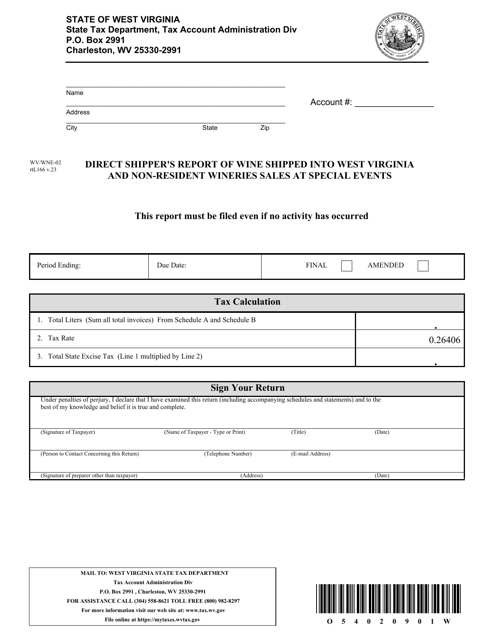

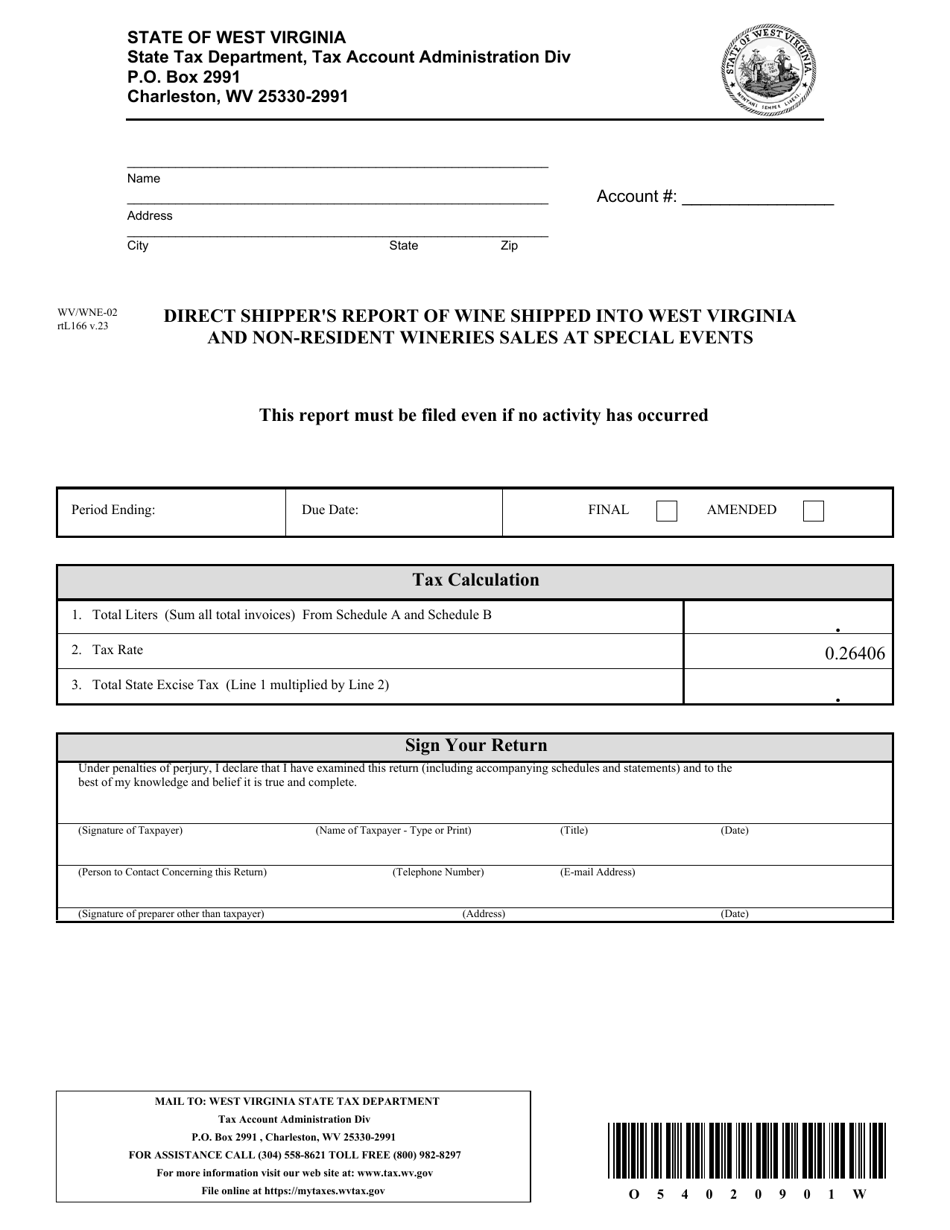

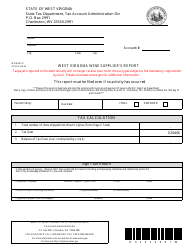

Form WV / WNE-02 Direct Shipper's Report of Wine Shipped Into West Virginia and Non-resident Wineries Sales at Special Events - West Virginia

What Is Form WV/WNE-02?

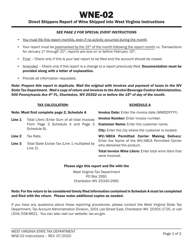

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form WV/WNE-02?

A: Form WV/WNE-02 is a Direct Shipper's Report of Wine Shipped Into West Virginia and Non-resident Wineries Sales at Special Events.

Q: Who needs to file form WV/WNE-02?

A: Direct shippers of wine into West Virginia and non-resident wineries who make sales at special events are required to file form WV/WNE-02.

Q: What is the purpose of form WV/WNE-02?

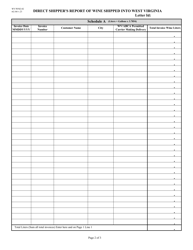

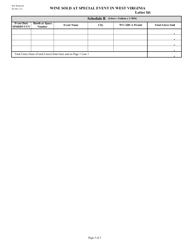

A: The purpose of form WV/WNE-02 is to report wine shipments into West Virginia and sales made by non-resident wineries at special events.

Q: When is form WV/WNE-02 due?

A: Form WV/WNE-02 is due on or before the 20th day of the month following the end of the reporting period.

Q: What information is required on form WV/WNE-02?

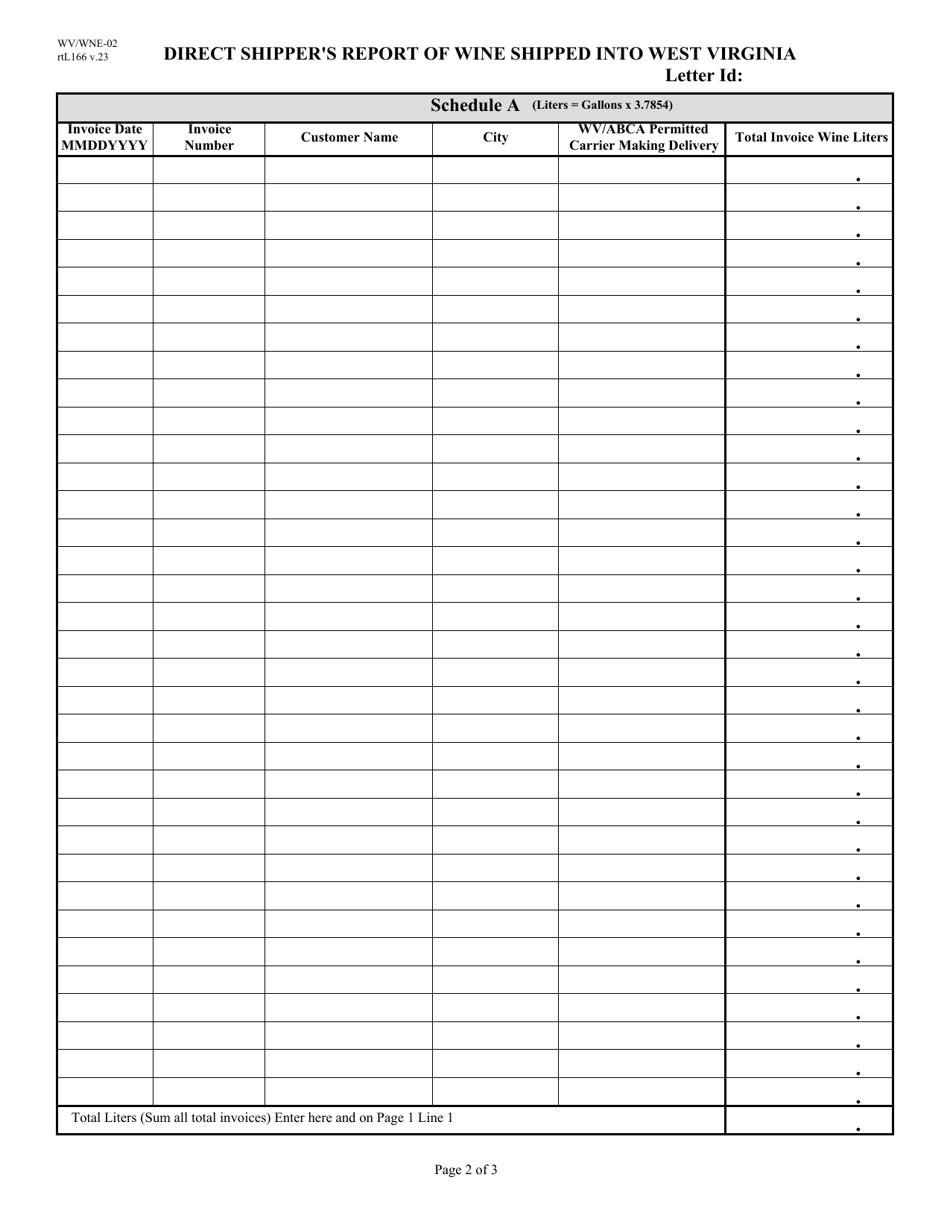

A: Form WV/WNE-02 requires information such as the direct shipper's or non-resident winery's name and address, details of wine shipments or sales, and the amount of taxes collected.

Q: Are there any penalties for not filing form WV/WNE-02?

A: Yes, failure to file form WV/WNE-02 or filing false or incomplete information may result in penalties and interest charges.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/WNE-02 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.