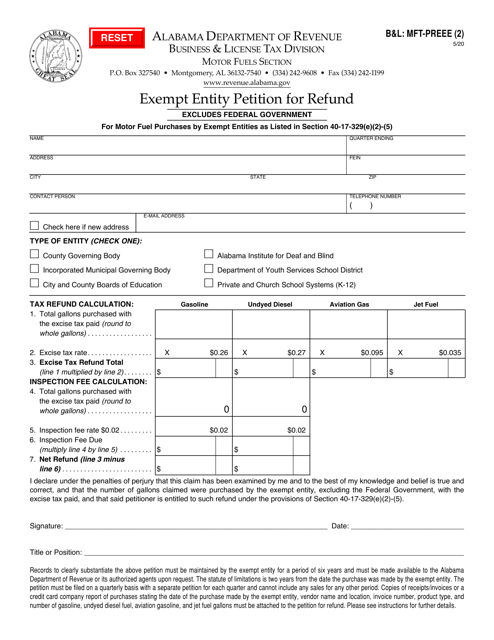

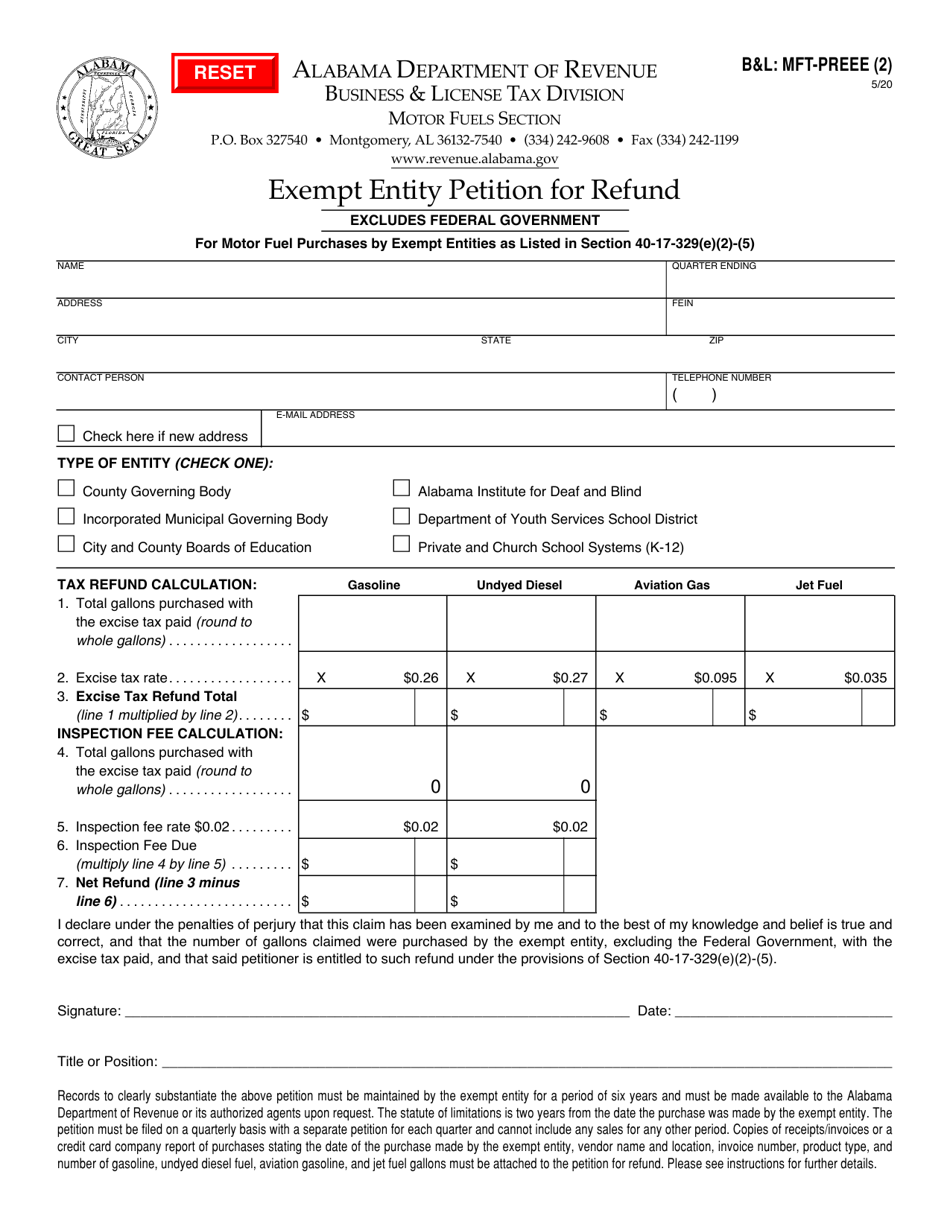

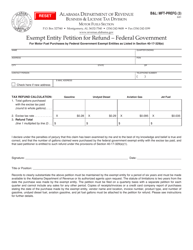

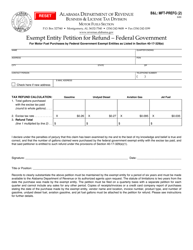

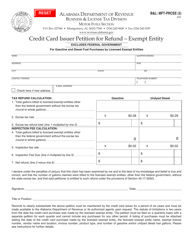

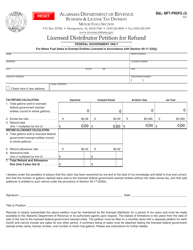

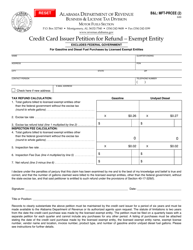

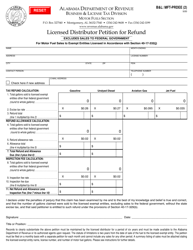

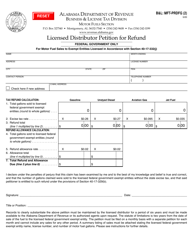

Form B&L: MFT-PREEE (2) Exempt Entity Petition for Refund - Alabama

What Is Form B&L: MFT-PREEE (2)?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B&L: MFT-PREEE (2)?

A: Form B&L: MFT-PREEE (2) is an Exempt Entity Petition for Refund in Alabama.

Q: Who can use Form B&L: MFT-PREEE (2)?

A: Form B&L: MFT-PREEE (2) is for exempt entities in Alabama who want to request a refund.

Q: What is an exempt entity?

A: An exempt entity is an organization or entity that is exempt from paying certain taxes.

Q: What taxes can be refunded using Form B&L: MFT-PREEE (2)?

A: Form B&L: MFT-PREEE (2) can be used to request a refund for various taxes paid by exempt entities in Alabama.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: MFT-PREEE (2) by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.