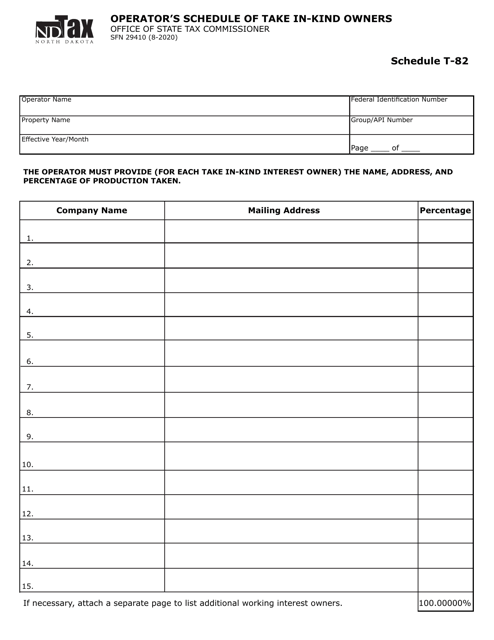

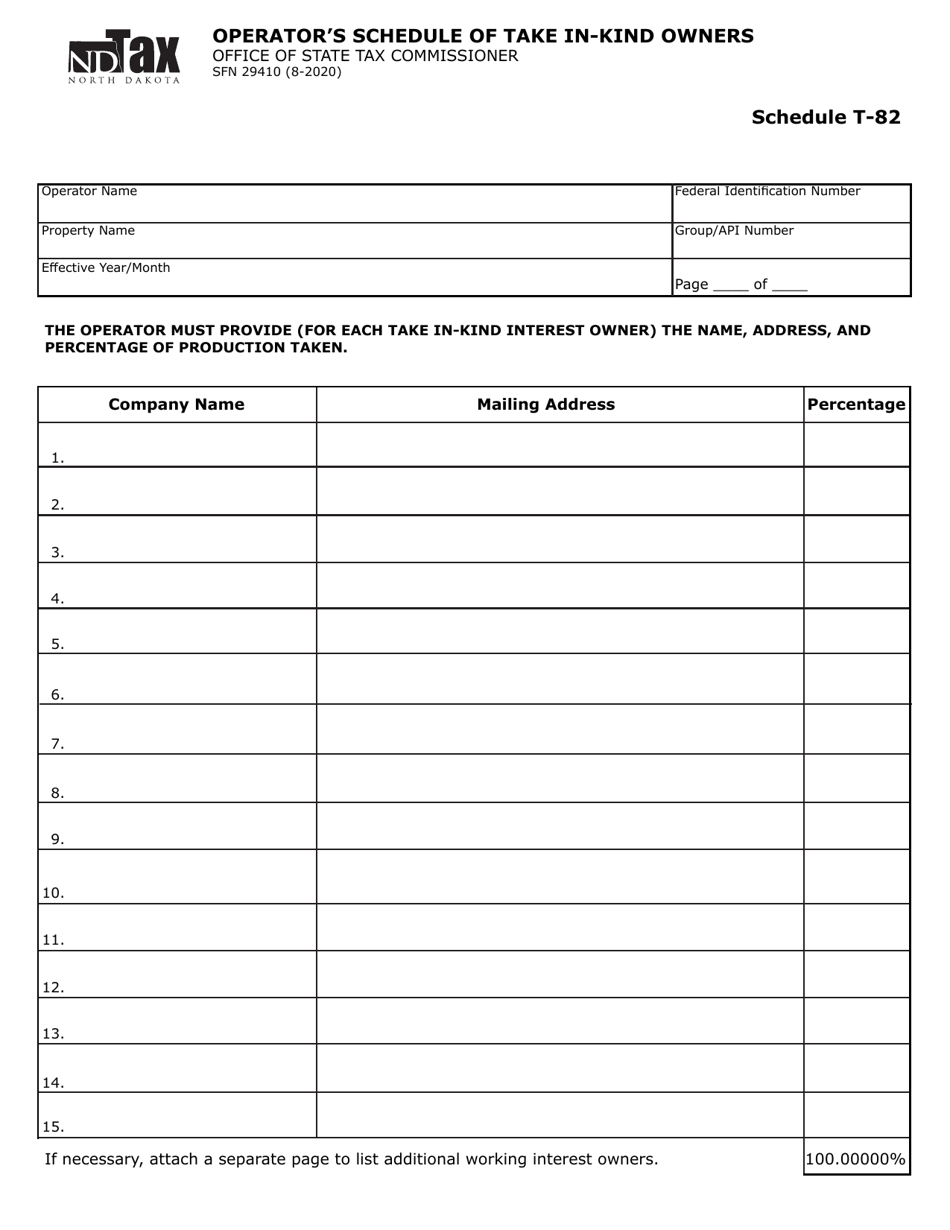

Form SFN29410 Schedule T-82 Operator's Schedule of Take in-Kind Owners - North Dakota

What Is Form SFN29410 Schedule T-82?

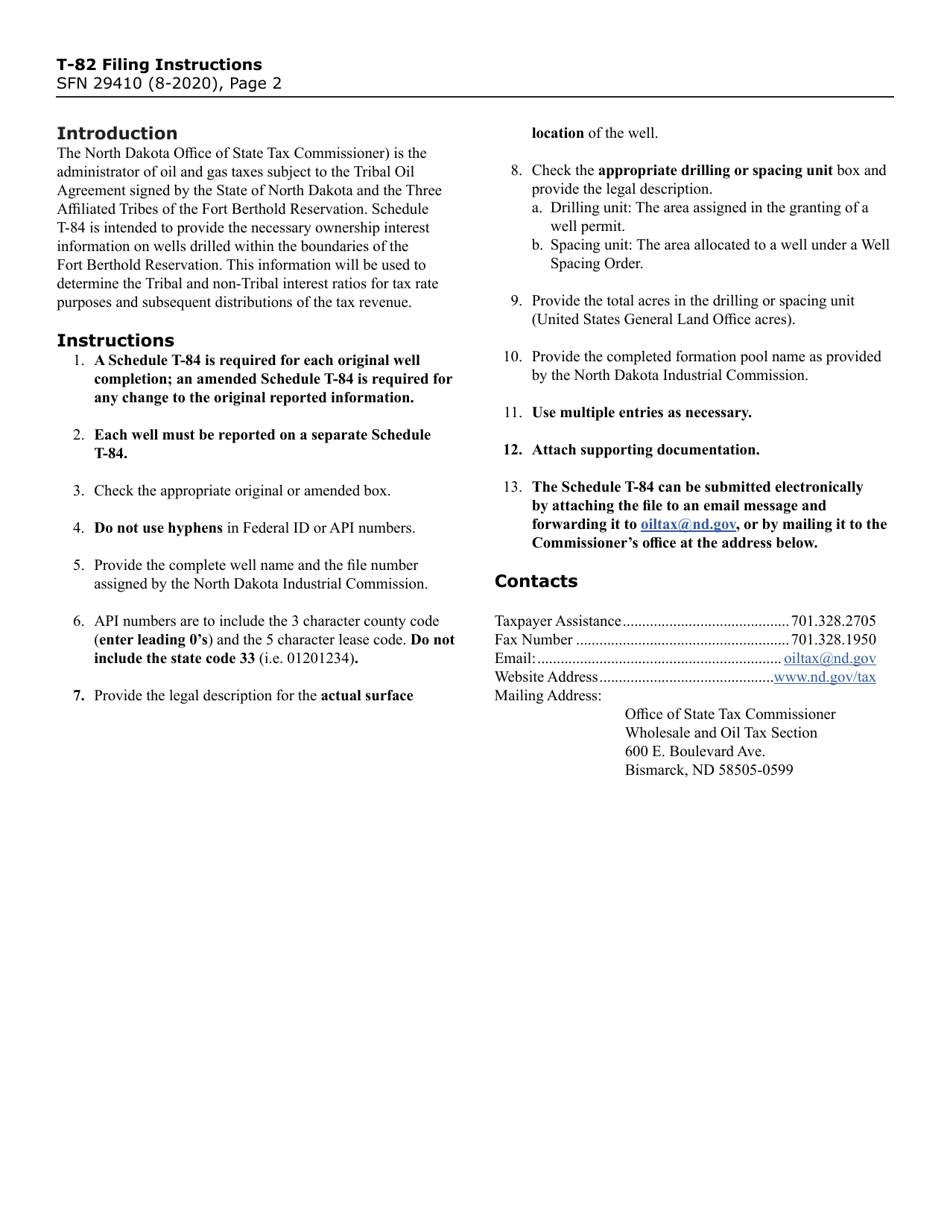

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN29410?

A: Form SFN29410 is the Operator's Schedule of Take in-Kind Owners specifically for North Dakota.

Q: What is Schedule T-82?

A: Schedule T-82 is the specific section of Form SFN29410 that pertains to the Operator's Schedule of Take in-Kind Owners.

Q: Who needs to fill out Form SFN29410?

A: Operators of oil or gas wells in North Dakota who receive take in-kind must fill out Form SFN29410.

Q: What is take in-kind?

A: Take in-kind refers to receiving oil or gas rather than cash as payment for the operator's share of production from a well.

Q: What information is required on Schedule T-82?

A: Schedule T-82 requires the operator to provide detailed information about the take in-kind owners, such as their names, addresses, and percentages of ownership.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN29410 Schedule T-82 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.