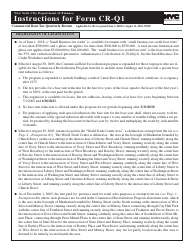

This version of the form is not currently in use and is provided for reference only. Download this version of

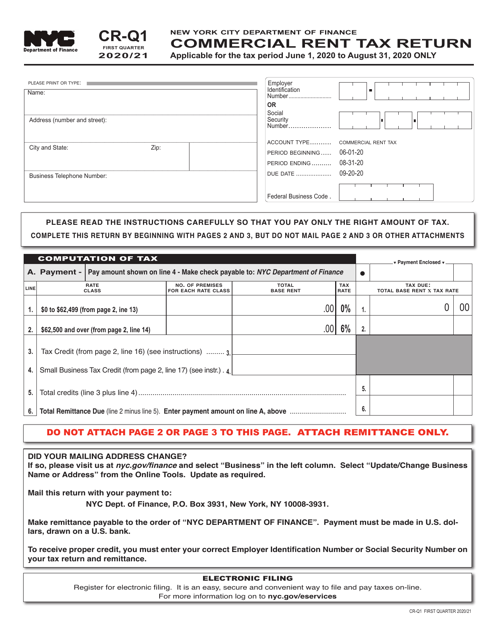

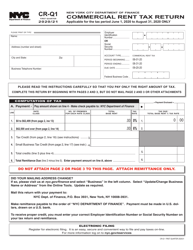

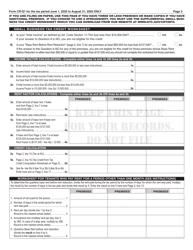

Form CR-Q1

for the current year.

Form CR-Q1 Commercial Rent Tax Return - New York City

What Is Form CR-Q1?

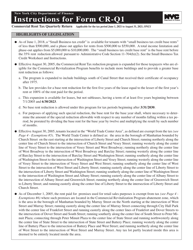

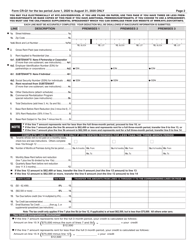

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

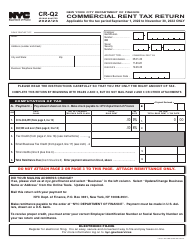

Q: What is the Form CR-Q1?

A: The Form CR-Q1 is the Commercial Rent Tax Return for businesses in New York City.

Q: Who needs to file the Form CR-Q1?

A: Businesses that pay commercial rent in New York City are required to file the Form CR-Q1.

Q: What is the Commercial Rent Tax?

A: The Commercial Rent Tax is a tax imposed on businesses that pay rent for certain commercial properties in New York City.

Q: What is the purpose of filing the Form CR-Q1?

A: The purpose of filing the Form CR-Q1 is to report and pay the Commercial Rent Tax owed to the City of New York.

Q: When is the Form CR-Q1 due?

A: The Form CR-Q1 is due on a quarterly basis, and the due dates are April 30, July 31, October 31, and January 31 of each year.

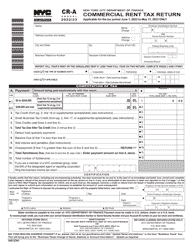

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CR-Q1 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.