This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

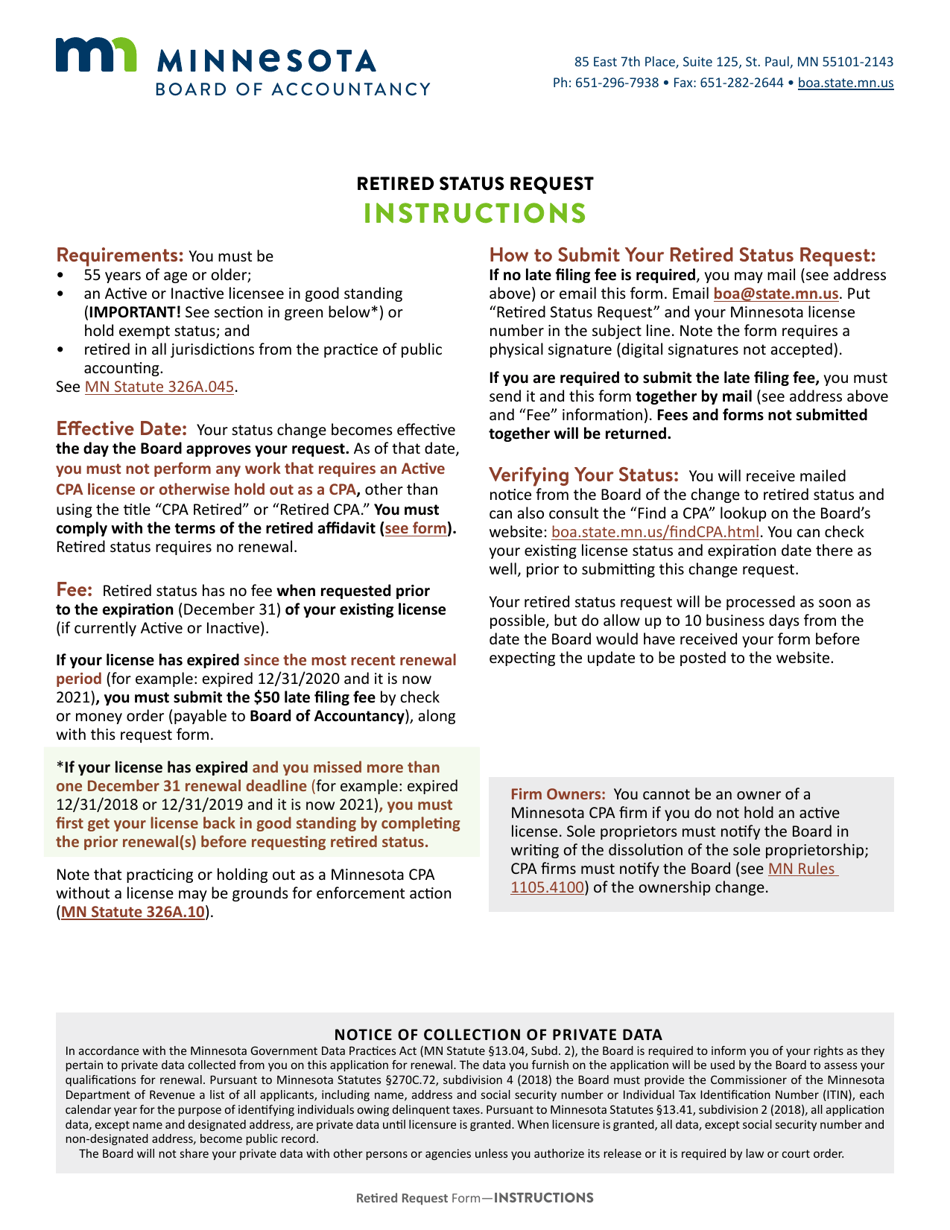

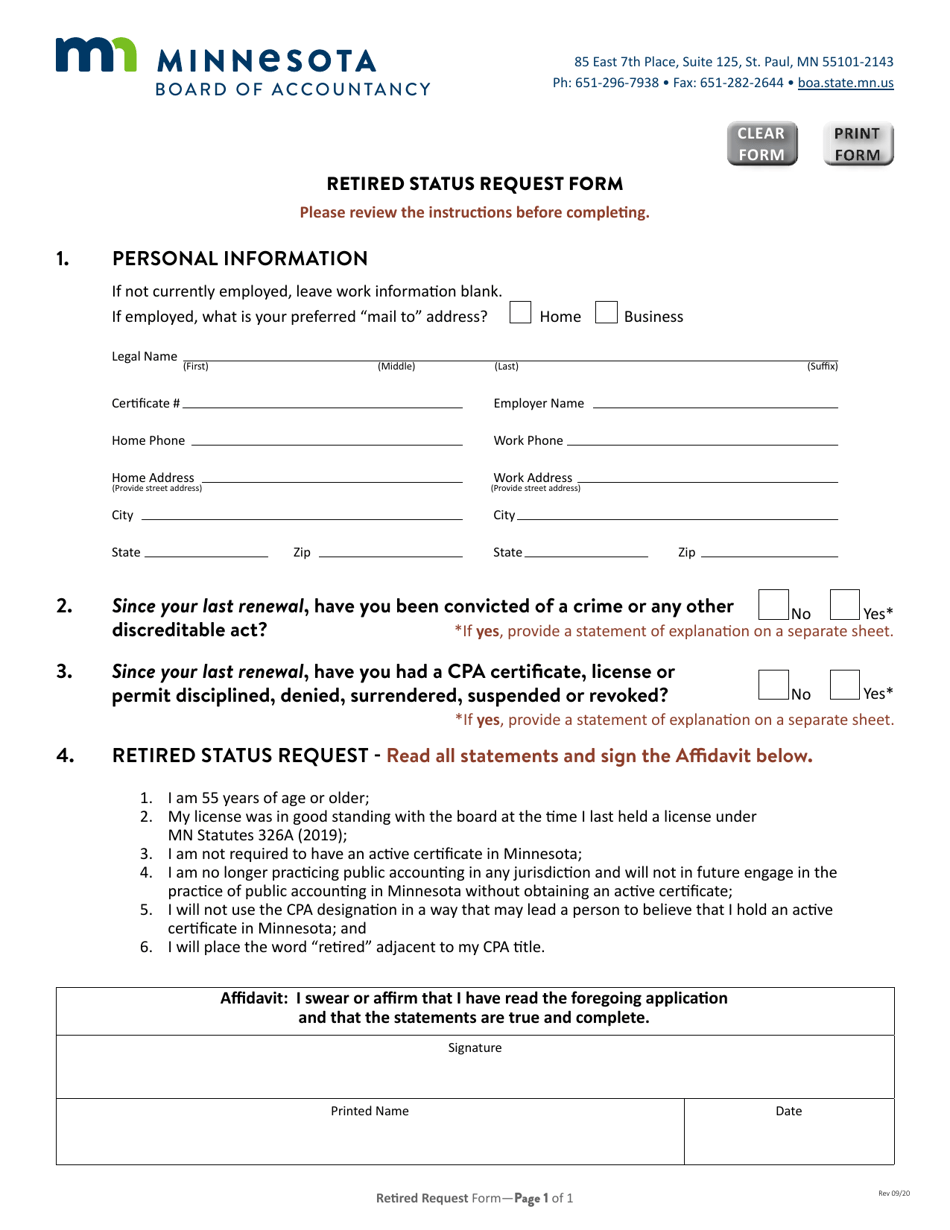

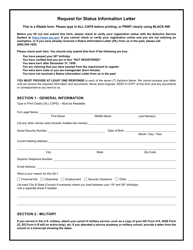

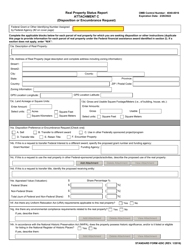

Retired Status Request Form - Minnesota

Retired Status Request Form is a legal document that was released by the Minnesota Board of Accountancy - a government authority operating within Minnesota.

FAQ

Q: What is the Retired Status Request Form?

A: The Retired Status Request Form is a document used in Minnesota to request a retired status for certain professional licenses.

Q: Who can use the Retired Status Request Form?

A: Any individual holding a professional license in Minnesota who wishes to request a retired status for their license.

Q: What is the purpose of requesting a retired status for a license?

A: Requesting a retired status for a license allows individuals to maintain their professional license without having to meet the usual active practice requirements.

Q: What are the requirements for requesting a retired status?

A: The specific requirements may vary depending on the profession, but generally, the individual must have held an active license for a certain time period and no longer be engaged in active practice.

Q: How can I obtain the Retired Status Request Form?

A: You can obtain the Retired Status Request Form from the regulatory board or agency that oversees your specific professional license in Minnesota.

Q: What should I do once I have completed the Retired Status Request Form?

A: Once you have completed the form, you should submit it to the appropriate regulatory board or agency along with any required fees or supporting documents.

Q: Is there a fee for requesting a retired status for a license?

A: There may be a fee associated with requesting a retired status for a license. The specific fee amount and payment instructions can be found on the Retired Status Request Form or by contacting the regulatory board or agency.

Q: Can I still practice my profession if my license is in retired status?

A: No, individuals with a retired status for their license are generally not allowed to practice their profession. Retired status is for maintaining the license without actively practicing.

Q: Can I reactivate my license if it is in retired status?

A: Yes, in most cases, you can reactivate your license if it is in retired status. However, you may need to meet certain requirements or pay a reactivation fee.

Q: Can I transfer my license to another state if it is in retired status?

A: The ability to transfer a license to another state while in retired status may vary depending on the specific state's licensing requirements. It is recommended to contact the licensing board or agency in the state you wish to transfer to for more information.

Form Details:

- Released on September 1, 2020;

- The latest edition currently provided by the Minnesota Board of Accountancy;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Board of Accountancy.