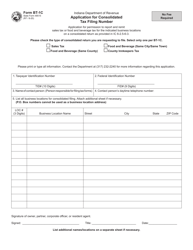

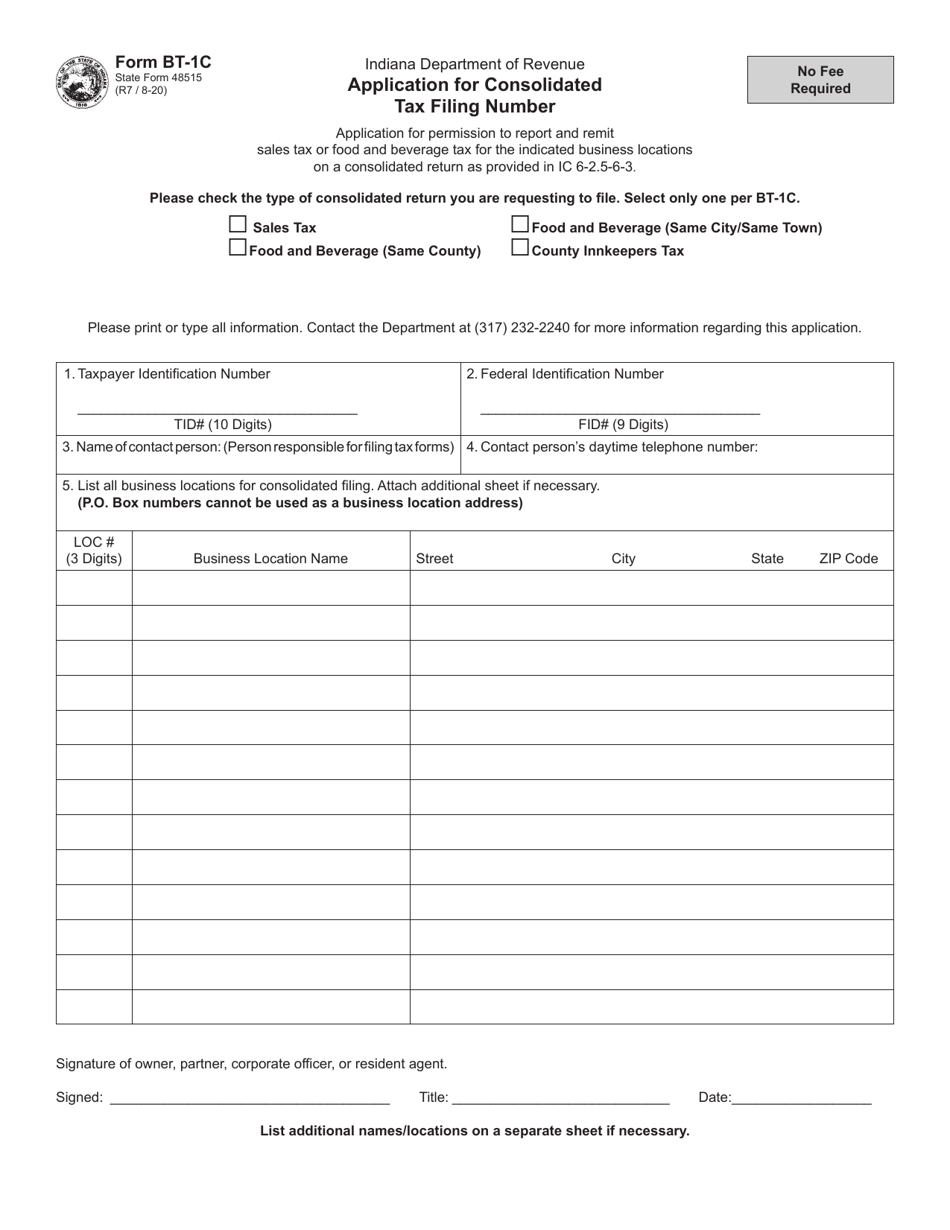

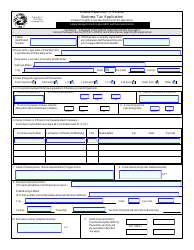

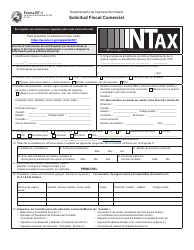

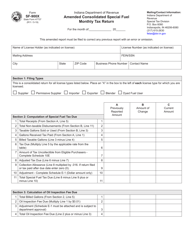

Form BT-1C (State Form 48515) Application for Consolidated Tax Filing Number - Indiana

What Is Form BT-1C (State Form 48515)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

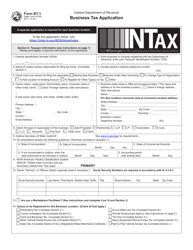

Q: What is Form BT-1C?

A: Form BT-1C is an Application for Consolidated Tax Filing Number in Indiana.

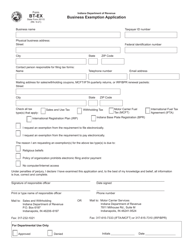

Q: What is the purpose of Form BT-1C?

A: The purpose of Form BT-1C is to apply for a consolidated tax filing number in Indiana.

Q: Is Form BT-1C only applicable in Indiana?

A: Yes, Form BT-1C is specifically for applying for consolidated tax filing number in Indiana.

Q: Is Form BT-1C for individuals or businesses?

A: Form BT-1C is for businesses that want to consolidate their tax filings in Indiana.

Q: Do I have to file Form BT-1C?

A: Filing Form BT-1C is optional and only necessary if you want to consolidate your tax filings in Indiana.

Q: Are there any fees associated with filing Form BT-1C?

A: There are no fees associated with filing Form BT-1C.

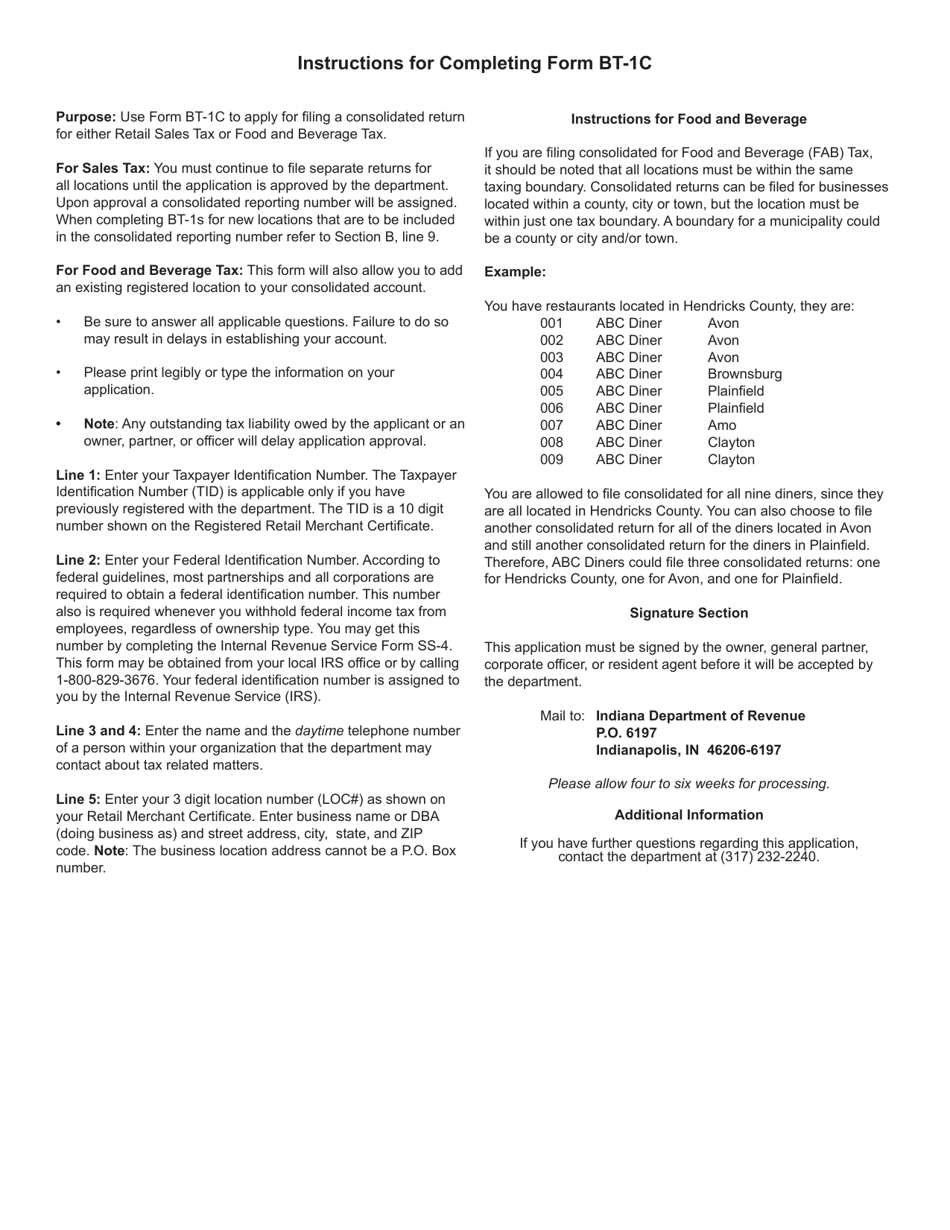

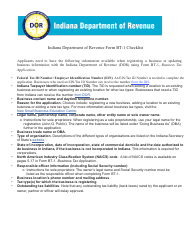

Q: What information do I need to provide on Form BT-1C?

A: You will need to provide your business information, including your federal employer identification number (FEIN), to complete Form BT-1C.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-1C (State Form 48515) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.