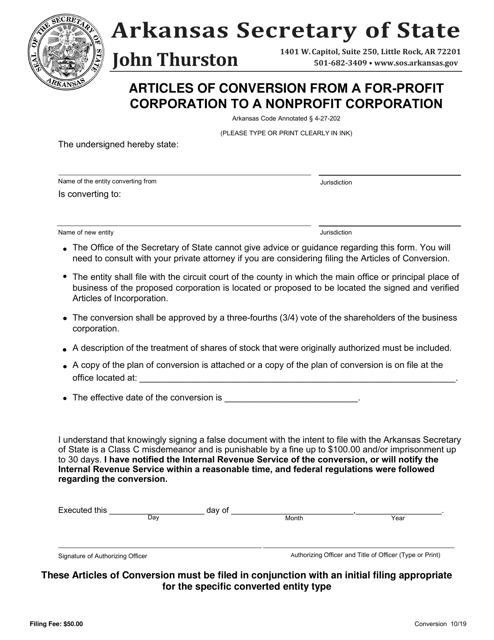

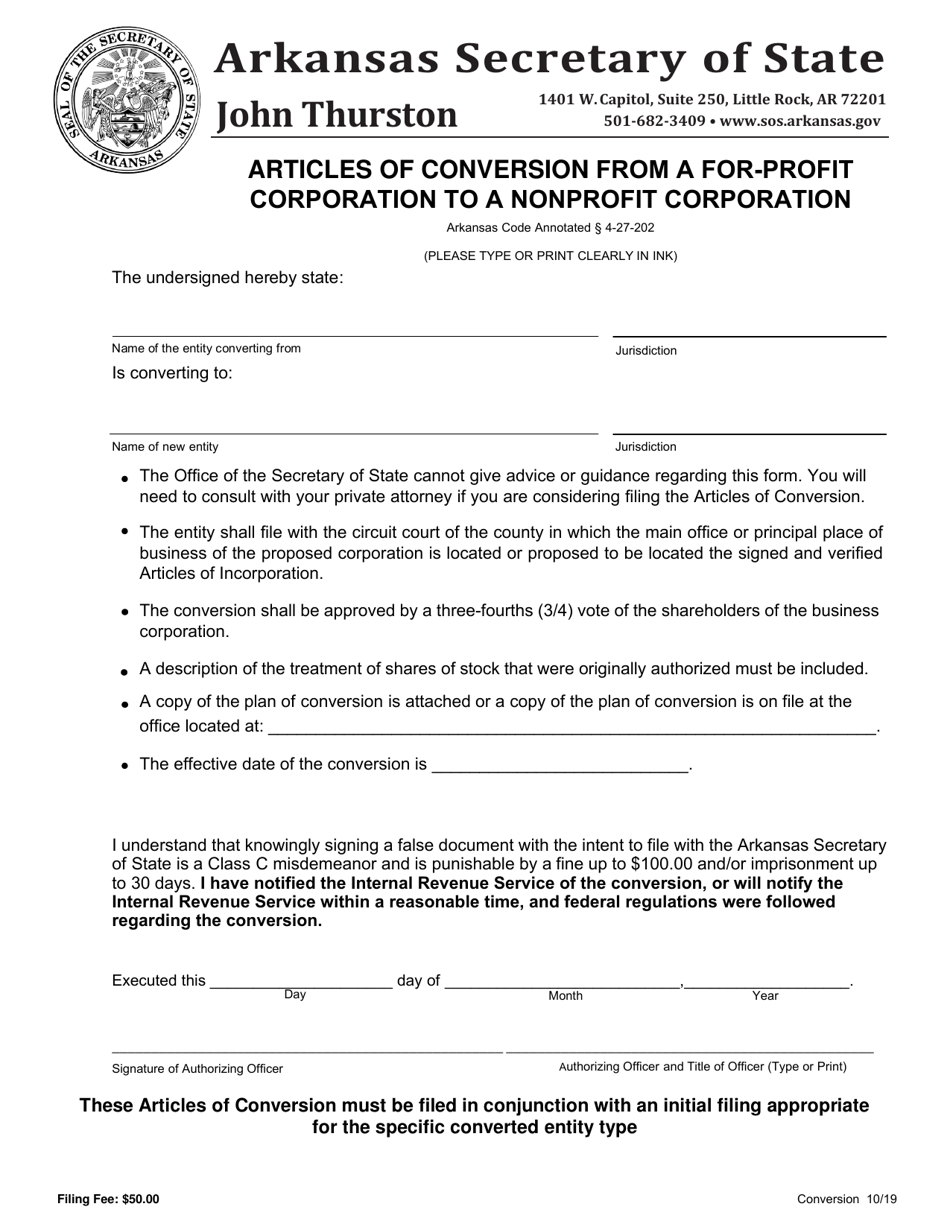

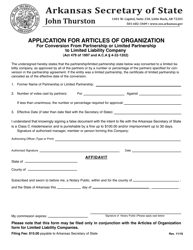

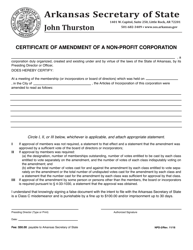

Articles of Conversion From a for-Profit Corporation to a Nonprofit Corporation - Arkansas

Articles of Conversion From a for-Profit Corporation to a Nonprofit Corporation is a legal document that was released by the Arkansas Secretary of State - a government authority operating within Arkansas.

FAQ

Q: What is the purpose of converting a for-profit corporation to a nonprofit corporation in Arkansas?

A: The purpose is to change the company's legal structure and status to a nonprofit organization.

Q: What are the requirements for converting a for-profit corporation to a nonprofit corporation in Arkansas?

A: The requirements may include amending the company's articles of incorporation, obtaining IRS tax-exempt status, and complying with Arkansas nonprofit laws.

Q: Do I need to obtain IRS tax-exempt status for the converted nonprofit corporation?

A: Yes, in order to qualify for tax benefits and charitable contributions, obtaining IRS tax-exempt status is necessary.

Q: What are the benefits of converting a for-profit corporation to a nonprofit corporation in Arkansas?

A: Benefits may include tax advantages, access to grants and donations, and fulfilling a social or charitable mission.

Q: Can the converted nonprofit corporation engage in profit-generating activities?

A: Yes, nonprofit corporations are allowed to engage in certain profit-generating activities, but the profits must be used for the organization's mission rather than distributed to shareholders.

Q: Are there any filing fees for converting a for-profit corporation to a nonprofit corporation in Arkansas?

A: Yes, there are filing fees associated with amending the articles of incorporation and other required filings.

Q: How long does the process of converting a for-profit corporation to a nonprofit corporation in Arkansas usually take?

A: The process can vary depending on the complexity of the conversion, but it may take several months to complete.

Q: Can a for-profit corporation convert to a nonprofit corporation if it has existing debts or liabilities?

A: Yes, a for-profit corporation can convert to a nonprofit corporation even if it has existing debts or liabilities, but those obligations will generally remain with the corporation.

Q: Do I need legal assistance to convert a for-profit corporation to a nonprofit corporation in Arkansas?

A: While it is not required, legal assistance is recommended to ensure compliance with all legal requirements and to properly navigate the conversion process.

Q: Can a sole proprietorship or partnership convert to a nonprofit corporation in Arkansas?

A: No, only for-profit corporations can usually convert to nonprofit corporations. Sole proprietorships and partnerships have different legal structures.

Form Details:

- Released on October 1, 2019;

- The latest edition currently provided by the Arkansas Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Secretary of State.