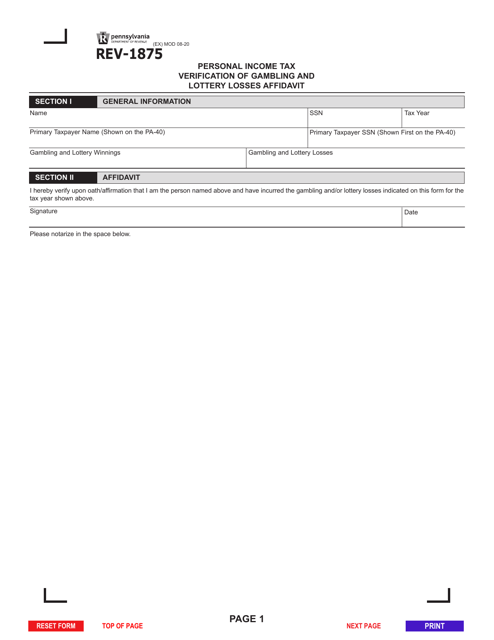

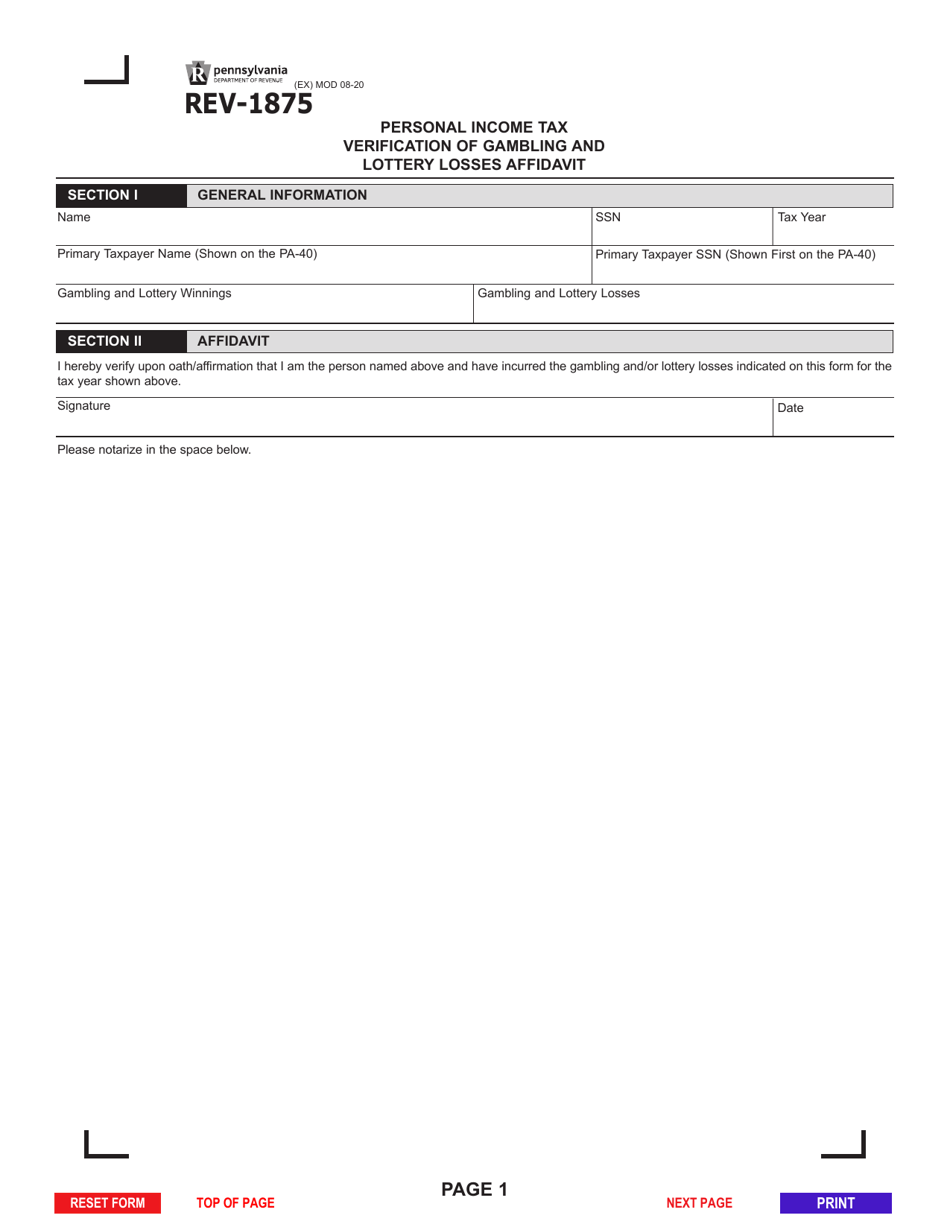

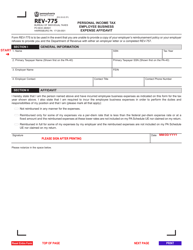

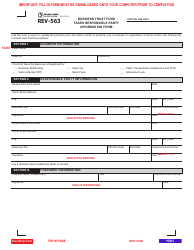

Form REV-1875 Personal Income Tax Verification of Gambling and Lottery Losses Affidavit - Pennsylvania

What Is Form REV-1875?

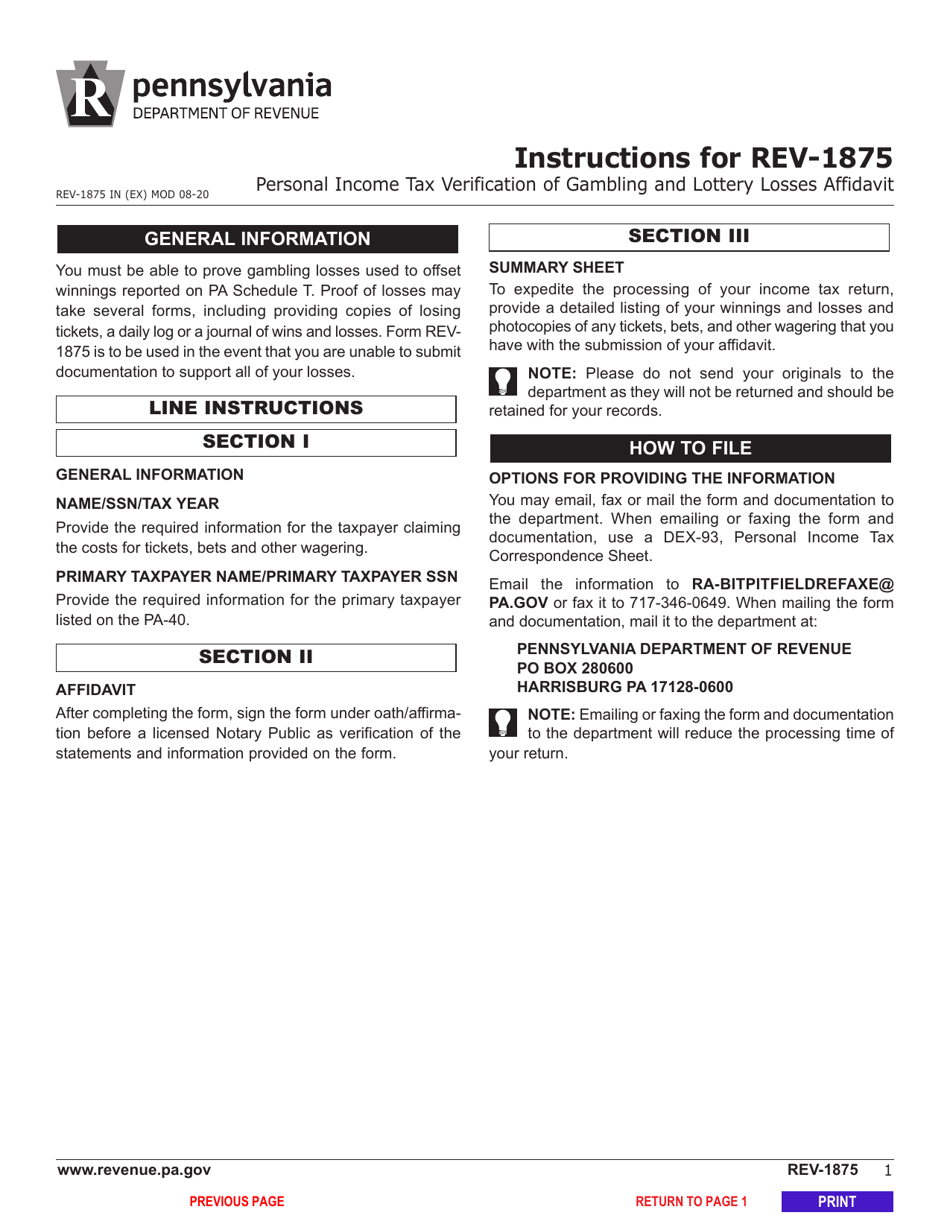

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1875?

A: Form REV-1875 is the Personal Income Tax Verification of Gambling and Lottery Losses Affidavit in Pennsylvania.

Q: What is the purpose of Form REV-1875?

A: The purpose of Form REV-1875 is to verify gambling and lottery losses for personal incometax purposes in Pennsylvania.

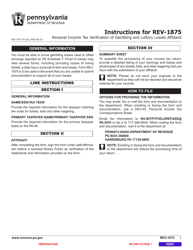

Q: Who is required to file Form REV-1875?

A: Individuals who have experienced gambling or lottery losses and want to claim deductions for those losses on their Pennsylvania personal income tax return are required to file Form REV-1875.

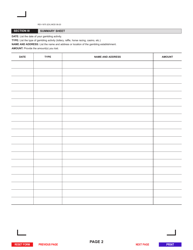

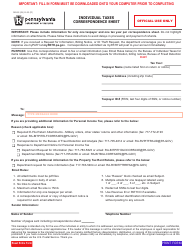

Q: What information is required on Form REV-1875?

A: Form REV-1875 requires information such as the taxpayer's name, Social Security number, address, date of birth, and details about the gambling or lottery losses being claimed.

Q: When is the deadline to file Form REV-1875?

A: Form REV-1875 should be filed with your Pennsylvania personal income tax return by the regular tax filing deadline, which is typically April 15 of each year.

Q: Are there any penalties for not filing Form REV-1875?

A: Failure to file Form REV-1875 when claiming gambling or lottery losses may result in the disallowance of the deductions or further examination of your tax return by the Pennsylvania Department of Revenue.

Q: Can I file Form REV-1875 electronically?

A: Currently, Pennsylvania does not offer electronic filing for Form REV-1875. It must be filed by mail along with your personal income tax return.

Q: Can I claim losses on Form REV-1875 if I am not a Pennsylvania resident?

A: No, Form REV-1875 is specifically for claiming gambling and lottery losses on your Pennsylvania personal income tax return. If you are not a resident of Pennsylvania, you should consult your own state's tax regulations.

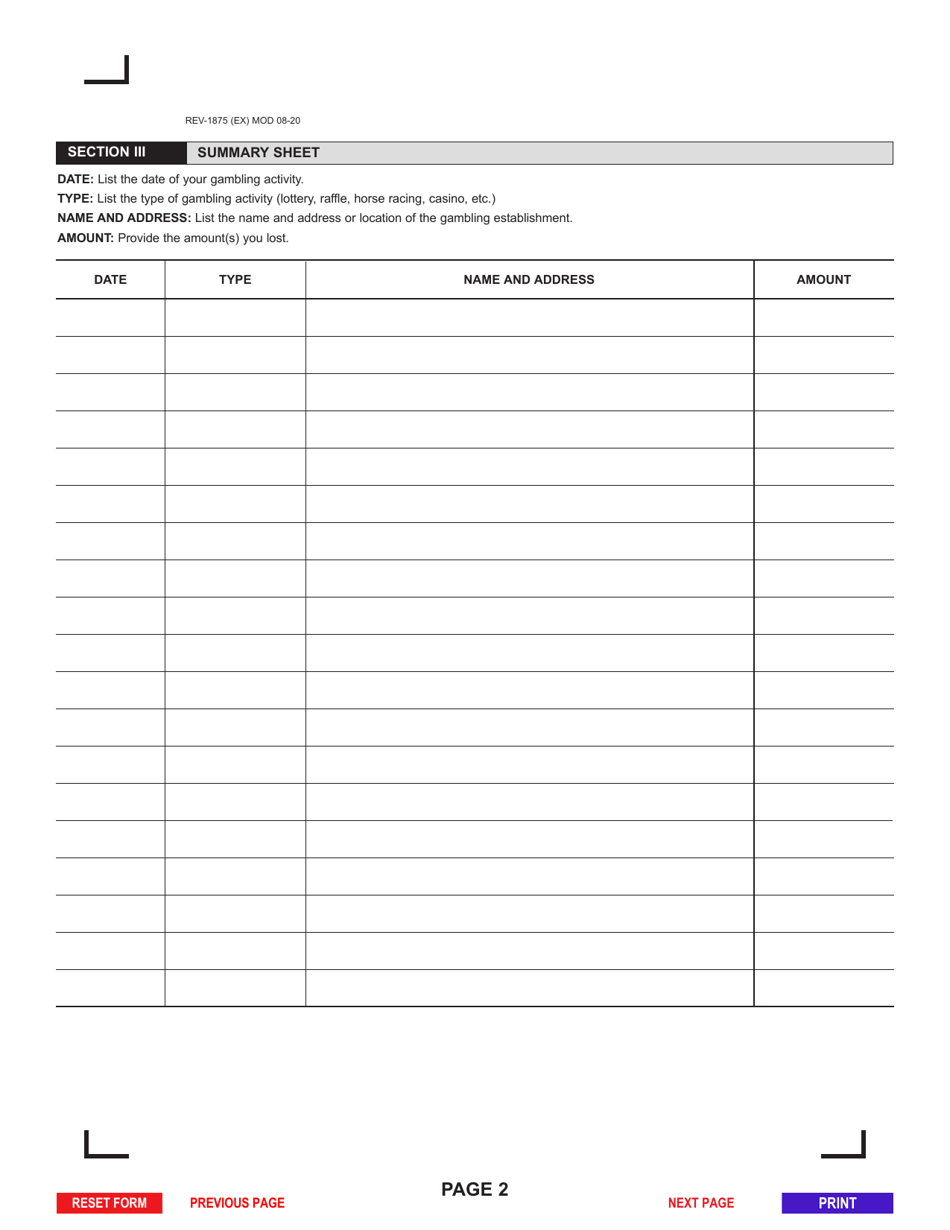

Q: What supporting documentation should I include with Form REV-1875?

A: You should include any documentation that supports your claimed gambling or lottery losses, such as records of winnings and losses from casinos, racetracks, or other gambling establishments.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1875 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.