This version of the form is not currently in use and is provided for reference only. Download this version of

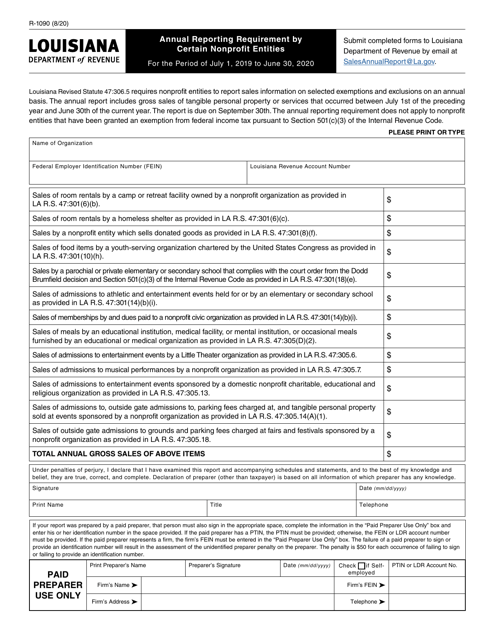

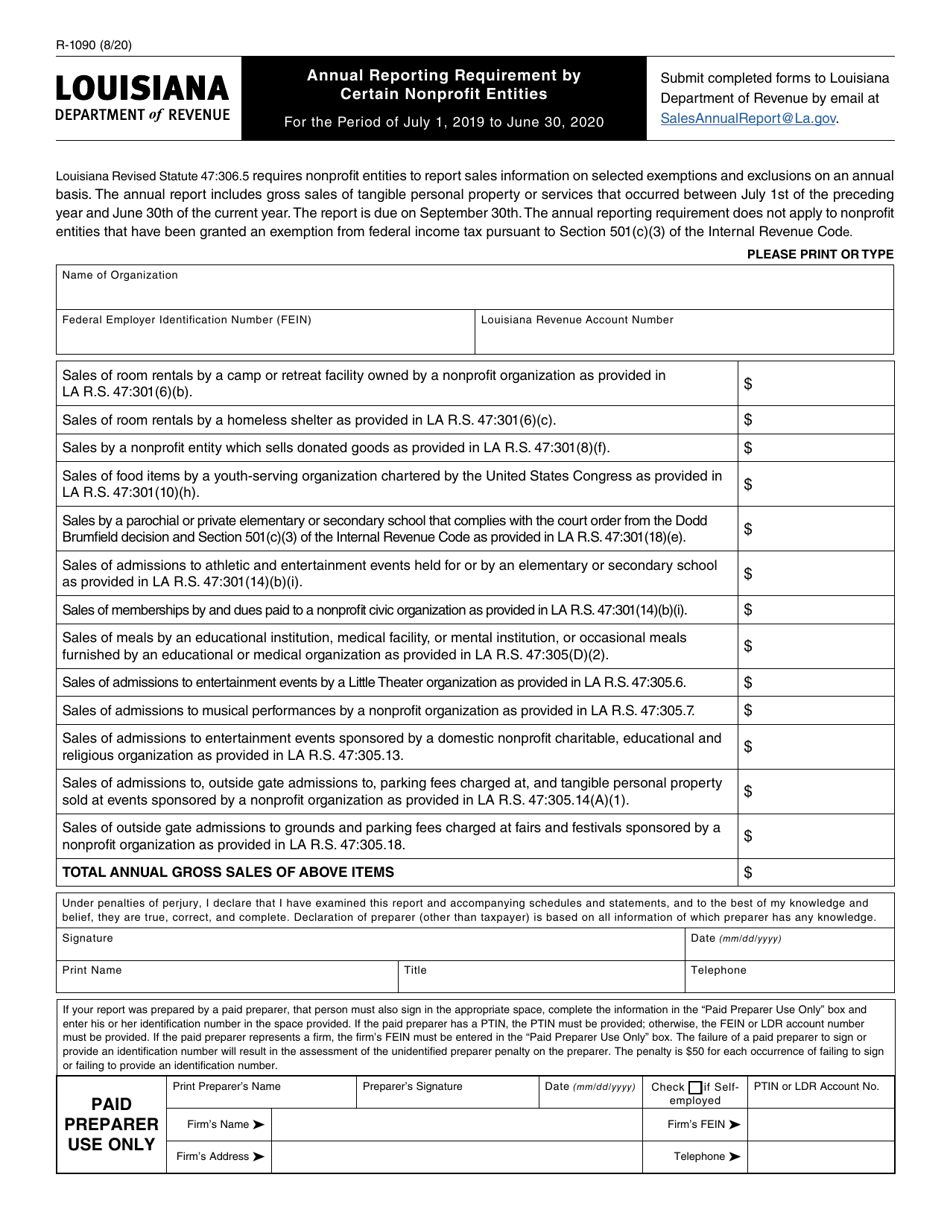

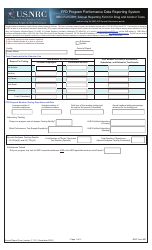

Form R-1090

for the current year.

Form R-1090 Annual Reporting Requirement by Certain Nonprofit Entities - Louisiana

What Is Form R-1090?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1090?

A: Form R-1090 is the Annual Reporting Requirement by Certain Nonprofit Entities in Louisiana.

Q: Who is required to file Form R-1090?

A: Certain nonprofit entities in Louisiana are required to file Form R-1090.

Q: What is the purpose of Form R-1090?

A: The purpose of Form R-1090 is to report annual financial information for nonprofit entities in Louisiana.

Q: What information is required to be reported on Form R-1090?

A: Form R-1090 requires the reporting of financial information, such as revenue, expenses, assets, and liabilities.

Q: When is Form R-1090 due?

A: Form R-1090 is due on or before the 15th day of the fifth month after the close of the entity's fiscal year-end.

Q: Are there any penalties for not filing Form R-1090?

A: Yes, there are penalties for not filing Form R-1090, including late filing penalties and interest on unpaid taxes.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1090 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.