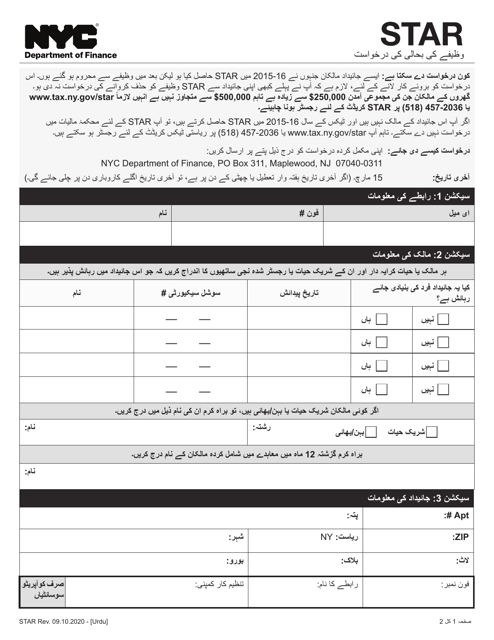

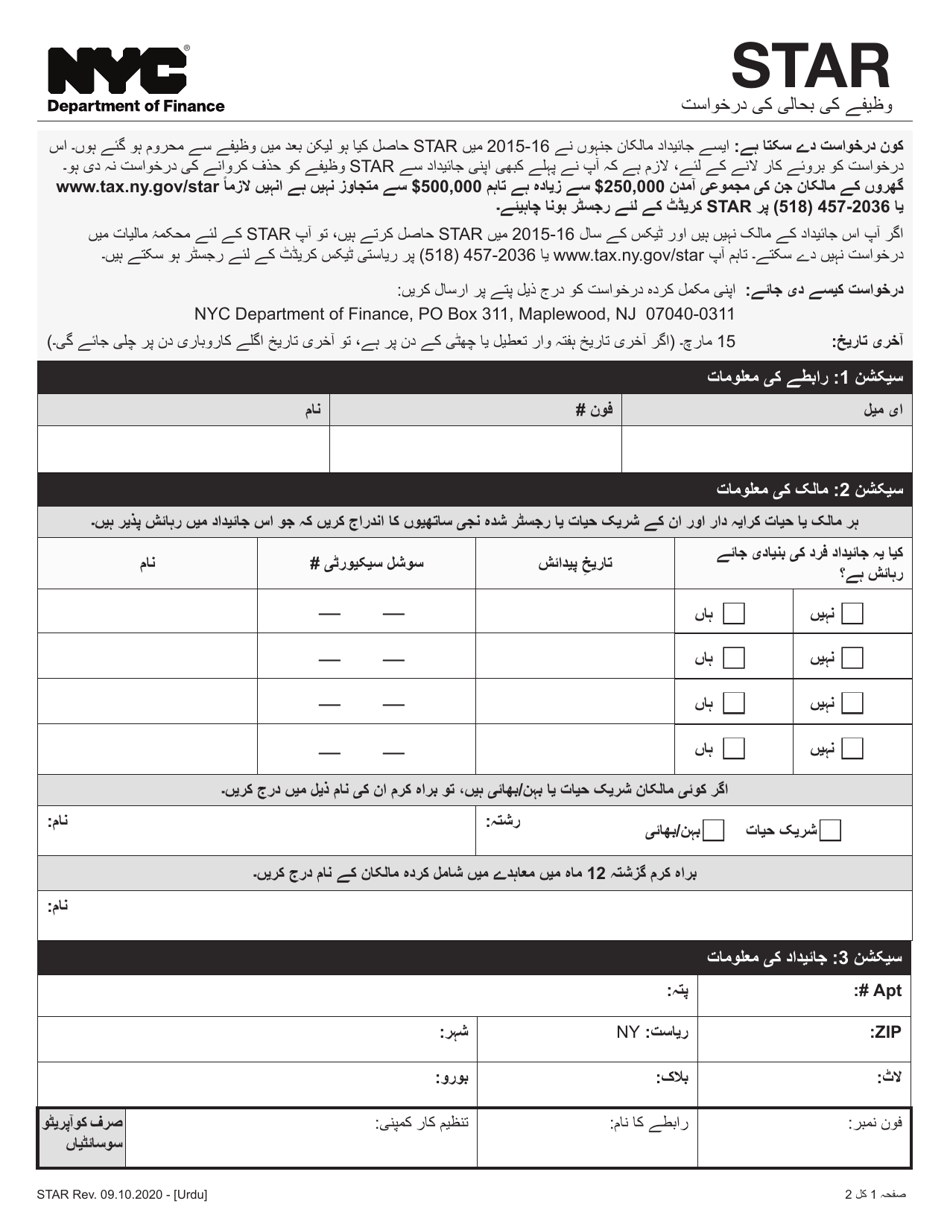

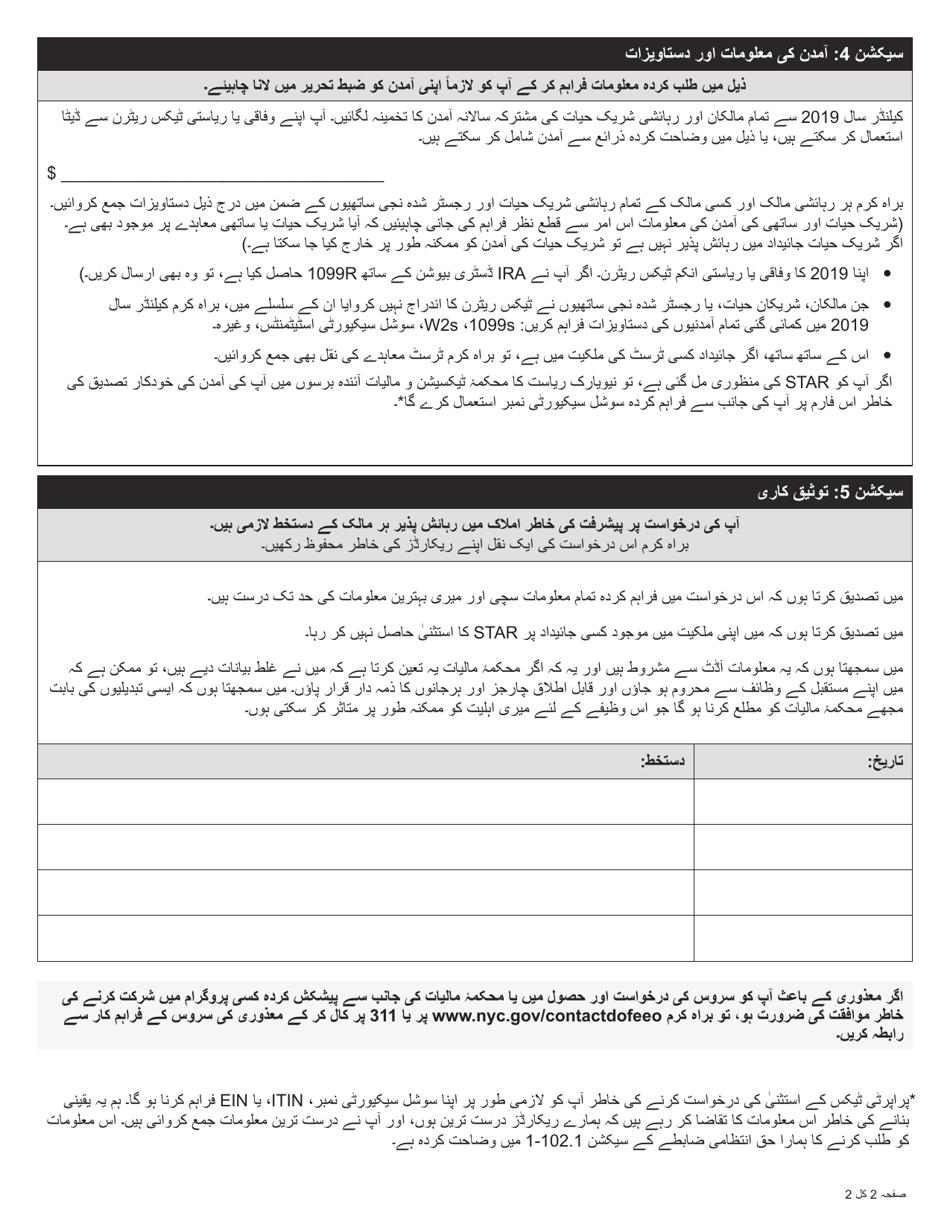

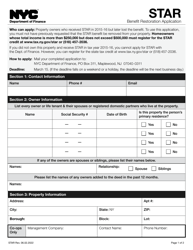

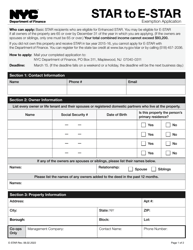

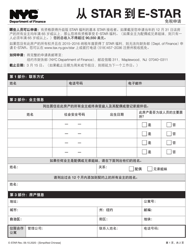

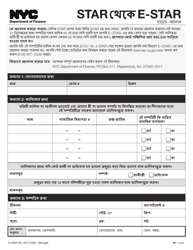

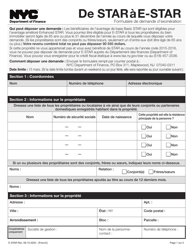

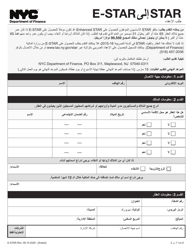

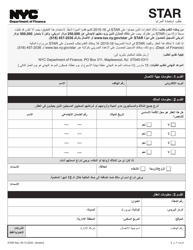

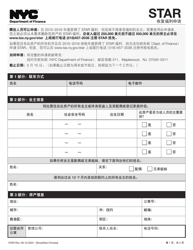

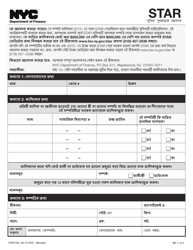

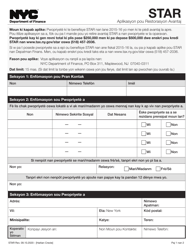

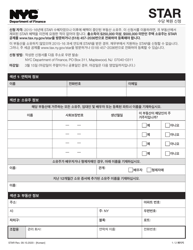

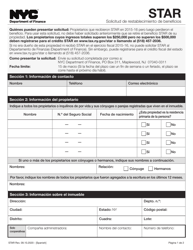

Star Benefit Restoration Application - New York City (Urdu)

This is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

The document is provided in Urdu.

FAQ

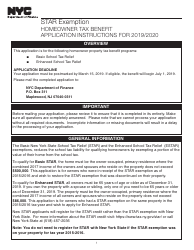

Q: What is the Star Benefit Restoration Application?

A: The Star Benefit Restoration Application is a process in New York City to apply for a restoration of a previous STAR exemption.

Q: What is the STAR exemption?

A: The STAR exemption is a tax benefit program in New York State that provides property tax reductions for eligible homeowners.

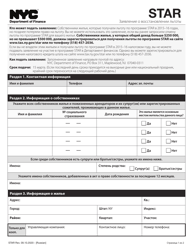

Q: Who is eligible for the Star Benefit Restoration Application?

A: Homeowners in New York City who have previously received the STAR exemption but had it removed may be eligible for the Star Benefit Restoration Application.

Q: How can I apply for the Star Benefit Restoration Application?

A: You can apply for the Star Benefit Restoration Application by completing the application form and submitting it to the designated office in New York City.

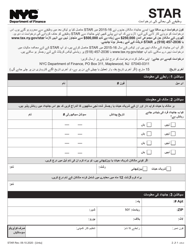

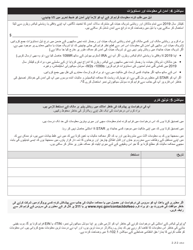

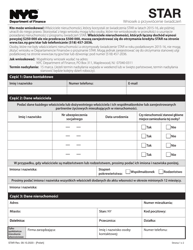

Q: What documents do I need to include with my application?

A: You may need to include documents such as proof of residency, previous STAR exemption letter, and any other relevant documentation as specified in the application form.

Q: Is there a deadline to submit the Star Benefit Restoration Application?

A: Yes, there is a deadline to submit the Star Benefit Restoration Application, and it is typically mentioned in the application form or guidelines.

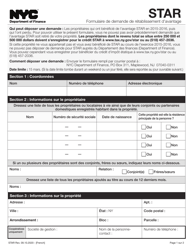

Form Details:

- Released on September 10, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.