This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 5C

for the current year.

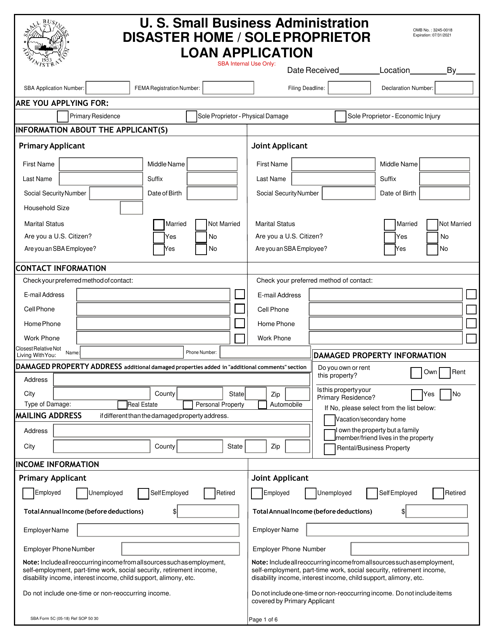

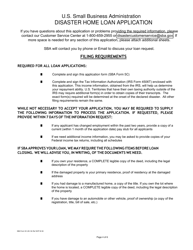

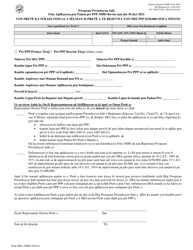

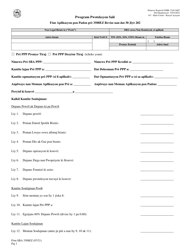

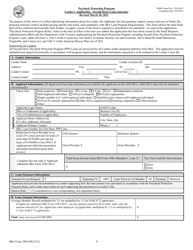

SBA Form 5C Disaster Home / Sole Proprietor Loan Application

What Is SBA Form 5C?

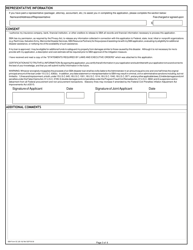

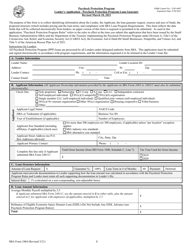

This is a legal form that was released by the U.S. Small Business Administration on May 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 5C?

A: SBA Form 5C is the Disaster Home/Sole Proprietor Loan Application.

Q: Who can use SBA Form 5C?

A: SBA Form 5C is for individuals who are applying for a disaster home loan or a loan as a sole proprietor.

Q: What is the purpose of SBA Form 5C?

A: The purpose of SBA Form 5C is to gather information from applicants applying for disaster home or sole proprietor loans.

Q: Is SBA Form 5C for homeowners or business owners?

A: SBA Form 5C can be used by both homeowners and business owners who are affected by a disaster and need financial assistance.

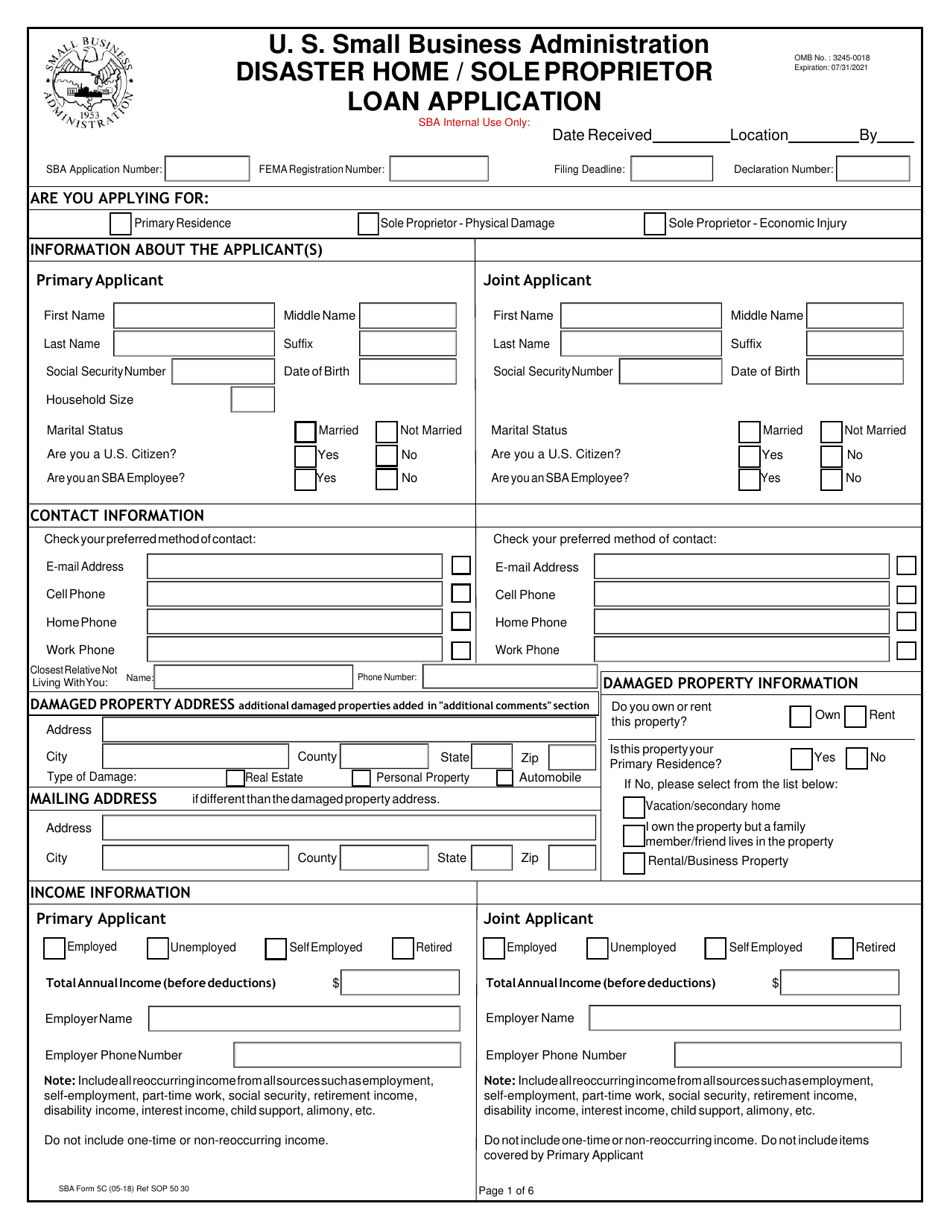

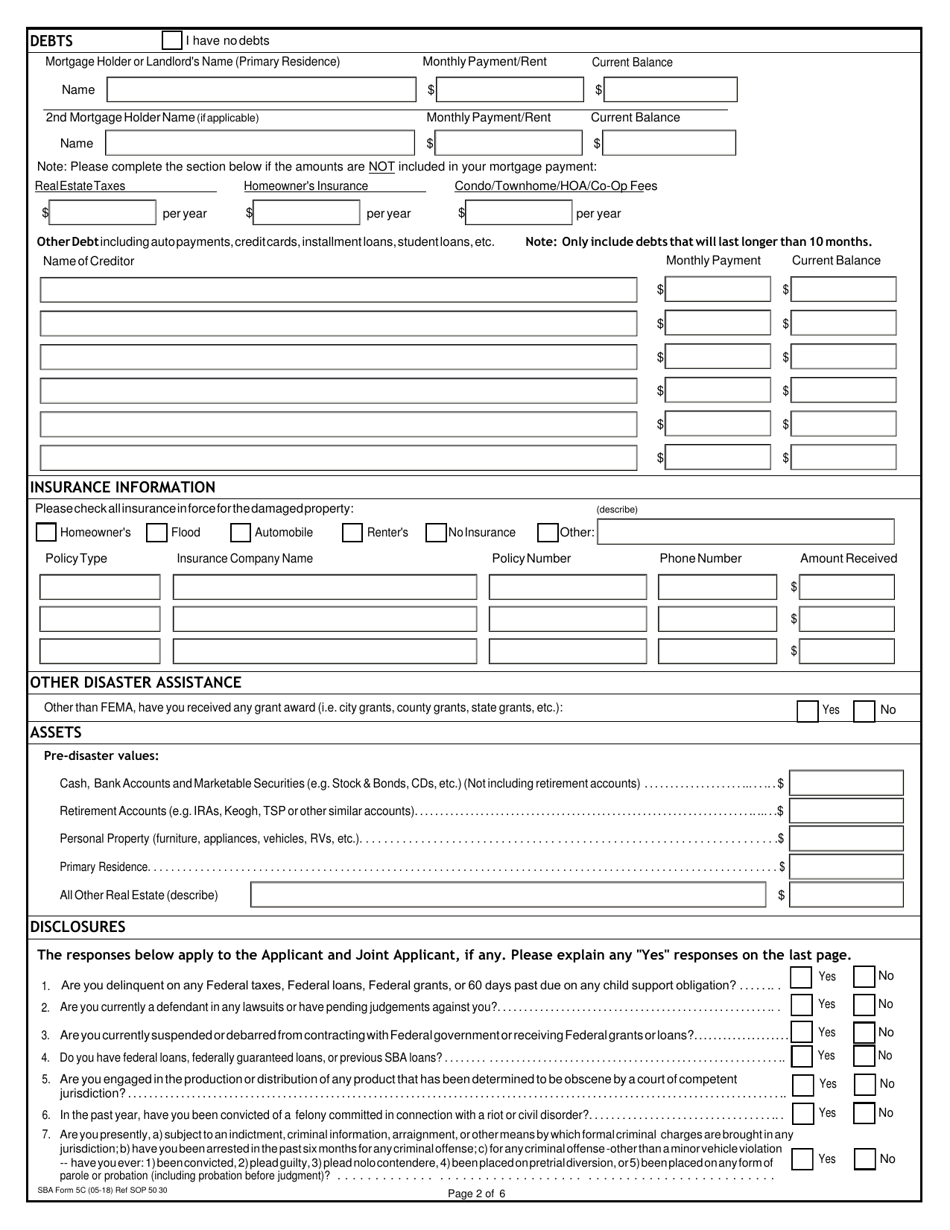

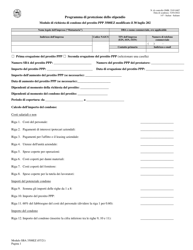

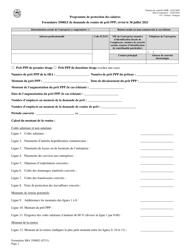

Q: What information is required on SBA Form 5C?

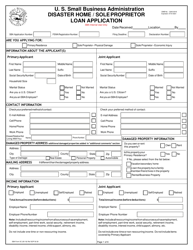

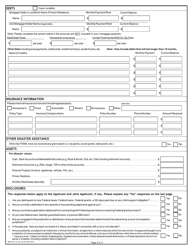

A: SBA Form 5C requires information such as personal details, income and expenses, property information, and other relevant financial information.

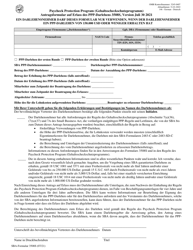

Q: Are there any fees associated with submitting SBA Form 5C?

A: There are no fees for submitting SBA Form 5C. However, if the loan is approved, there may be loan closing costs and interest charges.

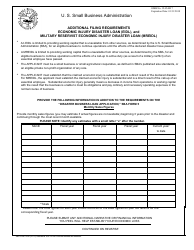

Q: Is SBA Form 5C the only form required for a disaster home or sole proprietor loan application?

A: No, in addition to SBA Form 5C, you may be required to submit other supporting documents such as tax returns, financial statements, and proof of property ownership or occupancy.

Q: How long does it take to process SBA Form 5C?

A: The processing time for SBA Form 5C can vary depending on the volume of applications and the complexity of the case. It is best to check with the SBA for the most up-to-date information on processing times.

Q: Can I apply for a loan if I have bad credit?

A: Having bad credit may affect your loan eligibility, but it does not necessarily disqualify you from applying. The SBA considers various factors in the loan decision-making process, so it is recommended to submit an application even if you have bad credit.

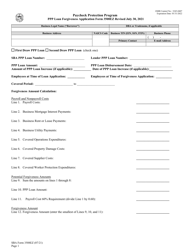

Form Details:

- Released on May 1, 2018;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 5C by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.