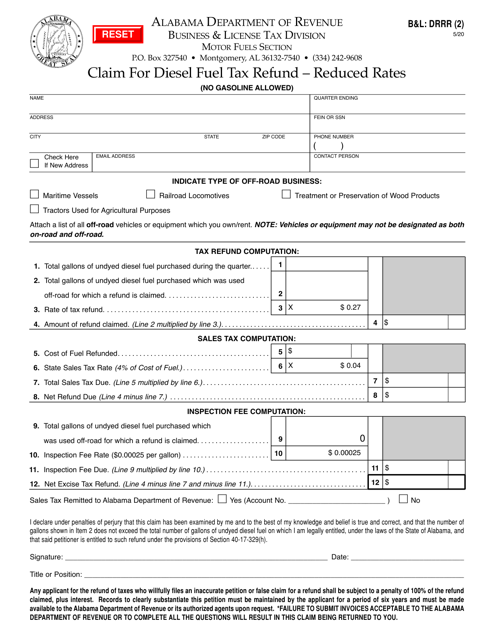

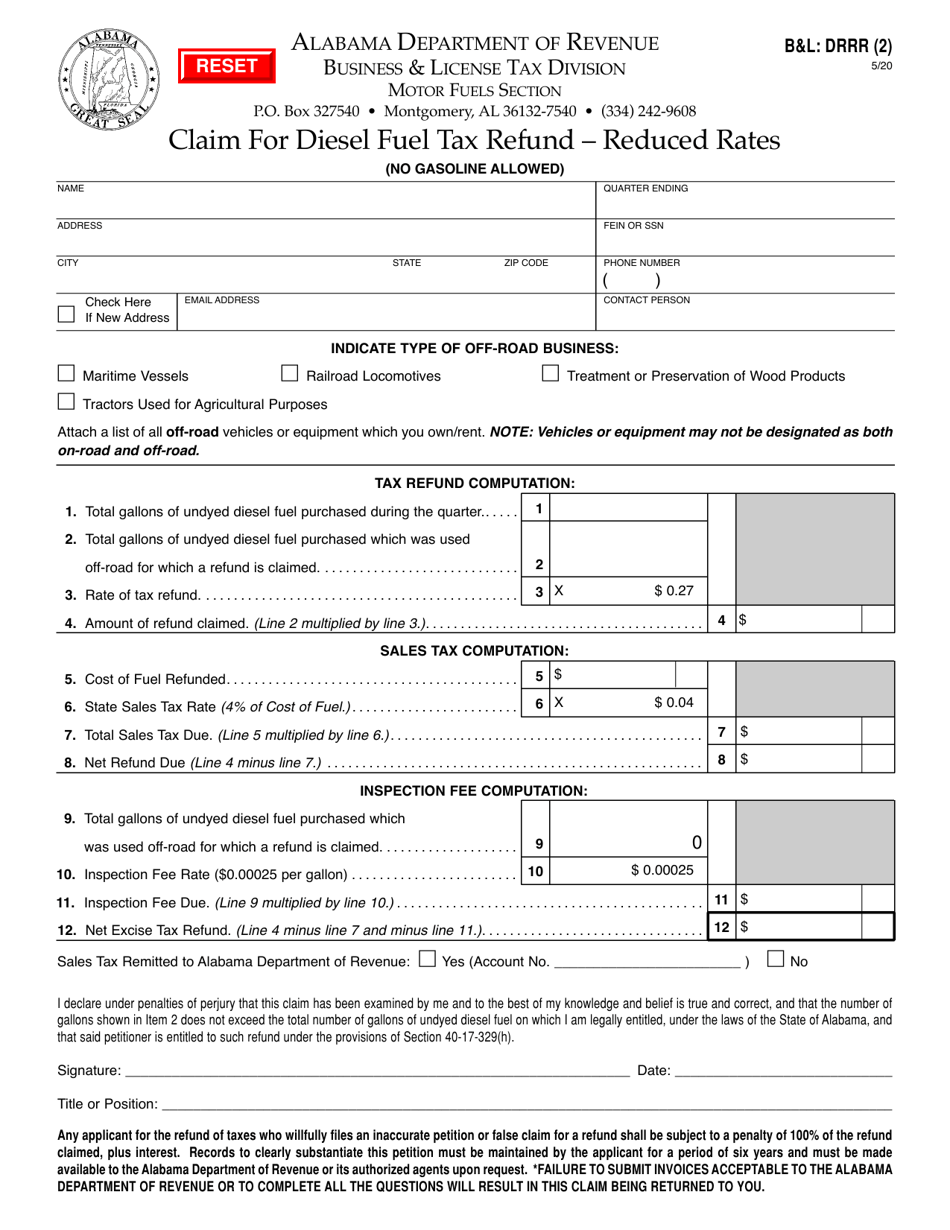

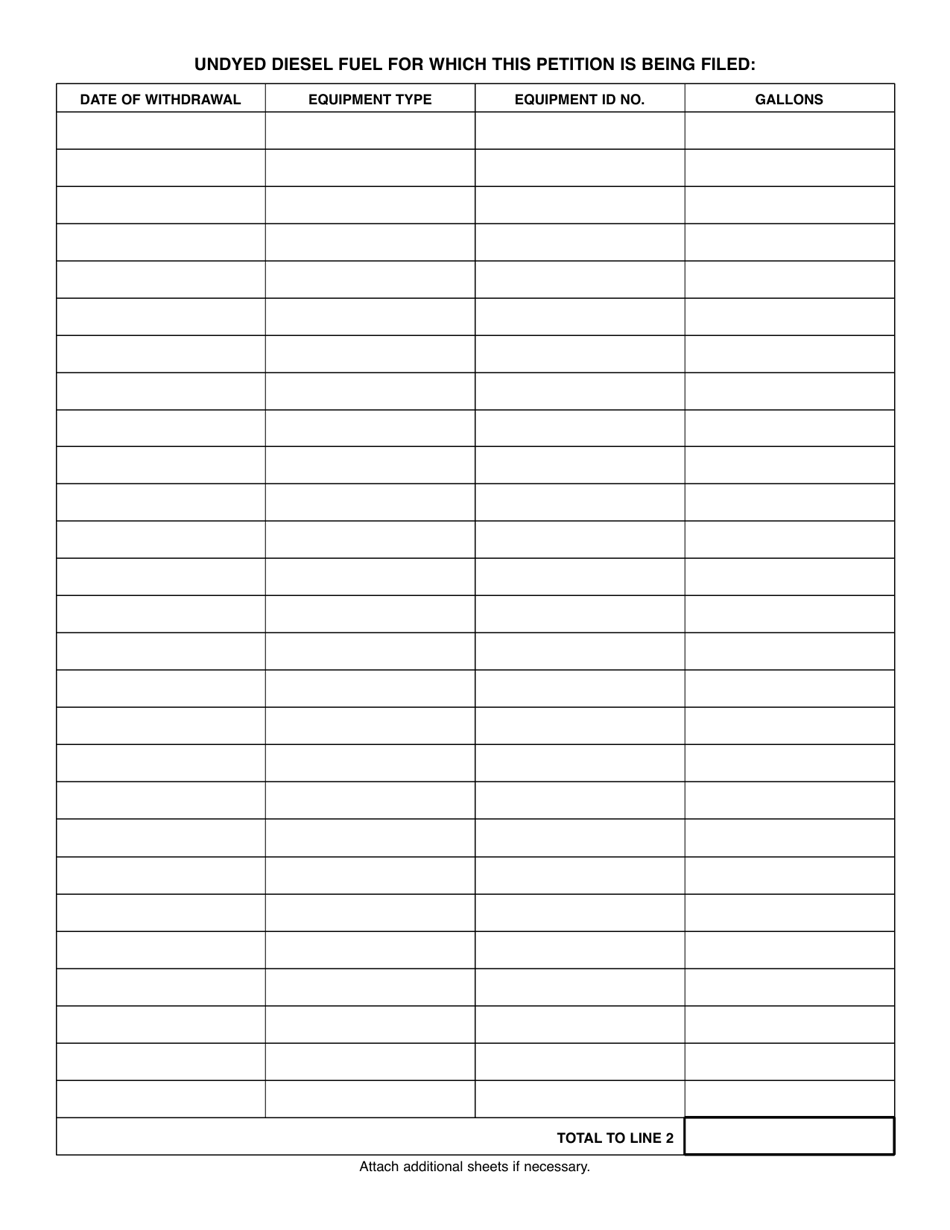

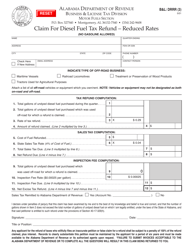

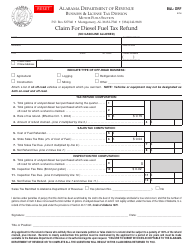

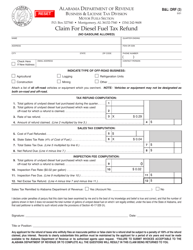

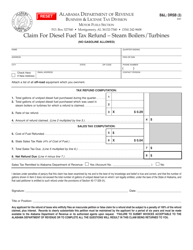

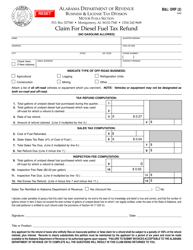

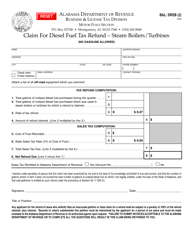

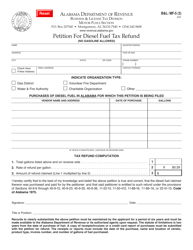

Form B&L: DRRR (2) Claim for Diesel Fuel Tax Refund - Reduced Rates - Alabama

What Is Form B&L: DRRR (2)?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B&L: DRRR (2)?

A: Form B&L: DRRR (2) is a claim for diesel fuel tax refund.

Q: What does DRRR stand for?

A: DRRR stands for Diesel Fuel Tax Refund - Reduced Rates.

Q: Who can file Form B&L: DRRR (2)?

A: Individuals and businesses in Alabama who have used diesel fuel are eligible to file Form B&L: DRRR (2).

Q: What is the purpose of Form B&L: DRRR (2)?

A: The purpose of Form B&L: DRRR (2) is to claim a refund for the difference between the regular tax rate and the reduced tax rate on diesel fuel.

Q: What are the reduced rates for diesel fuel tax in Alabama?

A: The reduced rates for diesel fuel tax in Alabama vary depending on the type of vehicle or equipment.

Q: Is there a deadline for filing Form B&L: DRRR (2)?

A: Yes, the deadline for filing Form B&L: DRRR (2) is the last day of the month following the quarter in which the diesel fuel was purchased.

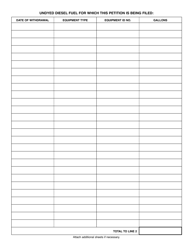

Q: What documentation do I need to include with Form B&L: DRRR (2)?

A: You need to include receipts and invoices that show the amount of diesel fuel purchased and the tax paid.

Q: How long does it take to receive the refund?

A: It generally takes 45 to 60 days to process the refund claim.

Q: Can I amend my Form B&L: DRRR (2) if there are errors?

A: Yes, you can file an amended Form B&L: DRRR (2) to correct any errors or omissions.

Q: Are there any penalties for filing Form B&L: DRRR (2) late?

A: Yes, there may be penalties for late filing, so it is important to submit the form by the deadline.

Q: Can I claim a refund for diesel fuel used in other states?

A: No, Form B&L: DRRR (2) is specific to diesel fuel used in Alabama.

Q: Is there a minimum amount of refund that can be claimed?

A: Yes, the minimum refund amount that can be claimed is $25.

Q: Can I get assistance with filling out Form B&L: DRRR (2)?

A: Yes, you can contact the Alabama Department of Revenue for assistance with filling out Form B&L: DRRR (2).

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: DRRR (2) by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.