This version of the form is not currently in use and is provided for reference only. Download this version of

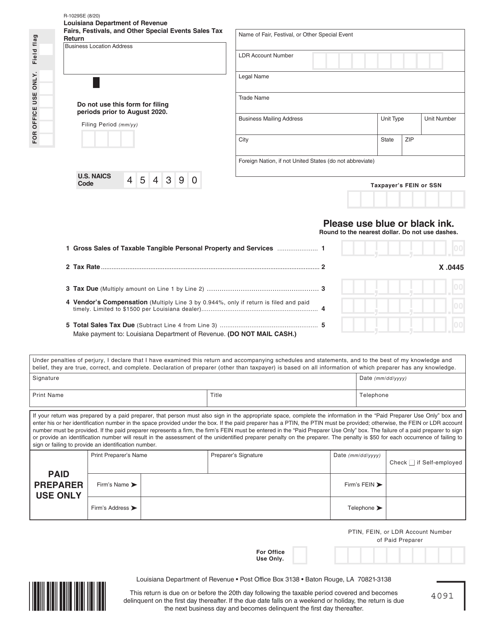

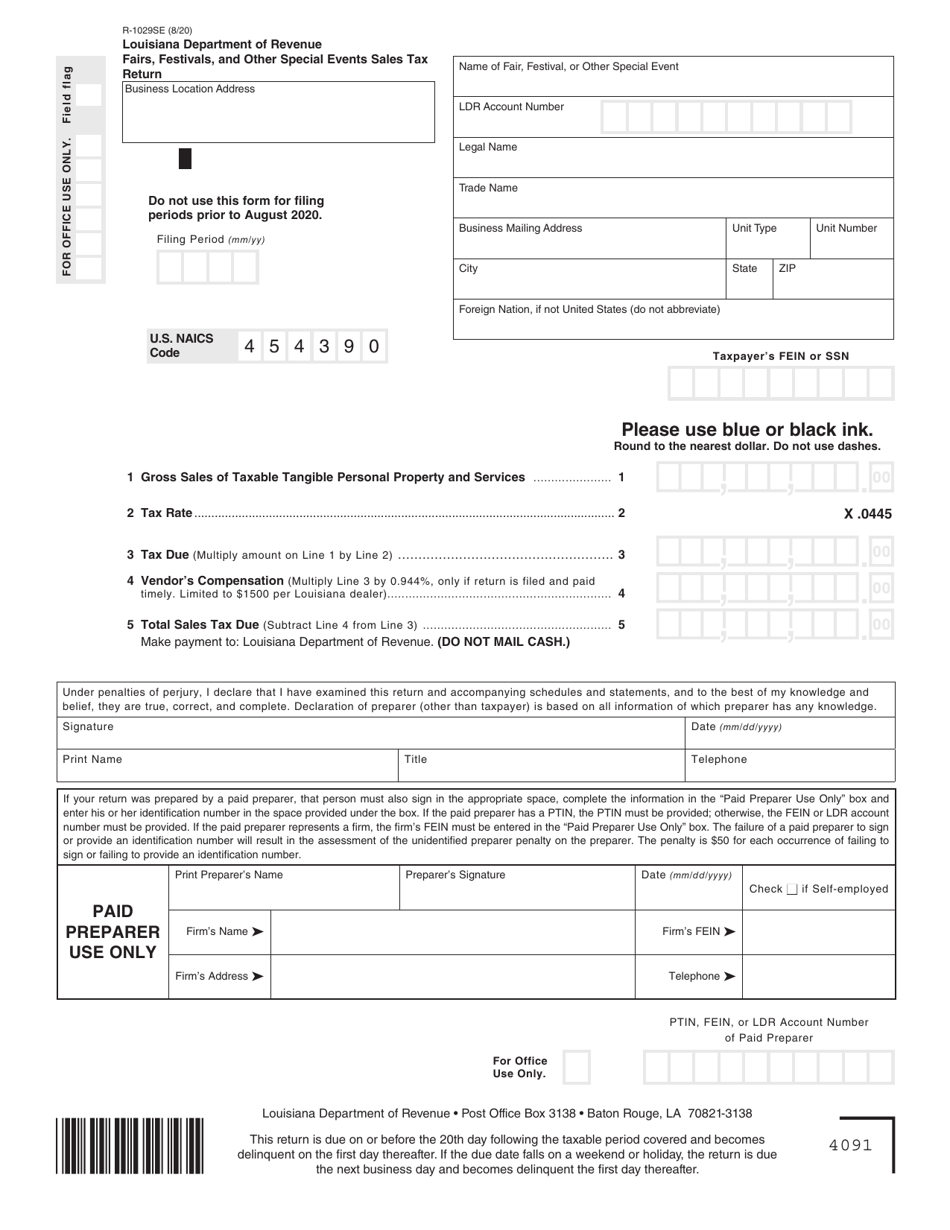

Form R-1029SE

for the current year.

Form R-1029SE Fairs, Festivals, and Other Special Events Sales Tax Return - Louisiana

What Is Form R-1029SE?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1029SE?

A: Form R-1029SE is the Louisiana Sales Tax Return specifically designed for Fairs, Festivals, and Other Special Events.

Q: Who needs to file Form R-1029SE?

A: Organizers or sponsors of fairs, festivals, and other special events in Louisiana need to file Form R-1029SE.

Q: What is the purpose of Form R-1029SE?

A: Form R-1029SE is used to report and remit sales tax collected at fairs, festivals, and other special events in Louisiana.

Q: When is the due date for Form R-1029SE?

A: Form R-1029SE is due on or before the 20th day of the month following the month in which the event took place.

Q: Are there any penalties for late filing of Form R-1029SE?

A: Yes, there are penalties for late filing of Form R-1029SE. The penalty is 5% of the tax due for each month or fraction of a month that the return is late, up to a maximum penalty of 25%.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1029SE by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.