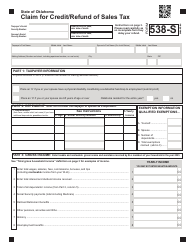

This version of the form is not currently in use and is provided for reference only. Download this version of

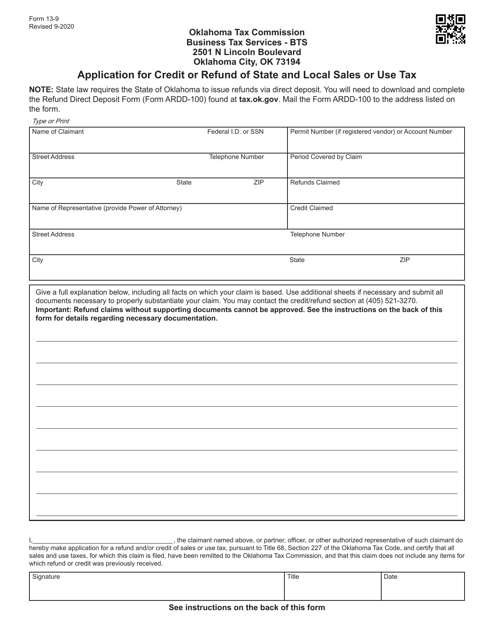

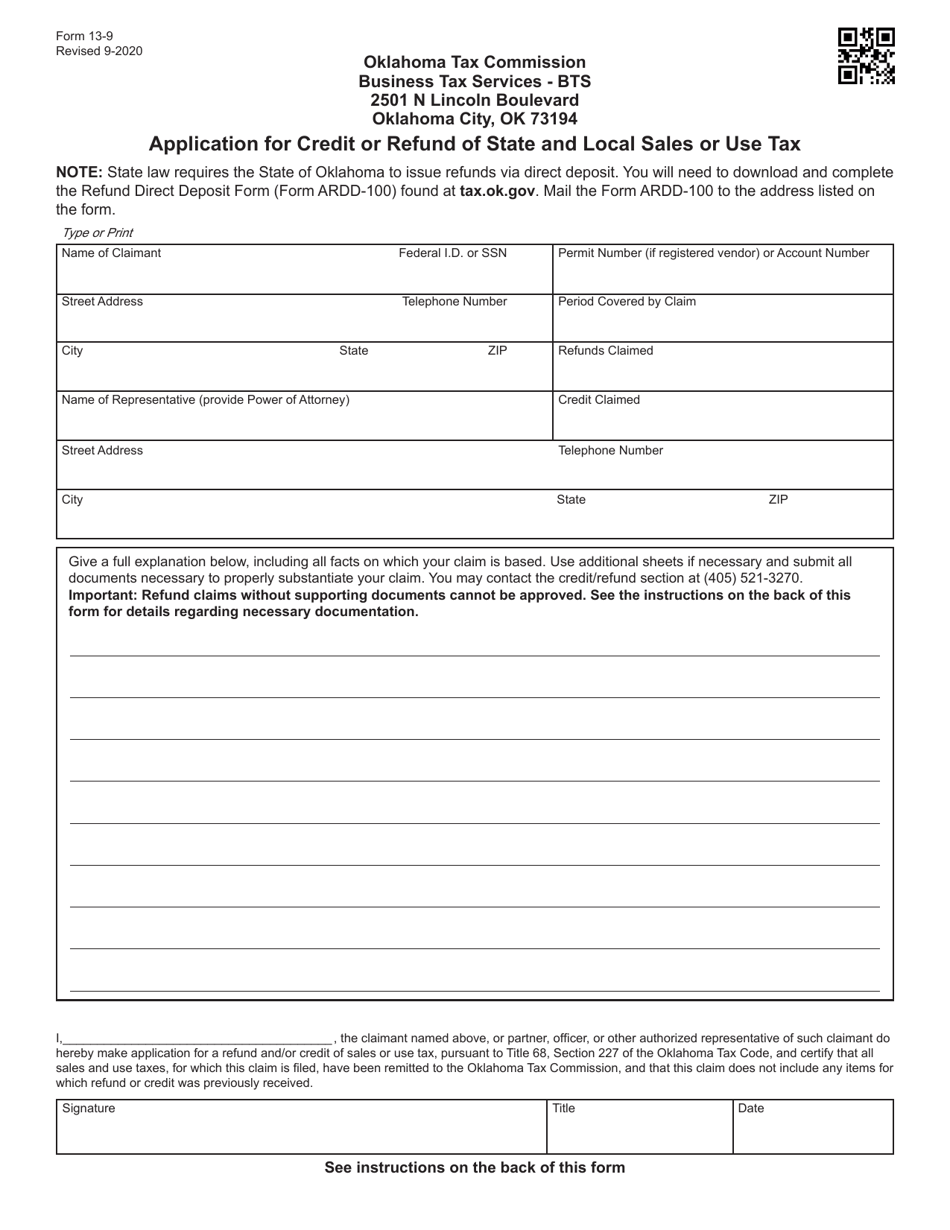

Form 13-9

for the current year.

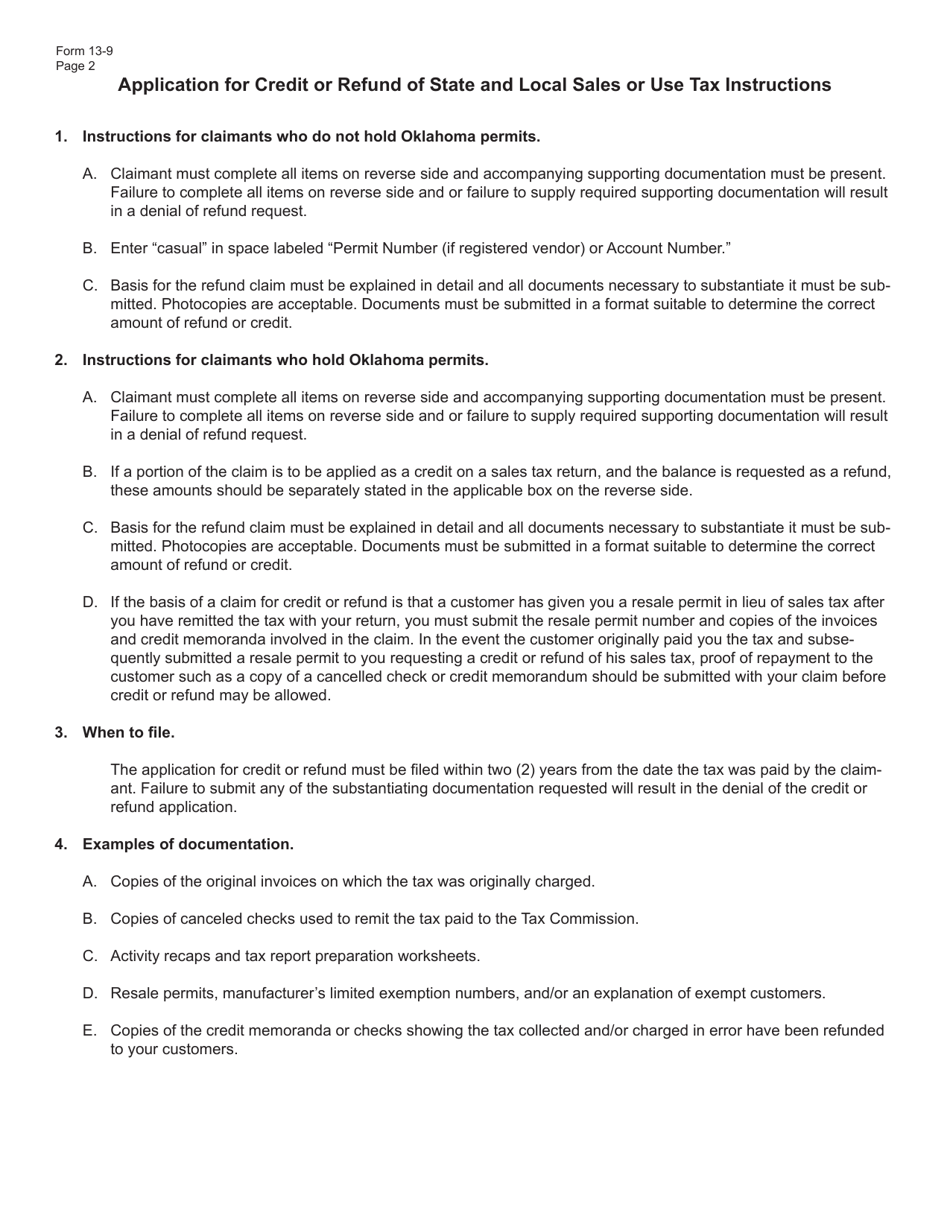

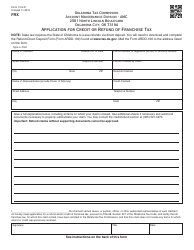

Form 13-9 Application for Credit or Refund of State and Local Sales or Use Tax - Oklahoma

What Is Form 13-9?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 13-9?

A: Form 13-9 is an application for credit or refund of state and local sales or use tax in Oklahoma.

Q: Who can use Form 13-9?

A: Individuals and businesses in Oklahoma who have overpaid or been charged incorrectly for state and local sales or use tax can use Form 13-9.

Q: What is the purpose of Form 13-9?

A: The purpose of Form 13-9 is to apply for a credit or refund of state and local sales or use tax in Oklahoma.

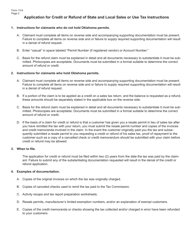

Q: How do I fill out Form 13-9?

A: You need to provide your personal or business information, explain the reason for the refund or credit, and provide supporting documentation with Form 13-9.

Q: When should I submit Form 13-9?

A: You should submit Form 13-9 within three years from the date of the overpayment or incorrect charge.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 13-9 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.