This version of the form is not currently in use and is provided for reference only. Download this version of

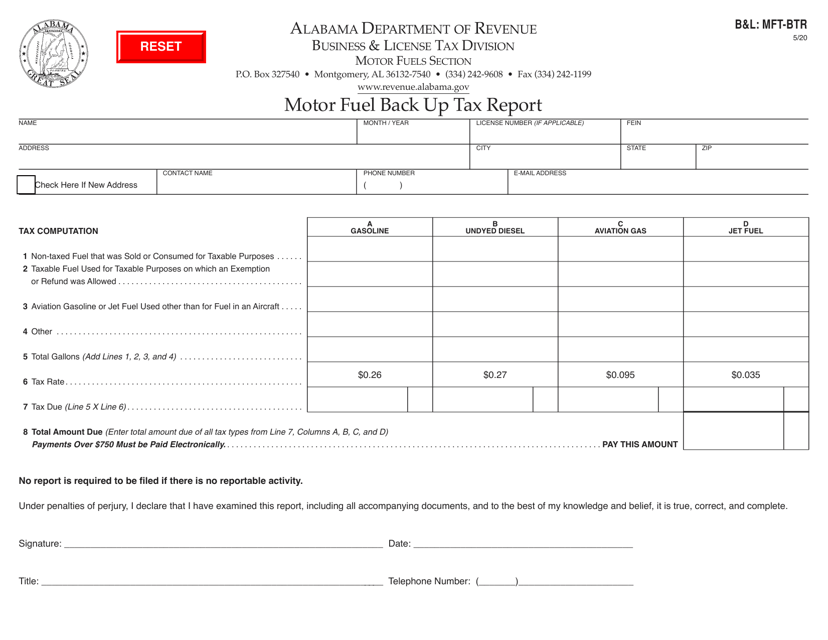

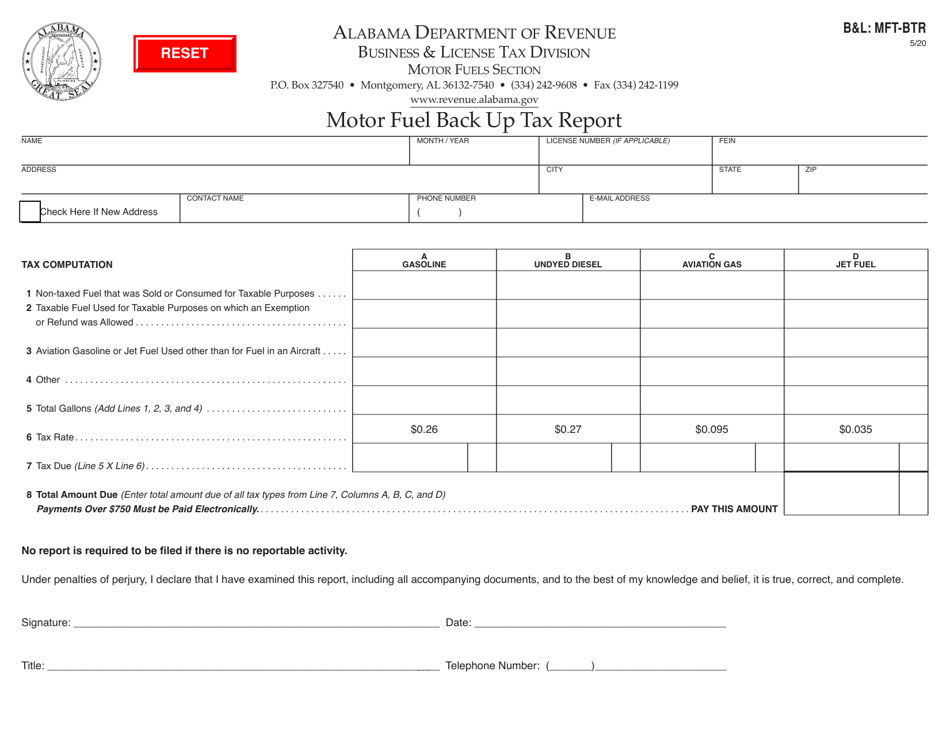

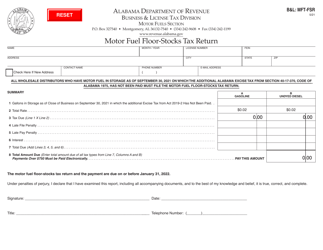

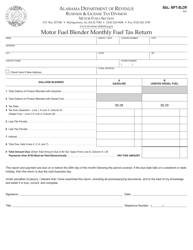

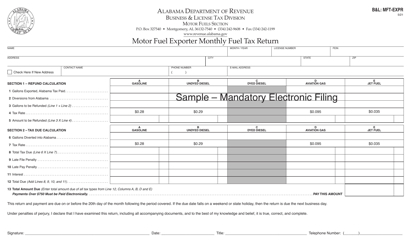

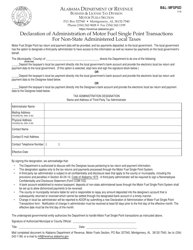

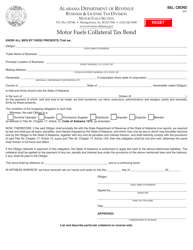

Form B&L: MFT-BTR

for the current year.

Form B&L: MFT-BTR Motor Fuel Back up Tax Report - Alabama

What Is Form B&L: MFT-BTR?

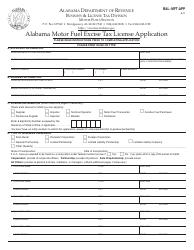

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the MFT-BTR Motor Fuel Back up Tax Report?

A: The MFT-BTR Motor Fuel Back up Tax Report is a form used in Alabama to report and pay taxes on motor fuel.

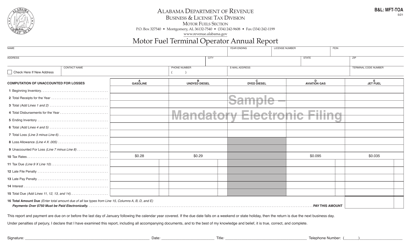

Q: Who is required to file the MFT-BTR Motor Fuel Back up Tax Report?

A: Any person or entity engaged in the importation, manufacture, or sale of motor fuel in Alabama is required to file this report.

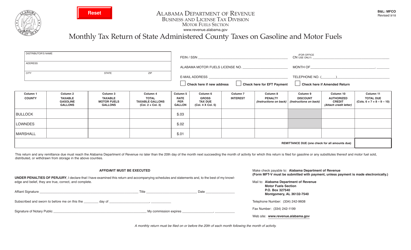

Q: When is the deadline to file the MFT-BTR Motor Fuel Back up Tax Report?

A: The report is due on or before the 20th day of the month following the month in which the motor fuel is imported, manufactured, or sold.

Q: How do I pay the taxes owed on the MFT-BTR Motor Fuel Back up Tax Report?

A: You can pay the taxes owed electronically or by check. Instructions for payment are provided on the form.

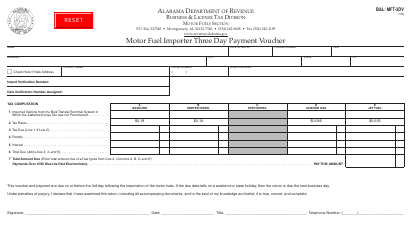

Q: Are there any penalties for late filing or non-filing of the MFT-BTR Motor Fuel Back up Tax Report?

A: Yes, there are penalties for late filing or non-filing, including interest charges and potential criminal penalties.

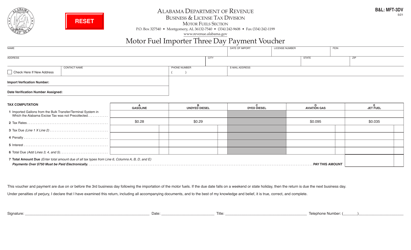

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: MFT-BTR by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.