This version of the form is not currently in use and is provided for reference only. Download this version of

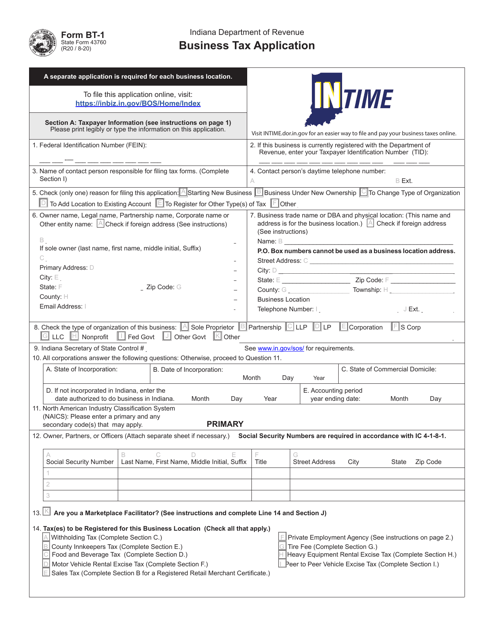

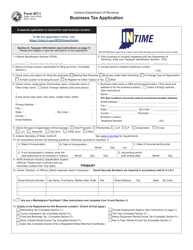

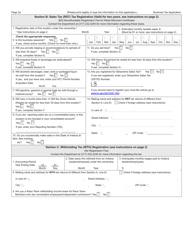

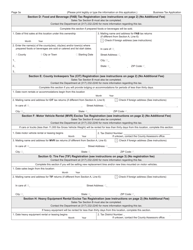

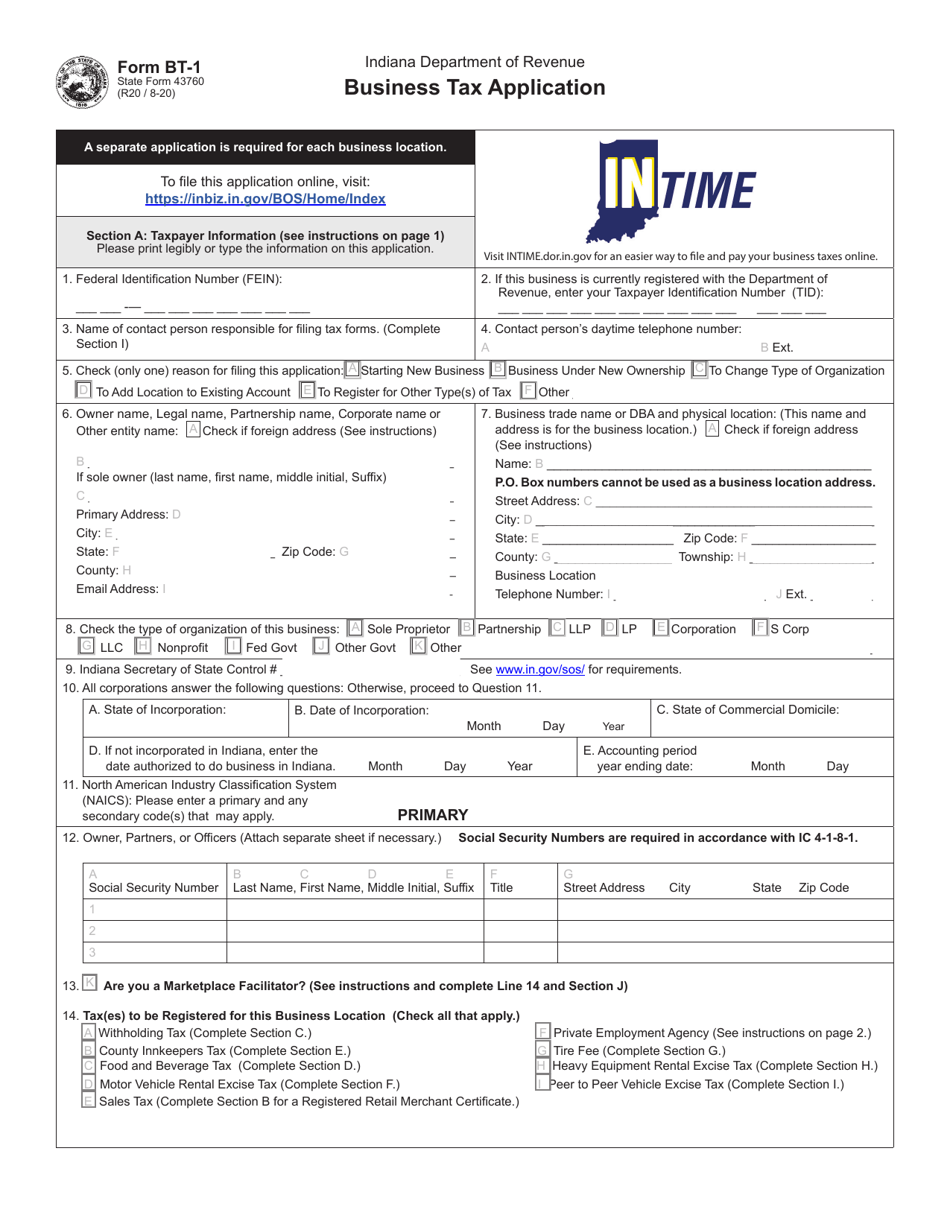

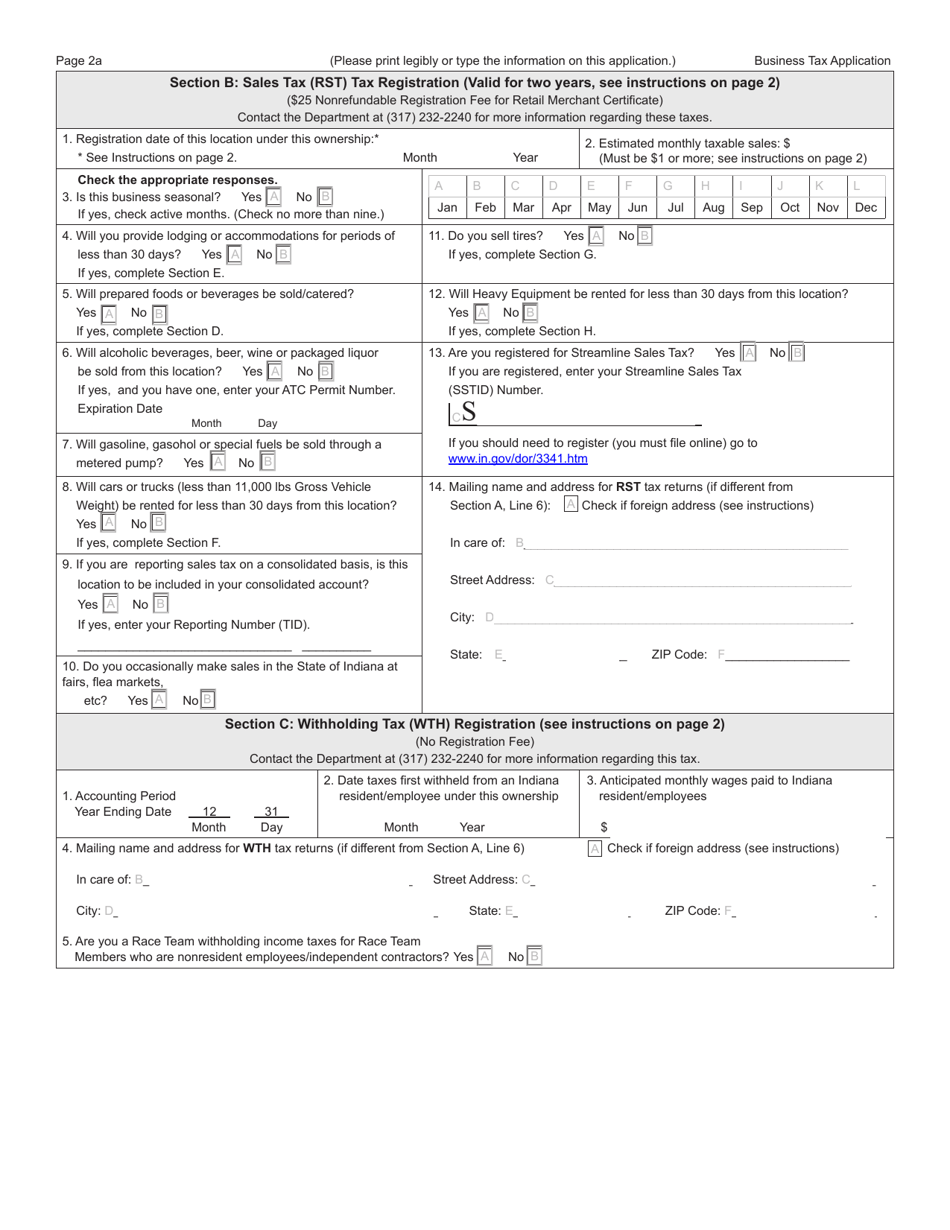

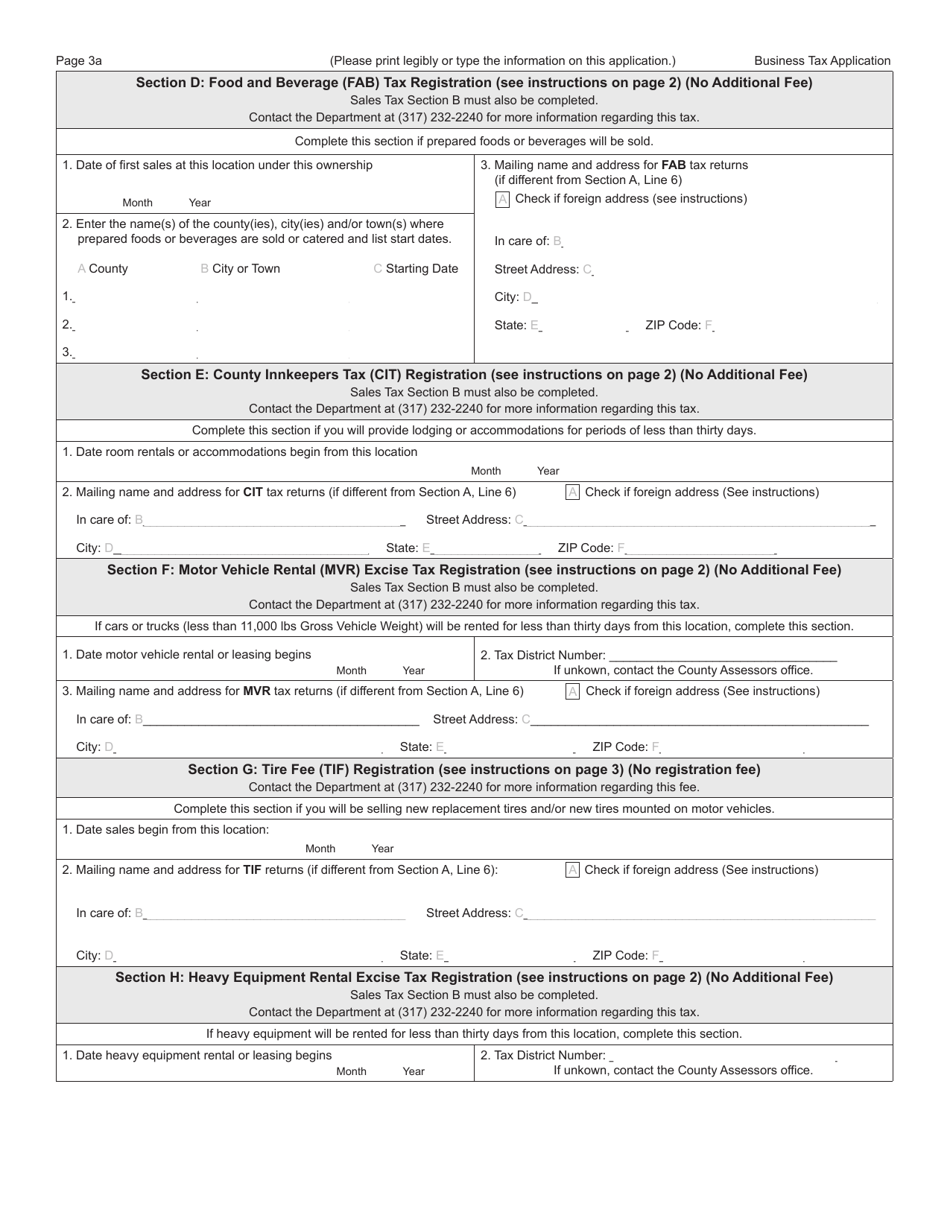

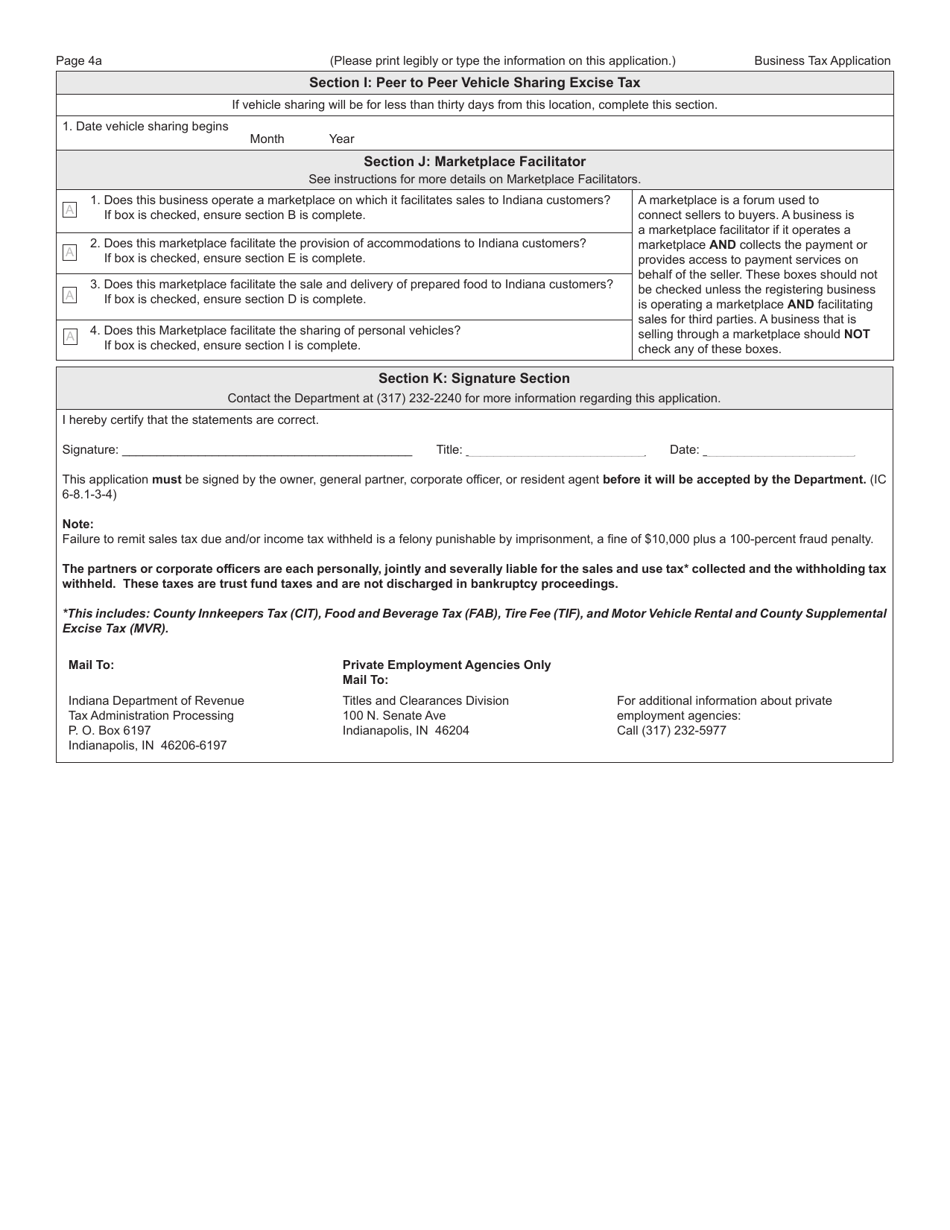

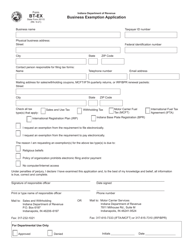

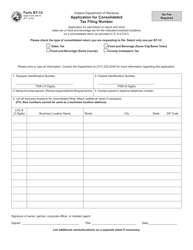

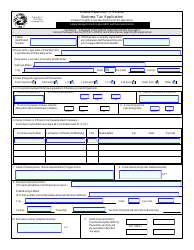

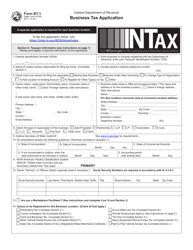

Form BT-1 (State Form 43760)

for the current year.

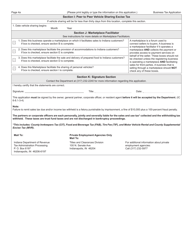

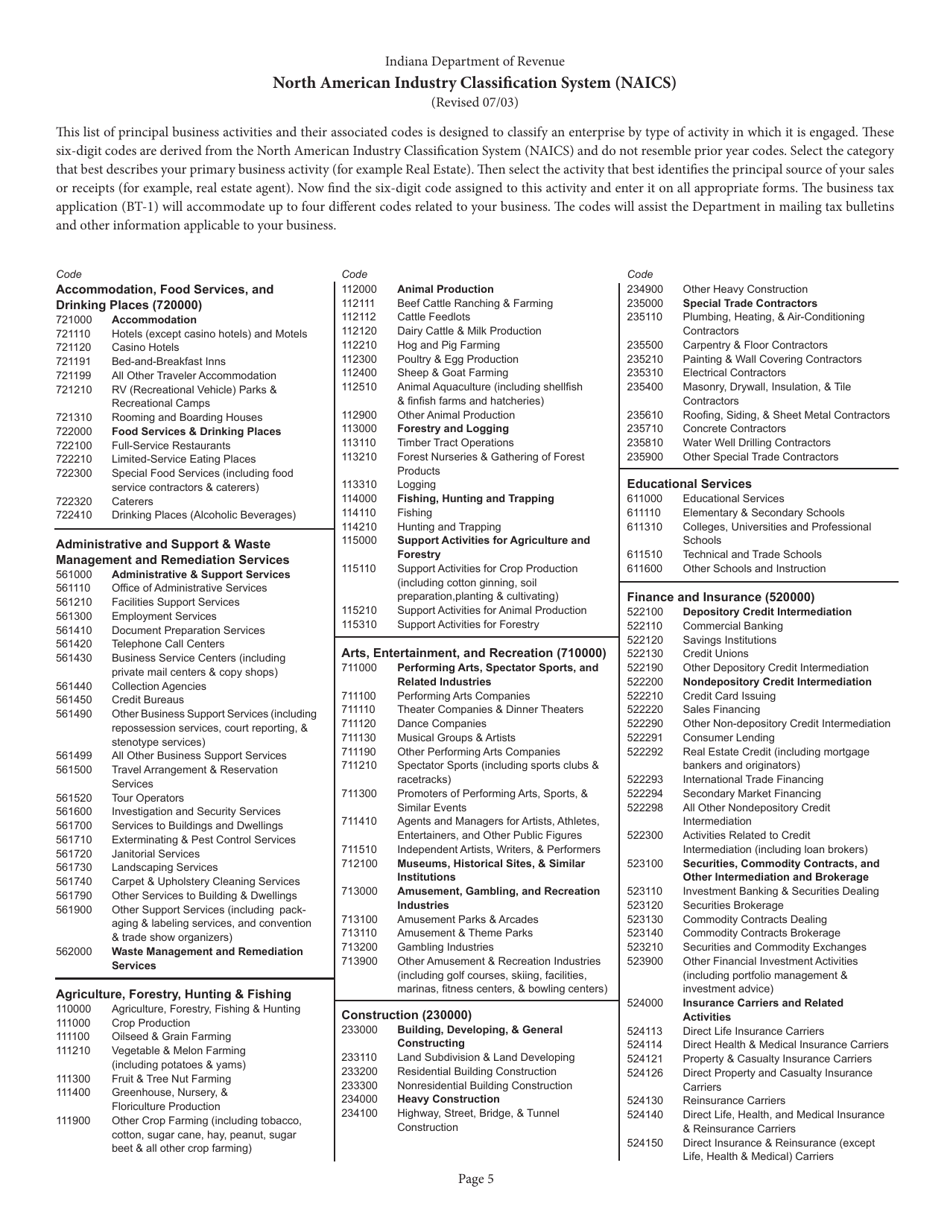

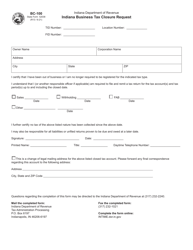

Form BT-1 (State Form 43760) Business Tax Application - Indiana

What Is Form BT-1 (State Form 43760)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

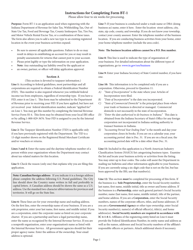

Q: What is Form BT-1?

A: Form BT-1 is the Business Tax Application for businesses in the state of Indiana.

Q: Who needs to file Form BT-1?

A: Any business operating in Indiana is required to file Form BT-1.

Q: What is the purpose of Form BT-1?

A: The purpose of Form BT-1 is to register a business with the Indiana Department of Revenue and obtain a Taxpayer Identification Number.

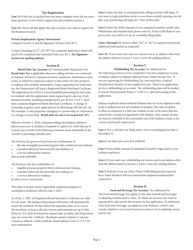

Q: What information is required on Form BT-1?

A: Form BT-1 requires information such as the business name, address, type of business, and ownership details.

Q: Are there any fees associated with filing Form BT-1?

A: No, there are no fees for filing Form BT-1.

Q: When is the deadline for filing Form BT-1?

A: Form BT-1 must be filed within 30 days of starting business operations in Indiana.

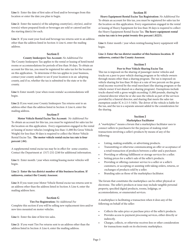

Q: What happens after I file Form BT-1?

A: After filing Form BT-1, you will receive a Taxpayer Identification Number from the Indiana Department of Revenue, which you will use for tax purposes.

Q: Are there any penalties for not filing Form BT-1?

A: Yes, there may be penalties for not filing Form BT-1, including late filing fees and potential legal consequences.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-1 (State Form 43760) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.