This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

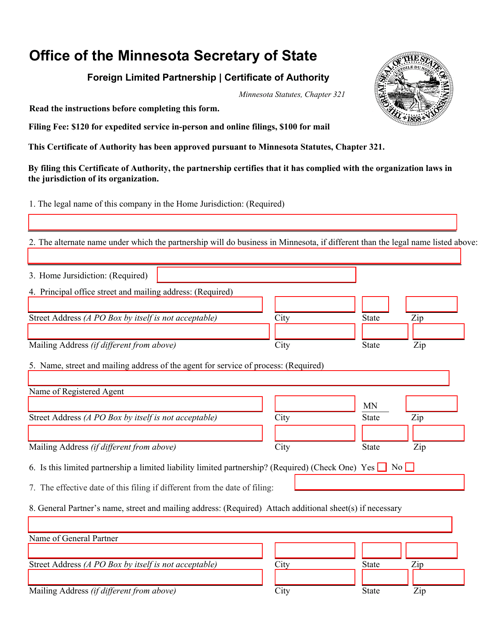

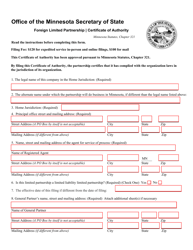

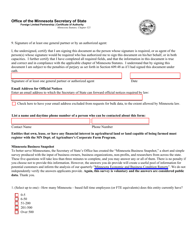

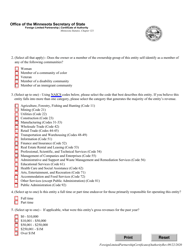

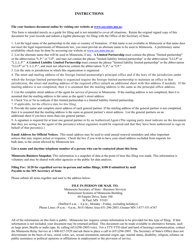

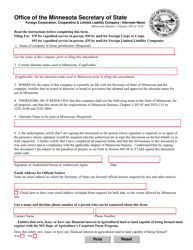

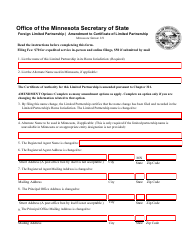

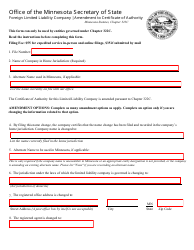

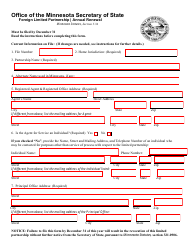

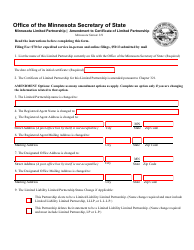

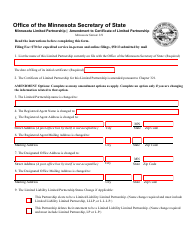

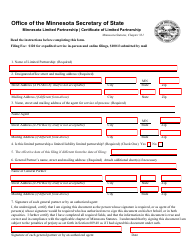

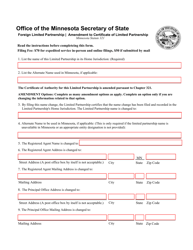

Foreign Limited Partnership Certificate of Authority - Minnesota

Foreign Limited Partnership Certificate of Authority is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a Foreign Limited Partnership Certificate of Authority?

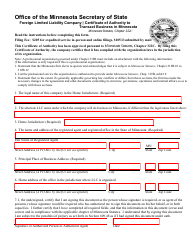

A: A Foreign Limited Partnership Certificate of Authority is a legal document that allows a limited partnership formed outside of Minnesota to do business in the state.

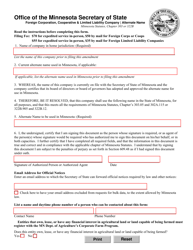

Q: How can I obtain a Foreign Limited Partnership Certificate of Authority in Minnesota?

A: To obtain a Foreign Limited Partnership Certificate of Authority in Minnesota, you need to file an application with the Minnesota Secretary of State and pay the required fees.

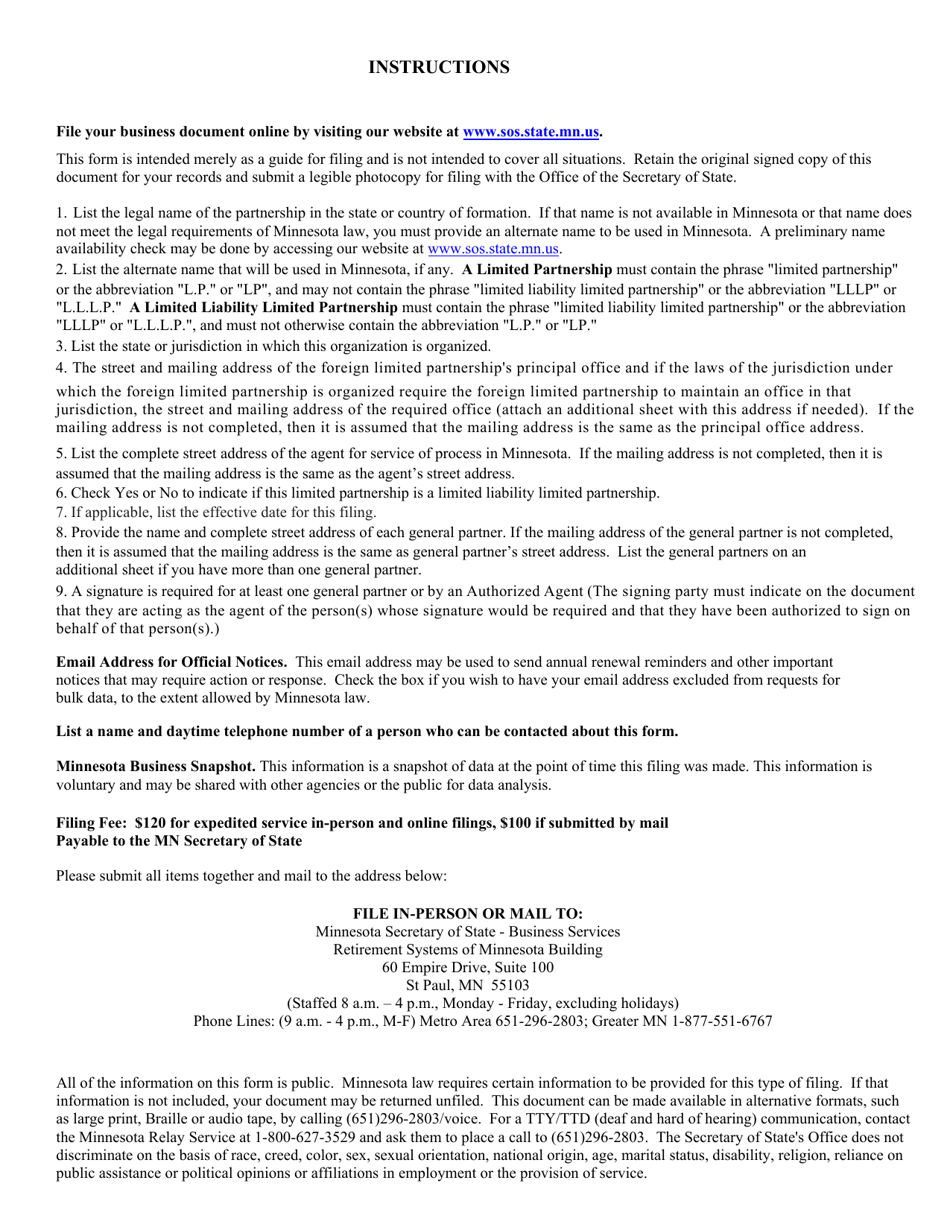

Q: What information is required to be included in the application for a Foreign Limited Partnership Certificate of Authority?

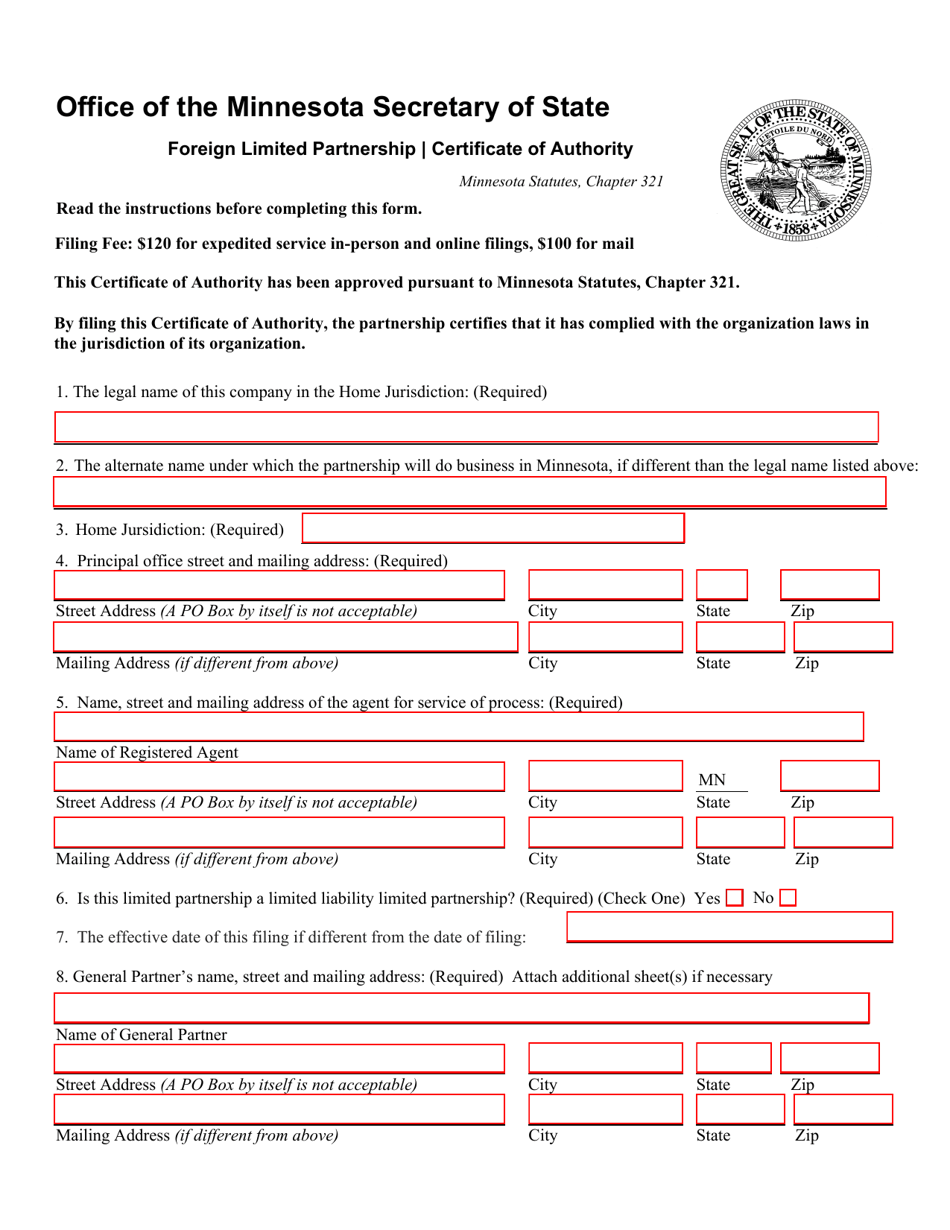

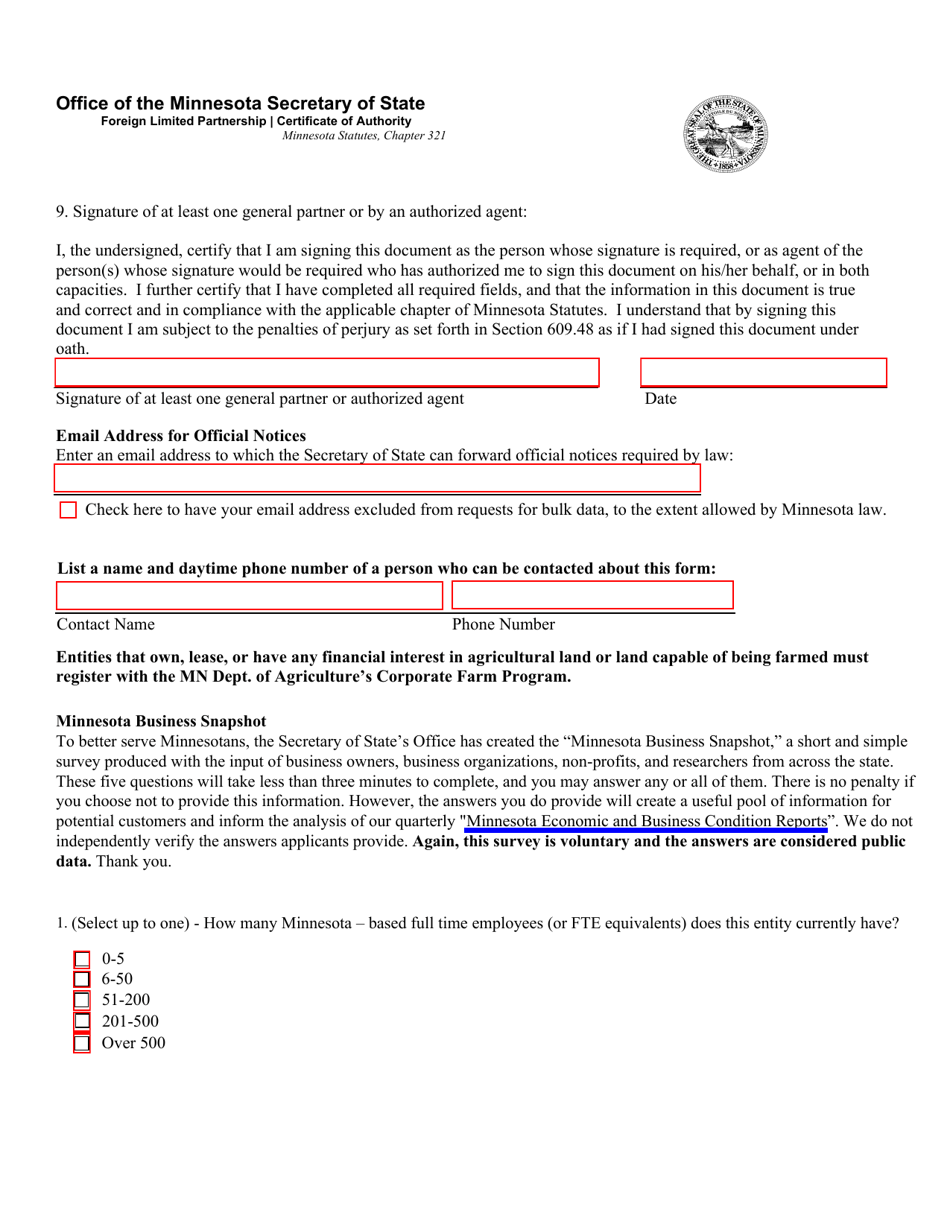

A: The application for a Foreign Limited Partnership Certificate of Authority typically requires the name and address of the partnership, the jurisdiction of formation, the principal place of business, and the name and address of the partnership's registered agent in Minnesota.

Q: What is the purpose of a Foreign Limited Partnership Certificate of Authority?

A: The purpose of a Foreign Limited Partnership Certificate of Authority is to provide legal recognition and authorization for a limited partnership to operate in Minnesota, allowing it to conduct business activities and enter into contracts in the state.

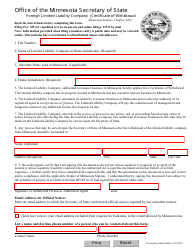

Q: Are there any ongoing requirements for a limited partnership with a Foreign Limited Partnership Certificate of Authority in Minnesota?

A: Yes, a limited partnership with a Foreign Limited Partnership Certificate of Authority in Minnesota is generally required to file an annual report and pay any applicable fees to the Minnesota Secretary of State to maintain its authorization to do business in the state.

Q: What happens if a limited partnership fails to obtain a Foreign Limited Partnership Certificate of Authority before conducting business in Minnesota?

A: If a limited partnership fails to obtain a Foreign Limited Partnership Certificate of Authority before conducting business in Minnesota, it may be subject to fines, penalties, and potential legal consequences. It is important to comply with the state's requirements to avoid these issues.

Form Details:

- Released on September 22, 2020;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.