This version of the form is not currently in use and is provided for reference only. Download this version of

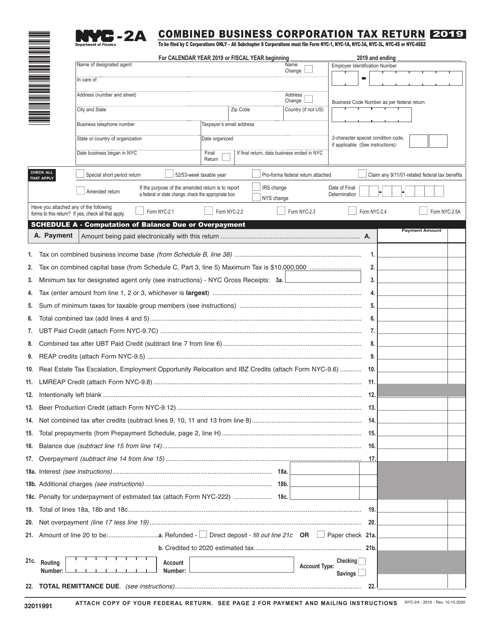

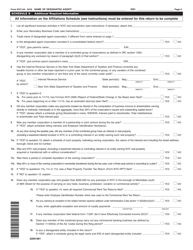

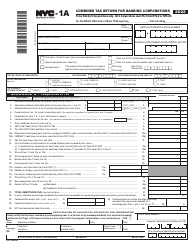

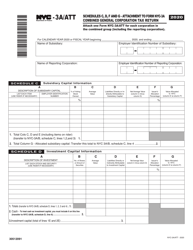

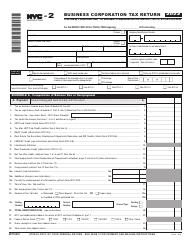

Form NYC-2A

for the current year.

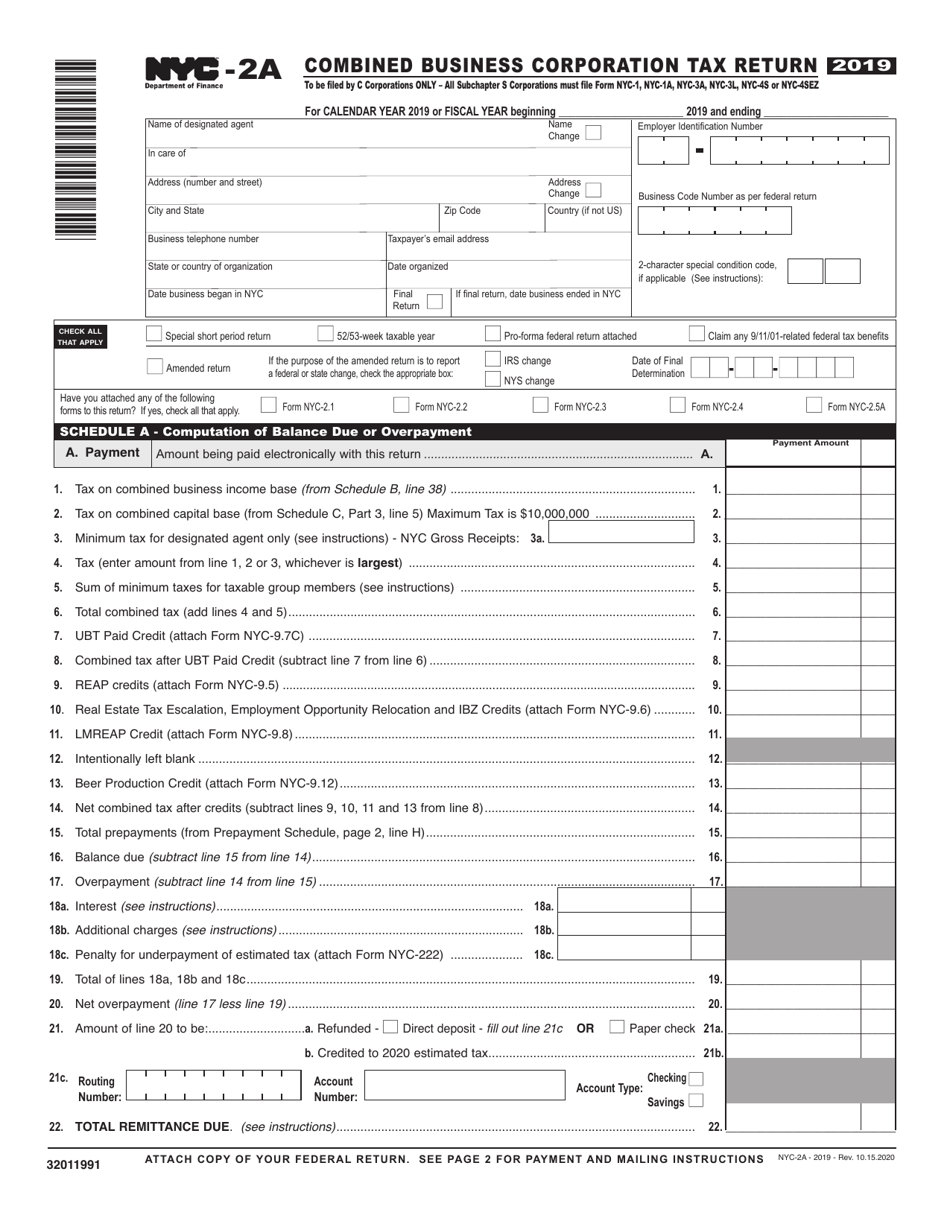

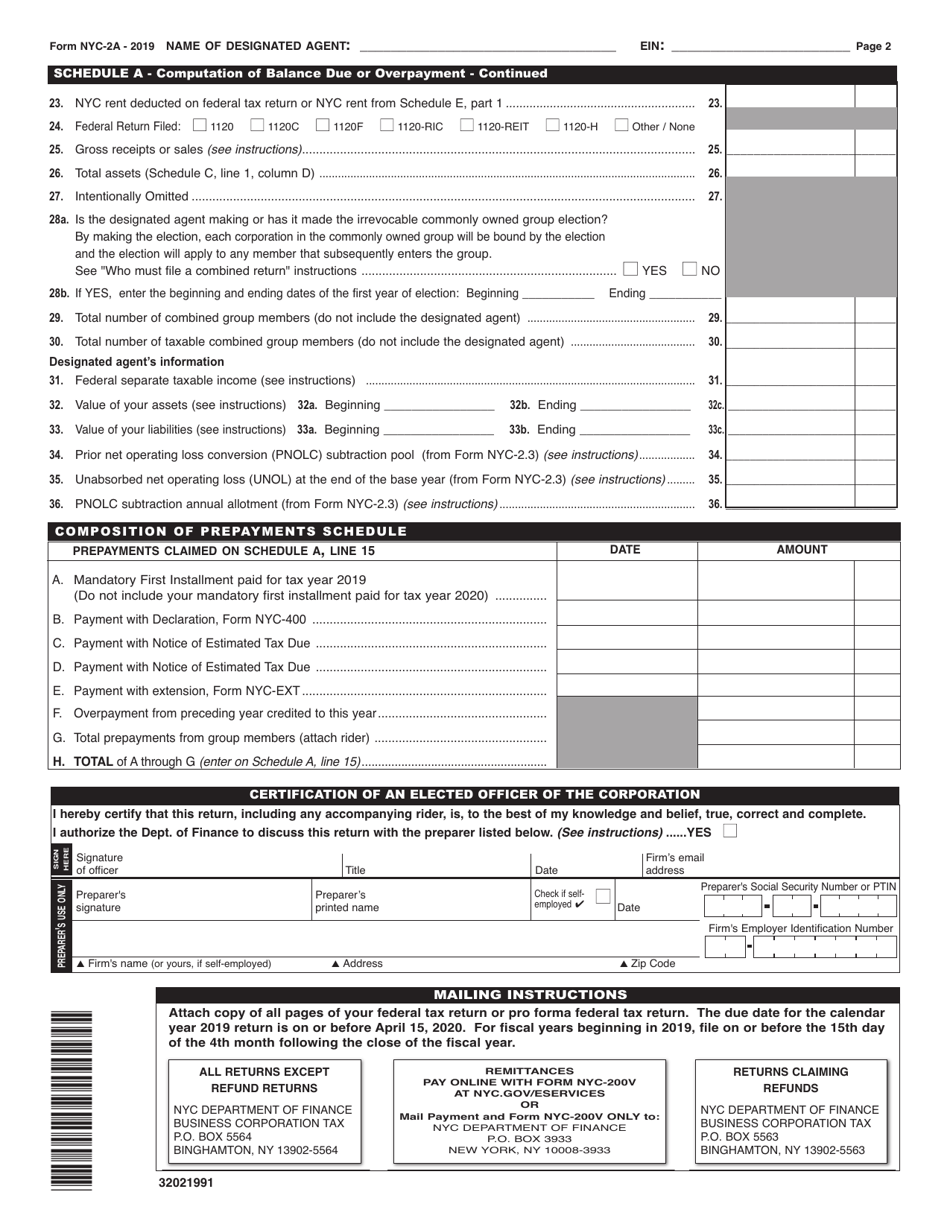

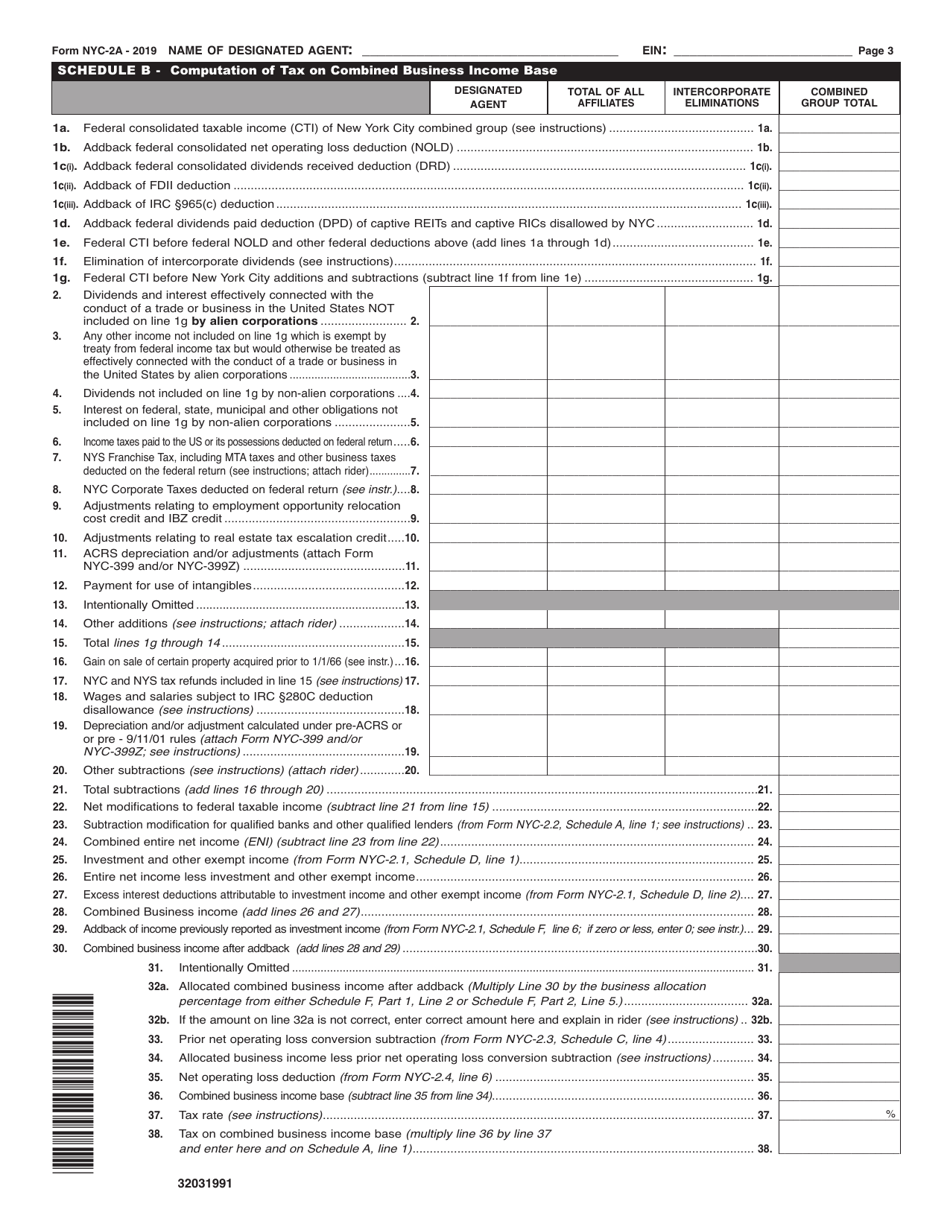

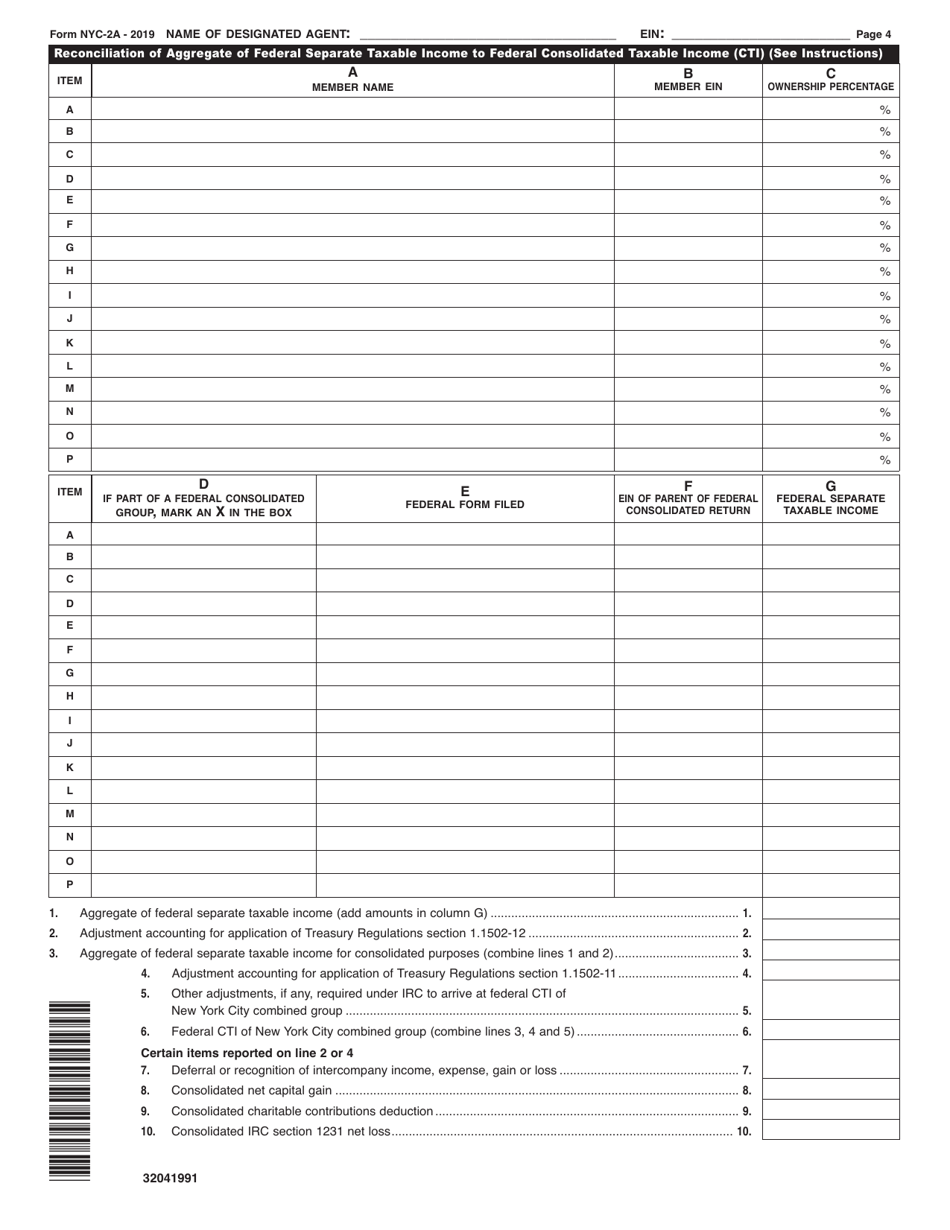

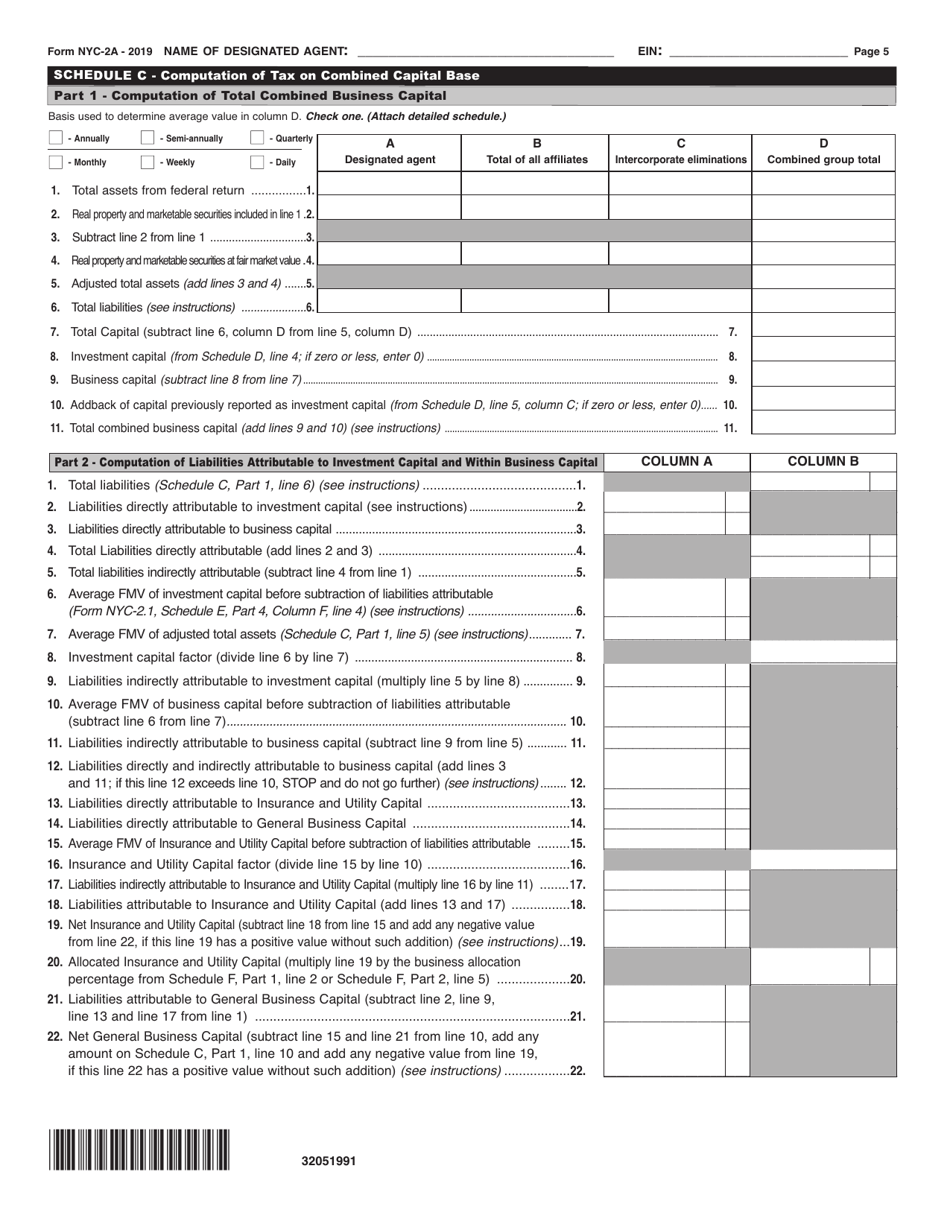

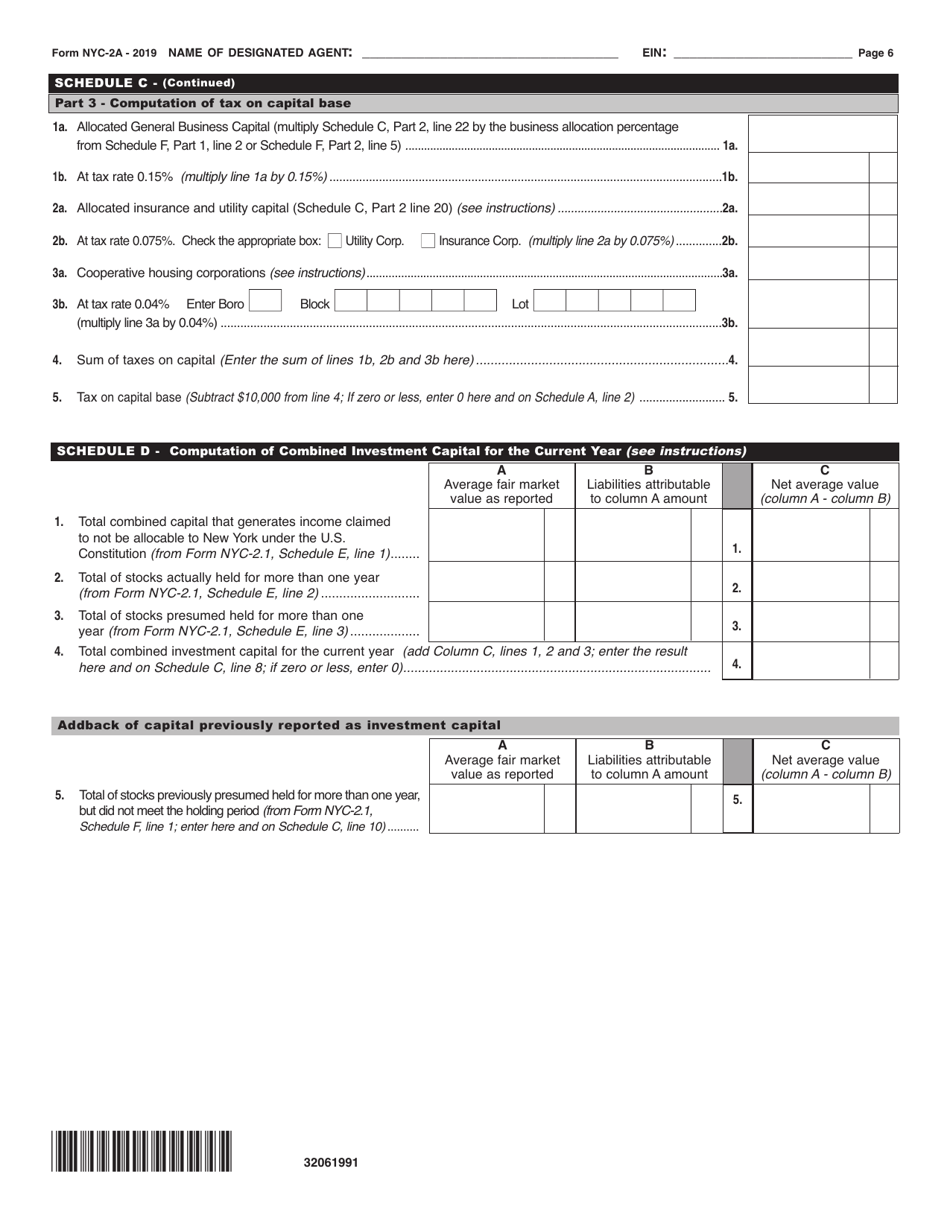

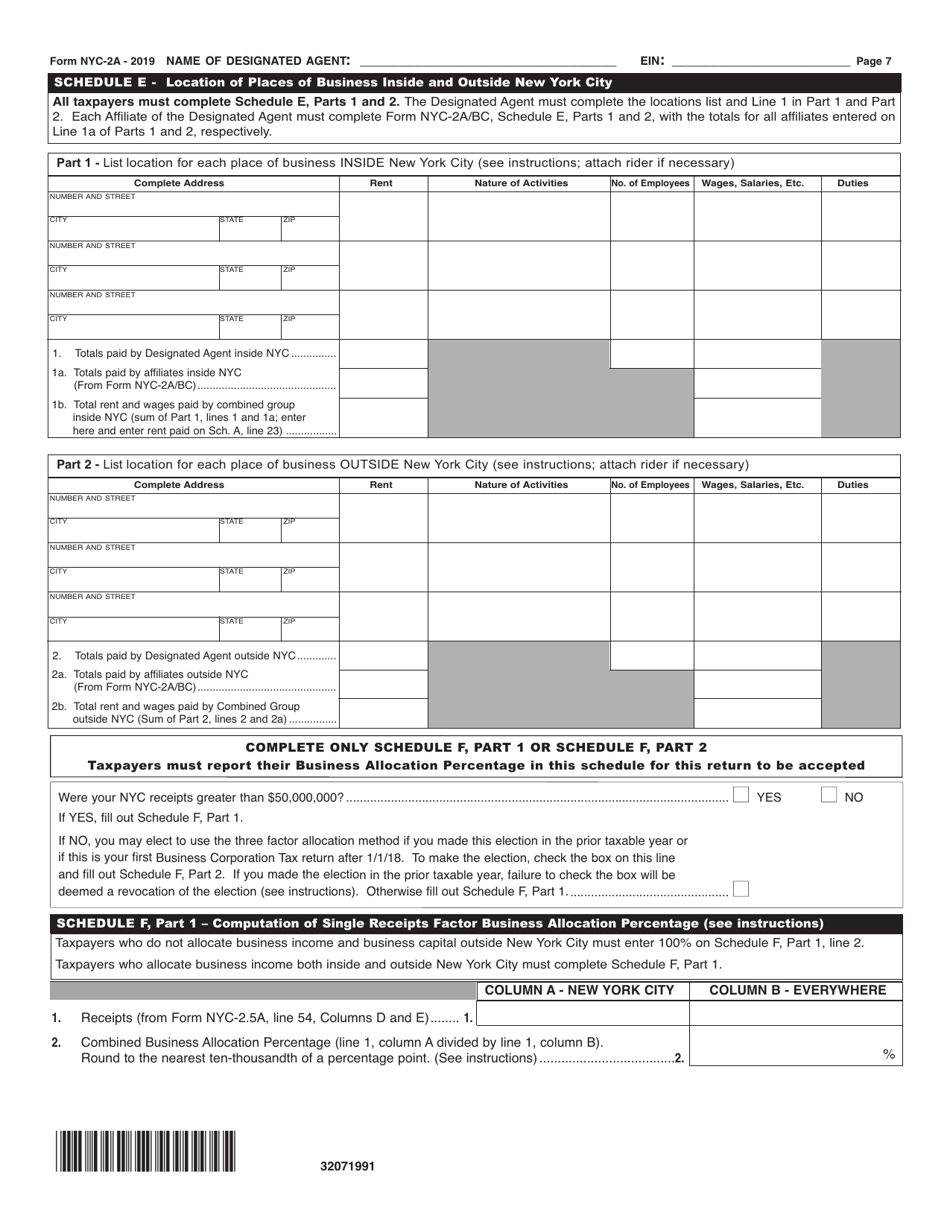

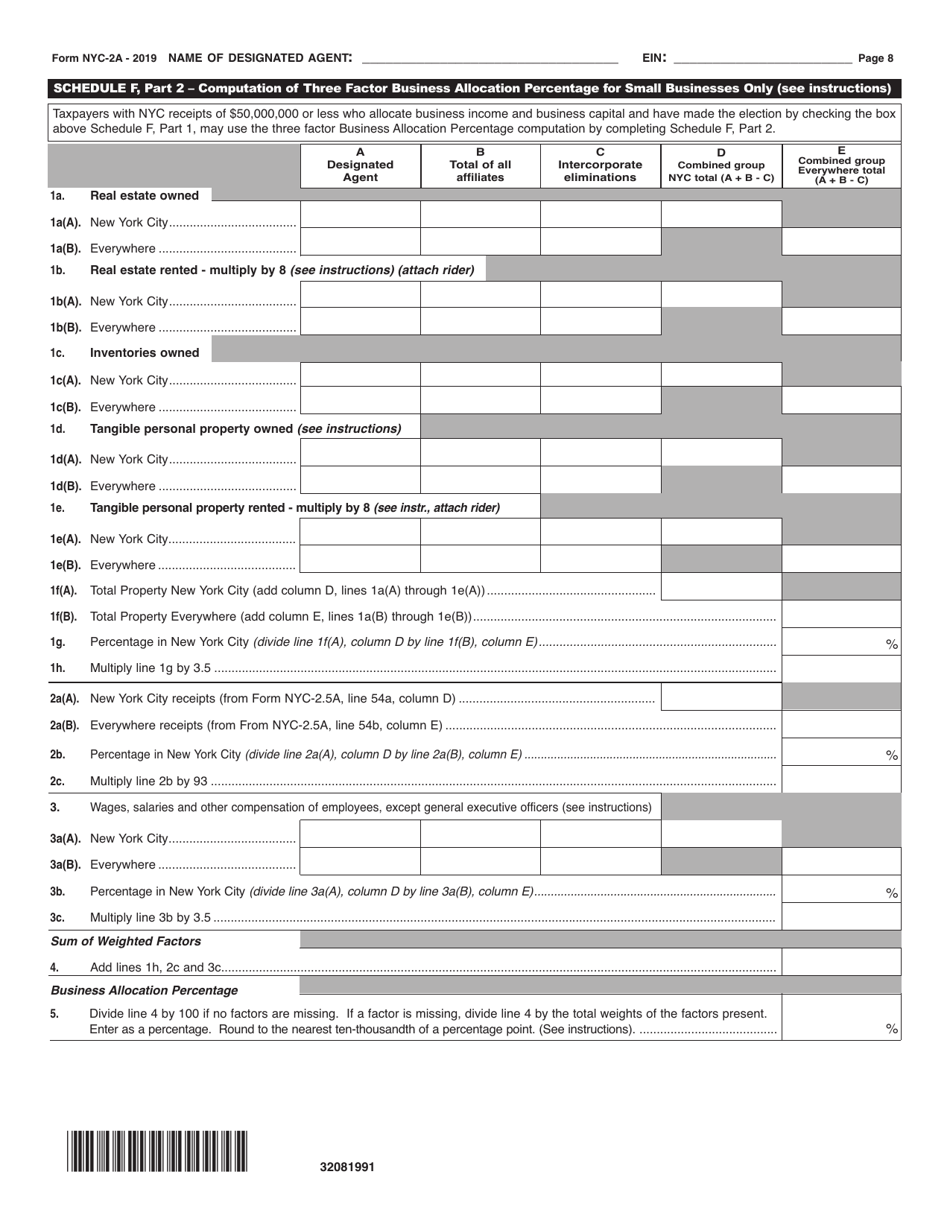

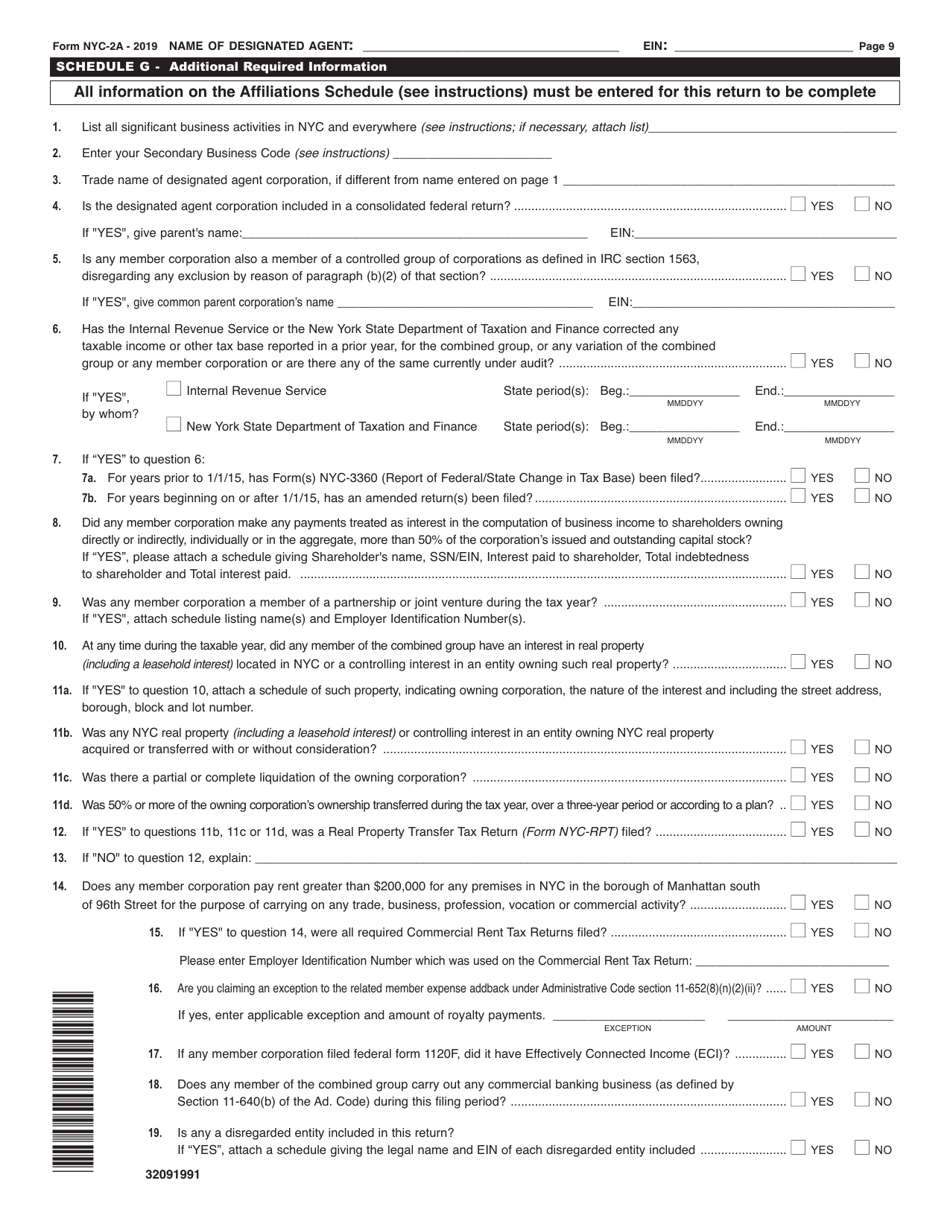

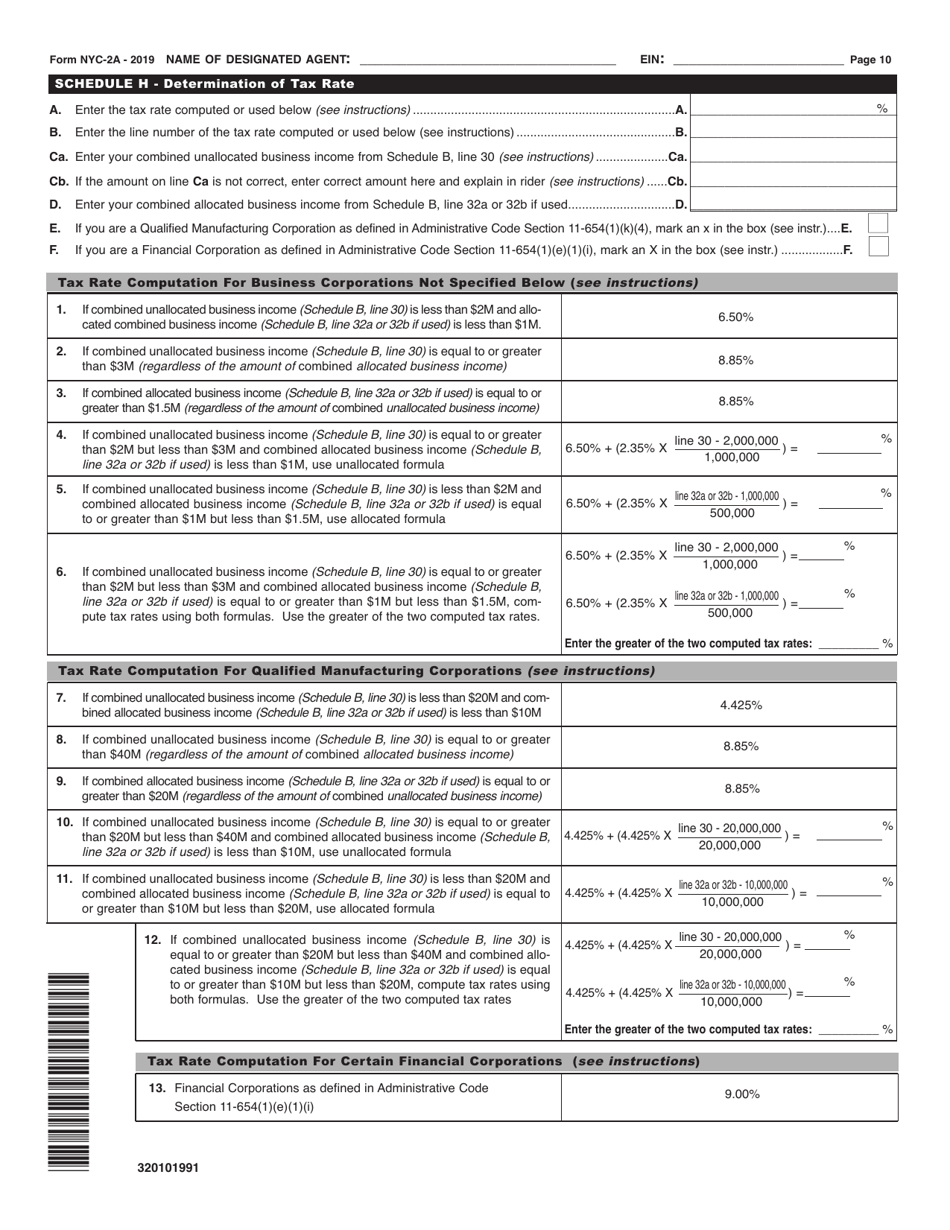

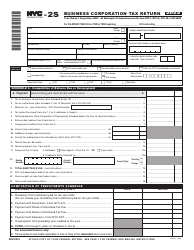

Form NYC-2A Combined Business Corporation Tax Return - New York City

What Is Form NYC-2A?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-2A Combined Business Corporation Tax Return?

A: The NYC-2A Combined Business Corporation Tax Return is a tax form specifically designed for Business Corporations operating in New York City.

Q: Who needs to file the NYC-2A Combined Business Corporation Tax Return?

A: Business Corporations operating in New York City need to file the NYC-2A Combined Business Corporation Tax Return.

Q: What is the purpose of the NYC-2A Combined Business Corporation Tax Return?

A: The purpose of the NYC-2A Combined Business Corporation Tax Return is to report and pay the business taxes owed by the corporation to New York City.

Q: Is there a deadline for filing the NYC-2A Combined Business Corporation Tax Return?

A: Yes, the deadline for filing the NYC-2A Combined Business Corporation Tax Return is generally on or before April 15th of each year.

Q: Are there any penalties for late filing of the NYC-2A Combined Business Corporation Tax Return?

A: Yes, if you file the NYC-2A Combined Business Corporation Tax Return after the deadline, you may be subject to late filing penalties and interest charges.

Q: What if I need help with filling out the NYC-2A Combined Business Corporation Tax Return?

A: If you need assistance with filling out the NYC-2A Combined Business Corporation Tax Return, you can consult a tax professional or contact the New York City Department of Finance for guidance.

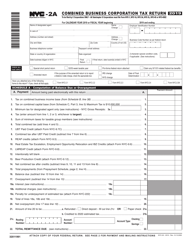

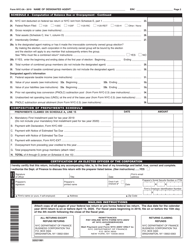

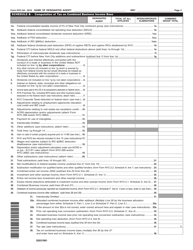

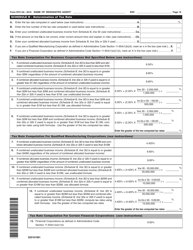

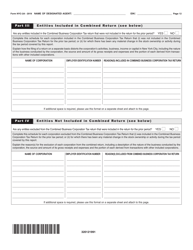

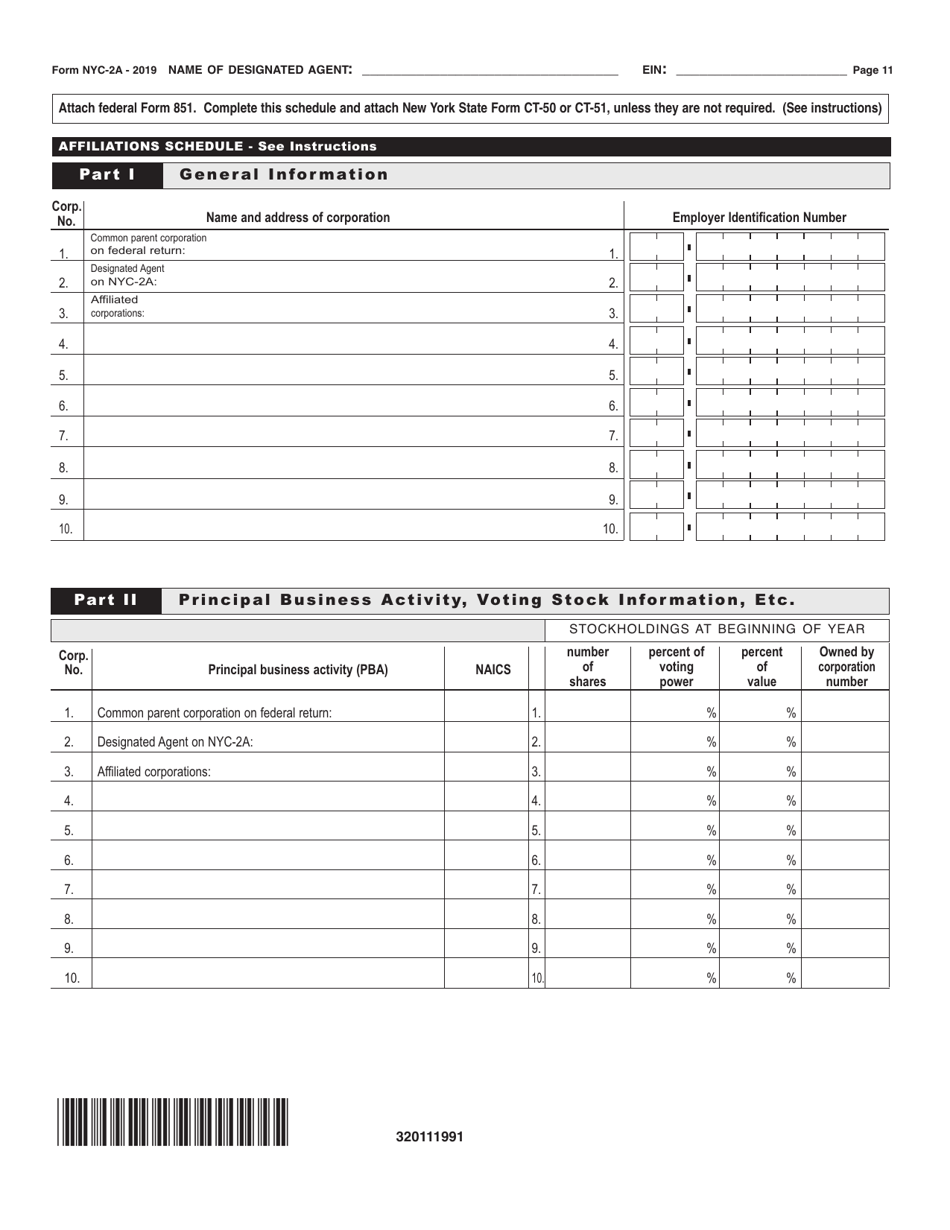

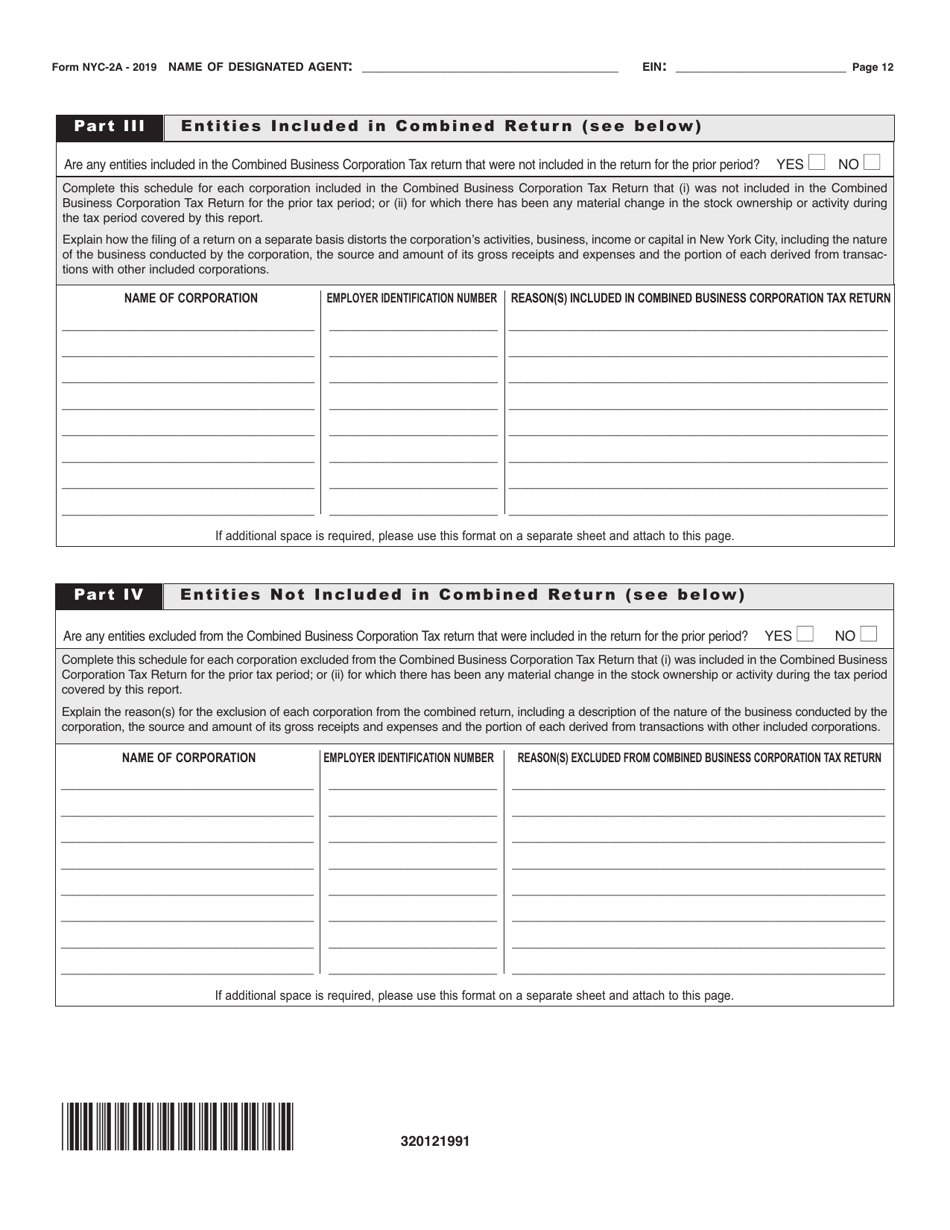

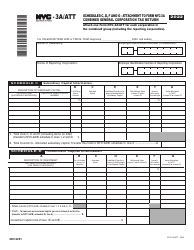

Q: Are there any additional forms or schedules that need to be filed along with the NYC-2A Combined Business Corporation Tax Return?

A: Yes, depending on the specific circumstances of the corporation, there may be additional forms or schedules that need to be filed along with the NYC-2A Combined Business Corporation Tax Return. It is important to review the instructions provided with the form.

Q: What types of taxes are reported on the NYC-2A Combined Business Corporation Tax Return?

A: The NYC-2A Combined Business Corporation Tax Return is used to report various taxes including the General Corporation Tax, Banking Corporation Tax, and the Unincorporated Business Tax.

Q: Is there a fee for filing the NYC-2A Combined Business Corporation Tax Return?

A: No, there is no fee for filing the NYC-2A Combined Business Corporation Tax Return.

Q: Can I amend the NYC-2A Combined Business Corporation Tax Return if I made a mistake?

A: Yes, you can amend the NYC-2A Combined Business Corporation Tax Return if you made a mistake or need to make changes. You can file an amended return using the appropriate form, usually the NYC-2A-CA.

Q: What documentation should I keep after filing the NYC-2A Combined Business Corporation Tax Return?

A: It is important to keep copies of all relevant documentation, including the completed NYC-2A Combined Business Corporation Tax Return, supporting schedules, and any other related records, for at least three years.

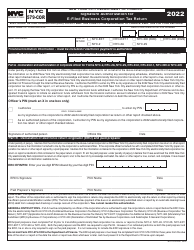

Form Details:

- Released on October 15, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.