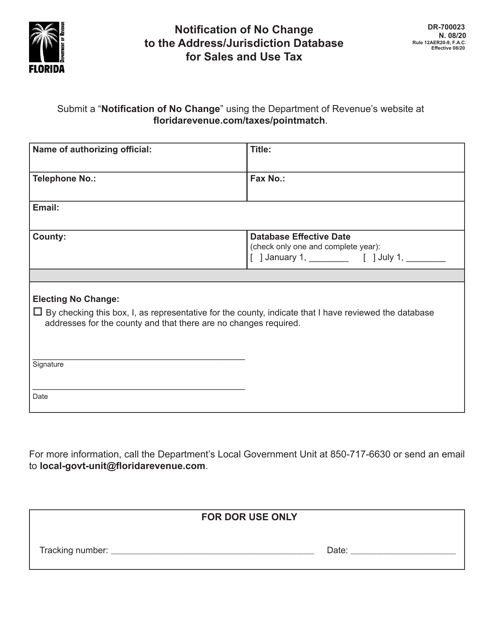

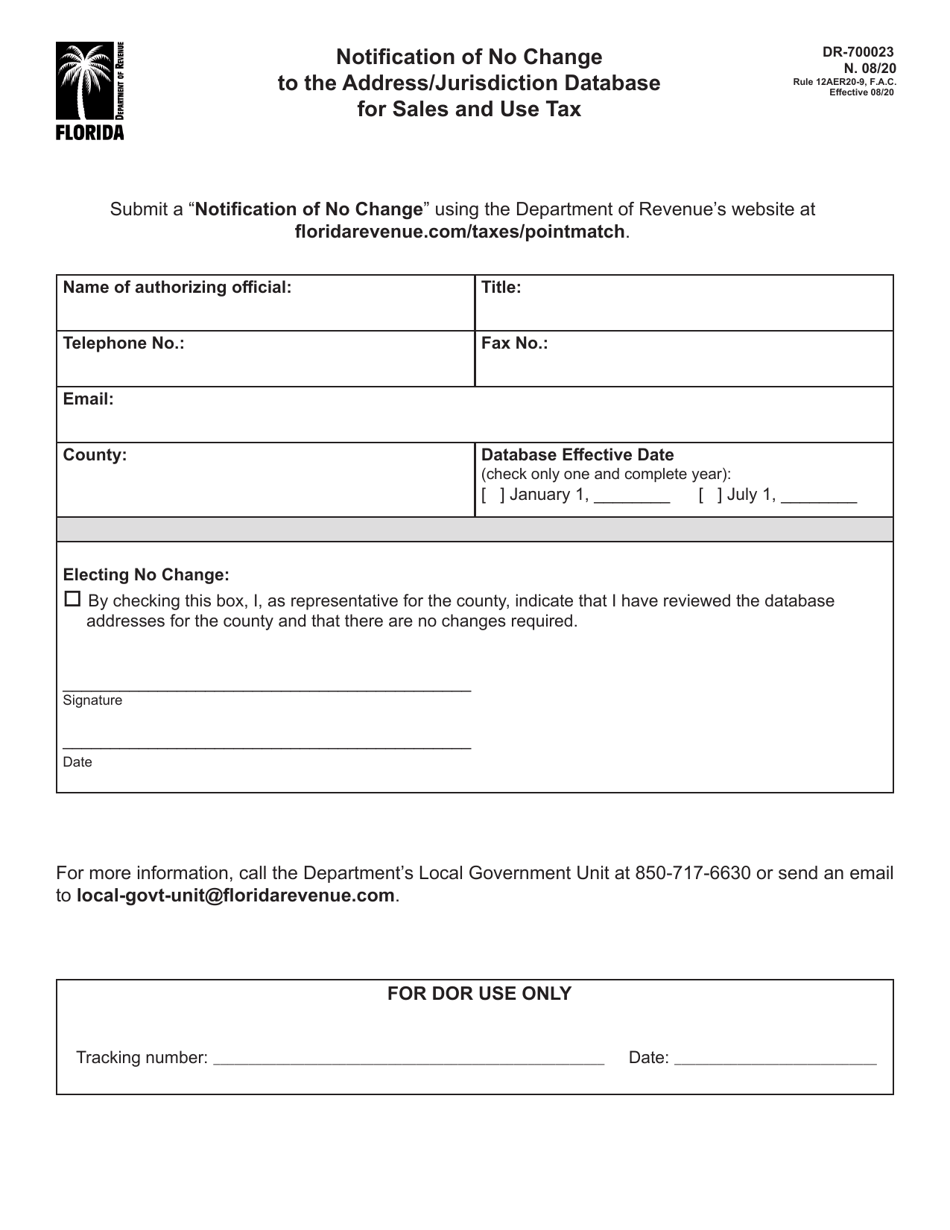

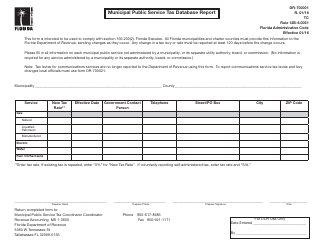

Form DR-700023 Notification of No Change to the Address / Jurisdiction Database for Sales and Use Tax - Florida

What Is Form DR-700023?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-700023?

A: Form DR-700023 is a form used to notify the Florida Department of Revenue of no changes to the address/jurisdiction database for sales and use tax.

Q: What is the purpose of Form DR-700023?

A: The purpose of Form DR-700023 is to inform the Florida Department of Revenue that there have been no changes to the address/jurisdiction database for sales and use tax.

Q: When should Form DR-700023 be filed?

A: Form DR-700023 should be filed when there have been no changes to the address/jurisdiction database for sales and use tax.

Q: Who should file Form DR-700023?

A: Anyone who needs to notify the Florida Department of Revenue of no changes to the address/jurisdiction database for sales and use tax should file Form DR-700023.

Q: Is there a fee for filing Form DR-700023?

A: No, there is no fee for filing Form DR-700023.

Q: Are there any penalties for not filing Form DR-700023?

A: There are no penalties for not filing Form DR-700023, but it is recommended to file the form if there have been no changes to the address/jurisdiction database for sales and use tax.

Q: What other documentation do I need to submit with Form DR-700023?

A: No additional documentation needs to be submitted with Form DR-700023 if there have been no changes to the address/jurisdiction database for sales and use tax.

Q: How often should Form DR-700023 be filed?

A: Form DR-700023 should be filed annually if there have been no changes to the address/jurisdiction database for sales and use tax.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-700023 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.