This version of the form is not currently in use and is provided for reference only. Download this version of

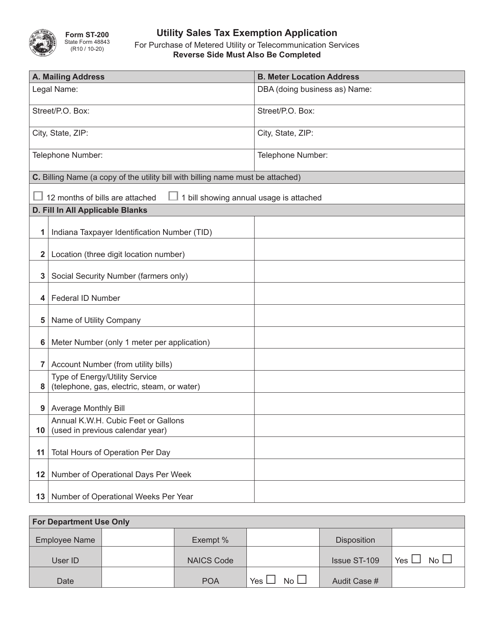

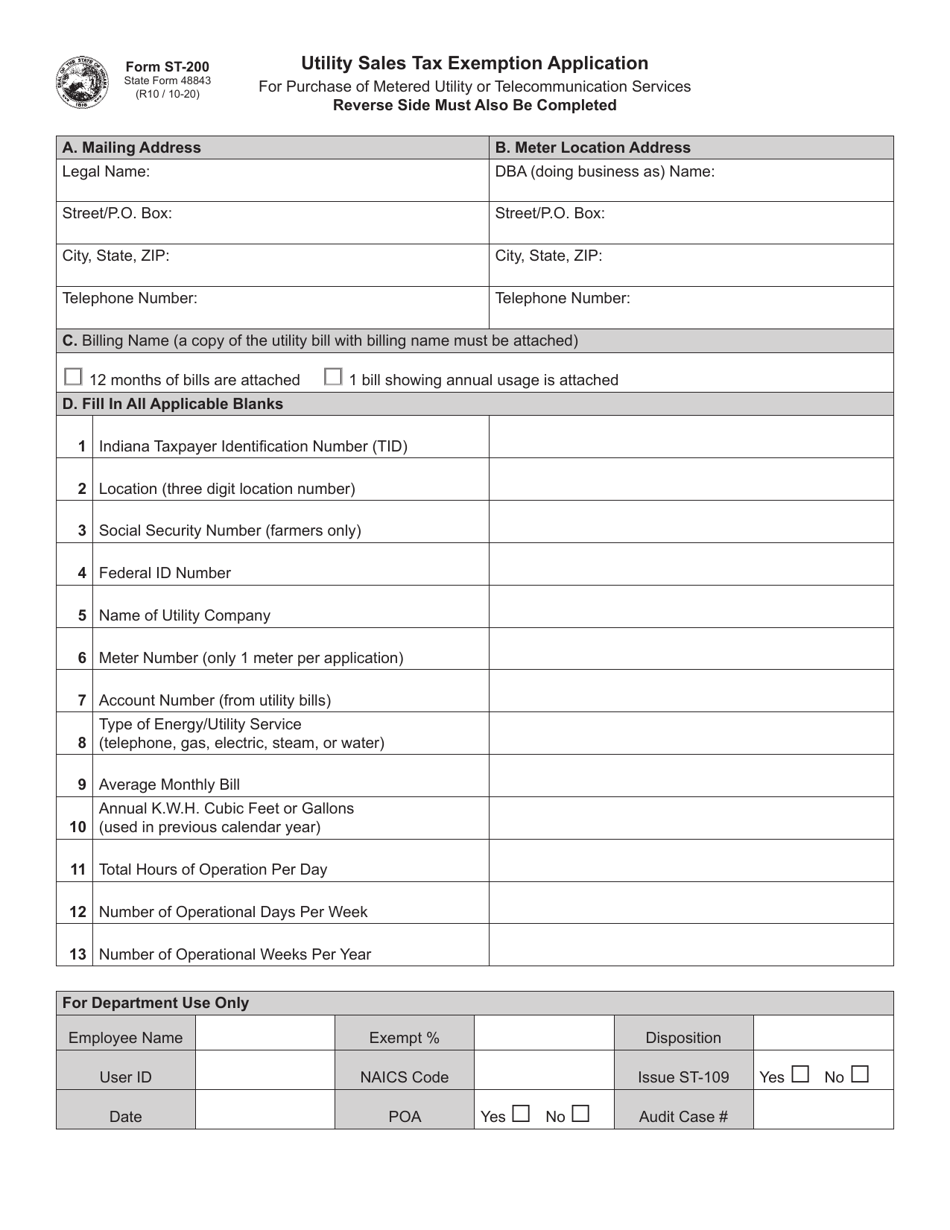

Form ST-200 (State Form 48843)

for the current year.

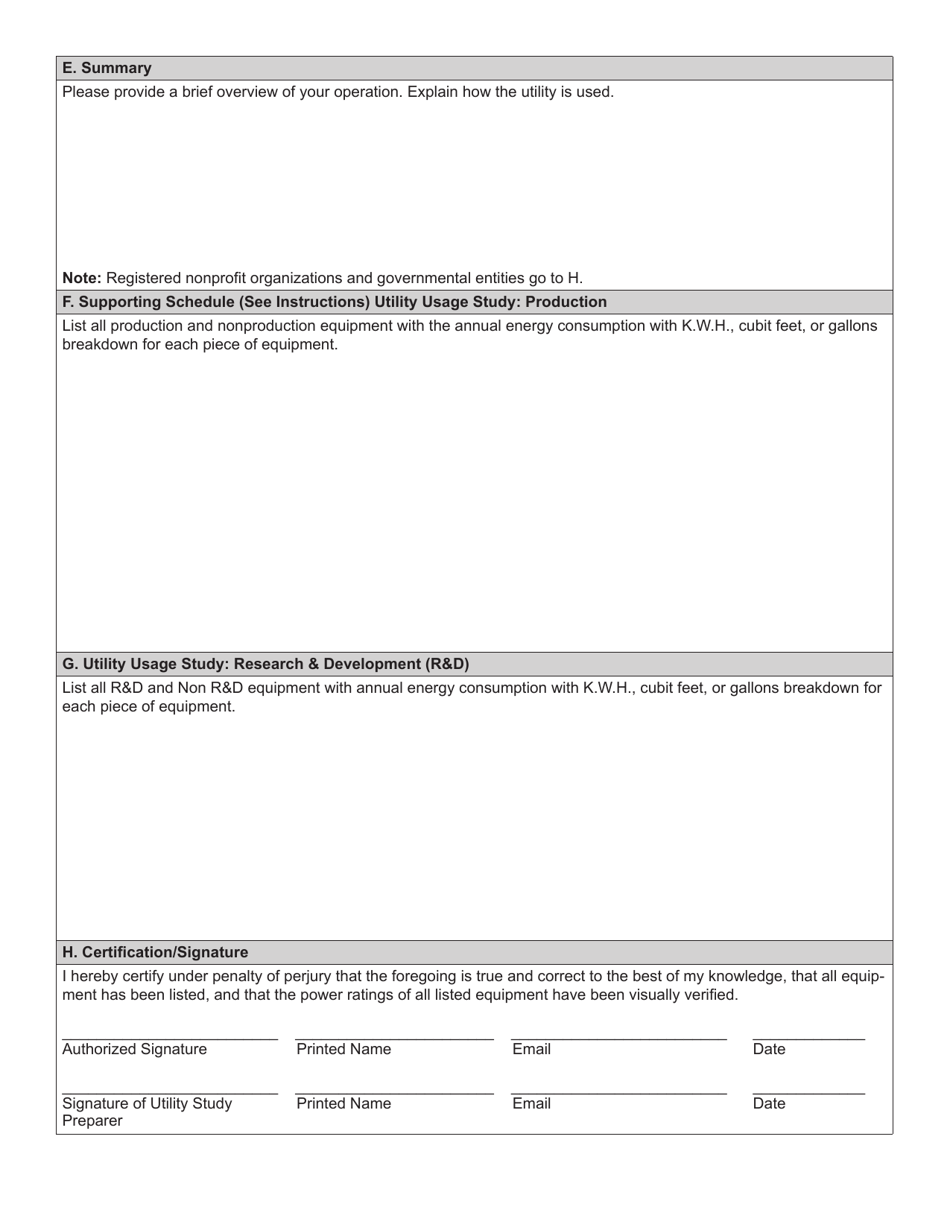

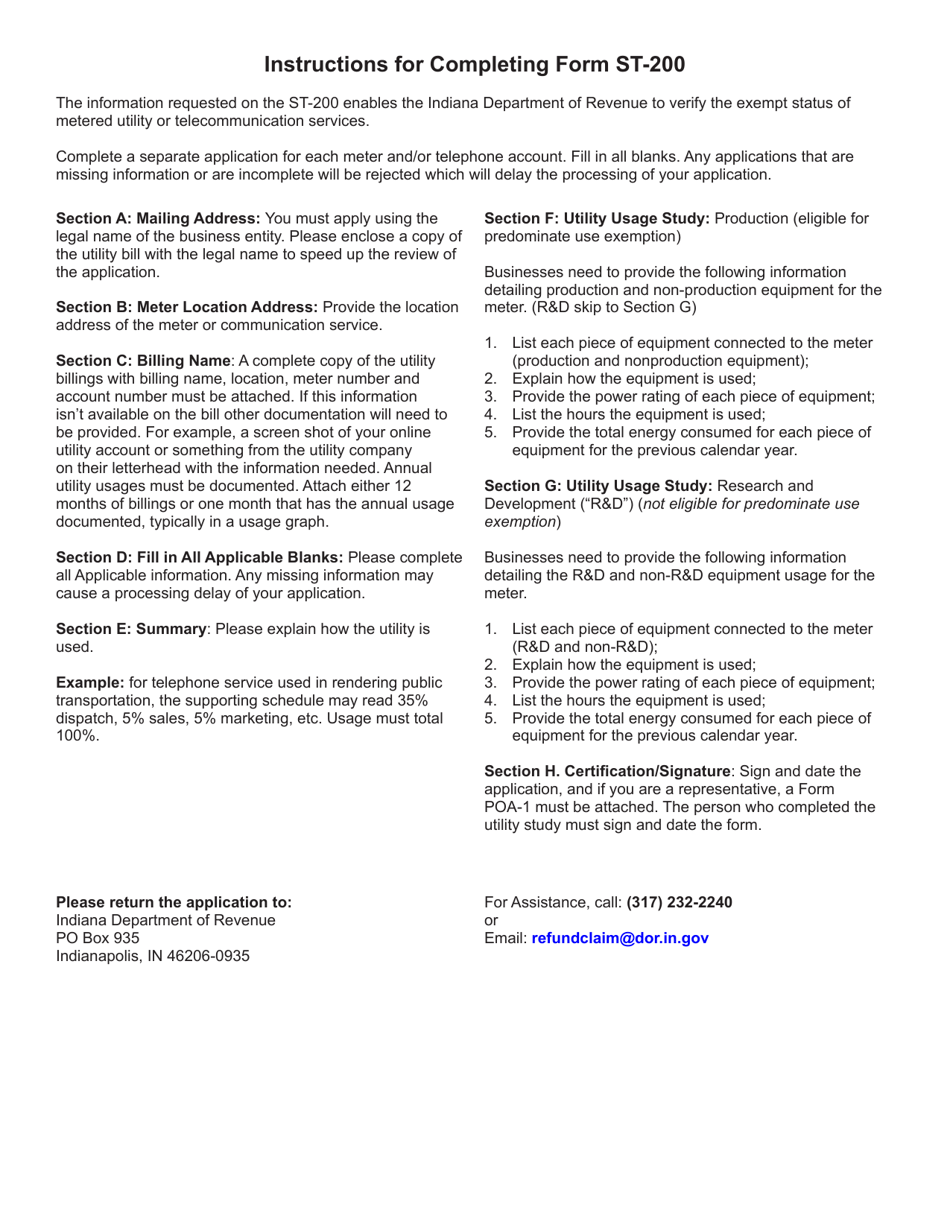

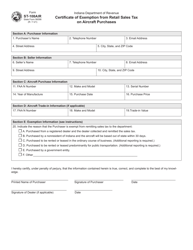

Form ST-200 (State Form 48843) Utility Sales Tax Exemption Application for Purchase of Metered Utility or Telecommunication Services - Indiana

What Is Form ST-200 (State Form 48843)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-200?

A: Form ST-200 is the Utility Sales Tax Exemption Application for the purchase of metered utility or telecommunication services in Indiana.

Q: Why do I need to fill out Form ST-200?

A: You need to fill out Form ST-200 to apply for exemption from sales tax on the purchase of metered utility or telecommunication services in Indiana.

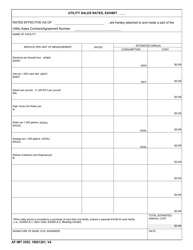

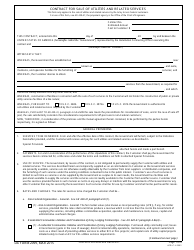

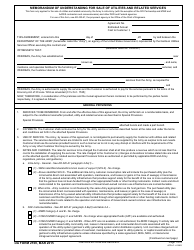

Q: What information do I need to provide on Form ST-200?

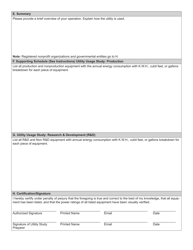

A: You need to provide information about the purchaser, utility provider, and the specific utility services for which you are applying for exemption.

Q: Can I claim exemption for both metered utility and telecommunication services on the same form?

A: Yes, you can claim exemption for both metered utility and telecommunication services on the same Form ST-200.

Q: Are there any limitations to the exemption?

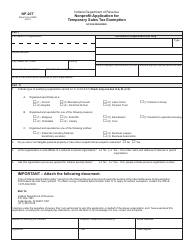

A: Yes, there are limitations to the exemption. The exemption does not apply to certain utility services, such as motor fuel, water delivered by a private water company, or telecommunication services sold on a pre-paid basis.

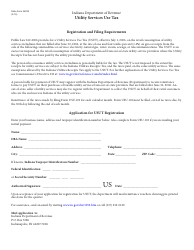

Q: What do I do after filling out Form ST-200?

A: After filling out Form ST-200, you need to submit it to the Indiana Department of Revenue for review and processing.

Q: How long does it take to process Form ST-200?

A: The processing time for Form ST-200 can vary, but it is typically processed within a few weeks of submission.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-200 (State Form 48843) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.