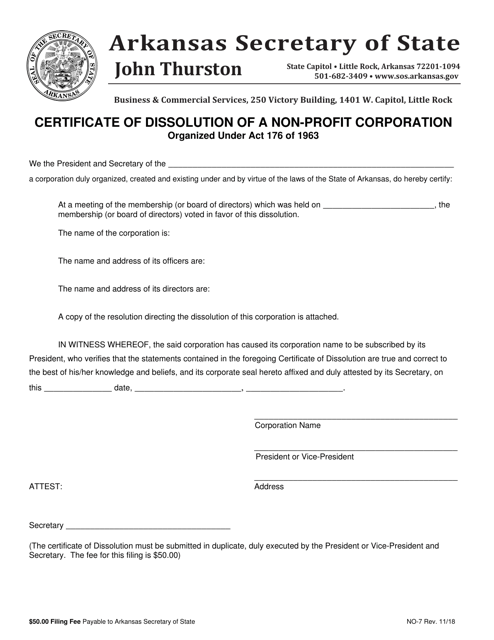

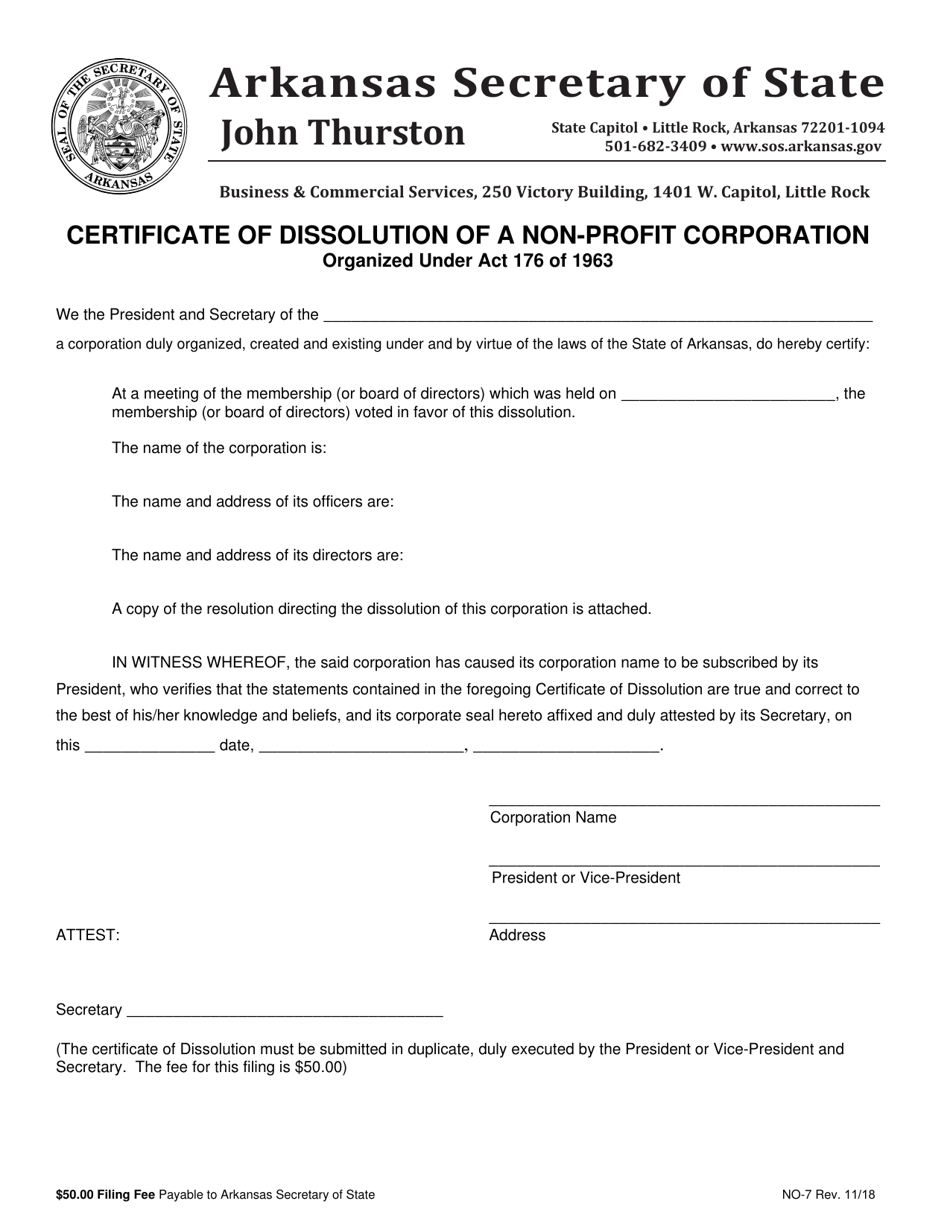

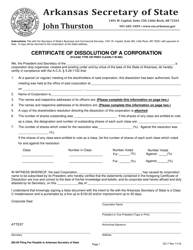

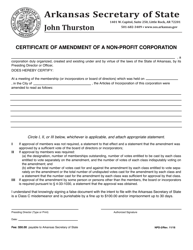

Form NO-7 Certificate of Dissolution of a Non-profit Corporation - Arkansas

What Is Form NO-7?

This is a legal form that was released by the Arkansas Secretary of State - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NO-7?

A: Form NO-7 is the Certificate of Dissolution of a Non-profit Corporation in Arkansas.

Q: What is a non-profit corporation?

A: A non-profit corporation is a legal entity that is organized and operated for purposes other than generating profit.

Q: Why would a non-profit corporation dissolve?

A: A non-profit corporation may dissolve for a variety of reasons, such as achieving its mission, lack of funding, or changes in leadership.

Q: How do I fill out Form NO-7?

A: You will need to provide information about the corporation's name, date of dissolution, and signatures of authorized individuals.

Q: What happens after I file Form NO-7?

A: After filing Form NO-7, the Secretary of State will review the application and, if approved, issue a Certificate of Dissolution.

Q: Are there any tax implications when dissolving a non-profit corporation?

A: Yes, there may be tax implications when dissolving a non-profit corporation. It is recommended to consult with a tax professional for guidance.

Q: Can a dissolved non-profit corporation be revived?

A: Yes, in some cases a dissolved non-profit corporation can be revived. However, specific requirements and procedures must be followed.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Arkansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NO-7 by clicking the link below or browse more documents and templates provided by the Arkansas Secretary of State.