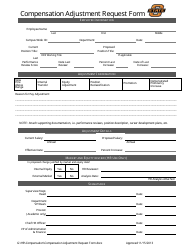

This version of the form is not currently in use and is provided for reference only. Download this version of

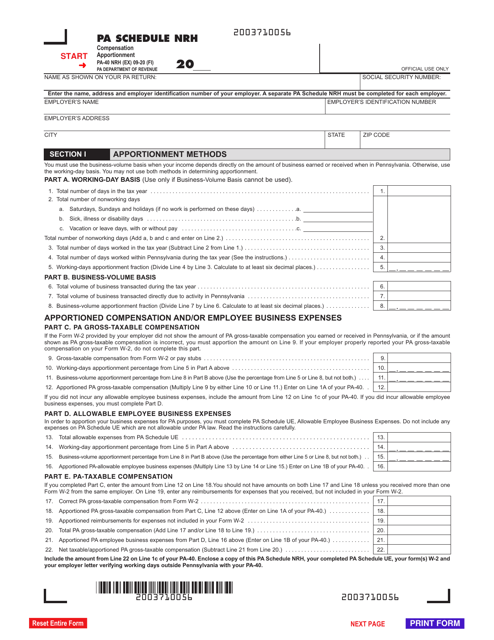

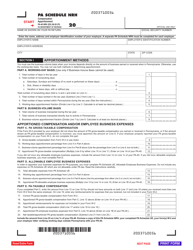

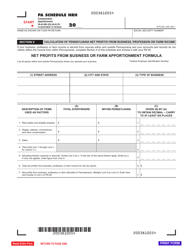

Form PA-40 Schedule NRH

for the current year.

Form PA-40 Schedule NRH Compensation Apportionment - Pennsylvania

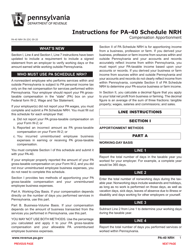

What Is Form PA-40 Schedule NRH?

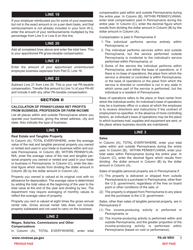

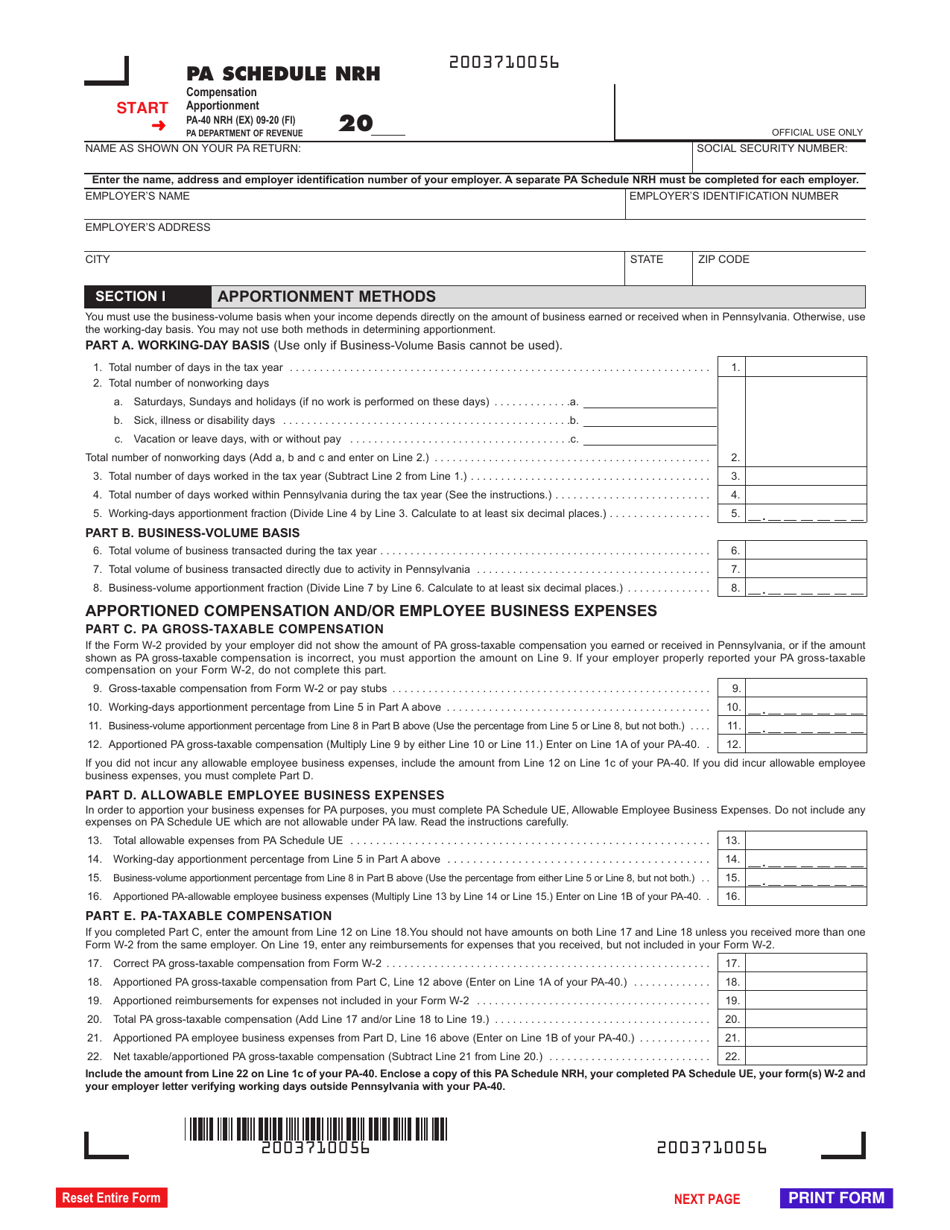

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule NRH?

A: Form PA-40 Schedule NRH is a form used to apportion compensation for Pennsylvania residents with income earned in other states.

Q: What is compensation apportionment?

A: Compensation apportionment is the process of determining how much of a taxpayer's compensation should be allocated to Pennsylvania and other states.

Q: Who should file Form PA-40 Schedule NRH?

A: Pennsylvania residents who earn income in other states and want to apportion their compensation should file Form PA-40 Schedule NRH.

Q: Are all types of compensation subject to apportionment?

A: No, only certain types of compensation, such as salaries, wages, bonuses, and commissions, are subject to apportionment.

Q: How does the apportionment process work?

A: The apportionment process involves calculating the ratio of days worked in Pennsylvania to total days worked everywhere, and applying that ratio to the total compensation earned.

Q: Is there a deadline to file Form PA-40 Schedule NRH?

A: Yes, Form PA-40 Schedule NRH must be filed with your Pennsylvania tax return by the due date, which is usually April 15th.

Q: Do I need to attach any supporting documentation with Form PA-40 Schedule NRH?

A: Yes, you may need to attach copies of your federal tax return and your nonresident state tax return(s) to support your apportionment calculation.

Q: Can I electronically file Form PA-40 Schedule NRH?

A: Yes, you can electronically file Form PA-40 Schedule NRH using approved tax preparation software or through the Pennsylvania Department of Revenue's e-file system.

Q: What happens if I don't file Form PA-40 Schedule NRH?

A: If you have earned income in other states and do not file Form PA-40 Schedule NRH, you may be subject to penalties and interest for underreporting your Pennsylvania tax liability.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule NRH by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.