This version of the form is not currently in use and is provided for reference only. Download this version of

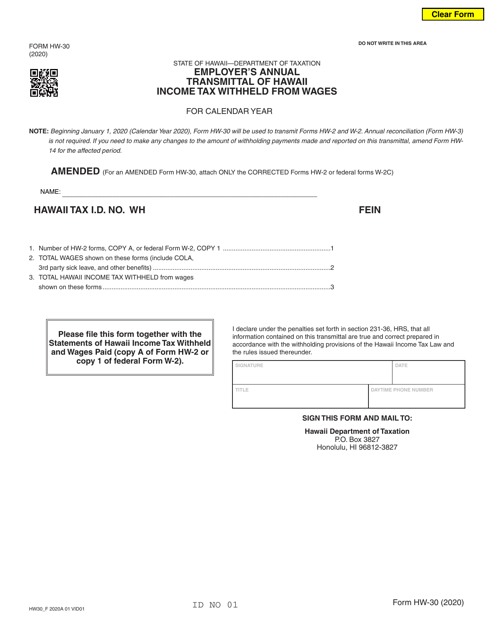

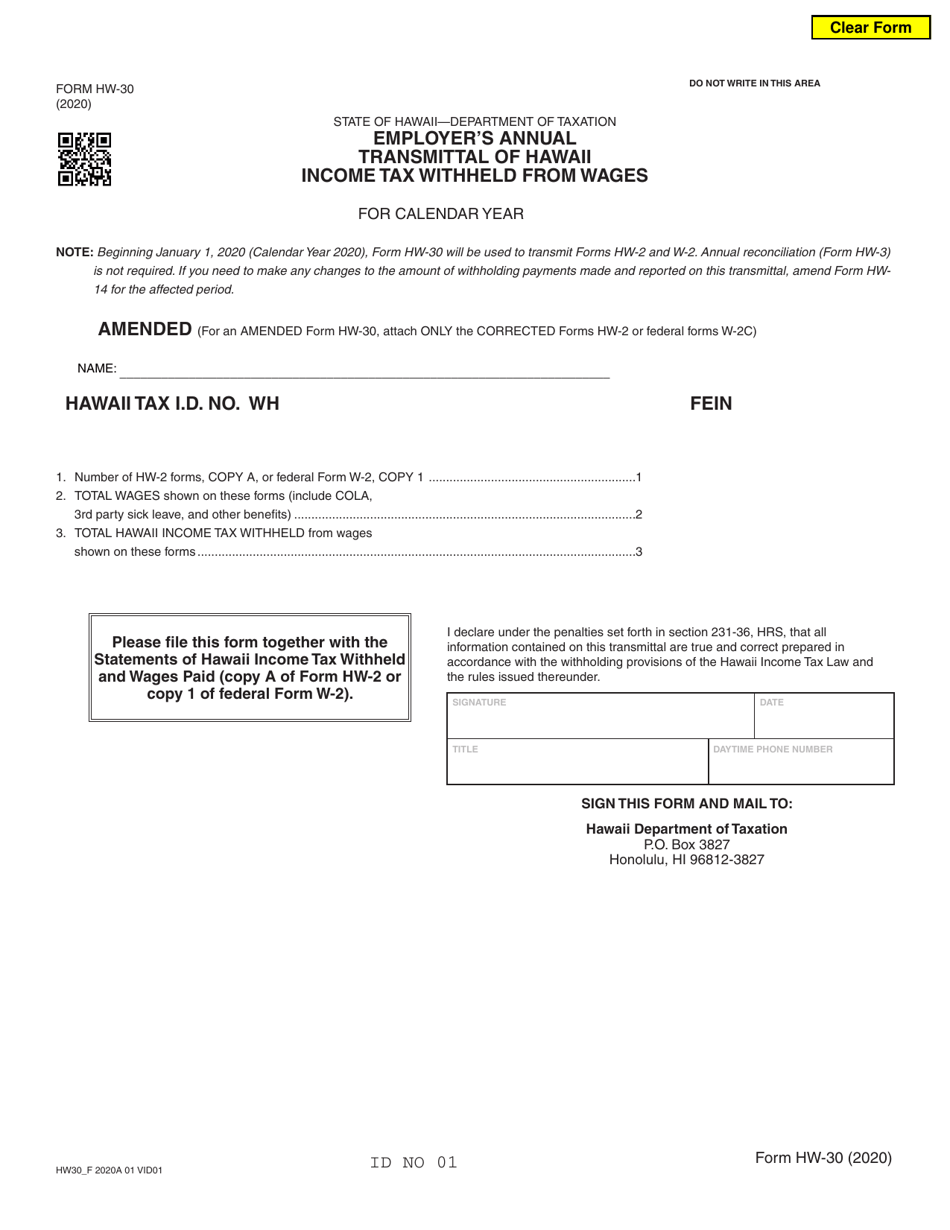

Form HW-30

for the current year.

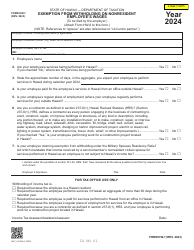

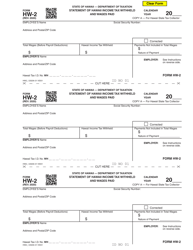

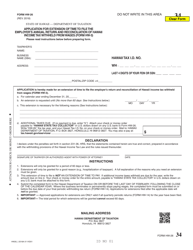

Form HW-30 Employer's Annual Transmittal of Hawaii Income Tax Withheld From Wages - Hawaii

What Is Form HW-30?

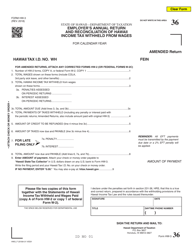

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form HW-30?

A: Form HW-30 is the Employer's Annual Transmittal of Hawaii Income Tax Withheld From Wages.

Q: Who is required to submit form HW-30?

A: Employers in Hawaii who have withheld income tax from their employees' wages are required to submit form HW-30.

Q: What is the purpose of form HW-30?

A: The purpose of form HW-30 is to report the total amount of income tax withheld from employees' wages and remit the withheld taxes to the state of Hawaii.

Q: When is form HW-30 due?

A: Form HW-30 is due on or before the last day of February following the calendar year for which the taxes were withheld.

Q: Are there any penalties for not filing form HW-30?

A: Yes, there may be penalties for not filing form HW-30 or for filing it late. It is important to file the form on time to avoid penalties.

Q: Is form HW-30 only for businesses with employees?

A: Yes, form HW-30 is specifically for employers who have employees and have withheld income tax from their wages.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HW-30 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.