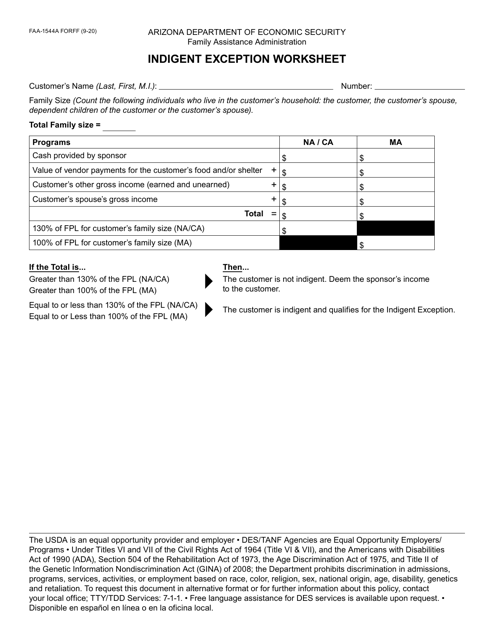

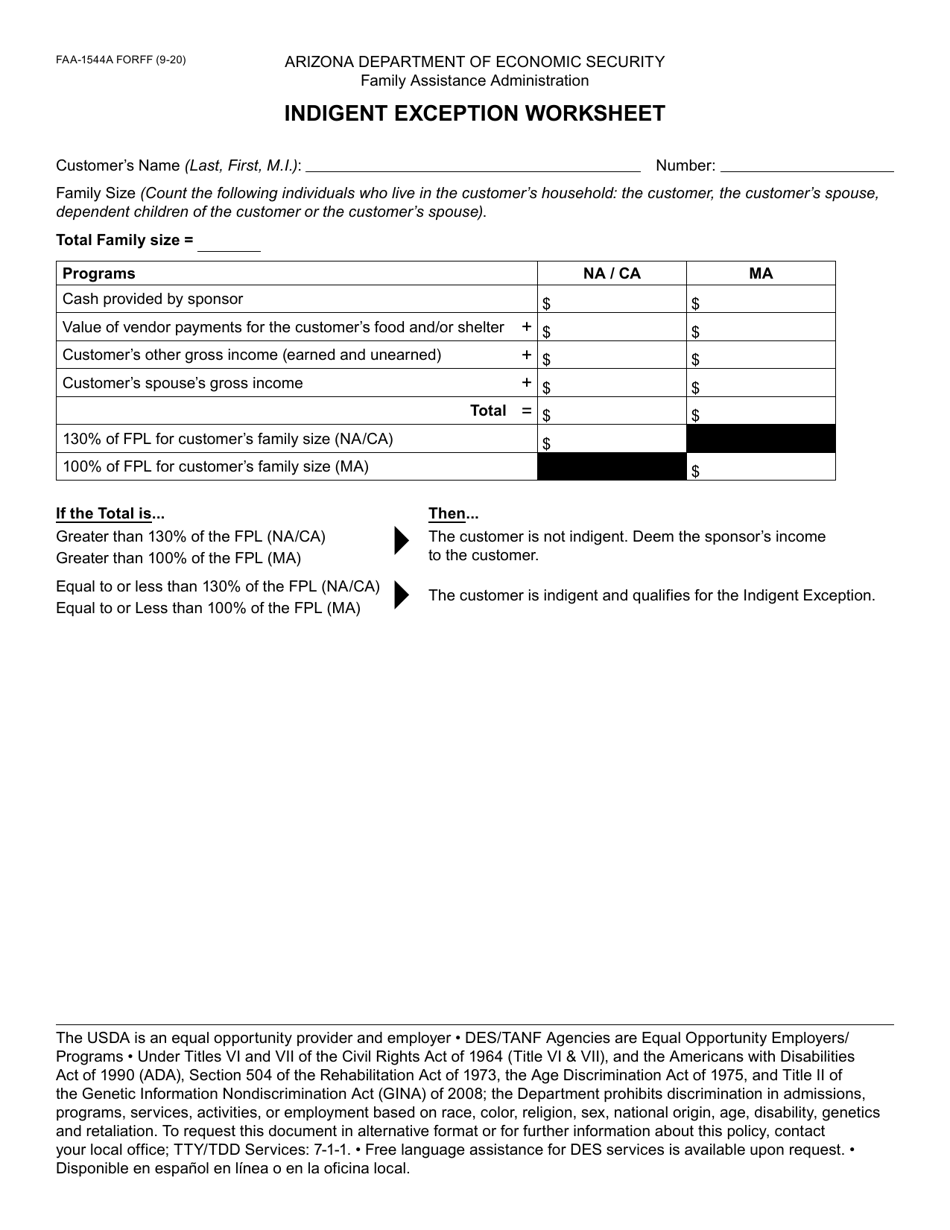

Form FAA-1544A Indigent Exception Worksheet - Arizona

What Is Form FAA-1544A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form FAA-1544A?

A: The Form FAA-1544A is the Indigent Exception Worksheet.

Q: What is the purpose of the Form FAA-1544A?

A: The purpose of the Form FAA-1544A is to determine if an individual qualifies for an indigent exception.

Q: What is an indigent exception?

A: An indigent exception is a provision that allows individuals with low income to be exempt from certain fees or charges.

Q: Who should use the Form FAA-1544A?

A: Individuals in the state of Arizona seeking an indigent exception should use the Form FAA-1544A.

Q: Is the Form FAA-1544A specific to Arizona?

A: Yes, the Form FAA-1544A is specific to Arizona.

Q: What information is required on the Form FAA-1544A?

A: The Form FAA-1544A requires information about the individual's income, assets, and expenses.

Q: How can I submit the Form FAA-1544A?

A: The Form FAA-1544A can be submitted by mail or in person to the appropriate agency.

Q: What happens after I submit the Form FAA-1544A?

A: After submitting the Form FAA-1544A, your eligibility for an indigent exception will be reviewed by the relevant agency.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FAA-1544A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.