This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

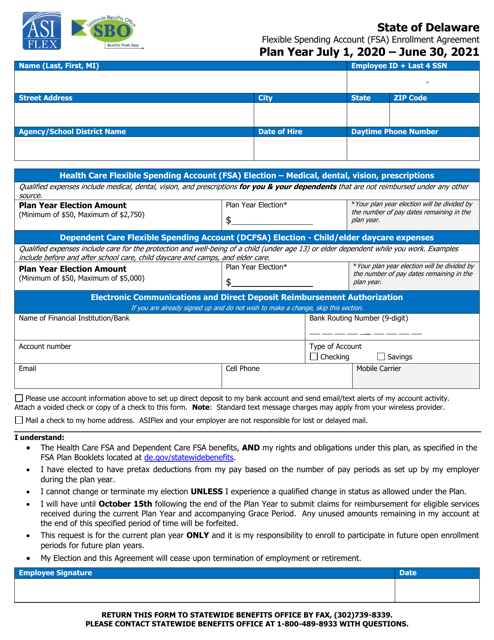

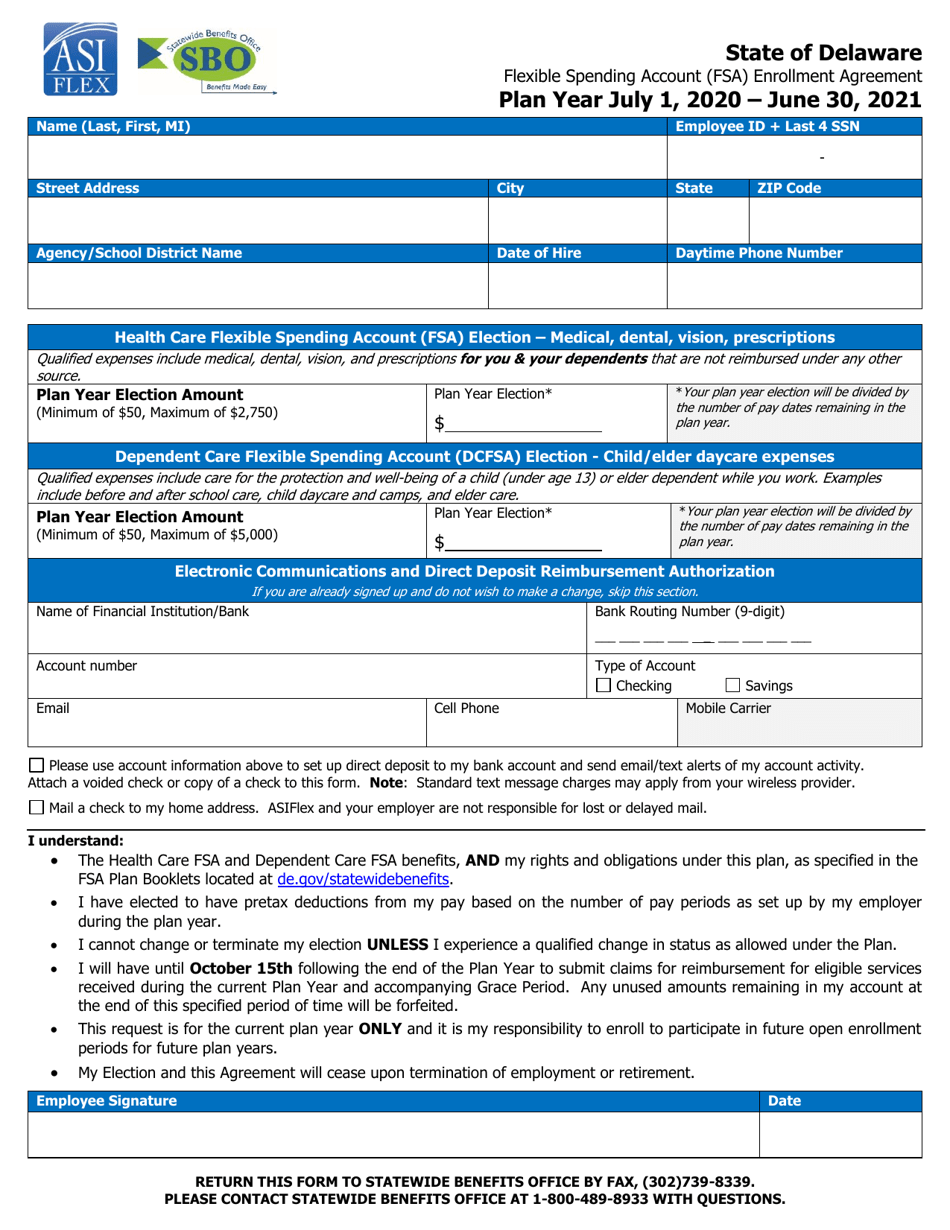

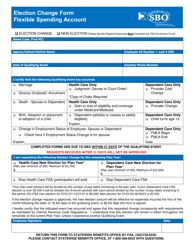

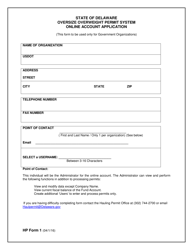

Flexible Spending Account (FSA) Enrollment Agreement - Delaware

Flexible Spending Account (FSA) Enrollment Agreement is a legal document that was released by the Delaware Department of Human Resources - a government authority operating within Delaware.

FAQ

Q: What is a Flexible Spending Account (FSA)?

A: A Flexible Spending Account (FSA) is a tax-advantaged account that allows you to set aside pre-tax money to pay for eligible healthcare expenses.

Q: How does a Flexible Spending Account (FSA) work?

A: You contribute a portion of your pre-tax salary to your FSA, and that money can be used to pay for eligible healthcare expenses not covered by insurance.

Q: What expenses can be paid for using a Flexible Spending Account (FSA)?

A: Expenses such as medical co-pays, prescription medications, dental and vision expenses, and certain over-the-counter items can be paid for using a Flexible Spending Account (FSA).

Q: How much can I contribute to my Flexible Spending Account (FSA)?

A: The maximum annual contribution limit for a Flexible Spending Account (FSA) is set by the IRS and may change each year. For the latest limit, refer to your FSA enrollment materials or consult with your employer.

Q: Can I roll over unused funds in my Flexible Spending Account (FSA) to the next year?

A: The rules for rollover of unused funds in a Flexible Spending Account (FSA) vary. Some plans allow a limited rollover, while others may have a use-it-or-lose-it policy. Check with your FSA administrator or employer for specific details.

Q: Is a Flexible Spending Account (FSA) a good option for me?

A: A Flexible Spending Account (FSA) can be a good option for individuals and families who anticipate regular healthcare expenses not covered by insurance. It can help save money on taxes and make healthcare expenses more affordable.

Q: Are there any restrictions on using funds from a Flexible Spending Account (FSA)?

A: Flexible Spending Account (FSA) funds can only be used for eligible healthcare expenses as defined by the IRS. It's important to keep track of your expenses and understand what is covered to ensure compliance with the rules.

Q: Can I use my Flexible Spending Account (FSA) for dependent care expenses?

A: No, a Flexible Spending Account (FSA) is specifically for healthcare expenses. Dependent care expenses may be eligible for reimbursement through a separate Dependent Care Flexible Spending Account (DCFSA) if your employer offers one.

Q: What happens to my Flexible Spending Account (FSA) if I leave my job?

A: If you leave your job, the rules regarding your Flexible Spending Account (FSA) may vary. Some plans offer a grace period or the option to continue coverage under COBRA, while others may have different arrangements. Contact your FSA administrator or employer for guidance.

Q: Can I change my contribution amount to my Flexible Spending Account (FSA) during the year?

A: It depends on your employer's plan. Some plans allow changes to contribution amounts during specific periods, such as during open enrollment or after a qualifying life event. Consult your employer or FSA administrator for information on your specific plan.

Form Details:

- The latest edition currently provided by the Delaware Department of Human Resources;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Human Resources.