This version of the form is not currently in use and is provided for reference only. Download this version of

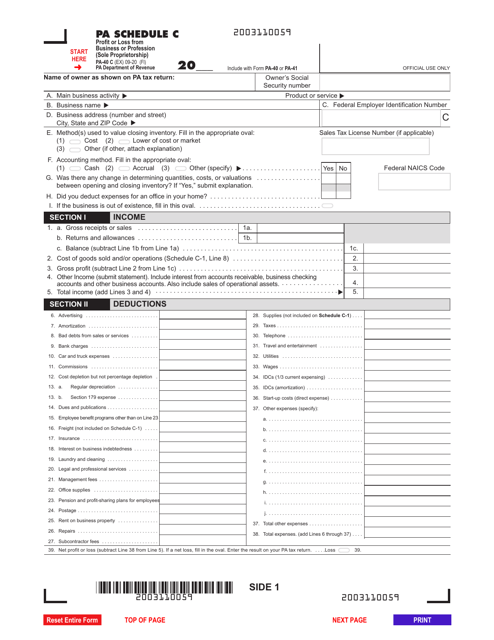

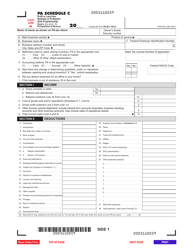

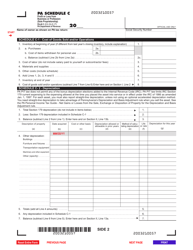

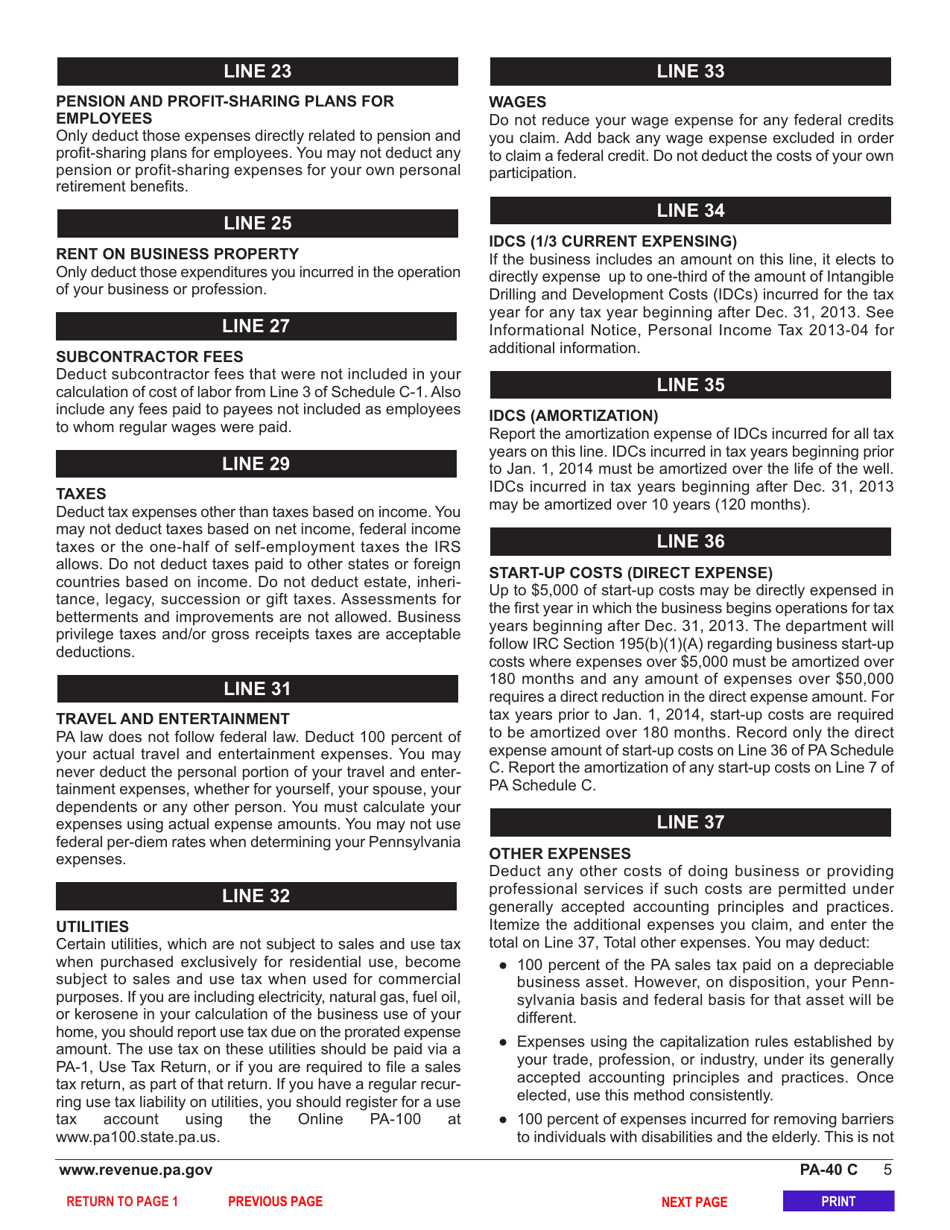

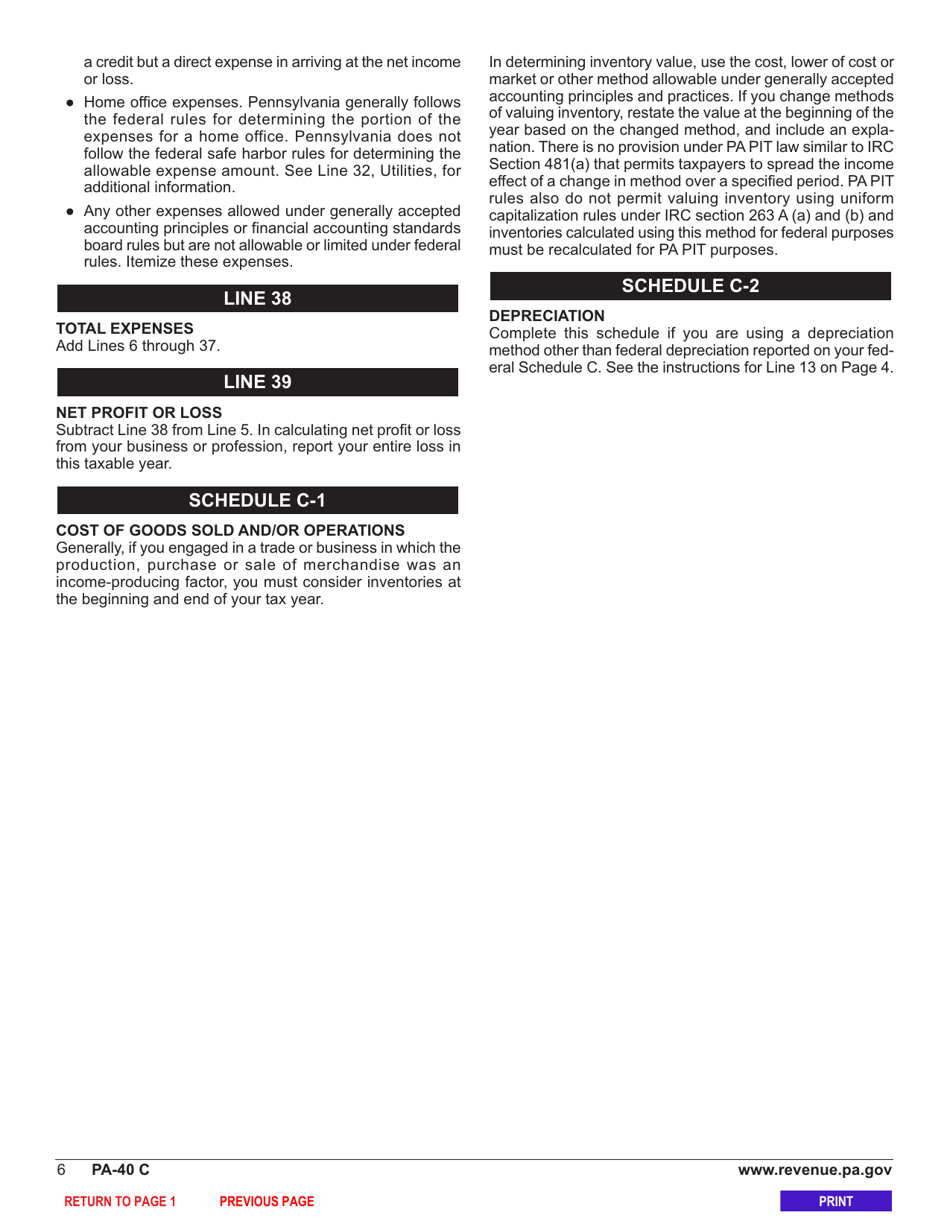

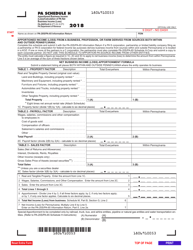

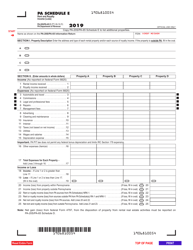

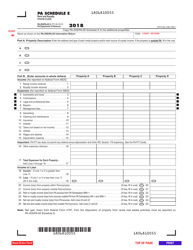

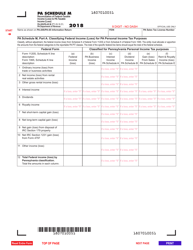

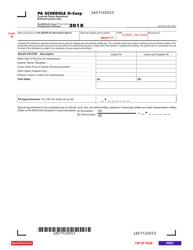

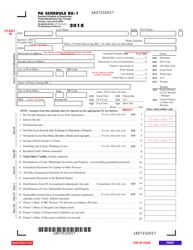

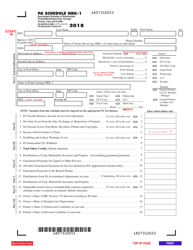

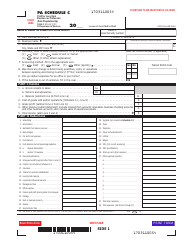

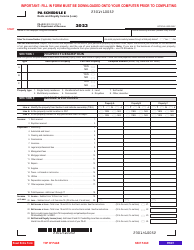

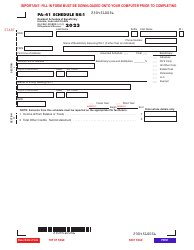

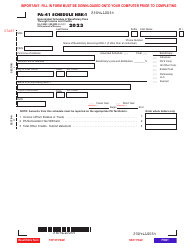

Form PA-40 Schedule C

for the current year.

Form PA-40 Schedule C Profit or Loss From Business or Profession (Sole Proprietorship) - Pennsylvania

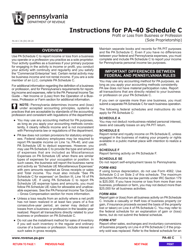

What Is Form PA-40 Schedule C?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

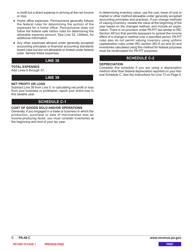

Q: What is Form PA-40 Schedule C?

A: Form PA-40 Schedule C is a form used in Pennsylvania to report the profit or loss from a business or profession operated as a sole proprietorship.

Q: Who needs to file Form PA-40 Schedule C?

A: Individuals who operate a business or profession as a sole proprietorship in Pennsylvania need to file Form PA-40 Schedule C.

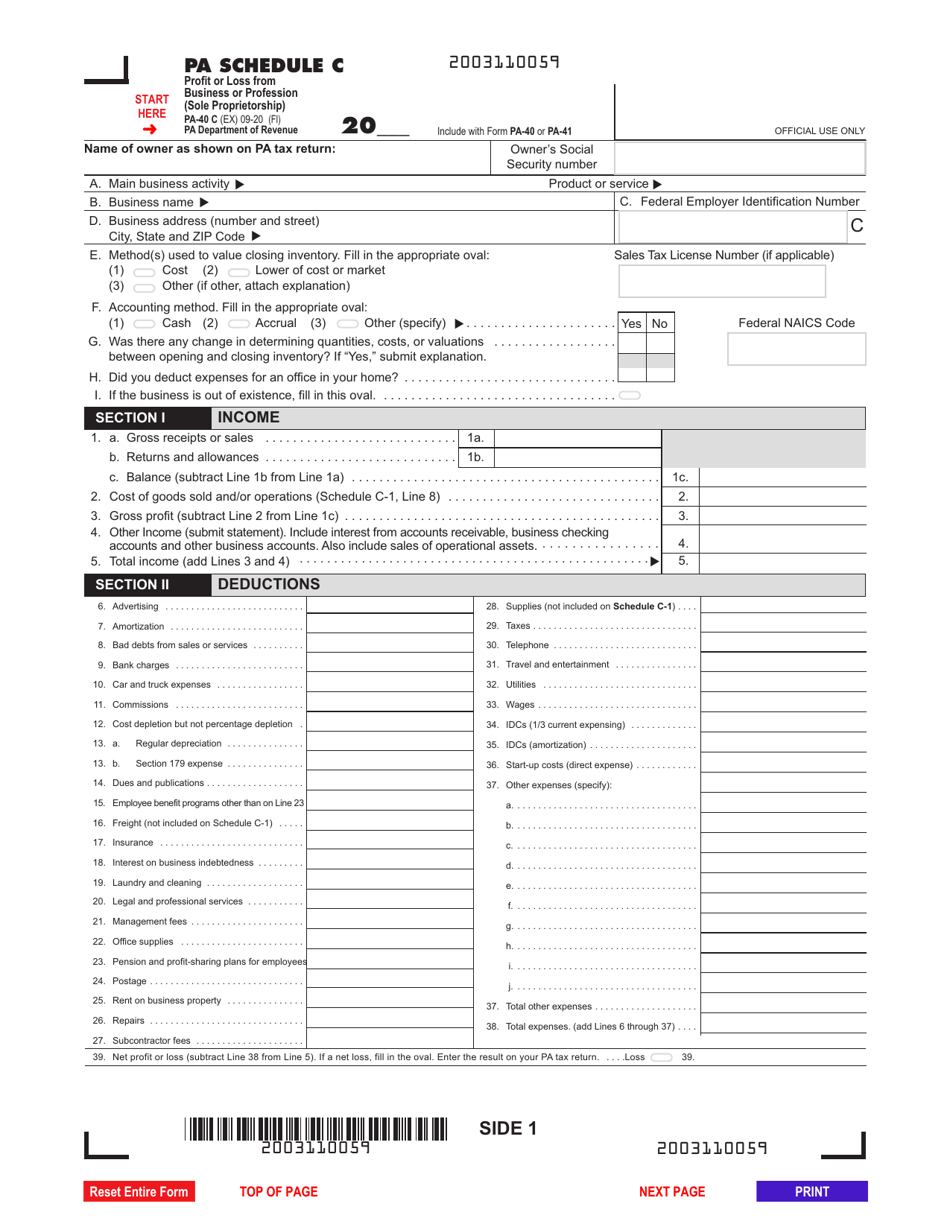

Q: What is reported on Form PA-40 Schedule C?

A: Form PA-40 Schedule C is used to report the income, expenses, and deductions related to the sole proprietorship business or profession.

Q: When is the deadline to file Form PA-40 Schedule C?

A: Form PA-40 Schedule C is typically due on the same date as the individual income tax return, which is April 15th of each year.

Q: Are there any specific requirements for keeping records related to Form PA-40 Schedule C?

A: Yes, you should keep records of all income, expenses, and deductions related to your sole proprietorship business or profession for at least 3 years.

Q: Can I use Form PA-40 Schedule C if I have a partnership or corporation?

A: No, Form PA-40 Schedule C is specifically for reporting the profit or loss from a sole proprietorship. Partnerships and corporations have different forms for reporting their income and expenses.

Q: What should I do if I made a mistake on my Form PA-40 Schedule C?

A: If you made a mistake on your Form PA-40 Schedule C, you may need to file an amended return using Form PA-40X to correct the error.

Q: Is there a fee for filing Form PA-40 Schedule C?

A: No, there is no fee for filing Form PA-40 Schedule C. However, you may owe taxes based on the profit of your sole proprietorship.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule C by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.